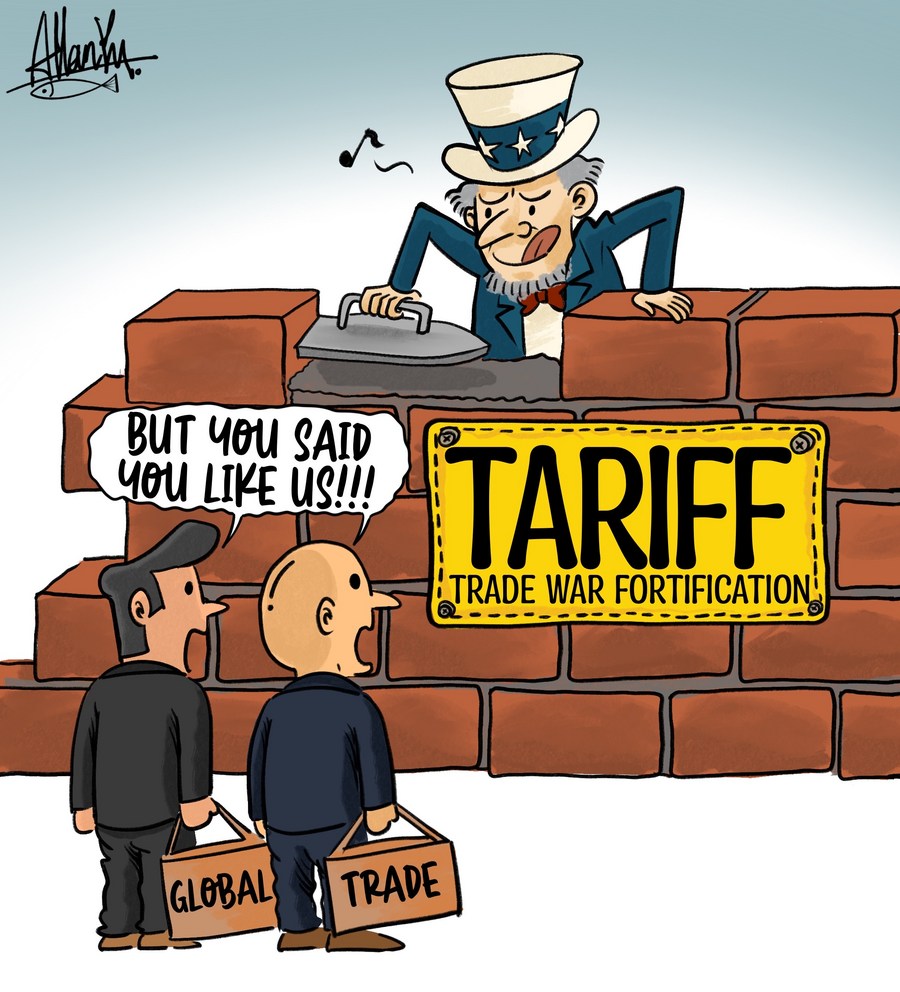

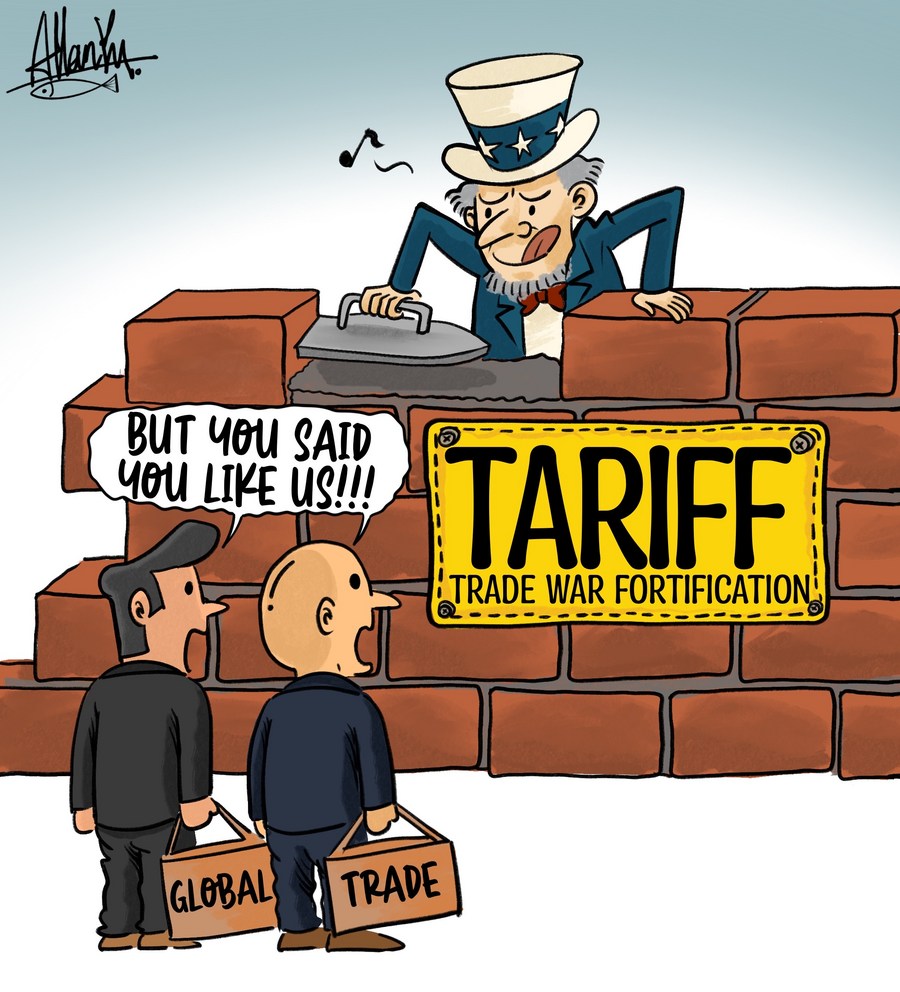

Trump's Trade Wars: A $174 Billion Blow To Global Billionaires' Wealth

Table of Contents

The Target: Specific Industries Affected by Trump's Tariffs

Trump's tariffs targeted various sectors, causing widespread economic ripple effects and significantly impacting the bottom lines of numerous multinational corporations, ultimately diminishing the wealth of their shareholders, many of whom are billionaires.

Impact on the Tech Sector

The tech sector, a cornerstone of the global economy, felt the brunt of Trump's trade policies. Supply chains, intricate webs connecting manufacturers and consumers across the globe, were severely disrupted.

- Examples of affected companies: Apple, Qualcomm, and numerous other tech giants faced increased costs due to tariffs on imported components and finished goods. This led to reduced profit margins and, in some cases, price increases for consumers.

- Stock market reactions: The uncertainty created by Trump's trade wars led to significant stock market volatility. Shares of tech companies, particularly those heavily reliant on global supply chains, experienced substantial drops, directly eroding the wealth of billionaire investors.

- Financial losses: The combined financial losses for tech billionaires due to decreased stock valuations and reduced company profits were substantial, contributing significantly to the overall $174 billion figure. This highlighted the vulnerability of even the most powerful companies to global trade disruptions.

The Automotive Industry's Struggle

The automotive industry, another sector deeply intertwined with global supply chains, faced considerable challenges due to Trump's tariffs. Increased costs for imported parts and materials, coupled with retaliatory tariffs from other countries, created a perfect storm for car manufacturers.

- Examples of affected car companies: Major players like General Motors, Ford, and their international counterparts suffered from production delays, increased manufacturing costs, and decreased sales due to higher prices for consumers.

- Disruptions to production: Tariffs on steel and aluminum, crucial materials in car manufacturing, disrupted supply chains and forced automakers to re-evaluate their global operations. This inefficiency directly translated into reduced profitability and lower stock prices.

- Increased costs for consumers: Higher production costs were inevitably passed on to consumers in the form of increased vehicle prices, further dampening demand and impacting the overall profitability of the industry.

Agriculture's Painful Harvest

American farmers, a traditionally vital sector of the US economy, were particularly vulnerable to Trump's trade wars, especially the disputes with China, a major importer of US agricultural products.

- Impact on specific agricultural products: Soybeans, wheat, and pork were among the agricultural products most affected by tariffs and trade restrictions, leading to significant price drops and reduced exports.

- Trade disputes with key partners: The trade war with China caused substantial harm to the agricultural sector, as China imposed retaliatory tariffs on American farm products, severely impacting farmers' incomes and livelihoods.

- Financial distress faced by farmers: Many farmers faced financial hardship, with some forced to sell their land or declare bankruptcy due to reduced income and increased debt. The overall impact on the agricultural economy contributed to the wealth erosion experienced across various sectors.

Mechanisms of Wealth Erosion Due to Trump's Trade Policies

Trump's trade policies employed several mechanisms that eroded the wealth of global billionaires:

Stock Market Volatility

The uncertainty created by the trade wars induced significant volatility in the stock market. This negatively affected the value of investments held by billionaires.

- Correlation between trade tensions and stock market performance: Periods of increased trade tensions were often accompanied by significant drops in stock market indices, reflecting investor uncertainty and risk aversion.

- Examples of significant market drops: Several instances of market corrections and declines could be directly attributed, at least partially, to concerns about the escalating trade conflicts.

- Impact on billionaire portfolios: Billionaires, whose wealth is often heavily invested in the stock market, saw their net worth decline significantly during periods of market volatility caused by trade wars.

Weakened Global Economic Growth

Trump's trade wars contributed to a slowdown in global economic growth, impacting the value of billionaire holdings.

- Reduction in global GDP growth: The International Monetary Fund (IMF) and other organizations documented a reduction in global GDP growth during the period of heightened trade tensions.

- Knock-on effect on various economies: The slowdown impacted various economies around the world, further reducing the value of assets owned by billionaires across different countries.

- Decline in asset values: As the global economy slowed, the value of many assets, including real estate, stocks, and other investments held by billionaires, declined, leading to a significant decrease in their net worth.

Increased Business Costs and Reduced Profitability

Tariffs imposed by the Trump administration directly increased the operational costs of many multinational corporations, leading to reduced profitability.

- Examples of businesses that experienced increased costs: Companies with global supply chains experienced significant increases in their costs as a result of tariffs on imported goods and materials.

- Reduced profitability: Higher costs and reduced demand resulted in decreased profits for many multinational corporations.

- Consequential effects on shareholder value: The decline in profitability directly impacted shareholder value, leading to a decrease in the wealth of billionaires who held shares in these companies.

Beyond the Numbers: The Broader Geopolitical Consequences of Trump's Trade Wars

The long-term effects of Trump's trade wars extended beyond the immediate financial losses. They significantly damaged international relationships and weakened the global trading system.

- Examples of damaged international relationships: The trade wars strained relationships with key trading partners like China and the European Union, creating uncertainty and distrust.

- Weakening of multilateral trade organizations: The reliance on unilateral actions rather than multilateral cooperation weakened the role of organizations like the World Trade Organization (WTO).

- Implications for future trade negotiations: The precedent set by Trump's trade wars created uncertainty and skepticism regarding future trade negotiations and the stability of the global trading system.

Conclusion

Trump's trade wars resulted in a staggering $174 billion loss to the wealth of global billionaires. This significant financial impact was felt across various sectors, including tech, automotive, and agriculture. The mechanisms of wealth erosion included stock market volatility, weakened global economic growth, and increased business costs. Furthermore, the trade wars had broader geopolitical consequences, damaging international relationships and weakening multilateral trade organizations. Learn more about the lasting effects of Trump's trade wars and how they continue to shape the global economic landscape.

Featured Posts

-

Gen Z And Smartphones Androids Redesign And I Phone Loyalty

May 09, 2025

Gen Z And Smartphones Androids Redesign And I Phone Loyalty

May 09, 2025 -

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Decline Post Trump Inauguration

May 09, 2025

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Decline Post Trump Inauguration

May 09, 2025 -

Victory Day Ceasefire Assessing Putins Move In Ukraine

May 09, 2025

Victory Day Ceasefire Assessing Putins Move In Ukraine

May 09, 2025 -

6

May 09, 2025

6

May 09, 2025 -

Expensive Babysitting Costs A Man 3 600 In Daycare Fees

May 09, 2025

Expensive Babysitting Costs A Man 3 600 In Daycare Fees

May 09, 2025