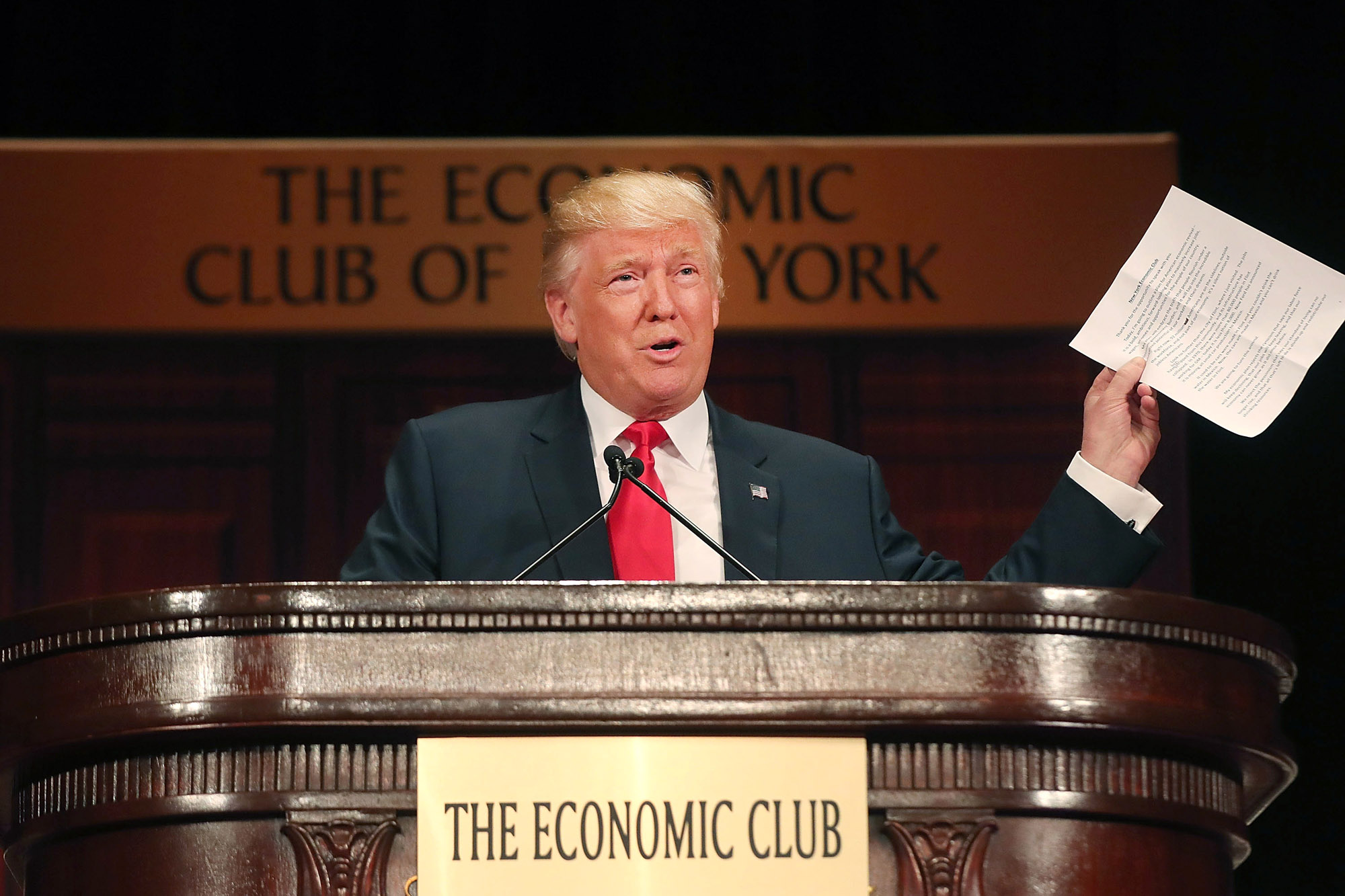

Trump's Economic Policies: Increased Difficulty For The Next Fed Chair

Table of Contents

The Inflationary Legacy of Trump's Tax Cuts

Trump's 2017 tax cuts, a cornerstone of his economic agenda, significantly reduced corporate and individual income tax rates. While proponents argued this would stimulate economic growth, critics warned of potential inflationary pressures. This prediction has proven, at least in part, to be accurate. The significant injection of disposable income into the economy fueled increased consumer spending, potentially overheating the economy and contributing to inflationary pressures.

The resulting increase in government debt further complicates the Fed's task. Managing this debt while simultaneously addressing inflation requires a delicate balancing act. The Fed's dual mandate—to maintain price stability and promote maximum employment—becomes significantly more challenging under these circumstances.

- Increased consumer spending due to tax cuts: The surge in disposable income led to a robust increase in consumer spending, placing upward pressure on prices.

- Potential for overheating of the economy: The influx of capital without corresponding increases in production capacity can lead to overheating and inflationary spirals.

- Challenges in controlling inflation without triggering a recession: The Fed faces the difficult choice between raising interest rates to curb inflation, potentially slowing economic growth, or allowing inflation to persist, risking further economic instability.

- The Fed's mandate to balance price stability with full employment: This inherent tension is magnified by the economic conditions inherited from Trump's policies.

Deregulation and its Ripple Effects on Monetary Policy

Trump's administration pursued a significant deregulation agenda across various sectors of the economy. While intended to foster economic growth by reducing bureaucratic burdens, this approach carries substantial risks for financial stability. Less stringent regulations could embolden increased risk-taking by businesses and financial institutions. This increased risk appetite increases the potential for future financial crises, demanding greater vigilance and proactive intervention from the Federal Reserve.

The Fed must now navigate a more complex regulatory landscape, requiring enhanced monitoring and potentially more interventionist policies to prevent systemic risk. This creates a significant challenge, forcing a careful balancing act between promoting economic growth and ensuring financial stability.

- Increased vulnerability to financial crises: Less regulation means increased risk-taking, potentially creating systemic vulnerabilities within the financial system.

- Need for more vigilant monitoring by the Fed: The Fed must proactively identify and address potential risks in a less regulated environment.

- Potential conflicts between deregulation and financial stability goals: Balancing the pursuit of economic growth with the imperative of safeguarding financial stability is a constant challenge for the Fed.

- The challenge of balancing economic growth with financial regulation: Finding the optimal balance between stimulating economic activity and preventing excessive risk-taking is a key policy challenge.

Trade Wars and Global Economic Uncertainty

Trump's imposition of tariffs and trade restrictions significantly increased global economic uncertainty. These trade wars disrupted global supply chains, leading to increased input costs for businesses and contributing to inflationary pressures. The resulting uncertainty makes it incredibly difficult for the Fed to accurately forecast economic trends and develop effective monetary policy. Unpredictable changes in trade policies create volatility that complicates the already challenging task of economic management.

The impact on US exports and imports added another layer of complexity. The disruptions created by trade wars significantly altered the landscape for businesses relying on international trade, leading to uncertainty and instability.

- Disruption of global supply chains and increased input costs: Tariffs and trade restrictions increased costs for businesses reliant on global supply chains.

- Impact on US exports and imports: Trade wars affected both US exports and imports, creating economic ripples throughout the economy.

- Difficulty in predicting economic trends accurately: The increased volatility created by trade wars makes economic forecasting far more challenging.

- The Fed's need to adapt to shifting global economic landscapes: The Fed must remain agile and adaptable in the face of rapidly changing global economic conditions.

The Political Tightrope Walk for the Next Fed Chair

The Federal Reserve Chair operates within a highly politicized environment. The actions of the central bank directly impact the economy and, consequently, the political landscape. Maintaining the Fed's independence from partisan political pressures is crucial for its credibility and effectiveness. However, the legacy of Trump's administration, marked by frequent criticisms of the Fed's decisions, creates a more challenging political environment for the next Chair.

The next Chair must navigate the complexities of this environment, balancing the need for sound economic policy with the pressures of maintaining the Fed's independence and preserving public trust.

- Potential for political interference in monetary policy decisions: Political pressures can tempt the Fed Chair to prioritize short-term political gains over long-term economic stability.

- Maintaining credibility and public trust in the Fed: The Fed's credibility depends on its ability to remain independent and make decisions based on economic fundamentals.

- Navigating conflicting political pressures: Balancing diverse political viewpoints and priorities will be a significant challenge.

- The balance between responding to short-term political needs and long-term economic stability: This represents the core tension the next Fed Chair must resolve.

The Complex Inheritance: Preparing for the Challenges Ahead

The next Federal Reserve Chair inherits a complex economic landscape significantly shaped by Trump's economic policies. Navigating the inflationary pressures stemming from tax cuts, managing the risks associated with deregulation, and addressing the global uncertainty caused by trade wars will demand exceptional skill and judgment. Understanding the interconnectedness of these factors is critical for developing effective monetary policy. The enduring impact of Trump's economic policies requires a deep understanding and a proactive approach to mitigate potential risks and ensure long-term economic stability.

Understanding the implications of Trump's economic policies is crucial for navigating the complexities facing the next Federal Reserve Chair. Further research into this crucial intersection of politics and economics is vital.

Featured Posts

-

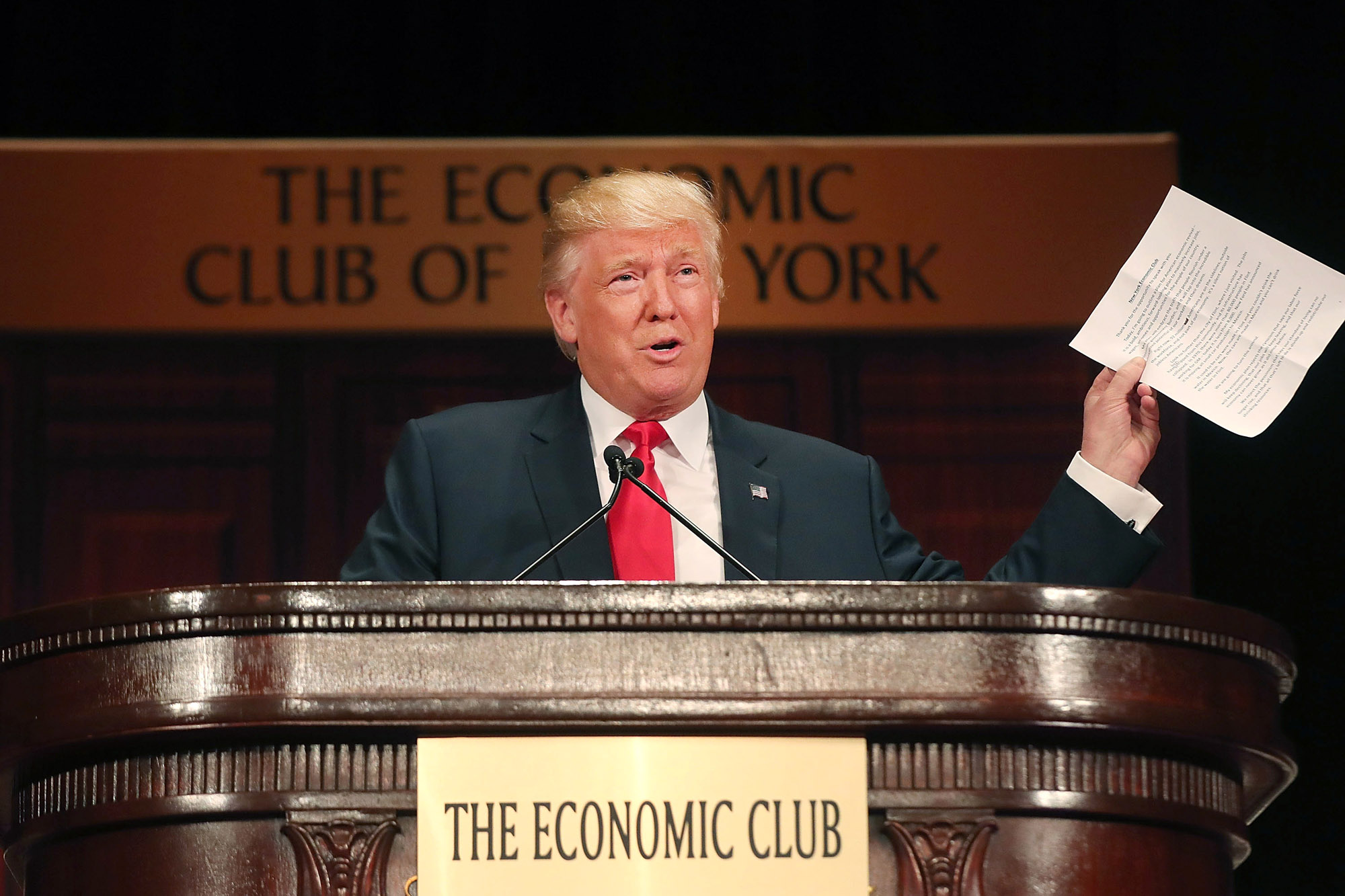

Guilty Plea Lab Owner Falsified Covid Test Results

Apr 26, 2025

Guilty Plea Lab Owner Falsified Covid Test Results

Apr 26, 2025 -

Trumps Time Interview Key Takeaways On The Proposed Congressional Stock Trading Ban

Apr 26, 2025

Trumps Time Interview Key Takeaways On The Proposed Congressional Stock Trading Ban

Apr 26, 2025 -

Luxury In Hue Dong Duong Hotels Integration Into The Fusion Brand

Apr 26, 2025

Luxury In Hue Dong Duong Hotels Integration Into The Fusion Brand

Apr 26, 2025 -

Selling Stakes In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025

Selling Stakes In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025 -

Thunderbolt Star Addresses Nepotism Fck Yeah Are You Kidding Me

Apr 26, 2025

Thunderbolt Star Addresses Nepotism Fck Yeah Are You Kidding Me

Apr 26, 2025