Top Performing India Fund, DSP, Issues Stock Market Caution, Raises Cash Levels

Table of Contents

DSP's Rationale for Increasing Cash Levels

DSP, a renowned fund house known for its strong track record and expertise in India mutual funds, has justified its increased cash levels by citing several key concerns impacting its DSP investment strategy. Their assessment of the current market risk landscape reveals a proactive approach to risk mitigation and portfolio management. This cautious stance reflects a deep understanding of the complexities within the India economic outlook.

-

Concerns about global inflationary pressures: Persistently high inflation globally is impacting economies worldwide, leading to uncertainty in growth projections. This uncertainty necessitates a more conservative approach to investments.

-

Potential impact of interest rate hikes on valuations: Central banks globally are implementing interest rate hikes to combat inflation. These hikes can significantly impact the valuations of assets, potentially leading to market corrections.

-

Geopolitical uncertainties affecting market stability: Geopolitical tensions and events create instability in the global financial markets, impacting investor sentiment and creating uncertainty for market stability.

-

Valuation concerns within specific sectors of the Indian market: While the Indian market has shown resilience, certain sectors may be overvalued, leading to a need for selective investment and cautious portfolio management.

Impact on Investors and Portfolio Strategies

DSP's decision to increase cash levels may lead to some short-term consequences for existing investors. While this might result in lower short-term returns due to increased cash holdings, it also reflects a commitment to long-term value creation. This strategic move aims to safeguard investor capital during periods of market volatility.

-

Potential for lower short-term returns due to increased cash holdings: Investors should be prepared for potentially lower returns in the short term, as a higher proportion of the portfolio is held in cash, which generally offers lower returns than equities.

-

Emphasis on long-term value creation despite short-term volatility: DSP's strategy prioritizes preserving capital and long-term growth, even if it means accepting lower short-term returns.

-

Advice for investors with different risk profiles: Investors with lower risk tolerance might view this as a positive development, while those seeking higher short-term gains may need to re-evaluate their investment strategies and risk tolerance.

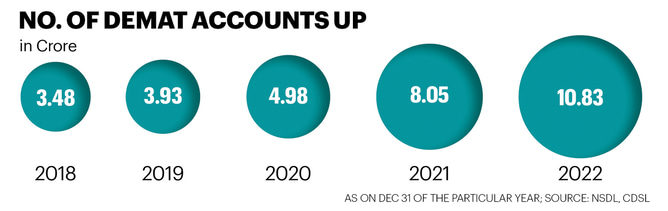

Analyzing the Indian Stock Market's Current State

The Indian stock market currently presents a mixed picture. While fundamental economic indicators remain positive in many aspects, several factors influence its performance. Analyzing these factors is crucial for informed investment decisions. This detailed Indian stock market analysis will help guide your strategies.

-

Recent performance of key market indices (e.g., Nifty 50, Sensex): Monitoring the performance of key indices provides insights into the overall market trend and helps assess the impact of various factors.

-

Analysis of sector-specific performance: Different sectors within the Indian economy perform differently based on market trends and macro-economic factors. Careful sector analysis is crucial.

-

Discussion of macroeconomic factors influencing the market: Factors like inflation, interest rates, global economic growth, and government policies significantly influence the performance of the Indian stock market.

Alternative Investment Options and Diversification

Given the current market climate, diversification becomes increasingly crucial. Investors should consider spreading their investments across various asset classes to mitigate risk. A well-structured diversification strategy forms the cornerstone of robust risk management.

-

Exploring other asset classes (e.g., bonds, gold): Including asset classes like bonds and gold can help reduce portfolio volatility and provide stability during market downturns.

-

Considering investments in different sectors or geographies: Diversification across sectors and geographies helps reduce dependence on any single market or economic condition.

-

Importance of aligning investments with individual risk profiles: Investment decisions should always reflect an investor's individual risk tolerance and financial goals.

Conclusion: Navigating Market Uncertainty with the Top Performing India Fund

DSP's cautious approach, demonstrated by its decision to raise cash levels, highlights the importance of navigating market uncertainty with a balanced and informed investment strategy. This top performing India fund’s actions underscore the need for investors to carefully consider their risk tolerance and long-term investment goals. By understanding the current market landscape and exploring various investment options, you can adapt your portfolio to meet your financial objectives. Learn more about DSP's investment strategies and how to adjust your portfolio for optimal performance in this evolving market. Consider your risk tolerance and explore alternative investment options available with DSP mutual funds to manage your India mutual fund investments effectively. Remember, long-term investment planning is key to successful investing in the ever-changing world of India mutual fund investments.

Featured Posts

-

Analysis Of Benny Johnsons Statement Regarding Jeffrey Goldberg And National Security Information

Apr 29, 2025

Analysis Of Benny Johnsons Statement Regarding Jeffrey Goldberg And National Security Information

Apr 29, 2025 -

Kitzbuehel Feiert Mit Tgi Ag Praesentiert Zukunftsplaene

Apr 29, 2025

Kitzbuehel Feiert Mit Tgi Ag Praesentiert Zukunftsplaene

Apr 29, 2025 -

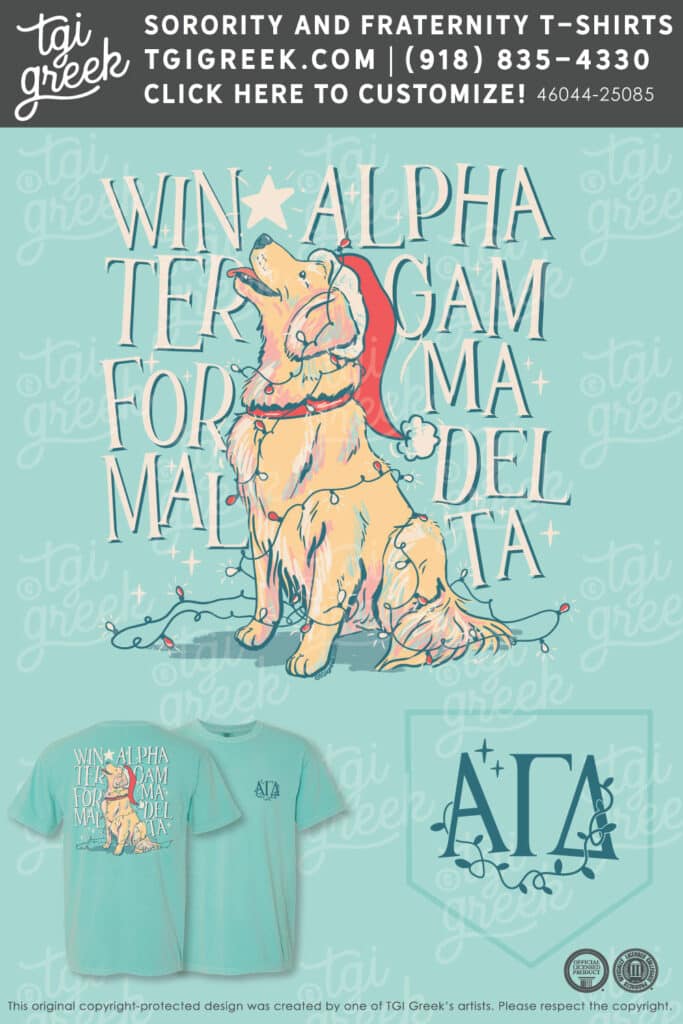

Republican Revolt Will Trumps Tax Plan Face Defeat

Apr 29, 2025

Republican Revolt Will Trumps Tax Plan Face Defeat

Apr 29, 2025 -

Nyi Rafdrifnir Porsche Macan Oell Upplysingar

Apr 29, 2025

Nyi Rafdrifnir Porsche Macan Oell Upplysingar

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025