The Impact Of Trump's First 100 Days On Elon Musk's Financial Status

Table of Contents

H2: Regulatory Changes and Their Effect on Tesla

Trump's presidency ushered in a period of significant regulatory change, impacting various sectors, including the automotive industry. The effect on Tesla, a company heavily reliant on government incentives and subject to environmental regulations, was potentially substantial.

H3: Impact of Environmental Regulations

Trump's administration signaled a shift away from stringent environmental regulations. This had potential implications for Tesla, a company heavily invested in electric vehicles and pushing for sustainable energy solutions.

- Weakening of Fuel Efficiency Standards: The Trump administration considered relaxing fuel efficiency standards, potentially reducing the competitive advantage enjoyed by electric vehicles like those produced by Tesla. This could have led to decreased demand for Tesla vehicles if gasoline-powered cars became more cost-competitive.

- Impact on Electric Vehicle Incentives: Changes in federal tax credits and subsidies for electric vehicles could have directly influenced Tesla's profitability and sales. Any reduction in these incentives could have negatively impacted Tesla's growth trajectory.

- Sources: While concrete data on the immediate impact during Trump's first 100 days is difficult to isolate, analyses of proposed regulatory changes from organizations like the Environmental Protection Agency and the National Highway Traffic Safety Administration offer insight into the potential consequences.

H3: Changes in Tax Policies and Incentives

The 2017 Tax Cuts and Jobs Act, passed during Trump's first year, introduced significant changes to the US tax code. These changes had a complex impact on Tesla.

- Corporate Tax Rate Reduction: The reduction in the corporate tax rate could have benefitted Tesla's bottom line, leading to higher profits. However, the specific impact depended on Tesla's overall tax liability and the structure of its international operations.

- Impact on Investment Attractiveness: Tax reforms could also have affected investor sentiment towards Tesla, influencing its access to capital for future projects and expansion. A more favorable tax environment could have attracted greater investment.

- Financial Data: Analyzing Tesla's financial reports for the period surrounding the tax cuts provides valuable data to assess the actual impact on the company's profitability and cash flow.

H2: Geopolitical Shifts and SpaceX

SpaceX, Musk's space exploration company, is also susceptible to geopolitical shifts and changes in international relations and defense spending.

H3: Impact on International Relations and Space Exploration

Trump's foreign policy during his early days in office brought uncertainty to international collaborations, potentially affecting SpaceX's partnerships and contracts.

- NASA Partnerships: Changes in the US relationship with international space agencies could have influenced collaborative space projects involving SpaceX. Potential reductions in funding or changes in mission priorities could have impacted SpaceX's revenue streams.

- International Launch Contracts: SpaceX's reliance on international clients for launching satellites could have been affected by any shifts in global political dynamics. Geopolitical tensions could have reduced demand for SpaceX's launch services.

- Sources: News reports and official statements from NASA and other international space agencies during Trump's first 100 days shed light on potential impacts on SpaceX's collaborations.

H3: Defense Spending and its Implications for SpaceX

SpaceX also participates in defense-related projects. Changes in defense spending could have profoundly affected its revenue.

- Military Contracts: Increased defense spending under the Trump administration could have translated into more government contracts for SpaceX's launch services or satellite technology. Conversely, reductions could have diminished these opportunities.

- Revenue Streams: The impact of changes in defense spending on SpaceX's revenue would depend on the proportion of its income derived from these contracts. Analyzing SpaceX's financial data is crucial here, though such data is less publicly accessible than Tesla's.

- Sources: Analysis of the US defense budget and news reports on government contracts awarded to SpaceX during this period provide crucial context.

H2: Market Sentiment and Investor Confidence

Market sentiment and investor confidence played a crucial role in shaping Elon Musk's financial status during Trump's first 100 days.

H3: Overall Market Volatility

The early days of the Trump administration were characterized by considerable market volatility. This impacted the stock prices of Tesla and SpaceX.

- Policy Uncertainty: The uncertainty surrounding Trump's policy decisions created volatility in the stock market, impacting investor confidence in various sectors, including the technology and space exploration industries.

- Economic Forecasts: Varying economic forecasts in response to Trump's proposed policies influenced investor sentiment, leading to fluctuations in Tesla and SpaceX stock prices.

- Stock Price Charts: Analyzing stock market data for Tesla (TSLA) and SpaceX (private, so limited data available) from this period illustrates the impact of market volatility.

H3: Trump's Public Statements on Tesla & Elon Musk

Any public statements made by President Trump concerning Tesla or Elon Musk could have directly influenced investor confidence.

- Impact on Investor Sentiment: Positive or negative statements from the president could have significantly affected the market's perception of Tesla and SpaceX, triggering corresponding price movements.

- Musk's Public Image: The president's comments could have influenced Musk's public image and brand value, impacting consumer confidence in Tesla products.

- News Coverage: Examining news coverage of any presidential statements regarding Tesla or Musk helps understand their impact on investor sentiment.

3. Conclusion: Summarizing the Impact of Trump's First 100 Days on Elon Musk's Financial Status

Trump's first 100 days brought significant regulatory and geopolitical changes, influencing both Tesla and SpaceX. While the corporate tax cuts potentially benefited Tesla's bottom line, uncertainty around environmental regulations and international collaborations presented challenges. Market volatility, driven by policy uncertainty and presidential pronouncements, also played a significant role. Assessing the precise financial impact requires a deeper dive into financial reports and market analysis. The interwoven fates of political shifts and corporate fortunes underscore the complex interplay between governance and the business world. Learn more about the complex relationship between political shifts and the financial fortunes of major corporations like Tesla and SpaceX by further researching the impact of Trump's first 100 days on Elon Musk's financial status.

Featured Posts

-

Los Angeles Kings Vs Edmonton Oilers Betting Odds And Series Outlook

May 10, 2025

Los Angeles Kings Vs Edmonton Oilers Betting Odds And Series Outlook

May 10, 2025 -

Young Thugs New Album Uy Scuti Expected Release Date And Tracklist Speculation

May 10, 2025

Young Thugs New Album Uy Scuti Expected Release Date And Tracklist Speculation

May 10, 2025 -

Barbashevs Ot Goal Evens Series Knights Top Wild 4 3

May 10, 2025

Barbashevs Ot Goal Evens Series Knights Top Wild 4 3

May 10, 2025 -

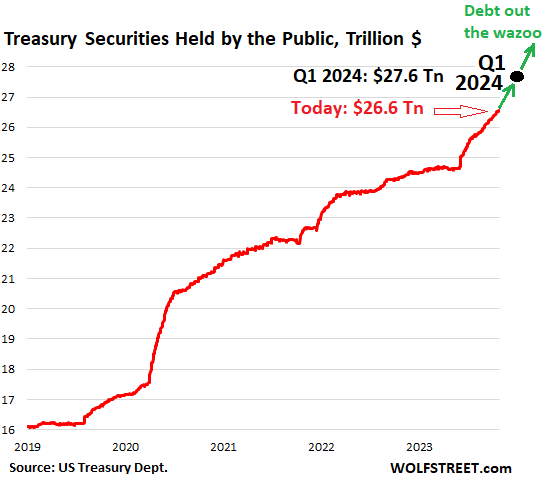

Potential August Expiration Of Us Debt Limit Measures Treasury Alert

May 10, 2025

Potential August Expiration Of Us Debt Limit Measures Treasury Alert

May 10, 2025 -

Discovering The Medieval Story Of Merlin And Arthur A Book Cover Mystery

May 10, 2025

Discovering The Medieval Story Of Merlin And Arthur A Book Cover Mystery

May 10, 2025