XRP Price Analysis: Is $3.40 Achievable For Ripple?

Table of Contents

Current Market Conditions and Technical Analysis of XRP

Understanding the current market dynamics is crucial for any XRP price prediction. We'll analyze XRP's chart patterns and trading activity to gauge its potential for growth.

Analyzing XRP's Chart Patterns:

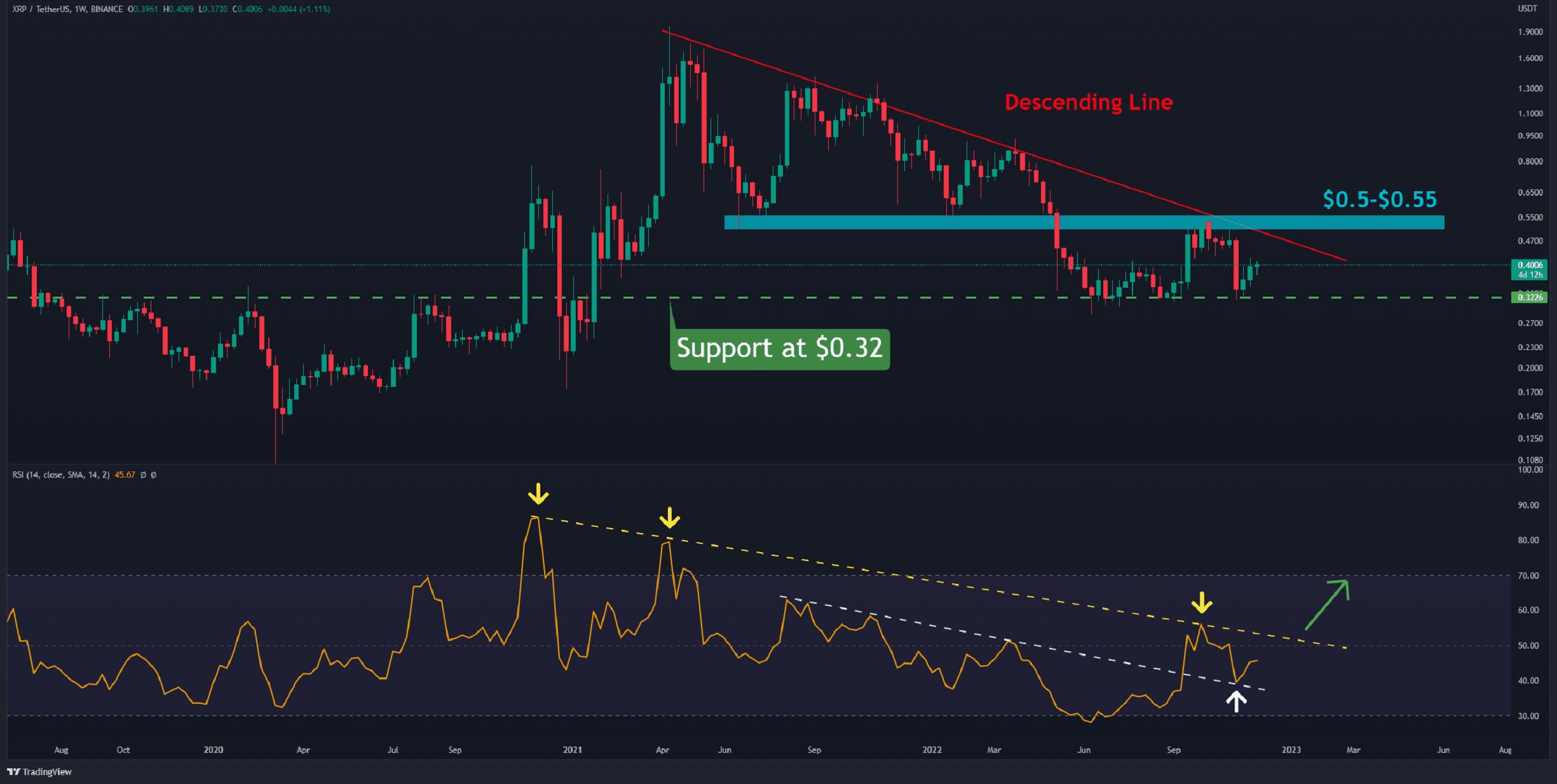

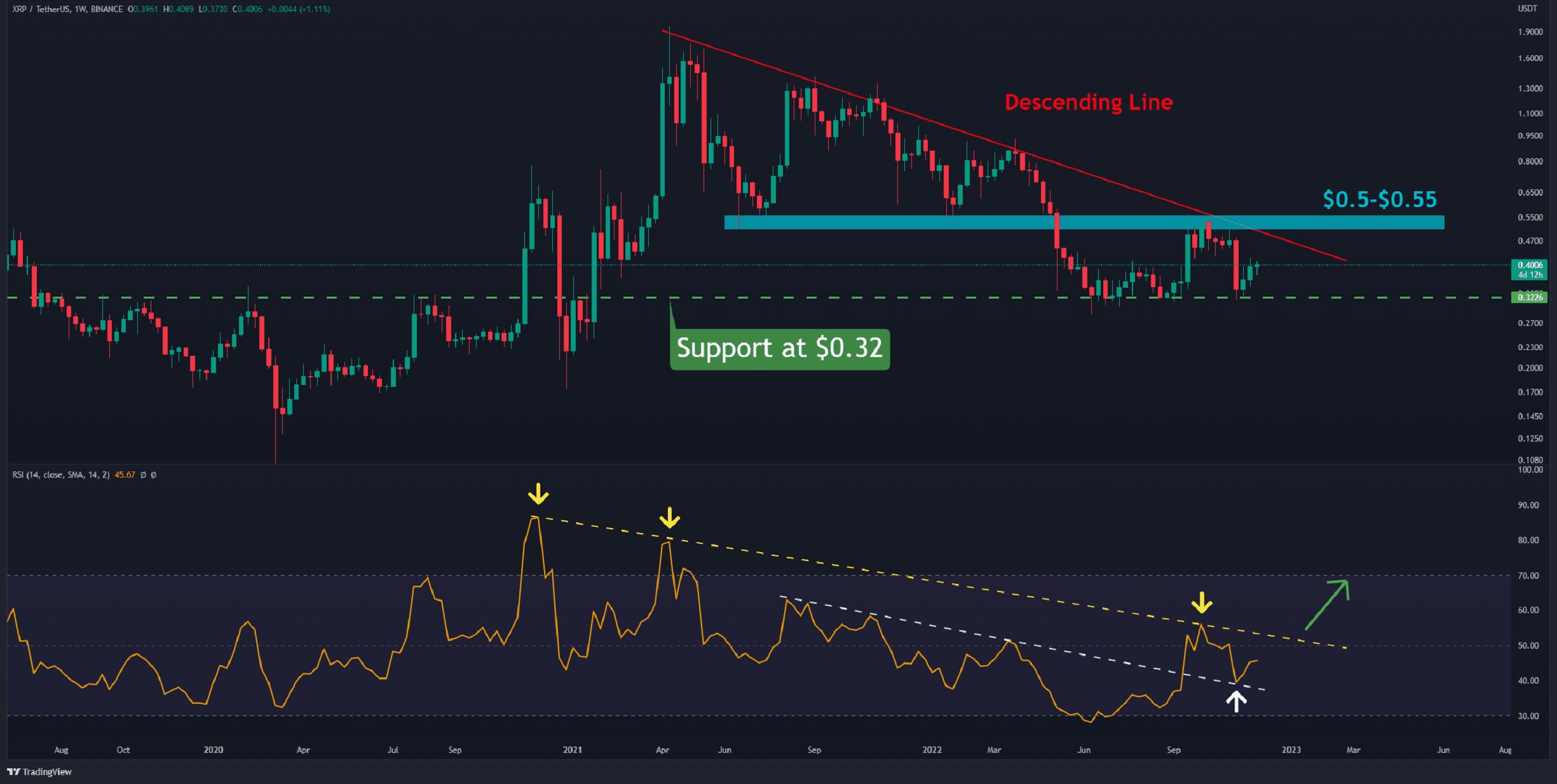

Analyzing XRP's price charts helps identify potential support and resistance levels. Recent price movements reveal key trends.

- Support Levels: Identifying key support levels helps predict potential price floors. A strong support level suggests a price floor where buying pressure might outweigh selling pressure.

- Resistance Levels: Conversely, resistance levels represent price ceilings where selling pressure could overcome buying pressure. Breaking through resistance levels is often a bullish signal.

- Technical Indicators: Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) provide insights into momentum, trends, and potential reversals. Analyzing these indicators in conjunction with chart patterns offers a more comprehensive picture.

- Chart Examples: [Insert relevant charts and graphs showcasing XRP's price action, support/resistance levels, and key technical indicators]. Visual representations enhance understanding and provide compelling evidence for the analysis.

Volume and Trading Activity:

Trading volume is a critical indicator of market interest and potential price momentum. High volume accompanying price increases suggests strong buying pressure, while high volume during price declines indicates significant selling pressure.

- Exchange Volume: Monitoring trading volume across major cryptocurrency exchanges provides insights into overall market activity. Significant increases in volume often precede substantial price movements.

- Trading Platform Influence: The choice of trading platforms and their liquidity can influence XRP's price. Platforms with high liquidity generally experience smoother price movements.

- Trend Analysis: Analyzing trends in trading volume helps predict future price movements. Increasing volume alongside rising prices is a bullish sign, while decreasing volume during price increases might indicate weakening momentum.

Ripple's Technological Advancements and Adoption

Ripple's technological advancements and the increasing adoption of its solutions significantly influence XRP's price.

RippleNet and On-Demand Liquidity (ODL):

RippleNet, Ripple's global payment network, and its On-Demand Liquidity (ODL) solution are key drivers of XRP adoption.

- ODL's Impact: ODL uses XRP to facilitate faster and cheaper cross-border payments, thereby increasing XRP's utility and demand.

- Partnerships and Collaborations: Strategic partnerships with financial institutions globally expand RippleNet's reach and increase XRP usage. Each new partnership can potentially boost XRP's price.

- Institutional Adoption: Increased institutional adoption of Ripple's solutions is a major bullish factor for XRP. Large-scale adoption by banks and financial institutions can drive significant price appreciation.

Technological Developments and Upgrades:

Continuous improvements to the XRP Ledger (XRPL) enhance its efficiency, scalability, and overall appeal.

- XRPL Upgrades: Upgrades to the XRPL, such as improved transaction speeds and enhanced security features, increase its attractiveness to users and developers.

- Value Proposition: These improvements strengthen XRP's value proposition as a fast, efficient, and cost-effective solution for cross-border payments.

- Future Vision: Ripple's long-term vision for the XRPL, including its potential for decentralized finance (DeFi) applications, could significantly impact XRP's price in the long run.

Regulatory Landscape and Legal Factors Affecting XRP Price

The regulatory landscape surrounding XRP significantly influences its price.

SEC Lawsuit and its Impact:

The ongoing SEC lawsuit against Ripple creates uncertainty in the market.

- Lawsuit Update: The outcome of the lawsuit could significantly impact XRP's price. A favorable ruling could lead to a substantial price increase, while an unfavorable outcome could negatively affect the price.

- Regulatory Clarity: Regulatory clarity is crucial for XRP's price stability and growth. A clear regulatory framework could attract more institutional investors.

- Uncertainty and Volatility: The ongoing uncertainty surrounding the lawsuit contributes to price volatility.

Global Regulatory Trends and Their Influence:

Global regulatory trends regarding cryptocurrencies play a significant role in XRP's price.

- Varying Regulations: Different countries have varying regulations regarding cryptocurrencies, affecting XRP adoption and price. Favorable regulations in major markets can positively impact XRP's price.

- International Adoption: Increased adoption in various countries could lead to higher demand and price appreciation.

- Future Regulatory Developments: Future regulatory changes can significantly alter XRP's price trajectory, making it crucial to stay informed about regulatory developments.

Overall Cryptocurrency Market Sentiment and Bitcoin's Influence

The overall cryptocurrency market sentiment and Bitcoin's price significantly impact XRP's price.

Correlation between XRP and Bitcoin:

XRP's price often correlates with Bitcoin's price.

- Historical Correlation: Analyzing historical price movements of both XRP and Bitcoin reveals a degree of correlation, meaning movements in Bitcoin's price often influence XRP's price.

- Bitcoin's Influence: A bull market in Bitcoin often leads to increased investor interest in the broader cryptocurrency market, including XRP, potentially pushing its price higher. Conversely, a bear market in Bitcoin can negatively impact XRP's price.

- Market Sentiment: Positive sentiment towards Bitcoin often spills over into other cryptocurrencies, including XRP.

General Cryptocurrency Market Sentiment:

The overall sentiment in the cryptocurrency market impacts investor confidence and XRP's price.

- Investor Confidence: Positive market sentiment and increased investor confidence can drive demand for XRP, leading to price appreciation.

- Market Enthusiasm: Periods of high market enthusiasm often result in higher prices across the cryptocurrency market, including XRP.

- Economic Factors: Broader economic factors, such as inflation and interest rates, can also influence the cryptocurrency market and XRP's price.

Conclusion:

Reaching $3.40 for XRP is ambitious and depends on various factors, including the outcome of the SEC lawsuit, Ripple's technological advancements, global regulatory developments, and the overall cryptocurrency market sentiment. While predicting cryptocurrency prices is inherently uncertain, consistent monitoring of the XRP price, understanding Ripple's developments, and staying informed about the regulatory landscape are crucial for making informed decisions. Continue researching XRP price analysis and stay updated on the latest news to make informed decisions about your XRP investments. Learn more about how XRP price movements affect your portfolio.

Featured Posts

-

Bitcoin Golden Cross Flash Implications And Trading Strategies

May 08, 2025

Bitcoin Golden Cross Flash Implications And Trading Strategies

May 08, 2025 -

Thunder Pacers Injury Report Key Players Status For March 29

May 08, 2025

Thunder Pacers Injury Report Key Players Status For March 29

May 08, 2025 -

Mookie Betts Illness Sidelines Him For Freeway Series Game

May 08, 2025

Mookie Betts Illness Sidelines Him For Freeway Series Game

May 08, 2025 -

Oklahoma City Thunder Vs Houston Rockets Where To Watch Betting Predictions And Game Analysis

May 08, 2025

Oklahoma City Thunder Vs Houston Rockets Where To Watch Betting Predictions And Game Analysis

May 08, 2025 -

Psg Triumf I Veshtire Me Rezultat Minimal

May 08, 2025

Psg Triumf I Veshtire Me Rezultat Minimal

May 08, 2025