Trump Administration Tariffs And Their Effect On Fintech IPOs: The AFRM Case

Table of Contents

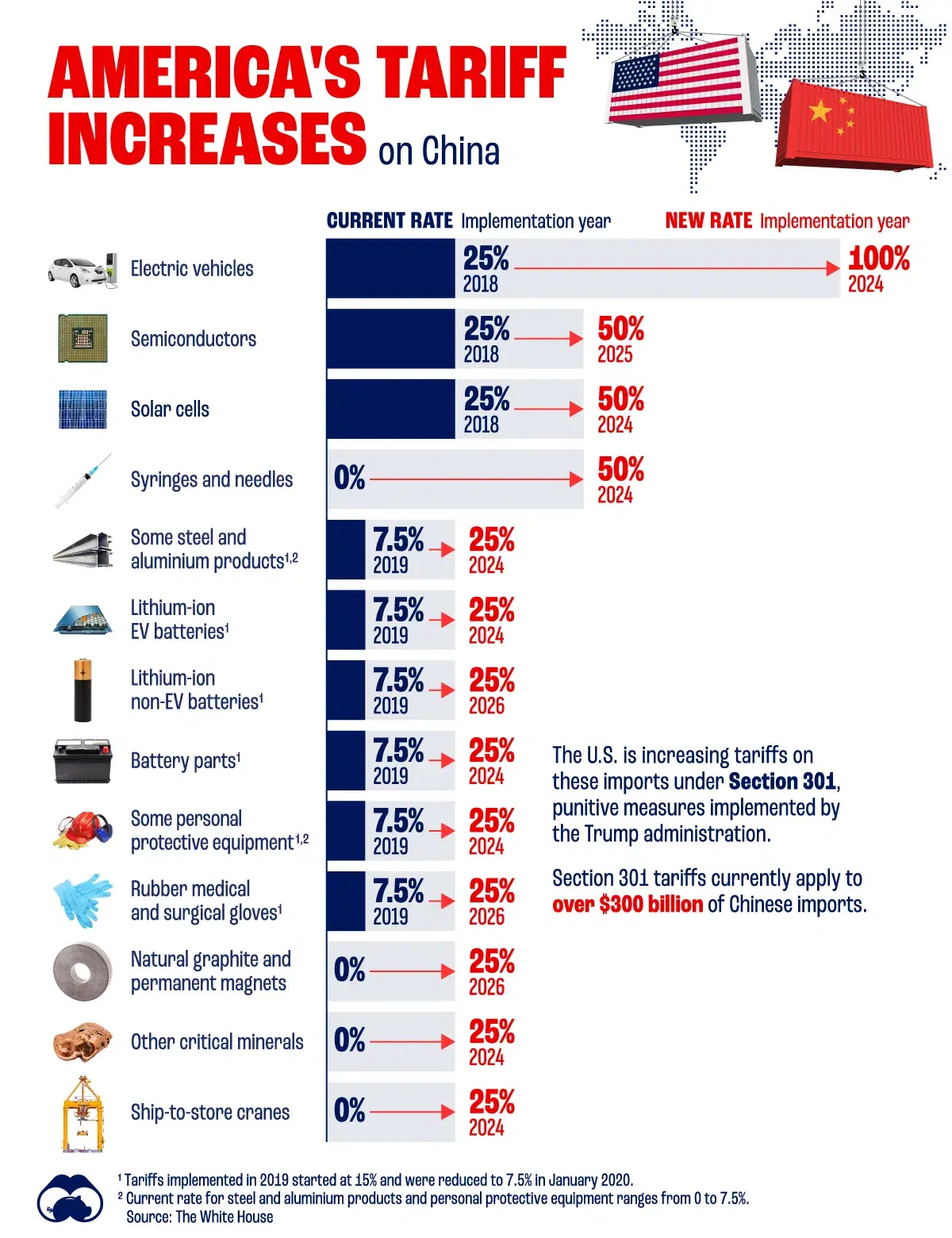

The Trump Tariff Policy and its Global Economic Impact

The Trump administration implemented a series of tariffs, primarily targeting China, aiming to reduce the US trade deficit and protect domestic industries. This sparked a trade war, with retaliatory tariffs imposed by other countries, creating a climate of global uncertainty. The broader economic consequences were substantial:

- Increased costs for imported goods: Tariffs directly increased the price of imported materials and goods, impacting businesses across various sectors.

- Retaliatory tariffs from other countries: China and other nations retaliated with their own tariffs, disrupting global supply chains and escalating trade tensions.

- Negative impact on investor confidence: The uncertainty created by the trade war led to decreased investor confidence and increased market volatility, making it riskier for companies to pursue IPOs.

- Supply chain disruptions: The imposition of tariffs caused significant disruptions to global supply chains, leading to delays and increased costs for businesses reliant on international trade. This was particularly impactful for industries with intricate global supply chains.

- Inflationary pressures: Increased import costs contributed to inflationary pressures, further impacting consumer spending and business investment.

The Fintech Sector's Vulnerability to Tariffs

The Fintech industry, heavily reliant on global markets and advanced technology, proved particularly vulnerable to the impact of tariffs. Many Fintech companies depend on international partnerships, collaborations, and access to global talent. The increased costs associated with tariffs affected various aspects of their operations:

- Dependence on international partnerships and collaborations: Fintech often involves partnerships with companies across borders, making them susceptible to disruptions caused by tariffs and trade disputes.

- Increased costs for cloud computing services: Many Fintech firms rely heavily on cloud computing infrastructure, often provided by international companies. Tariffs on imported technology components or services could impact their operating costs.

- Difficulty in accessing international markets: Tariffs and trade tensions can create barriers to entry for Fintech companies seeking to expand into new international markets.

- Hardware and software dependency: The production of many hardware components and software solutions utilized by Fintech companies often involves global supply chains, making them susceptible to tariff-related delays and price increases.

Affirm (AFRM) IPO and Market Conditions During the Tariff Period

Affirm, a Buy Now, Pay Later (BNPL) company, operates within a rapidly growing segment of the Fintech landscape. Its IPO timing coincided with a period of significant market volatility influenced by the ongoing trade war.

- AFRM's initial public offering date and valuation: Affirm's IPO occurred amidst the ongoing tariff disputes, impacting investor sentiment and market conditions. The initial valuation reflected the prevailing market uncertainty.

- Stock performance in the months following the IPO: Analysis of AFRM's stock performance in the months following its IPO reveals a complex interplay of factors, including the overall market sentiment, the performance of the broader Fintech sector, and the specific news and events relating to Affirm.

- Factors influencing AFRM's stock performance beyond tariffs: While tariffs certainly played a role, other factors, such as the company's growth trajectory, competitive landscape, and overall investor confidence in the BNPL sector, also significantly influenced AFRM's stock performance.

Analyzing the Correlation Between Tariffs and AFRM's IPO Performance

Determining a direct causal link between the Trump tariffs and AFRM's specific IPO performance requires a sophisticated analysis. While a direct correlation might be difficult to isolate, indirect effects are undeniable:

- Statistical analysis of tariff impact (if applicable): Econometric modeling could be used to analyze the impact of tariff announcements on AFRM's stock price, controlling for other market factors.

- Comparison of AFRM's performance to other Fintech IPOs during the same period: Benchmarking AFRM's performance against similar Fintech companies that went public during the same period helps assess the unique impact of tariffs versus general market conditions.

- Qualitative analysis of news and market commentary: Examining news articles, analyst reports, and market commentary surrounding AFRM's IPO provides valuable qualitative insights into how the tariffs were perceived by investors and analysts.

Lessons Learned and Future Implications for Fintech IPOs

The experience of Affirm and other Fintech companies during the Trump tariff period provides valuable lessons for future IPOs:

- Importance of robust risk management strategies: Fintech companies need to incorporate geopolitical and macroeconomic risks, including potential trade disputes and tariff impacts, into their risk management strategies.

- Diversification of supply chains and global partnerships: Reducing reliance on single suppliers and diversifying global partnerships helps mitigate supply chain vulnerabilities stemming from trade disputes.

- Close monitoring of macroeconomic indicators: Careful monitoring of macroeconomic indicators, including trade policy developments, inflation, and investor sentiment, is crucial for successful IPO planning and execution.

Conclusion

The Trump administration's tariffs created significant global economic uncertainty, impacting various sectors, including the Fintech industry. Our case study of Affirm (AFRM) highlights the complexities of navigating macroeconomic headwinds during an IPO. While isolating the direct impact of tariffs on AFRM's performance requires further investigation, the indirect effects through decreased investor confidence and supply chain disruptions are clear. For a comprehensive understanding of navigating global economic uncertainties impacting Fintech IPOs, further research into the effects of trade policies on financial technology companies is crucial. Understanding the complexities surrounding Trump Administration Tariffs and Their Effect on Fintech IPOs is paramount for investors and entrepreneurs alike.

Featured Posts

-

Nuit Des Musees 2025 Au Petit Palais La Mode A L Honneur

May 14, 2025

Nuit Des Musees 2025 Au Petit Palais La Mode A L Honneur

May 14, 2025 -

Schutz Vor Waldbraenden Modernste Technik Im Einsatz In Sachsen

May 14, 2025

Schutz Vor Waldbraenden Modernste Technik Im Einsatz In Sachsen

May 14, 2025 -

Us Tech Ipo Freeze Tariffs Chill Investment

May 14, 2025

Us Tech Ipo Freeze Tariffs Chill Investment

May 14, 2025 -

Eurovision 2024 Swedens Path To Victory

May 14, 2025

Eurovision 2024 Swedens Path To Victory

May 14, 2025 -

Death Of Former Uruguayan President Jose Mujica At 89

May 14, 2025

Death Of Former Uruguayan President Jose Mujica At 89

May 14, 2025