Today's Stock Market: China Tariff News And UK Trade Deal Developments

Table of Contents

The global stock market is a dynamic landscape, constantly shifting based on international trade relations. Today's market is particularly sensitive to developments surrounding China-US tariffs and the evolving UK trade landscape post-Brexit. This article will delve into the key news impacting "Today's Stock Market," focusing on the influence of these crucial trade developments.

<h2>China Tariff News and its Impact on Global Markets</h2>

<h3>The Current State of US-China Trade Relations:</h3>

The US-China trade war, while not as overtly aggressive as in previous years, continues to cast a long shadow over global markets. While a full-scale trade agreement remains elusive, the current state is characterized by a complex web of tariffs and ongoing negotiations. Recent developments haven't seen major tariff escalations, but the threat remains. This creates an environment of uncertainty that impacts investor confidence.

- Specific Tariff Changes: While significant new tariff announcements have been relatively quiet recently, existing tariffs on various goods remain in place, impacting sectors such as technology and agriculture.

- Impact on Specific Sectors: The tech sector, particularly concerning semiconductor manufacturing and technology transfer, continues to be a focal point of trade tensions. Agricultural products remain vulnerable to tariff increases, affecting producers and exporters.

- Government Statements: Statements from both US and Chinese officials often hint at a willingness to negotiate, but concrete progress remains slow, fostering continued market volatility. Close monitoring of official communications is crucial for understanding the direction of US-China trade relations.

<h3>Analyzing the Impact on Key Stock Indices:</h3>

Recent tariff news and the overall uncertainty surrounding US-China relations have created significant volatility in global stock market indices.

- Percentage Changes: The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all shown periods of both significant gains and losses influenced by trade developments. The Shanghai Composite, naturally, is particularly sensitive to these shifts. Percentage changes are highly variable and depend on the specific news and overall market sentiment.

- Winning and Losing Sectors: Sectors heavily reliant on exports to China or the US have experienced the most pronounced swings. Technology and agricultural stocks, for example, often experience heightened volatility.

- Analyst Predictions: Analysts offer mixed predictions, with many suggesting that a resolution to the trade dispute is essential for sustained market growth. However, they also point to the resilience of the global economy and the potential for companies to adapt to the current trade environment.

<h3>Long-Term Implications and Investment Strategies:</h3>

The ongoing US-China trade dispute presents both challenges and opportunities for long-term investors.

- Diversification Strategies: Diversifying investments across different sectors and geographies is crucial to mitigate risk associated with trade uncertainties.

- Risk Mitigation Techniques: Employing hedging strategies, such as investing in less volatile assets, can help protect portfolios during periods of increased market uncertainty.

- Specific Sector Recommendations: Investors may consider underweighting sectors directly exposed to high tariffs while exploring opportunities in sectors less vulnerable to trade disruptions.

<h2>UK Trade Deal Developments and their Effect on the Stock Market</h2>

<h3>Post-Brexit Trade Agreements:</h3>

The UK's post-Brexit trade landscape is still evolving. The country is negotiating various trade deals globally, but progress varies.

- Specific Agreements: Agreements with the EU, while in place, continue to be a source of ongoing discussion and potential adjustments. Negotiations with other major economies, such as the US, are still underway, creating uncertainty for businesses.

- Current Status: The status of these deals influences investor sentiment and affects the performance of UK-based companies. Delays or setbacks can lead to negative market reactions.

- Potential Impact: The ultimate impact will depend on the terms of the agreements reached and how effectively UK businesses adapt to the new trade environment.

<h3>Impact on Specific UK Sectors:</h3>

Various UK sectors are experiencing different impacts based on the evolving trade landscape.

- Finance: The UK financial services sector is adapting to new regulatory frameworks related to EU trade and access to European markets.

- Agriculture: The agricultural sector has been affected by changes in trade relationships and access to European markets.

- Manufacturing: The manufacturing industry continues to grapple with supply chain disruptions and increased tariffs for some products.

- Stock Market Performance: The stock market performance of companies within these sectors reflects the challenges and opportunities presented by the new trade dynamics.

<h3>Opportunities and Challenges for UK Investors:</h3>

Navigating the UK market requires a keen understanding of the changing landscape.

- Potential Investment Opportunities: Opportunities may exist within sectors adapting well to the post-Brexit environment or exploring new global markets.

- Risk Factors: Risks include continued uncertainty surrounding trade deals and their impact on specific sectors.

- Strategies for Navigating Uncertainty: Careful analysis of individual company performance, sector-specific risks, and broader macroeconomic trends is critical for informed investment decisions.

<h2>Conclusion</h2>

Today's stock market is significantly influenced by both China tariff news and UK trade deal developments. Understanding the complexities of these international trade relations is vital for informed investment decisions. The ongoing US-China trade tensions and the evolving UK post-Brexit trade landscape create volatility, but also potential opportunities for savvy investors. Staying informed about "Today's Stock Market" news and analysis, understanding the specific impacts on key indices and sectors, and employing suitable investment strategies are crucial for navigating this dynamic landscape. Check back regularly for further updates on the ever-evolving global market.

Featured Posts

-

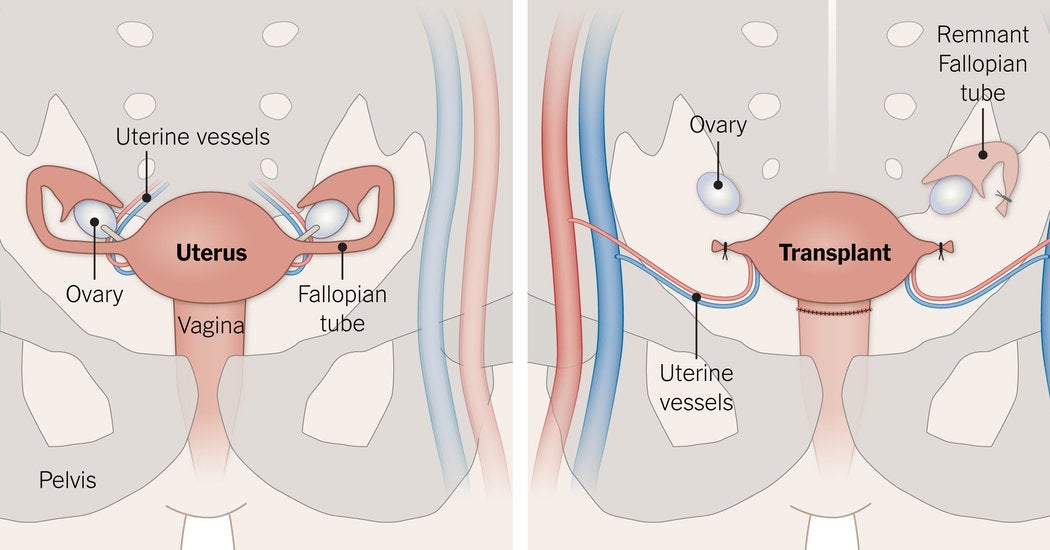

Live Uterus Transplants A Community Activists Proposal For Transgender Women

May 10, 2025

Live Uterus Transplants A Community Activists Proposal For Transgender Women

May 10, 2025 -

Incredibly Dangerous Months Of Warnings Preceded Latest Newark Air Traffic Control Outage

May 10, 2025

Incredibly Dangerous Months Of Warnings Preceded Latest Newark Air Traffic Control Outage

May 10, 2025 -

Credit Suisse Whistleblower Case 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case 150 Million Settlement

May 10, 2025 -

Wolves Rejection Fueled His Rise Now Hes Europes Best

May 10, 2025

Wolves Rejection Fueled His Rise Now Hes Europes Best

May 10, 2025 -

Detencion De Estudiante Transgenero Debate Sobre Banos Y Derechos Lgbtq

May 10, 2025

Detencion De Estudiante Transgenero Debate Sobre Banos Y Derechos Lgbtq

May 10, 2025