The Most Profitable Dividend Strategy Is Surprisingly Simple

Table of Contents

Understanding Dividend Investing Basics

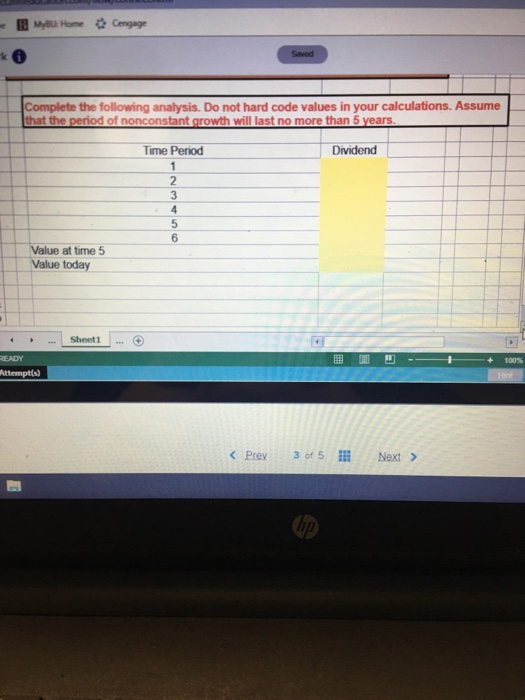

Dividend investing involves purchasing stocks in companies that regularly distribute a portion of their profits to shareholders as dividends. This provides a stream of passive income, supplementing capital appreciation. Understanding key terms is crucial. Dividend yield represents the annual dividend per share relative to the stock price. The dividend payout ratio indicates the percentage of earnings paid out as dividends. A high payout ratio may signal risk if not supported by strong earnings growth. Finally, the dividend growth rate shows the percentage increase in dividends over time.

Different types of dividend stocks exist, each with its own characteristics. Blue-chip stocks from established companies generally offer stability and consistent dividends. Growth stocks, while potentially offering less in dividends initially, focus on reinvesting profits for expansion, leading to future dividend growth. Income stocks prioritize high dividend payouts, often appealing to investors seeking immediate income.

- Why dividends are important for long-term wealth building: Dividends provide a regular income stream, allowing for reinvestment and compounding growth.

- The risks associated with dividend investing: Company performance can decline, reducing or eliminating dividends. Market fluctuations can also impact stock prices and overall returns.

- The difference between a high dividend yield and a sustainable dividend: A high yield might indicate financial distress; a sustainable dividend reflects a company's ability to consistently pay out dividends over time.

The Surprisingly Simple Strategy: Focus on Dividend Growth

The core principle of the most profitable dividend strategy is prioritizing companies with a history of consistent dividend growth, not just the highest current yield. A company with a modestly growing dividend can outperform one with a high but unsustainable yield over the long run. Sustainability hinges on analyzing the dividend payout ratio and free cash flow. A low payout ratio suggests ample room for future dividend increases, while strong free cash flow indicates the company’s ability to support its dividend payments even during challenging periods.

The power of compounding is critical. Reinvesting dividends automatically purchases more shares, accelerating growth over time. This snowball effect is far more powerful than simply receiving a higher immediate payout.

- How to identify companies with strong dividend growth potential: Analyze financial statements, specifically looking at earnings growth, free cash flow, and the dividend payout ratio. Research the company's history and future outlook.

- The benefits of dividend reinvestment plans (DRIPs): DRIPs automatically reinvest dividends, simplifying the process and maximizing compounding.

- Examples of companies known for consistent dividend growth: Research successful companies with a long track record of increasing dividend payouts to find potential additions to your portfolio.

Diversification: Spreading Your Risk Across Multiple Stocks

Diversification is fundamental to mitigating risk in any investment strategy, including dividend investing. Don't put all your eggs in one basket. Spread your investments across various sectors (technology, healthcare, consumer goods, etc.) and market capitalizations (large-cap, mid-cap, small-cap). Consider geographic diversification as well, investing in companies across different countries.

- The advantages of a diversified dividend portfolio: Reduced risk, improved stability, and a smoother ride during market downturns.

- How many stocks are ideal for a well-diversified portfolio: A generally accepted range is 15-25 stocks, offering a good balance between diversification and management effort.

- Tools and resources for building a diversified portfolio: Utilize online brokerage platforms, financial planning tools, and research resources to identify suitable stocks.

Long-Term Perspective: Patience is Key

The most profitable dividend strategy requires patience. Dividend growth takes time. Short-term market fluctuations are inevitable, but they shouldn't derail your long-term strategy. Emotional discipline is crucial; avoid impulsive decisions driven by fear or greed.

- The power of compounding over the long term: The longer you invest, the more significant the impact of compounding becomes.

- How to deal with market downturns and maintain your investment strategy: Stick to your investment plan, avoid panic selling, and consider dollar-cost averaging to accumulate shares at various price points.

- The benefits of dollar-cost averaging for consistent investment: Dollar-cost averaging mitigates the risk of investing a lump sum at a market peak.

Unlocking the Most Profitable Dividend Strategy

In conclusion, the most profitable dividend strategy boils down to three key elements: focusing on companies with a history of consistent dividend growth, diversifying your portfolio across various sectors and market capitalizations, and maintaining a long-term investment perspective. This simple yet effective approach, when implemented patiently and diligently, can unlock significant long-term returns.

Start building your own portfolio focused on the most profitable dividend strategy today! Begin researching dividend growth stocks and explore the potential of long-term dividend investing. Learn more about creating a sustainable dividend income stream and watch your wealth grow steadily over time.

Featured Posts

-

Aaron Judge At 1 000 Games His Path To Cooperstown

May 11, 2025

Aaron Judge At 1 000 Games His Path To Cooperstown

May 11, 2025 -

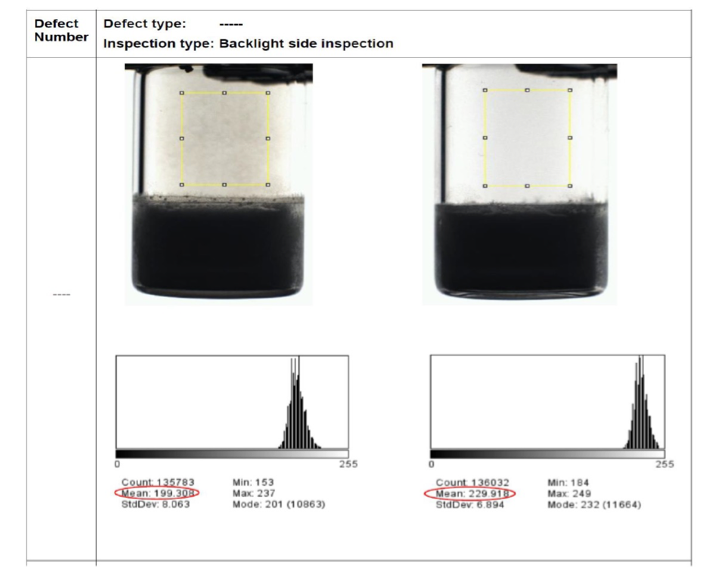

Enhanced Automated Visual Inspection For Lyophilized Vials Tackling Common Problems

May 11, 2025

Enhanced Automated Visual Inspection For Lyophilized Vials Tackling Common Problems

May 11, 2025 -

The Untold Story Of Prince Andrews Explosive Temper

May 11, 2025

The Untold Story Of Prince Andrews Explosive Temper

May 11, 2025 -

Le Divorce D Eric Antoine Et La Naissance De Son Enfant Avec Sa Nouvelle Compagne

May 11, 2025

Le Divorce D Eric Antoine Et La Naissance De Son Enfant Avec Sa Nouvelle Compagne

May 11, 2025 -

Flight Attendant To Pilot A Womans Journey Against The Odds

May 11, 2025

Flight Attendant To Pilot A Womans Journey Against The Odds

May 11, 2025