The Increasing Importance Of Succession Planning For Multi-Generational Wealth

Table of Contents

Avoiding Family Disputes and Ensuring a Smooth Wealth Transfer

One of the most significant challenges in multi-generational wealth transfer is the potential for family conflict. Disputes often arise from unequal distribution of assets, a lack of transparency in financial matters, differing values among family members, and unclear expectations regarding inheritance. A well-defined succession plan acts as a powerful tool for mitigating these risks. By establishing clear expectations and processes early on, families can significantly reduce the likelihood of future disagreements.

- Clearly defined ownership structures: Legally sound structures, such as trusts and family limited partnerships, clearly outline ownership rights and responsibilities, preventing ambiguity and disputes.

- Open communication and family meetings: Regular, facilitated family meetings provide a platform for open dialogue, addressing concerns, and fostering mutual understanding amongst family members. These meetings should be structured and professional.

- Professional mediation services where needed: Engaging a neutral third-party mediator can be invaluable in resolving conflicts that arise despite proactive planning.

- Pre-emptive legal agreements: Prenuptial agreements, shareholder agreements, and other legal documents can help prevent future disagreements related to property, business ownership, and other significant assets.

Protecting and Growing Multi-Generational Wealth

Preserving and growing multi-generational wealth requires a long-term perspective and a sophisticated approach to investment management. Simply transferring assets without a thoughtful strategy can lead to significant erosion of capital over time. A robust succession plan integrates long-term investment strategies designed to meet the needs of multiple generations.

- Diversified investment portfolios: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) helps mitigate risk and maximize returns over the long term.

- Tax optimization strategies: Minimizing tax liabilities through strategic planning is crucial to preserving wealth across generations. This requires expertise in estate, gift, and income taxation.

- Estate planning and trust management: Proper estate planning ensures that assets are transferred efficiently and according to the family's wishes, minimizing probate costs and delays. Trusts can play a vital role in protecting assets and managing distributions.

- Regular portfolio reviews and adjustments: Ongoing monitoring and adjustments to the investment strategy are necessary to adapt to changing market conditions and the evolving needs of the family.

The Role of Family Governance in Succession Planning

Family governance refers to the structures and processes that guide a family's decision-making regarding its wealth and shared values. A well-defined family governance structure, often embodied in a family constitution or charter, is critical for maintaining family unity and fostering a shared sense of purpose across generations. This document outlines family values, principles, and decision-making processes.

- Establishing clear family values and principles: Defining core family values provides a framework for making decisions related to wealth management and other family matters.

- Defining roles and responsibilities within the family: Clearly outlining roles for different family members in managing wealth and other family affairs prevents confusion and conflict.

- Creating a process for resolving family disputes: Establishing a clear process for conflict resolution ensures that disagreements are addressed fairly and efficiently.

- Regular family council meetings: Regular meetings provide a forum for communication, decision-making, and ongoing review of the family's governance structure.

The Importance of Professional Expertise in Multi-Generational Wealth Succession

Navigating the complexities of multi-generational wealth transfer requires the expertise of seasoned professionals. Engaging lawyers, financial advisors, and other specialists is crucial for developing a comprehensive and effective plan.

- Estate planning attorneys: Attorneys specializing in estate planning provide guidance on legal matters, ensuring the plan complies with all relevant laws and regulations.

- Financial advisors specializing in wealth management: These advisors provide expertise in investment management, tax planning, and other financial matters.

- Tax specialists: Tax specialists help optimize the plan to minimize tax liabilities and ensure compliance with tax laws.

- Family office services: Family offices provide comprehensive support in managing the family's wealth, including investment management, legal and tax advice, and administrative services.

Succession Planning and Philanthropy

Integrating philanthropic goals into the succession plan allows families to leverage their wealth to make a positive impact on the world while aligning with family values.

- Defining philanthropic priorities: Identifying causes that resonate with the family enables focused and effective charitable giving.

- Establishing a family foundation: A family foundation provides a formal structure for managing and distributing charitable grants.

- Creating a structured giving program: Developing a structured giving program ensures that charitable giving is aligned with family goals and values.

- Measuring the impact of charitable giving: Tracking and evaluating the impact of charitable initiatives provides accountability and ensures effectiveness.

Conclusion: Securing Your Legacy Through Effective Succession Planning

Comprehensive succession planning offers numerous benefits, including avoiding family disputes, preserving and growing wealth, and ensuring a smooth transfer of assets across generations. Proactive planning is essential to mitigating potential pitfalls and securing your family's financial future. Don't leave your family's legacy to chance. Seek professional guidance from experienced advisors and develop a personalized succession plan that addresses your unique circumstances and goals. Start planning your multi-generational wealth succession today! Contact us to learn more about how we can help you build a lasting legacy for your family.

Featured Posts

-

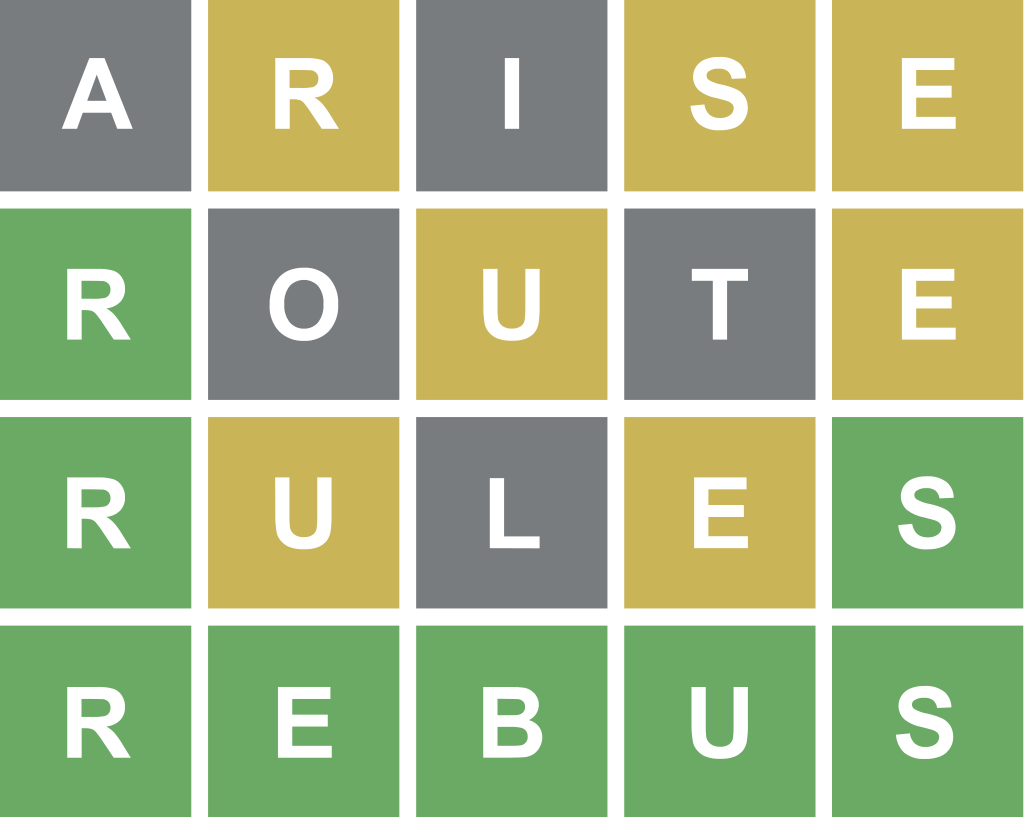

Wordle Answer Today March 16th Hints And Solution For Wordle 1366

May 22, 2025

Wordle Answer Today March 16th Hints And Solution For Wordle 1366

May 22, 2025 -

Ukrainian Ex Politician Murdered Near Madrid School Police

May 22, 2025

Ukrainian Ex Politician Murdered Near Madrid School Police

May 22, 2025 -

Low Rock Legends Vapors Of Morphine Live In Northcote

May 22, 2025

Low Rock Legends Vapors Of Morphine Live In Northcote

May 22, 2025 -

Fortnite Is Back Download On Us I Phones Now

May 22, 2025

Fortnite Is Back Download On Us I Phones Now

May 22, 2025 -

Factors Contributing To Core Weave Crwv Stocks Tuesday Increase

May 22, 2025

Factors Contributing To Core Weave Crwv Stocks Tuesday Increase

May 22, 2025