The "Just Contact Us" Phenomenon: Analyzing TikTok's Tariff Circumvention Strategies

Table of Contents

The "Just Contact Us" Strategy: A Deceptive Simplicity

The phrase "Just Contact Us," often found in TikTok's communication regarding pricing and import processes, acts as a smokescreen for potentially illegal activities related to tariff evasion. This seemingly simple phrase allows for a level of opacity that facilitates various methods of circumventing US import tariffs imposed on goods originating from China.

-

Avoids public disclosure of pricing and import processes: By directing inquiries to private channels, TikTok avoids public scrutiny of its pricing structures and import methods, making it difficult to verify compliance with tariff regulations. This lack of transparency is a red flag for potential tariff circumvention.

-

Allows for negotiation of prices outside formal channels: "Just Contact Us" allows for backroom deals and negotiations that could result in artificially lowered prices, potentially misrepresenting the true value of imported goods to avoid higher tariffs.

-

Facilitates potentially preferential treatment for certain importers: This approach allows for selective application of pricing and import procedures, possibly favoring certain importers and potentially disadvantaging competitors. This could be a strategy to manipulate the system and minimize tariff payments.

-

Obscures the origin of goods, making it difficult to verify compliance: The lack of transparent documentation and the reliance on private communication make it challenging for authorities to verify the true origin of the goods and ensure that the correct tariffs are being applied.

Analyzing TikTok's Supply Chain and Import Practices

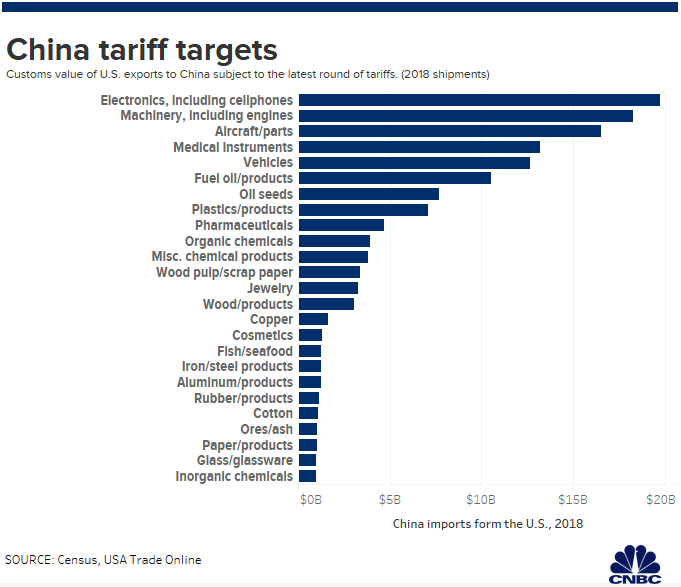

TikTok's complex global supply chain, spanning numerous countries and involving various intermediaries, presents significant vulnerabilities regarding tariff compliance. Understanding this intricate network is crucial to assessing the effectiveness of their "Just Contact Us" strategy in avoiding US tariffs.

-

Examination of TikTok's sourcing of components and manufacturing processes: A detailed investigation into where TikTok sources its components and how they are manufactured is needed to fully understand the potential for tariff avoidance. The use of multiple countries in the manufacturing process could be used to obfuscate the true origin.

-

Investigation into the role of intermediary companies in potentially avoiding tariffs: The involvement of shell corporations and intermediary companies based in different jurisdictions could mask the true origin and cost of imported goods, allowing TikTok to potentially reduce their tariff obligations.

-

Analysis of shipping routes and documentation to identify potential loopholes: Analyzing the shipping routes and documentation associated with TikTok's imports can reveal potential loopholes and inconsistencies that indicate attempts to circumvent tariffs. Unusual routes or discrepancies in documentation warrant closer examination.

-

Comparison with other Chinese companies' strategies for tariff avoidance: By comparing TikTok's strategies with those of other Chinese companies facing similar trade challenges, we can better understand the common tactics used and the effectiveness of different approaches to tariff evasion.

The Role of Intermediaries in Facilitating Tariff Circumvention

Third-party companies and shell corporations play a crucial role in potentially facilitating TikTok's tariff circumvention strategies. These entities can manipulate the supply chain to obscure the true origin and cost of goods.

-

Examples of intermediary companies and their roles in the supply chain: Identifying specific intermediary companies involved in TikTok's supply chain and analyzing their roles can shed light on how the "Just Contact Us" strategy facilitates tariff evasion.

-

Analysis of how intermediaries can manipulate invoicing and documentation: Intermediaries can manipulate invoices and other documentation to misrepresent the value or origin of goods, reducing the amount of tariffs payable. This is a common tactic in tariff evasion schemes.

-

Discussion of the legal and ethical implications of using intermediaries for tariff avoidance: Using intermediaries for tariff avoidance raises serious legal and ethical questions, particularly concerning transparency, fair competition, and compliance with international trade regulations.

The Legal and Regulatory Implications of TikTok's Practices

TikTok's "Just Contact Us" strategy and its potential involvement in tariff evasion expose the company to significant legal and regulatory repercussions under US trade laws.

-

Overview of relevant US trade regulations and statutes: Understanding the specific US trade regulations and statutes relevant to tariff evasion is crucial in evaluating the potential penalties TikTok could face. This includes examining the relevant sections of the Tariff Act of 1930 and other related legislation.

-

Analysis of potential fines and legal repercussions for tariff evasion: The penalties for tariff evasion can be substantial, including significant fines, legal fees, and potential criminal charges. The severity of the penalties depends on the scale and nature of the violation.

-

Discussion of the ongoing investigations and potential future actions: Any ongoing investigations into TikTok's trade practices and the potential for future legal actions must be considered when analyzing the risks the company faces.

-

Comparison with legal cases of other companies accused of similar practices: Examining similar cases involving other companies accused of tariff evasion can provide insights into the potential outcomes and penalties TikTok might face.

The Future of TikTok and its Trade Compliance

The future of TikTok hinges on its ability to adapt its strategies to comply with international trade regulations. Increased scrutiny from regulators will likely force changes in their approach.

-

Prediction on potential changes in TikTok's supply chain and import practices: TikTok may need to restructure its supply chain, increase transparency in its import processes, and improve its internal controls to mitigate the risks associated with tariff circumvention.

-

Discussion of the likelihood of future investigations and legal challenges: The likelihood of further investigations and potential legal challenges remains high, given the ongoing concerns about TikTok's trade practices.

-

Analysis of the impact of increased regulatory scrutiny on TikTok's operations: Increased regulatory scrutiny will inevitably impact TikTok's operations, potentially increasing compliance costs and limiting its flexibility in its supply chain management.

-

Suggestions for improved transparency and compliance within the company: Improving transparency, implementing robust internal controls, and cooperating fully with regulatory investigations are crucial steps for TikTok to address these concerns and ensure future compliance.

Conclusion

The "Just Contact Us" phenomenon highlights a potential loophole in international trade regulations, allowing companies like TikTok to potentially circumvent tariffs through opaque business practices. While the phrase itself is innocuous, its use in the context of complex global supply chains raises serious questions about trade compliance and fair competition. Understanding this tactic is crucial for enforcing trade regulations and ensuring a level playing field for all businesses. Further investigation into TikTok's practices, and similar strategies employed by other companies, is necessary to prevent future tariff circumvention. To learn more about the complexities of international trade and the strategies employed to avoid tariffs, continue your research using keywords such as TikTok Tariff Circumvention, "Just Contact Us" Strategy, and US Import Tariffs.

Featured Posts

-

Anchor Brewing Company To Shutter A Legacy Ends

Apr 22, 2025

Anchor Brewing Company To Shutter A Legacy Ends

Apr 22, 2025 -

Crooks Office365 Executive Inbox Hacks Result In Millions In Stolen Funds

Apr 22, 2025

Crooks Office365 Executive Inbox Hacks Result In Millions In Stolen Funds

Apr 22, 2025 -

Pope Franciss Papacy A Defining Conclave

Apr 22, 2025

Pope Franciss Papacy A Defining Conclave

Apr 22, 2025 -

Export Led Growth Assessing Chinas Tariff Sensitivity

Apr 22, 2025

Export Led Growth Assessing Chinas Tariff Sensitivity

Apr 22, 2025 -

Putin Ends Ukraine Truce Renewed Conflict Erupts

Apr 22, 2025

Putin Ends Ukraine Truce Renewed Conflict Erupts

Apr 22, 2025