The Impact Of Elon Musk's Renewed Intensity On Tesla

Table of Contents

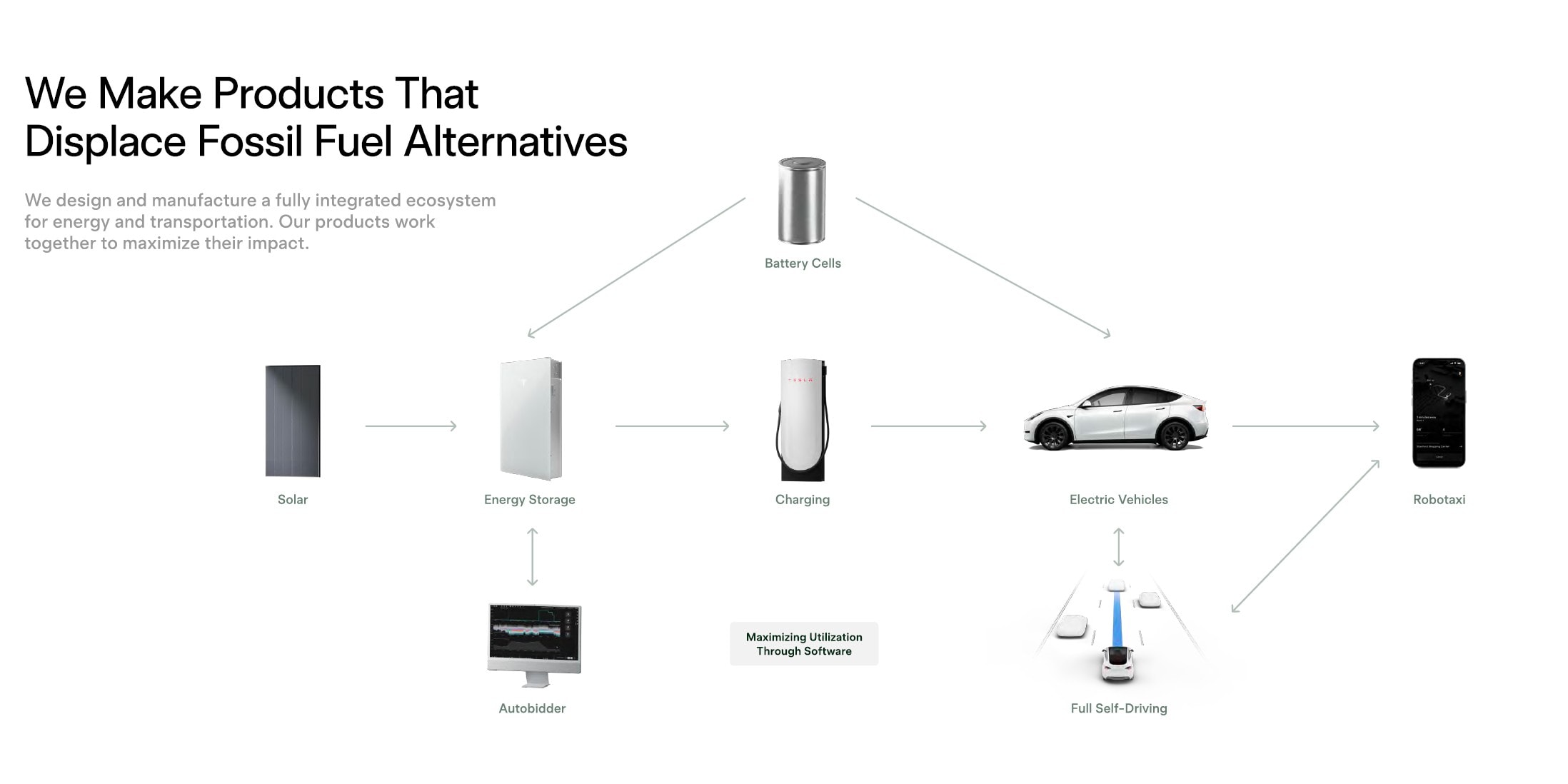

Increased Productivity and Innovation at Tesla

Musk's intensified leadership style is undeniably driving increased productivity and innovation within Tesla. This manifests in two key areas: accelerated product development and a relentless focus on efficiency and cost reduction.

Accelerated Product Development

Musk's push for rapid development is evident in Tesla's aggressive timelines. The highly anticipated Cybertruck, for example, while experiencing delays, continues to be a focal point, showcasing Musk's commitment to bringing disruptive technologies to market quickly. This accelerated approach also extends to improvements in existing models, with frequent over-the-air software updates enhancing features and performance.

- Examples of accelerated timelines: The rapid rollout of new battery technology, frequent software updates introducing new Autopilot features, and the ambitious timelines for the Cybertruck and other upcoming models.

- Increased production output: Tesla's gigafactories are pushing production limits, aiming to meet the growing global demand for electric vehicles.

- Specific product improvements: Enhancements to Autopilot and Full Self-Driving (FSD) capabilities, improvements in battery range and charging speed, and the introduction of new features like improved in-car entertainment systems.

Keywords: Tesla innovation, Cybertruck production, FSD development, Tesla production, Tesla technology.

Focus on Efficiency and Cost Reduction

Simultaneously, Musk is driving significant efforts to streamline operations and slash manufacturing costs. This involves increased automation, supply chain optimization, and a constant push for greater efficiency across all aspects of the business.

- Examples of cost-cutting measures: Lean manufacturing techniques, vertical integration, and exploration of alternative materials.

- Automation improvements: Increased use of robots and AI in manufacturing processes to enhance speed and precision.

- Supply chain optimization: Strategies to secure crucial materials and streamline the logistics of production.

Keywords: Tesla cost-cutting, Tesla efficiency, manufacturing optimization, supply chain management, Tesla manufacturing.

Impact on Tesla's Stock Price and Investor Sentiment

Musk's actions directly influence Tesla's stock price, creating significant volatility. His pronouncements, often shared via Twitter, can trigger immediate market reactions, both positive and negative.

Volatility and Market Reaction

Tesla's stock price is highly sensitive to Musk's activities. Positive news, like record-breaking delivery numbers or exciting product announcements, often leads to stock price increases. Conversely, controversial tweets or unexpected announcements can trigger significant drops. Investor confidence remains intrinsically linked to Musk's actions and public image.

- Positive impacts: Successful product launches, increased production figures, and positive regulatory news often lead to stock price surges.

- Negative impacts: Controversial tweets, unexpected company announcements, and negative media coverage can negatively impact investor sentiment and the stock price.

- Correlation with Musk's tweets and announcements: A clear correlation exists between Musk's public statements and the subsequent fluctuations in Tesla's stock price.

Keywords: Tesla stock price, Tesla investor sentiment, market volatility, Tesla stock, stock market.

Long-Term Investment Outlook

Despite the volatility, Tesla's long-term prospects remain a subject of significant debate. The company's position as a leader in the electric vehicle market presents a compelling investment case. However, fierce competition and potential regulatory hurdles pose significant risks. Musk's leadership style, while undeniably influential, also presents both opportunities and uncertainties for investors.

- Potential risks: Intense competition from established automakers and new entrants, regulatory challenges, and supply chain disruptions.

- Potential rewards: Growth in the EV market, continued innovation, and potential expansion into new energy sectors.

- Competition in the EV market: The EV market is rapidly evolving, with numerous competitors emerging, adding to the inherent risk and uncertainty.

Keywords: Tesla investment, long-term Tesla outlook, EV market competition, Tesla future.

The Diversification Factor: SpaceX, Twitter, and their Influence on Tesla

Musk's involvement in SpaceX and Twitter introduces another layer of complexity to the analysis of Tesla's future. His time and resources are spread across these ventures, raising questions about potential conflicts of interest and resource allocation.

Resource Allocation and Focus

The potential for conflicts of interest exists due to Musk's involvement in multiple companies. Resource allocation across Tesla, SpaceX, and Twitter could potentially impact Tesla's strategic focus and growth trajectory. It’s crucial to monitor how effectively Musk balances his responsibilities across these diverse entities.

- Potential conflicts of interest: Competition for talent, financial resources, and management attention.

- Resource allocation challenges: Determining the optimal distribution of resources among these diverse ventures.

- Impact on Tesla's executive team: The pressure on Tesla's leadership team to manage without constant direct oversight from Musk.

Keywords: SpaceX impact on Tesla, Twitter influence on Tesla, resource allocation, Elon Musk companies, Tesla management.

Brand Synergy and Cross-Pollination

Despite the potential challenges, there could also be positive synergies between Tesla, SpaceX, and Twitter. Technological advancements in one area could potentially benefit the others, and the strong brand recognition across these ventures might create cross-marketing opportunities.

- Examples of technology transfer: Potential for advancements in battery technology from Tesla to benefit SpaceX's space exploration efforts.

- Brand image enhancement: The association with SpaceX's innovative image might bolster Tesla's brand appeal.

- Cross-marketing opportunities: Potential for leveraging Twitter's vast reach to enhance Tesla's marketing and branding efforts.

Keywords: Tesla brand synergy, Tesla SpaceX collaboration, Tesla Twitter integration, brand marketing, cross-promotion.

Conclusion

Elon Musk's renewed intensity is significantly impacting Tesla's trajectory. His drive for innovation and efficiency is boosting productivity, while his actions create significant volatility in the stock market. His involvement in SpaceX and Twitter introduces a further layer of complexity, presenting both risks and opportunities for the electric vehicle giant. The long-term consequences of this multifaceted approach remain to be seen.

What do you think is the long-term impact of Elon Musk's intensified efforts on Tesla's success? How will Elon Musk's renewed intensity shape the future of electric vehicles? Share your thoughts! #ElonMusk #Tesla #ElectricVehicles #EVfuture #TeslaStock

Featured Posts

-

Can We Make Housing Affordable Without Collapsing Home Prices The Gregor Robertson Approach

May 26, 2025

Can We Make Housing Affordable Without Collapsing Home Prices The Gregor Robertson Approach

May 26, 2025 -

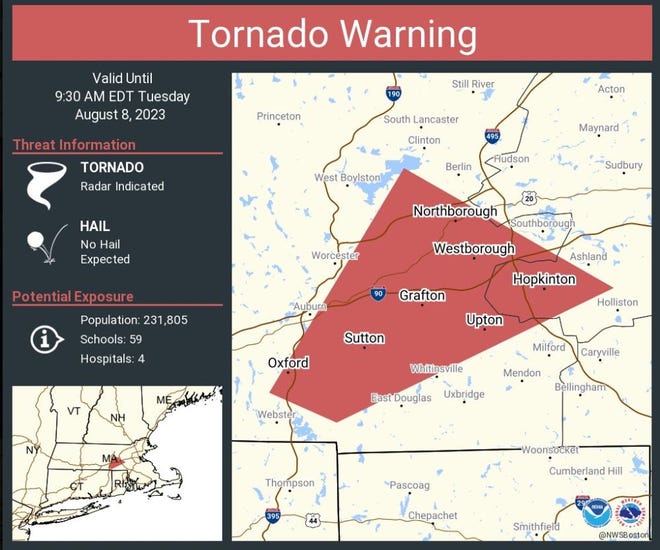

Hampshire And Worcester Counties Flash Flood Warning In Effect Thursday Night

May 26, 2025

Hampshire And Worcester Counties Flash Flood Warning In Effect Thursday Night

May 26, 2025 -

Dr Terrors House Of Horrors Your Guide To A Frightening Adventure

May 26, 2025

Dr Terrors House Of Horrors Your Guide To A Frightening Adventure

May 26, 2025 -

Ealas Grand Slam Debut Paris 2024

May 26, 2025

Ealas Grand Slam Debut Paris 2024

May 26, 2025 -

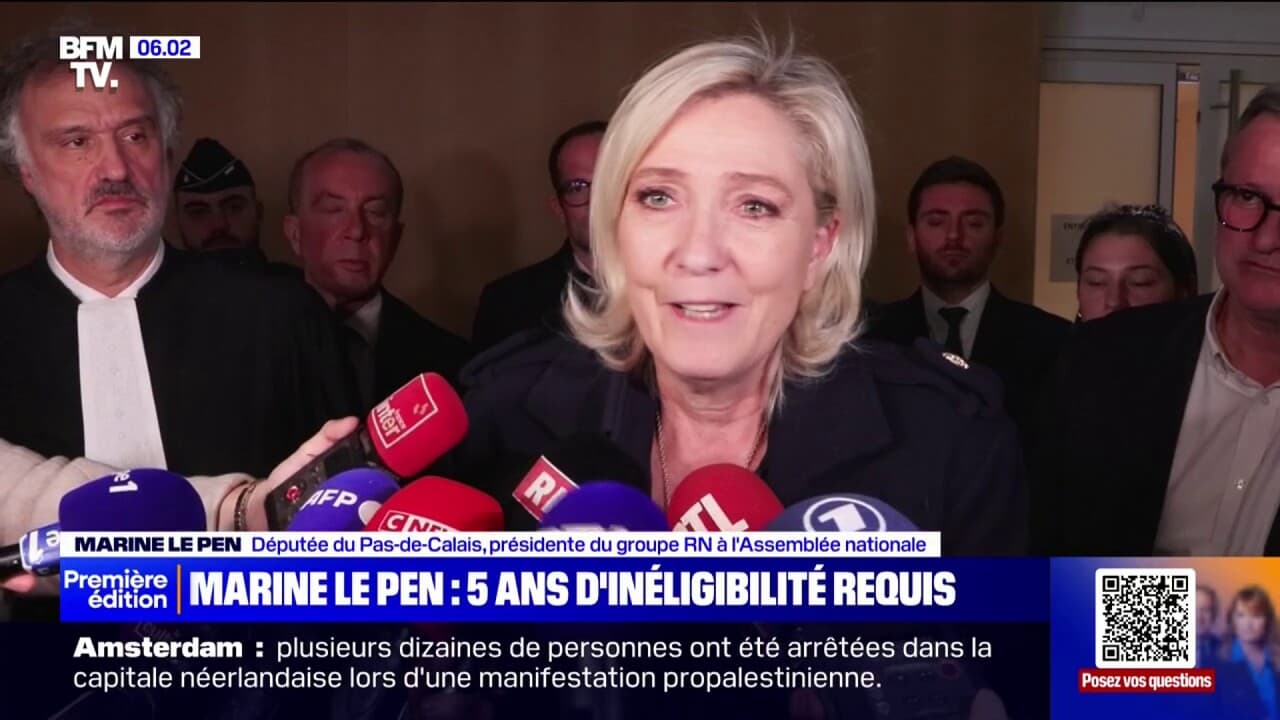

Condamnation Marine Le Pen Appel Contre Quatre Ans De Prison Et Ineligibilite Immediate

May 26, 2025

Condamnation Marine Le Pen Appel Contre Quatre Ans De Prison Et Ineligibilite Immediate

May 26, 2025