Trade Wars And Crypto: Identifying A Potential Winner

Table of Contents

The Impact of Trade Wars on Traditional Markets

Trade wars, characterized by escalating tariffs and trade restrictions, significantly impact traditional financial markets. Understanding these repercussions is crucial for assessing the potential of cryptocurrencies as an alternative.

Currency Devaluation and Inflation

Trade wars often lead to currency fluctuations and increased inflation. When a country imposes tariffs, it can lead to higher prices for imported goods, fueling inflation. Conversely, retaliatory tariffs from other nations can weaken a country's currency, impacting its purchasing power on the global stage.

- Historical Examples: The Smoot-Hawley Tariff Act of 1930, while not solely responsible, exacerbated the Great Depression by triggering retaliatory tariffs and disrupting global trade, leading to currency instability. More recently, the US-China trade war saw fluctuations in both the US dollar and the Chinese yuan.

- Negative Consequences for Investors:

- Reduced purchasing power, eroding the value of savings and investments.

- Decreased investment returns as inflation outpaces investment growth.

- Increased market volatility, making accurate investment predictions more challenging.

Supply Chain Disruptions and Market Volatility

Tariffs and trade restrictions disrupt global supply chains, leading to shortages, increased prices, and uncertainty. Businesses face higher costs and delays, impacting production and profitability. This uncertainty translates into increased volatility in traditional markets.

- Industries Significantly Affected:

- Technology: The tech industry relies heavily on global supply chains for components and manufacturing. Trade wars can disrupt production and increase the cost of electronic devices.

- Manufacturing: Manufacturing companies are particularly vulnerable to supply chain disruptions, facing higher input costs and potential production slowdowns.

- Agriculture: Agricultural products are often subject to tariffs, impacting both domestic producers and consumers.

Cryptocurrency as a Hedge Against Trade War Uncertainty

Cryptocurrencies, with their inherent characteristics, offer a potential hedge against the uncertainty created by trade wars.

Decentralization and Geopolitical Independence

The decentralized nature of cryptocurrencies makes them less susceptible to the impact of trade wars. Unlike fiat currencies tied to national economies, cryptocurrencies are not subject to the same level of geopolitical influence. Their operation is not dependent on any single government or institution.

- Advantages of Decentralization:

- Censorship Resistance: Crypto transactions are difficult to censor or control by governments or other entities.

- Increased Security: Decentralization distributes control and reduces the risk of single points of failure.

- Global Accessibility: Cryptocurrencies are accessible from anywhere with an internet connection, bypassing geographical restrictions.

Increased Demand During Economic Uncertainty

During periods of economic uncertainty, such as those triggered by trade wars, investors often seek safe haven assets. Cryptocurrencies, with their potential for price appreciation and limited correlation with traditional markets, may see increased demand.

- Examples of Increased Adoption: We've seen surges in cryptocurrency adoption during times of market instability and geopolitical uncertainty. This suggests a growing recognition of crypto's role as a potential safe haven asset.

- Reasons for Investor Interest:

- Diversification: Adding crypto to a portfolio helps diversify away from traditional assets vulnerable to trade war impacts.

- Inflation Hedge: Some believe cryptocurrencies can act as a hedge against inflation, preserving purchasing power during economic instability.

- Alternative Investment: Crypto provides an alternative investment option outside of traditional markets affected by trade wars.

Specific Cryptocurrencies Potentially Benefiting from Trade Wars

While all cryptocurrencies could potentially benefit from increased demand during trade wars, some may experience disproportionate growth.

- Potential Beneficiaries:

- Bitcoin (BTC): Its established market dominance and brand recognition often make it a preferred choice for investors seeking a safe haven.

- Ethereum (ETH): Ethereum's robust decentralized finance (DeFi) ecosystem may attract investors seeking alternative financial tools less susceptible to trade war impacts.

- Stablecoins: Stablecoins pegged to fiat currencies offer a refuge from volatile crypto markets while still offering the benefits of blockchain technology.

Conclusion

Trade wars create economic uncertainty, impacting traditional markets through currency devaluation, inflation, and supply chain disruptions. However, the decentralized and borderless nature of cryptocurrencies presents a compelling alternative. Their potential as a hedge against trade war uncertainty, coupled with increased demand during economic instability, makes them an increasingly attractive investment option. Diversifying a portfolio to include crypto assets is a strategic move to mitigate risks associated with global trade conflicts. While navigating the complexities of trade wars and the cryptocurrency market requires careful consideration, understanding the potential for cryptocurrency to act as a safe haven and a growth opportunity is crucial for informed investors. Learn more about how to strategically incorporate crypto assets into your portfolio to mitigate the risks associated with trade wars and explore the potential of trade wars and crypto as an investment strategy.

Featured Posts

-

Dakota Johnson Kraujosruvos Kas Nutiko

May 09, 2025

Dakota Johnson Kraujosruvos Kas Nutiko

May 09, 2025 -

Tham Kich Tien Giang Bao Mau Bao Hanh Tre Em Bai Hoc Kinh Nghiem

May 09, 2025

Tham Kich Tien Giang Bao Mau Bao Hanh Tre Em Bai Hoc Kinh Nghiem

May 09, 2025 -

The Unexpected Surge In Bitcoin Mining Whats Behind It

May 09, 2025

The Unexpected Surge In Bitcoin Mining Whats Behind It

May 09, 2025 -

Review St Albert Dinner Theatres Hilarious Fast Flying Farce

May 09, 2025

Review St Albert Dinner Theatres Hilarious Fast Flying Farce

May 09, 2025 -

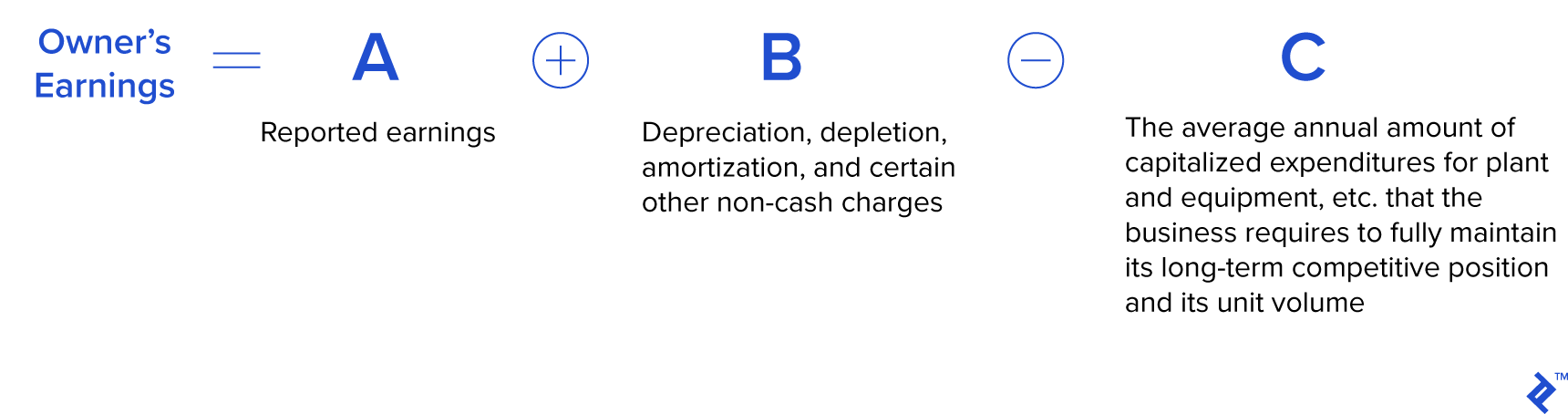

Analyzing The Investment Strategy Of Warren Buffetts Canadian Successor

May 09, 2025

Analyzing The Investment Strategy Of Warren Buffetts Canadian Successor

May 09, 2025