The Trump Tax Bill: House Passage After Late Amendments

Table of Contents

Key Provisions of the Amended Trump Tax Bill

The late amendments to the Trump Tax Bill introduced several key changes to the original proposal, impacting both corporate and individual taxpayers. These alterations significantly shaped the final legislation and its subsequent effects.

-

Corporate Tax Rate Reduction: The most significant change was the reduction in the corporate tax rate from 35% to 21%. This substantial tax cut was intended to boost economic growth by encouraging business investment and job creation. This change was a core element of the Trump administration's "tax reform" agenda.

-

Individual Tax Bracket Changes: The bill also modified individual income tax brackets, resulting in lower rates for some income levels. However, the standard deduction was increased, offsetting some of the benefits for higher earners. This led to debate on whether the tax cuts disproportionately benefitted the wealthy or provided relief to middle-class families. Analyzing individual tax brackets and their changes is crucial to understand the bill's true impact.

-

Changes to Itemized Deductions: Several itemized deductions, such as those for state and local taxes (SALT), were limited or eliminated altogether. This change impacted taxpayers in high-tax states, sparking significant political backlash and adding to the ongoing debate surrounding the Trump Tax Bill.

-

Increased Standard Deduction: The standard deduction was significantly increased, simplifying tax filing for many Americans, particularly those with lower incomes. This provision aimed to provide tax relief for a larger segment of the population. The impact of this increased standard deduction on various income levels requires further study.

The impact of these amendments varied across different income groups. While some benefited from lower tax rates, others faced limitations on deductions, creating a complex and often debated distribution of tax benefits. Understanding these impacts is critical to assessing the overall effectiveness of the Trump tax reform.

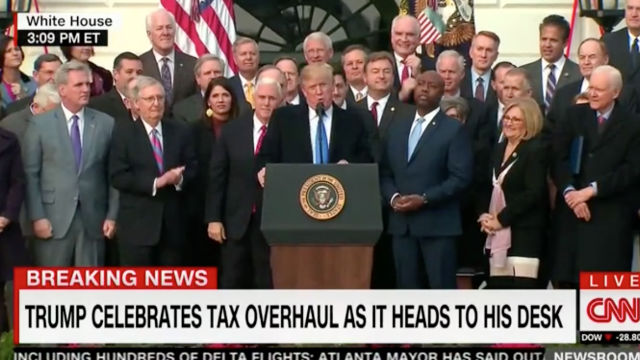

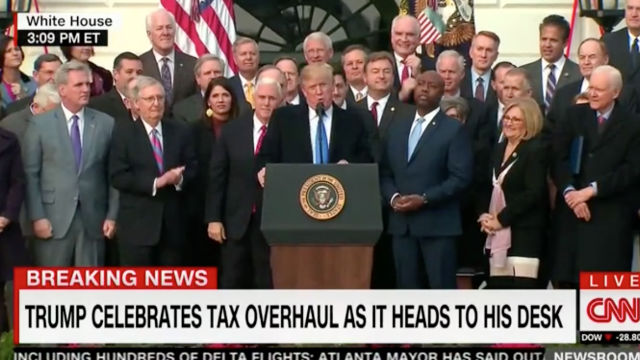

The Political Landscape Surrounding the Late Amendments

The late amendments to the Trump Tax Bill were the product of intense political negotiations and maneuvering. The political debate surrounding the bill was fierce, reflecting deep partisan divisions within Congress.

-

Republican Support and Internal Divisions: While Republicans largely supported the bill, internal disagreements over specific provisions, particularly regarding the tax cuts and deductions, created tension during the legislative process. Understanding these internal divisions is key to interpreting the final form of the bill.

-

Democratic Opposition: Democrats overwhelmingly opposed the bill, arguing that it favored corporations and the wealthy at the expense of the middle class and the poor. They pointed to the potential for increased national debt and the limitations on certain deductions as significant flaws.

-

Congressional Negotiations: The final version of the Trump Tax Bill was the result of numerous compromises and negotiations between different factions within Congress. Analyzing the legislative process reveals the political forces at play and the challenges involved in passing such significant legislation.

The partisan politics surrounding the Trump Tax Bill had a profound impact, not just on the final legislation itself but also on the broader political climate and future legislative efforts. The bill served as a prime example of the intense political divisions characterizing the era.

Potential Economic Impacts of the Trump Tax Bill

The Trump Tax Bill's economic impacts have been a subject of intense debate and analysis. Economists have offered various predictions, both positive and negative.

-

Short-Term Economic Stimulus: Some economists predicted a short-term boost to economic growth due to the tax cuts, stimulating consumer spending and business investment. However, this stimulus was not universally agreed upon.

-

Long-Term Uncertainty: The long-term effects remain uncertain, with different models predicting varying outcomes. Concerns have been raised regarding the impact on the national debt and potential inflationary pressures. The long-term effects of tax cuts and tax reform generally require significant time for accurate assessment.

-

Impact on Job Growth: Proponents argued the tax cuts would lead to significant job creation. Critics countered that the benefits would primarily accrue to corporations and the wealthy, with limited impact on job growth for the average worker. Evaluating the true impact of the bill on job creation requires extensive data analysis over a longer period.

-

Effect on the National Debt: The bill's effect on the national debt is another point of contention. While proponents argued that economic growth would offset the cost of the tax cuts, critics warned of a significant increase in the national debt. The relationship between the Trump Tax Bill and the national debt remains a highly debated economic topic.

Analyzing the potential economic impact requires considering a multitude of factors and utilizing various economic models. The long-term effects may only become fully apparent over several years.

Public Reaction and Future Implications

Public reaction to the Trump Tax Bill was mixed, reflecting the varied impacts on different groups. Public opinion polls showed divided reactions, with some approving of the tax cuts and others expressing concerns about its potential negative consequences.

-

Initial Public Response: Initial public response was largely divided along partisan lines. Supporters celebrated the tax cuts, while opponents criticized the bill's distributional effects and potential long-term consequences.

-

Legal Challenges: The bill faced legal challenges focusing on its constitutionality, but none proved ultimately successful. However, the legal scrutiny reflects the intensity of the public and political debate surrounding the legislation.

-

Future Legislative Efforts: The Trump Tax Bill's passage did not resolve all the issues surrounding American tax policy, and there have been ongoing efforts to reform or modify the bill. The potential for further changes reflects the dynamic nature of tax legislation and the ongoing debate surrounding tax reform.

The long-term effects of the Trump Tax Bill on American society and the economy remain to be fully understood and will likely be a subject of ongoing debate and analysis for many years to come.

Conclusion: Understanding the Trump Tax Bill's House Passage and Late Amendments

The House passage of the Trump Tax Bill, significantly shaped by late amendments, represents a major shift in American tax policy. The amended bill introduced substantial changes to corporate and individual tax rates, deductions, and the standard deduction. The political context surrounding its passage was highly contentious, revealing deep partisan divisions within Congress. The potential economic and social implications remain subjects of ongoing debate, with predictions ranging from short-term economic stimulus to long-term concerns about the national debt and income inequality. The late amendments themselves highlight the intense political negotiations and compromises that characterized the bill's creation.

The significance of these late amendments cannot be overstated; they fundamentally altered the original legislation and its impact on the American public. Understanding these amendments, the political landscape surrounding their introduction, and their potential economic consequences is crucial for navigating the complexities of American tax policy.

Stay updated on the ongoing impact of the Trump Tax Bill and its amendments by following reputable news sources and engaging in informed discussions about tax reform and its future. Understanding the nuances of this legislation—its provisions, its passage, and its amendments—is key to engaging effectively in the continuing conversation surrounding tax reform and its influence on American society.

Featured Posts

-

No Change For The Who Pete Townshend On Zak Starkeys Future

May 23, 2025

No Change For The Who Pete Townshend On Zak Starkeys Future

May 23, 2025 -

G 7 De Minimis Tariffs On Chinese Goods Key Discussion Points

May 23, 2025

G 7 De Minimis Tariffs On Chinese Goods Key Discussion Points

May 23, 2025 -

Tjrbt Snae Alaflam Fy Brnamj Qmrt Alqtry

May 23, 2025

Tjrbt Snae Alaflam Fy Brnamj Qmrt Alqtry

May 23, 2025 -

Injury Problems Plague England Ahead Of Zimbabwe Tour

May 23, 2025

Injury Problems Plague England Ahead Of Zimbabwe Tour

May 23, 2025 -

Las Novedades De Instituto Jugadores Citados Y El Once Probable Contra Lanus

May 23, 2025

Las Novedades De Instituto Jugadores Citados Y El Once Probable Contra Lanus

May 23, 2025