Toronto Home Sales And Prices: A 23% And 4% Decrease Respectively

Table of Contents

Significant Drop in Toronto Home Sales: Understanding the 23% Decrease

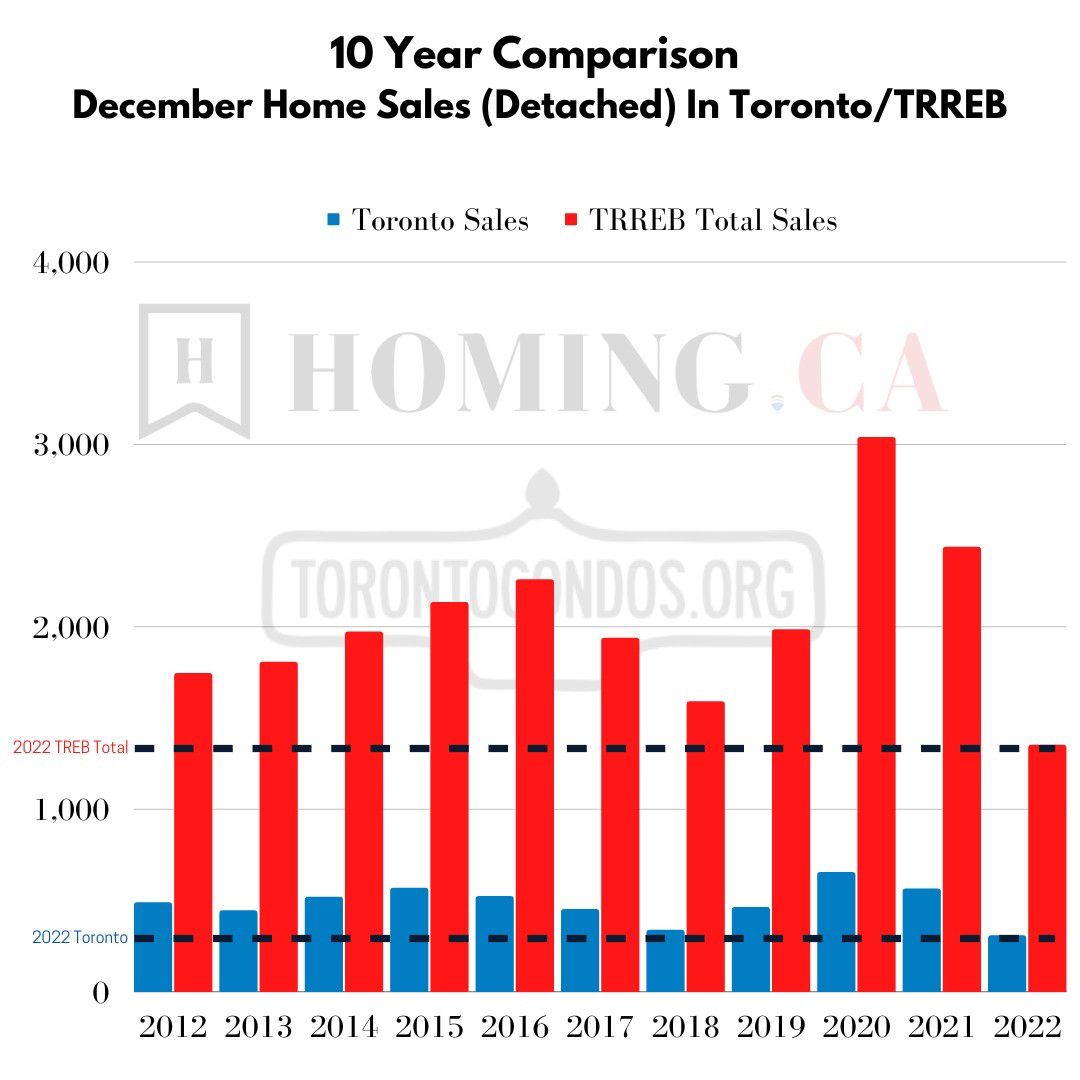

The 23% decrease in Toronto home sales in October 2023 represents a substantial cooling of the market. Several factors contributed to this significant drop, impacting both the number of transactions and the overall activity in the Toronto real estate market.

Impact of Rising Interest Rates

- Increased borrowing costs deter potential buyers. Higher interest rates translate directly into higher mortgage payments, making homeownership less affordable for many.

- Higher mortgage payments reduce affordability. Even for those who qualify for a mortgage, the increased monthly payments can significantly impact their budgets, limiting their purchasing power in the Toronto real estate market.

- Impact on both first-time homebuyers and those seeking to upgrade. First-time homebuyers are particularly vulnerable to rising interest rates, as they often have less financial flexibility. Similarly, those looking to upgrade their homes may find themselves priced out of their desired market segment.

The Bank of Canada's interest rate hikes throughout 2022 and into 2023 played a crucial role in dampening buyer enthusiasm. Each increase significantly impacted affordability, pushing many potential buyers out of the Toronto real estate market. The cumulative effect of these increases is clearly reflected in the substantial drop in sales.

Reduced Buyer Demand

- Economic uncertainty impacting consumer confidence. Concerns about inflation, recession, and job security have led to a decrease in consumer confidence, making potential homebuyers more hesitant to commit to large financial investments.

- Inflation impacting purchasing power. Rising inflation erodes the purchasing power of consumers, further reducing their ability to afford homes in the already expensive Toronto market.

- Potential for further interest rate increases. The anticipation of further interest rate hikes continues to create uncertainty in the market, prompting many to delay their purchasing decisions.

The combination of these macroeconomic factors has created a climate of caution among potential buyers, resulting in a significant reduction in demand for Toronto real estate.

Inventory Levels

- Increased supply of homes on the market. The number of homes listed for sale in Toronto increased significantly, giving buyers more options to choose from. This shift in supply contributed to the slowdown in sales.

- Shift in buyer-seller dynamics. The increased inventory has shifted the balance of power in favor of buyers, who now have more negotiating leverage.

- Impact on negotiation power for buyers. Buyers are now in a better position to negotiate lower prices and more favorable terms, which has further slowed down sales activity.

Data from the Toronto Real Estate Board shows a noticeable increase in the number of new listings and a lengthening of the average days-on-market, indicating a shift towards a buyers' market.

4% Decrease in Average Toronto Home Prices: A Moderating Market?

The 4% decrease in average Toronto home prices signals a moderation in the market, although it's important to consider the nuances within this figure.

Price Adjustments

- Sellers adjusting listing prices to reflect market conditions. Facing slower sales, many sellers are adjusting their listing prices downwards to attract buyers in the current market.

- Increased competition among sellers. With increased inventory, sellers are competing more fiercely for buyers' attention, leading to price adjustments.

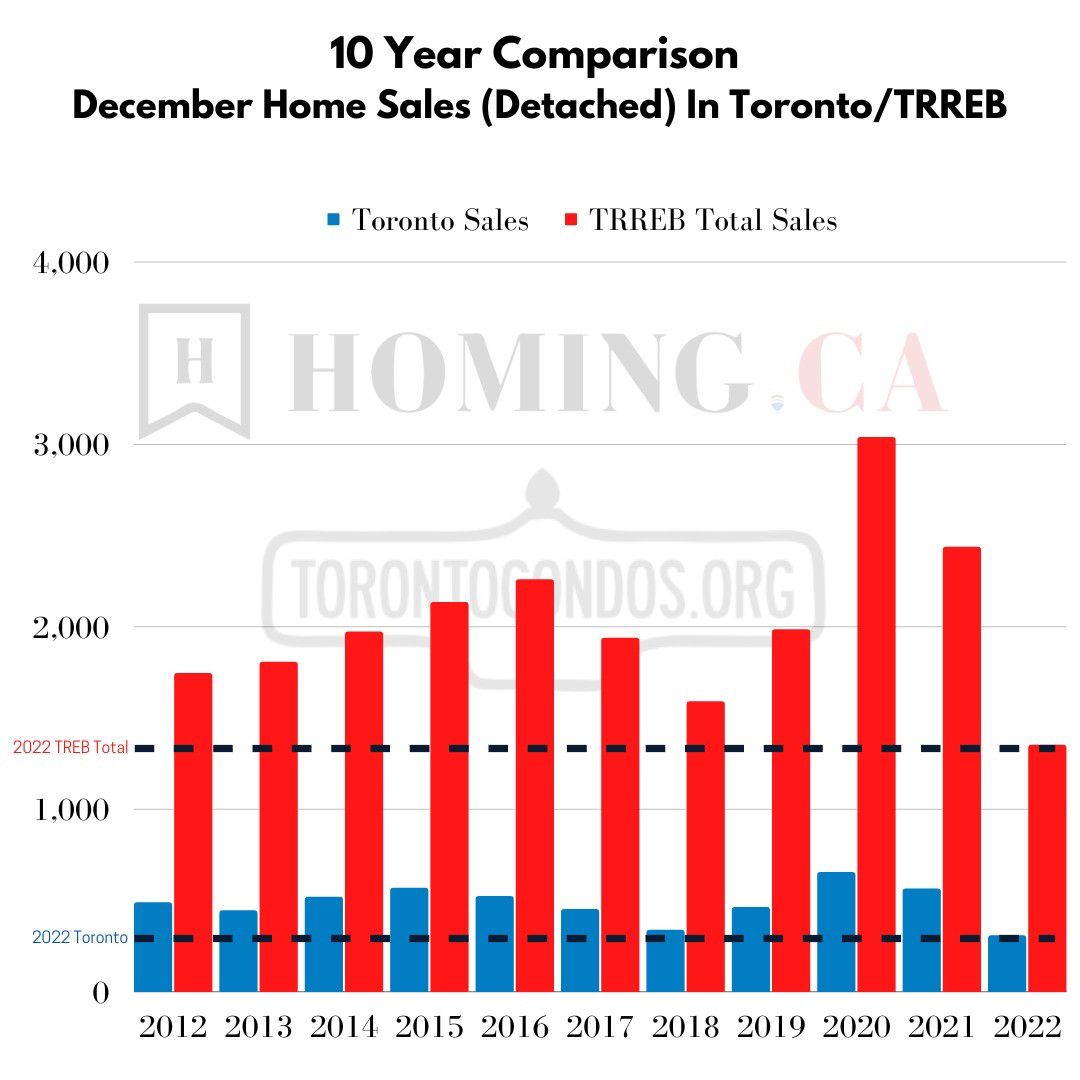

- Impact on average home prices across different property types (condos, detached homes, townhouses). The price adjustments are not uniform across all property types. While detached homes may have experienced more significant price drops, condo prices might show more resilience.

Detailed analysis reveals that price reductions are most evident in the higher price brackets and certain neighbourhoods.

Geographic Variations

- Analysis of price changes in different Toronto neighbourhoods. Price changes vary significantly across different neighborhoods in Toronto, reflecting local market dynamics and property type.

- Impact of local market conditions. Factors such as proximity to amenities, schools, and transportation infrastructure influence price fluctuations in different areas.

- Identification of areas experiencing greater or lesser price declines. Some neighbourhoods show more significant price corrections than others, highlighting the heterogeneity within the Toronto real estate market.

A map visualizing price changes across different Toronto neighbourhoods would provide a clearer picture of these variations.

Future Price Predictions

- Expert opinions on future price trends. Real estate experts offer diverse opinions on future price trends, with some predicting further price corrections and others anticipating a stabilization of the market.

- Analysis of economic forecasts and their impact on the Toronto real estate market. Future economic forecasts, including interest rate predictions and inflation rates, will play a crucial role in shaping the future trajectory of Toronto home prices.

- Potential for further price adjustments. The possibility of further interest rate hikes or unexpected economic shifts could lead to additional price adjustments in the Toronto real estate market.

While there's no consensus on future price movements, the consensus seems to be a period of market stabilization, with potential for further, albeit more moderate price adjustments.

Conclusion

The significant 23% decrease in Toronto home sales and the 4% drop in average prices represent a considerable shift in the Toronto real estate market. This is primarily driven by rising interest rates, reduced buyer demand, and increased inventory. While price adjustments are occurring, the overall market appears to be moderating.

Understanding the dynamics of the current Toronto home sales and prices is crucial for both buyers and sellers navigating this evolving market. Stay informed about the latest trends and consult with a real estate professional to make informed decisions regarding your Toronto property investments. Further research on Toronto real estate trends will help you navigate this shifting market successfully.

Featured Posts

-

Resultat Lotto 6aus49 Mittwoch 9 April 2025

May 08, 2025

Resultat Lotto 6aus49 Mittwoch 9 April 2025

May 08, 2025 -

A Look Back The Best Krypto Stories Ever Written

May 08, 2025

A Look Back The Best Krypto Stories Ever Written

May 08, 2025 -

Xrp On The Verge Of A Breakthrough Etf Applications Sec Case Updates And Market Analysis

May 08, 2025

Xrp On The Verge Of A Breakthrough Etf Applications Sec Case Updates And Market Analysis

May 08, 2025 -

Mookie Betts Absence From Freeway Series Illness To Blame

May 08, 2025

Mookie Betts Absence From Freeway Series Illness To Blame

May 08, 2025 -

The Best Krypto Comic Book Tales Ever Told

May 08, 2025

The Best Krypto Comic Book Tales Ever Told

May 08, 2025