Trump And Oil Prices: Goldman Sachs' Interpretation Of Recent Statements

Table of Contents

Goldman Sachs' Baseline Oil Price Forecast

Before considering the impact of Trump's statements, it's crucial to understand Goldman Sachs' baseline oil price forecast. This forecast considers several pre-existing factors influencing the market.

Pre-existing Factors Influencing Oil Prices

Several factors beyond Trump's influence significantly impact oil prices. Goldman Sachs incorporates these into their baseline projections:

- OPEC+ Production Cuts: Decisions by OPEC+ nations to reduce oil production directly impact global supply and subsequently prices. Goldman Sachs closely monitors these announcements and their projected effect.

- Global Demand: Global economic growth and energy consumption patterns heavily influence oil demand. Recessions or unexpected economic slowdowns can depress prices.

- Geopolitical Instability: The ongoing Russia-Ukraine war, among other geopolitical events, creates uncertainty and volatility in the oil market. Sanctions, disruptions to supply chains, and potential conflicts all contribute to price fluctuations.

- Transition to Renewable Energy: The increasing adoption of renewable energy sources like solar and wind power puts downward pressure on long-term oil demand, a factor considered in Goldman Sachs' long-term projections.

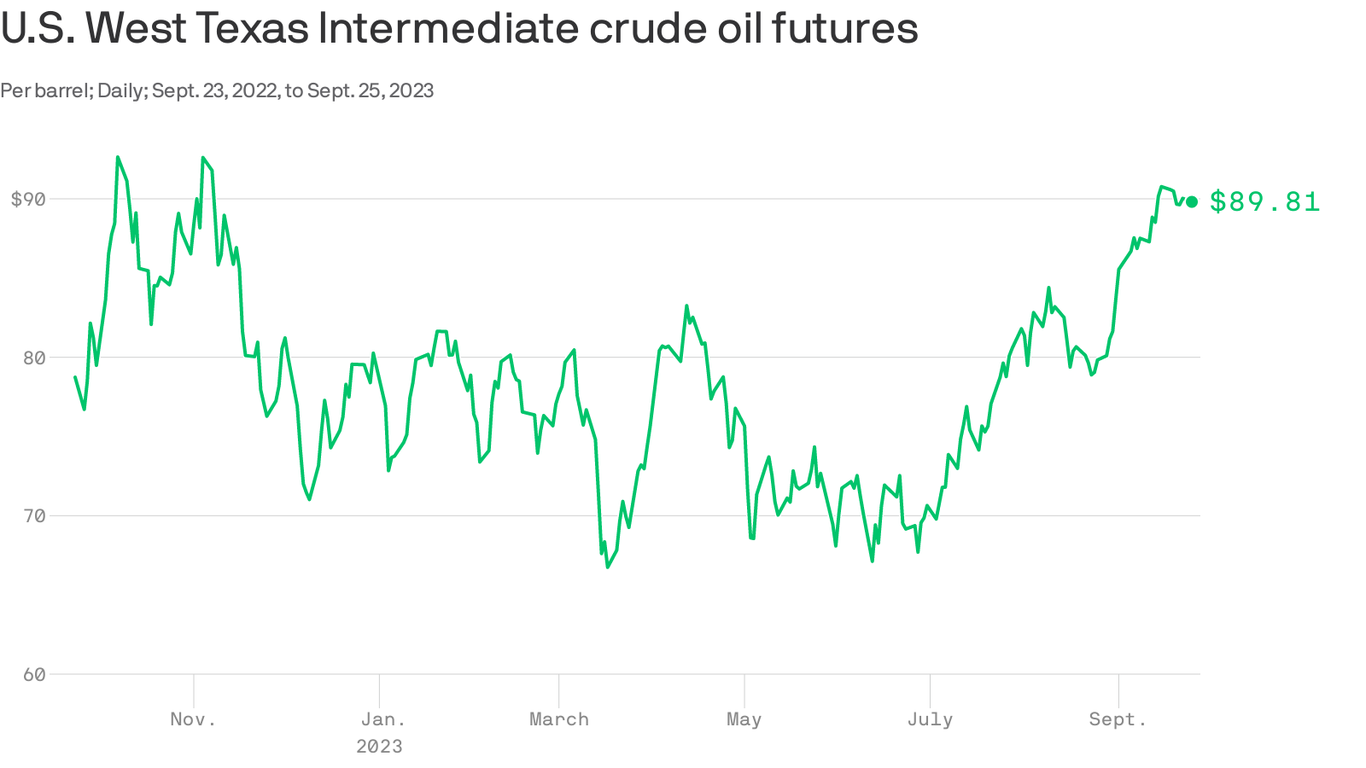

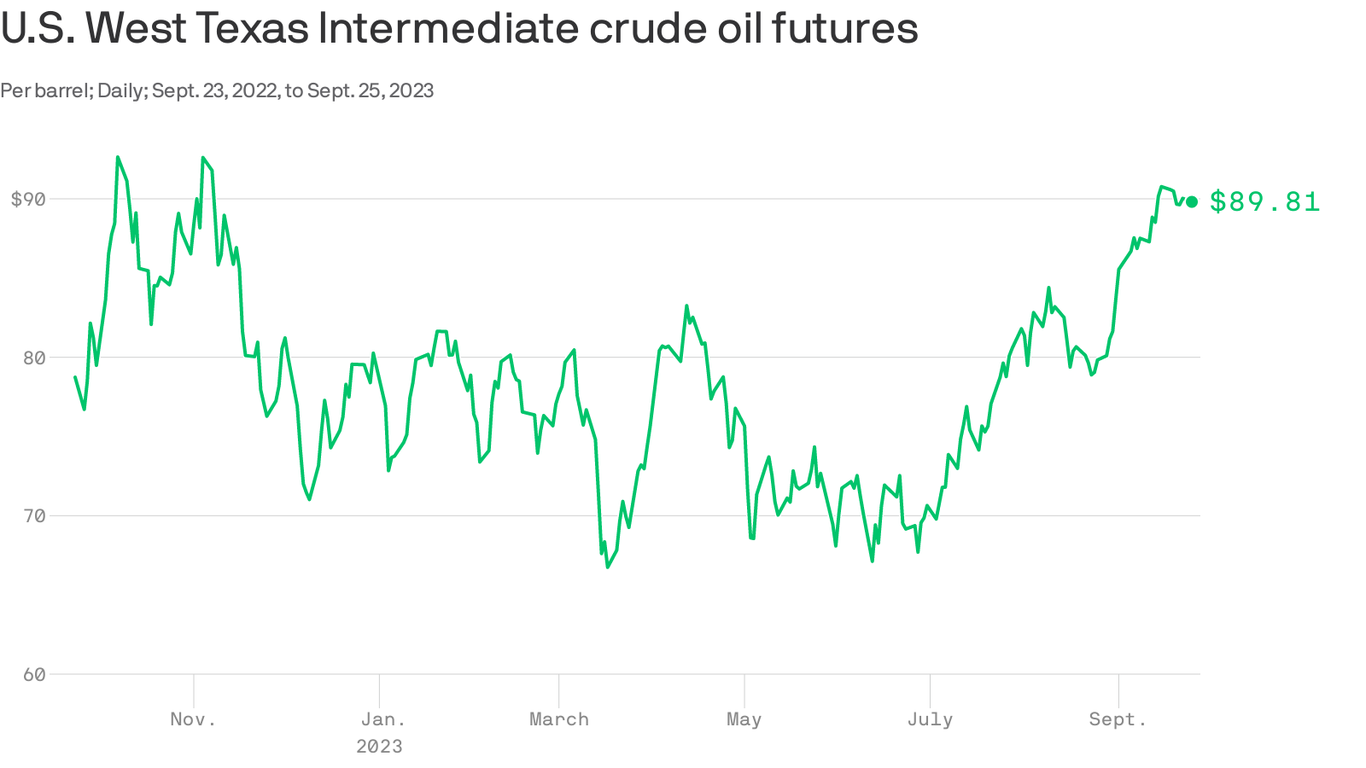

Goldman Sachs' baseline forecast, before considering Trump's influence, might have predicted a price range (for example) between $70 and $80 per barrel for Brent crude oil in the next quarter. These specific figures would need to be updated to reflect their most recent publications.

Impact of Trump's Statements on Goldman Sachs' Projections

Trump's statements on energy independence, sanctions on oil-producing nations, and deregulation significantly influence Goldman Sachs' oil price projections. For instance, his past pronouncements favoring energy independence and deregulation could potentially lead to increased US oil production.

- Specific Statements: By referencing specific statements and linking to reputable news sources, we can demonstrate the direct impact of Trump's rhetoric. (Example: A statement advocating for reduced regulation on drilling could be cited here, along with a link to the original source).

- Incorporation into Models: Goldman Sachs incorporates these statements into their sophisticated econometric models, assessing the likelihood of policy changes and their effect on supply and demand.

- Forecast Revisions: These statements cause adjustments in their oil price forecasts. For example, pro-production statements might lead to a downward revision in price predictions due to increased supply.

Comparison of Forecasts:

| Forecast Type | Price Range (Example) |

|---|---|

| Baseline (Pre-Trump) | $70-$80 per barrel |

| Post-Trump Statement | $65-$75 per barrel |

This example shows a potential downward adjustment due to expectations of increased US production following pro-drilling statements. The magnitude of change varies depending on the specific statement and its perceived impact.

Analysis of Trump's Energy Policies and their Impact

Goldman Sachs analyzes the broader impact of Trump's energy policies on oil prices.

Deregulation and its Effect on Oil Production

Trump's administration pursued deregulation of the oil and gas industry. Goldman Sachs assesses the effectiveness of these policies in stimulating oil production and considers potential environmental consequences.

- Increased Production: Deregulation can potentially increase domestic oil production by reducing the regulatory burden on producers.

- Environmental Concerns: Goldman Sachs likely weighs the potential environmental consequences of increased drilling and production against the benefits of lower prices and energy independence.

- Efficiency of Policies: Goldman Sachs analyzes the actual impact of the deregulation efforts, examining whether they led to significant increases in production and how efficiently.

Geopolitical Implications of Trump's Statements

Trump's foreign policy pronouncements regarding oil-producing nations have significant implications.

- Saudi Arabia: Statements concerning the US-Saudi relationship impact oil supply expectations.

- Iran: Sanctions and their impact on Iranian oil exports are crucial factors in Goldman Sachs' analysis.

- Venezuela: The situation in Venezuela and the potential for increased or reduced oil exports under various political scenarios heavily influences price predictions.

Goldman Sachs considers various scenarios:

- Scenario 1: Improved US relations with Saudi Arabia leading to increased oil production.

- Scenario 2: Continued sanctions on Iran keeping their oil exports low.

- Scenario 3: Political instability in Venezuela leading to unpredictable oil export levels.

Market Reactions and Investor Sentiment

Goldman Sachs analyzes how markets react to Trump's statements.

Stock Market Response to Trump's Statements

- Oil Futures Prices: Immediate price changes in oil futures contracts following a Trump statement reflect market sentiment.

- Energy Company Stock Prices: The stock prices of energy companies are also closely watched.

- Volatility: Goldman Sachs analyzes the increased market volatility resulting from Trump's statements.

Goldman Sachs' Recommendations to Investors

Based on their analysis, Goldman Sachs offers investment recommendations.

- Investment Strategies: They might advise investors to either buy, sell, or hold oil futures or energy stocks depending on their interpretation of the impact of Trump's statements.

- Risk Assessment: They'd highlight the risks associated with investing in the oil market considering the unpredictability introduced by Trump's pronouncements.

- Diversification: They might advise diversification to mitigate risk given the market's sensitivity to political events.

Conclusion

Goldman Sachs' analysis reveals a complex relationship between Trump and oil prices. Pre-existing factors like OPEC+ decisions and geopolitical events significantly influence baseline forecasts. However, Trump's statements and policies introduce considerable uncertainty, leading to adjustments in Goldman Sachs' projections. Market reactions often reflect a mix of anticipation and reaction to his pronouncements. To make informed investment decisions in this volatile market, staying updated on Goldman Sachs' ongoing analysis and other reliable sources is crucial. Understanding the intricacies of Trump oil prices requires constant monitoring of economic and geopolitical factors. Continue researching and consulting expert opinions to navigate the complexities of this dynamic relationship.

Featured Posts

-

Israel Adesanyas Praise For Paddy Pimbletts Flawless Performance Earns Him Michael Chandler Fight

May 15, 2025

Israel Adesanyas Praise For Paddy Pimbletts Flawless Performance Earns Him Michael Chandler Fight

May 15, 2025 -

Update Terkini Proyek Giant Sea Wall Penjelasan Menko Ahy

May 15, 2025

Update Terkini Proyek Giant Sea Wall Penjelasan Menko Ahy

May 15, 2025 -

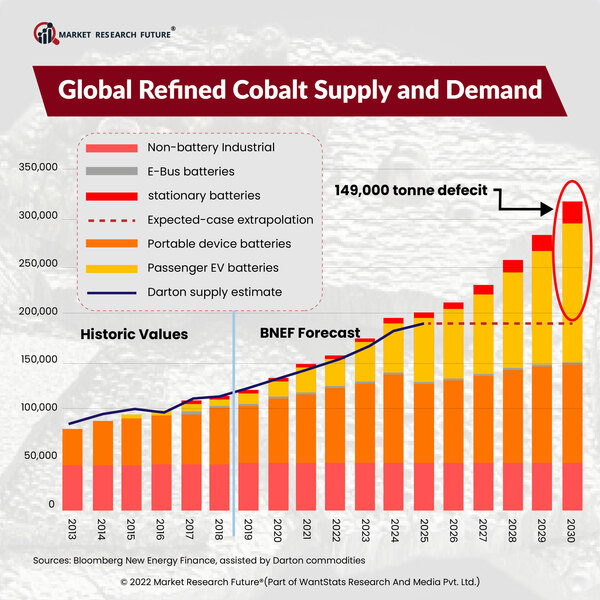

Congos Cobalt Export Ban Implications For The Global Cobalt Market

May 15, 2025

Congos Cobalt Export Ban Implications For The Global Cobalt Market

May 15, 2025 -

San Jose Earthquakes Preview Quakes Epicenter Analysis

May 15, 2025

San Jose Earthquakes Preview Quakes Epicenter Analysis

May 15, 2025 -

Knicks Playoff Hopes Rise As Jalen Brunson Nears Return Vs Pistons

May 15, 2025

Knicks Playoff Hopes Rise As Jalen Brunson Nears Return Vs Pistons

May 15, 2025