Trump's Trade War: IMF Warns Of Systemic Financial Risk

Table of Contents

Escalating Tariffs and Retaliatory Measures

The Trump administration's trade policies, characterized by aggressive tariffs on imported goods, ignited a global trade war. These actions triggered retaliatory measures from key trading partners, escalating the conflict and creating widespread economic uncertainty. The "trade war" label, while simplistic, accurately reflects the tit-for-tat nature of the conflict.

-

Specific examples of tariffs: The imposition of tariffs on steel and aluminum imports, initially targeting various countries, was a key trigger. Subsequently, significant tariffs were levied on Chinese goods, encompassing a vast range of products from consumer electronics to agricultural products.

-

Quantitative data: Billions of dollars worth of goods were affected. For example, the tariffs on Chinese goods alone reached hundreds of billions, impacting both US consumers and businesses.

-

Impact on specific industries and sectors: Industries heavily reliant on imported materials, such as manufacturing and construction, experienced cost increases. Agricultural sectors, like soybeans, faced significant losses due to retaliatory tariffs from China.

-

The "trade war" as a significant economic event: The scale and breadth of the tariffs and retaliatory measures marked a significant departure from traditional trade relations, destabilizing global markets and creating uncertainty. The term "trade war" accurately captured the intensity of the economic conflict. The impact of Trump tariffs extended beyond immediate economic consequences.

IMF's Assessment of Systemic Financial Risk

The IMF, through numerous reports and statements, expressed profound concern about the potential for systemic financial risk stemming from the trade war. Their analysis highlighted the interconnected nature of global financial markets and the potential for a domino effect.

-

Summary of the IMF's key findings and warnings: The IMF consistently warned that the trade war would negatively impact global economic growth, potentially triggering a broader financial crisis.

-

Specific quotes from IMF reports and officials: Reports consistently cited increased uncertainty and decreased investment as major concerns. Statements from high-ranking IMF officials emphasized the need for de-escalation and a return to multilateral trade negotiations.

-

Impact on global economic growth: The IMF's forecasts consistently showed reduced global GDP growth projections directly attributed to the trade war's negative impact.

-

Interconnectedness of global financial markets: The IMF highlighted how the trade war's effects were not contained within national borders. The interconnected nature of global finance meant that shocks in one area could quickly spread globally.

Impact on Global Supply Chains and Investment

The trade war significantly disrupted global supply chains and negatively impacted foreign direct investment (FDI). The uncertainty created by the unpredictable trade policies discouraged investment and forced businesses to re-evaluate their strategies.

-

Examples of disrupted supply chains: Companies reliant on global supply chains experienced delays, increased costs, and production disruptions due to tariffs and trade restrictions. This created ripple effects throughout various industries.

-

Data on decreased FDI flows: Statistics showed a decline in FDI flows, as investors hesitated to commit capital in an environment marked by high uncertainty.

-

Uncertainty and its impact on business decisions: The unpredictability surrounding trade policies led businesses to postpone or cancel investments, hindering economic growth and job creation. Businesses struggled to plan for the long term.

-

Negative effect on global trade and economic growth: The combination of disrupted supply chains and decreased investment contributed significantly to slower global trade growth and overall economic stagnation.

The Uncertainty Factor and Market Volatility

The ongoing trade conflict fueled market volatility and uncertainty. This created a climate of fear, impacting investor confidence and market stability.

-

Examples of market fluctuations: Stock markets experienced significant fluctuations in response to news related to trade negotiations and tariff announcements.

-

Investor sentiment and its impact on asset prices: Negative investor sentiment led to a decline in asset prices across various markets, reflecting a general lack of confidence.

-

Potential for a market correction or crash: The persistent uncertainty heightened the risk of a significant market correction or even a crash, due to investor panic.

Conclusion

The IMF's warnings about systemic financial risk stemming from Trump's trade war are serious and deserve careful consideration. The escalating tariffs, retaliatory measures, and resulting disruption to global supply chains and investment pose a significant threat to global economic stability. Understanding the multifaceted impact of this trade war is crucial for businesses, investors, and policymakers alike. Staying informed about the evolving situation and the IMF's ongoing assessments of the trade war's impact is critical to mitigating potential risks. Further research into the specific effects of the Trump tariffs and the ongoing global trade disputes is necessary to navigate this complex economic landscape.

Featured Posts

-

Pierre Poilievres Fall From 20 Point Lead To Election Setback

Apr 23, 2025

Pierre Poilievres Fall From 20 Point Lead To Election Setback

Apr 23, 2025 -

Lane Thomas Promising Spring Training Performance With Cleveland Guardians

Apr 23, 2025

Lane Thomas Promising Spring Training Performance With Cleveland Guardians

Apr 23, 2025 -

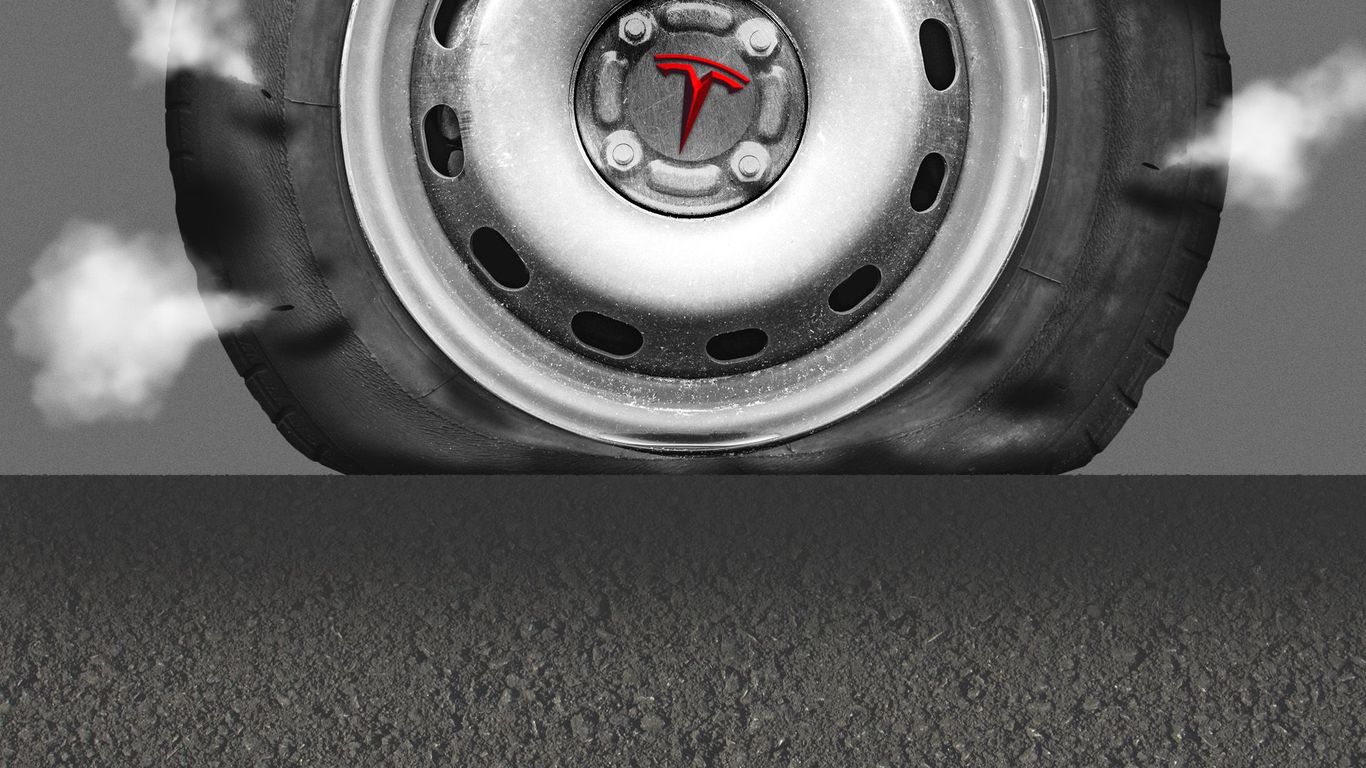

Tesla Board Faces Pressure From State Treasurers Over Musks Priorities

Apr 23, 2025

Tesla Board Faces Pressure From State Treasurers Over Musks Priorities

Apr 23, 2025 -

Bof As Assessment Why Current Stock Market Valuations Shouldnt Worry Investors

Apr 23, 2025

Bof As Assessment Why Current Stock Market Valuations Shouldnt Worry Investors

Apr 23, 2025 -

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Buildings And Residents

Apr 23, 2025

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Buildings And Residents

Apr 23, 2025