Trump's 100-Day Plan: What Does It Mean For The Bitcoin Price? A Prediction.

Table of Contents

- Fiscal Policy and Bitcoin's Safe Haven Status

- Increased Government Spending and Inflation

- Tax Cuts and their Impact on Investment

- Regulatory Uncertainty and Bitcoin's Price

- Uncertain Regulatory Environment

- Potential for Increased Scrutiny

- Geopolitical Instability and Bitcoin's Appeal

- International Trade Policies and Bitcoin

- Global Uncertainty and Bitcoin Adoption

- Conclusion

Fiscal Policy and Bitcoin's Safe Haven Status

Trump's 100-day plan prioritized significant fiscal changes. Let's examine how these policies potentially impacted Bitcoin's price.

Increased Government Spending and Inflation

A key element of Trump's plan was increased government spending. Such increases can lead to inflation, eroding the purchasing power of fiat currencies. This often drives investors towards alternative assets like Bitcoin as a hedge against inflation.

- Inflation Hedging: Bitcoin's limited supply (21 million coins) makes it attractive during inflationary periods. As the value of fiat currencies declines, Bitcoin's value can potentially rise, offering investors a store of value.

- Historical Correlation: While not perfectly linear, historical data shows some correlation between periods of high inflation and increases in Bitcoin's price. Further research is needed to definitively establish causality.

- Economic Theories: Monetary theories like the Quantity Theory of Money suggest that increased money supply (often a consequence of increased government spending) can lead to inflation, thus increasing the demand for alternative assets like Bitcoin.

Tax Cuts and their Impact on Investment

The proposed tax cuts were another significant component of Trump's plan. Lower taxes could have freed up capital for investments, potentially boosting investment in alternative assets including Bitcoin.

- Tax Implications for Bitcoin: The tax treatment of Bitcoin varied across jurisdictions, impacting investment decisions. Any changes to capital gains taxes, for instance, could directly affect the attractiveness of Bitcoin investments.

- Increased Disposable Income: Tax cuts can lead to increased disposable income, potentially allowing individuals to allocate more capital towards higher-risk, higher-reward investments like cryptocurrencies.

Regulatory Uncertainty and Bitcoin's Price

The Trump administration's stance on cryptocurrency regulation created a climate of uncertainty, significantly influencing Bitcoin's price volatility.

Uncertain Regulatory Environment

The lack of clear, consistent regulatory frameworks during this period contributed to the market's uncertainty. This ambiguity impacted investor sentiment and caused price fluctuations.

- Regulatory Uncertainty and Volatility: Periods of regulatory uncertainty are often associated with increased price volatility in the cryptocurrency market. Investors are hesitant to commit large sums of capital without clarity on regulatory implications.

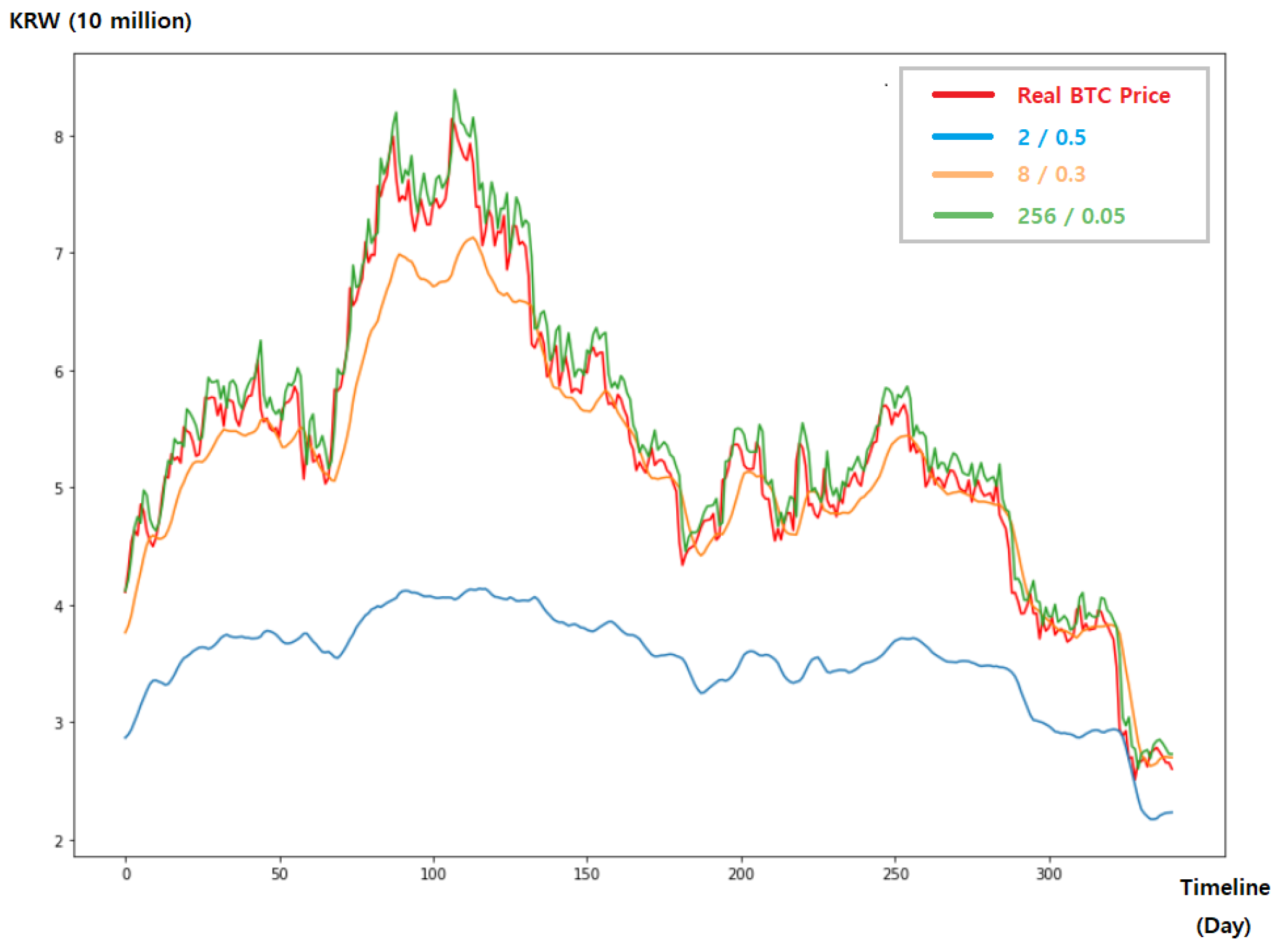

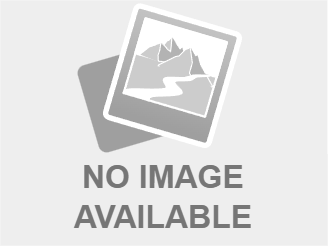

- Historical Impact on Bitcoin Price: Examining historical Bitcoin price charts alongside announcements and proposals regarding cryptocurrency regulation during the Trump era can reveal correlations between regulatory uncertainty and price movements.

Potential for Increased Scrutiny

The potential for increased regulatory scrutiny, whether positive or negative, had a significant impact on the Bitcoin price.

- Positive Regulatory Outcomes: Clear regulations could legitimize Bitcoin, potentially boosting investor confidence and driving price increases.

- Negative Regulatory Outcomes: Conversely, overly restrictive regulations or outright bans could significantly suppress Bitcoin's price. The potential for negative regulatory actions often contributes to significant price drops.

Geopolitical Instability and Bitcoin's Appeal

Trump's administration's policies significantly impacted global geopolitical stability, influencing Bitcoin's appeal as a safe-haven asset.

International Trade Policies and Bitcoin

Trump's protectionist trade policies introduced uncertainty into the global economic landscape. This instability could have fueled demand for Bitcoin, a decentralized asset perceived as less susceptible to government interference.

- Impact of Trade Wars: Trade disputes and tariffs can create economic uncertainty, driving investors towards perceived "safe haven" assets like Bitcoin.

- Investor Confidence: Geopolitical instability often erodes investor confidence in traditional markets, potentially increasing the attractiveness of decentralized alternatives.

Global Uncertainty and Bitcoin Adoption

The general geopolitical uncertainty during this period could have spurred increased adoption of Bitcoin as a hedge against instability.

- Increased Adoption: Periods of global uncertainty can lead to a flight to safety, driving increased adoption of Bitcoin as a decentralized and less government-controlled asset.

- Examples of Geopolitical Events: Specific events like trade disputes, international tensions, or unexpected policy announcements could have played a role in influencing Bitcoin's adoption rate.

Conclusion

Trump's 100-day plan, characterized by significant fiscal changes, regulatory uncertainty, and shifting geopolitical landscapes, had a complex and multifaceted impact on the Bitcoin price. While a direct causal link is difficult to definitively establish, the analysis suggests a correlation between periods of increased uncertainty and volatility in the Bitcoin market. Our prediction is that the long-term effect of Trump's 100-day plan on Bitcoin's price is likely to be indirect, primarily driven by the influence of the plan on global market sentiment and investor confidence. This analysis is based on observable market trends and economic theory, and further research is needed to establish definitive causality.

Prediction: While the immediate impact of Trump’s 100-day plan on the Bitcoin price may have been mixed, the longer-term effect likely involved increased volatility tied to the resulting uncertainty.

Call to Action: Stay informed about the impact of political events on your Bitcoin investments. Continue your research on the effects of Trump's 100-Day Plan on the Bitcoin price to make informed decisions. Understanding the interplay between macroeconomic policy and cryptocurrency prices is crucial for navigating the volatile world of digital assets.

The 10x Bitcoin Multiplier Market Analysis And Implications

The 10x Bitcoin Multiplier Market Analysis And Implications

Is The Dwp Owing You Money Claim Your Universal Credit Refund Now

Is The Dwp Owing You Money Claim Your Universal Credit Refund Now

The Crucial Role Of Middle Managers In Organizational Effectiveness

The Crucial Role Of Middle Managers In Organizational Effectiveness

Xrp Price Analysis Is 3 40 Achievable For Ripple

Xrp Price Analysis Is 3 40 Achievable For Ripple

Oklahoma City Thunder Players Verbal Sparring With National Media

Oklahoma City Thunder Players Verbal Sparring With National Media