TSX Composite Index: New Intraday Record High

Table of Contents

Factors Contributing to the TSX Record High

Several interconnected factors have contributed to the TSX Composite Index's remarkable ascent to a new intraday record high. Understanding these drivers is crucial for investors seeking to capitalize on current market conditions.

Strong Corporate Earnings

Robust performance across key sectors is a primary driver of the TSX record high. Companies in energy, technology, and financials have demonstrated exceptional profitability, exceeding expectations and fueling investor optimism.

- Energy Sector Boom: The energy sector has been a significant contributor, benefiting from elevated global energy prices and increased demand. Companies like Suncor Energy and Canadian Natural Resources have reported stellar earnings, boosting the overall index. Keywords: energy stocks, oil prices, Canadian energy sector.

- Technology Company Growth: The tech sector also showed strong growth, driven by innovation and increasing digital adoption. Companies specializing in artificial intelligence, software, and e-commerce have seen significant gains. Keywords: Canadian tech stocks, AI stocks, software companies.

- Financial Sector Strength: Strong performance in the financial sector, including banks and insurance companies, reflects a healthy Canadian economy and increased lending activity. Keywords: Canadian banks, financial services, insurance stocks.

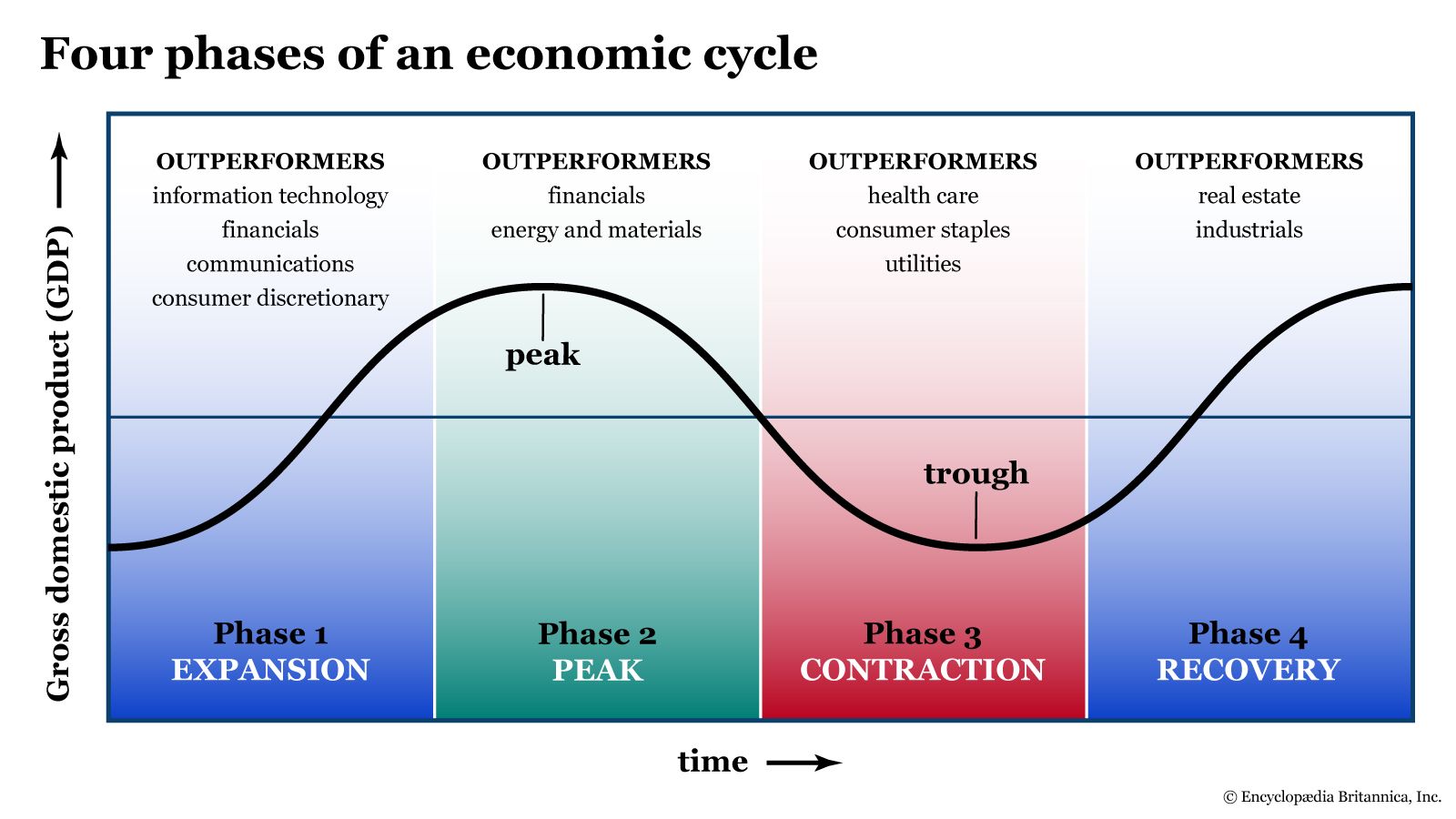

Global Economic Factors

Positive global economic indicators have significantly impacted the TSX's performance. Easing inflation in many developed economies, coupled with strong consumer spending, has created a favorable environment for investment.

- Global Economic Recovery: The ongoing global economic recovery, albeit uneven, has fostered investor confidence and increased foreign investment in the Canadian market. Keywords: global economic growth, foreign direct investment.

- Increased Foreign Investment: A surge in foreign investment into Canadian companies further contributes to the TSX's upward trajectory. This influx of capital reflects global investors' positive outlook on the Canadian economy. Keywords: international investment, Canadian market attractiveness.

- Impact of Interest Rate Changes: While interest rate hikes have presented some challenges, the market's resilience suggests that the Canadian economy remains relatively robust. Keywords: interest rate hikes, monetary policy, inflation control.

Government Policies and Initiatives

Government policies aimed at fostering economic growth and attracting investment play a crucial role in shaping market sentiment. Investor-friendly policies have contributed to the positive momentum of the TSX.

- Government Stimulus: While not as significant as in previous years, government initiatives aimed at supporting key sectors have helped maintain economic stability and investor confidence. Keywords: government spending, fiscal policy, economic stimulus.

- Investor-Friendly Regulations: Clear and consistent regulatory frameworks are essential for attracting foreign investment and encouraging domestic growth. Keywords: regulatory environment, investment regulations, business-friendly policies.

Implications for Investors

The TSX Composite Index reaching a record high presents both exciting opportunities and potential risks for investors. A strategic approach to investment is crucial in this dynamic market.

Opportunities and Risks

The current market environment presents several opportunities for investors, but it's crucial to recognize and mitigate potential risks.

- Investment Opportunities: The TSX record high opens doors to several investment opportunities across various sectors. However, thorough due diligence and a diversified portfolio are essential. Keywords: investment strategies, stock picking, portfolio management.

- Risk Management: While the market trend is positive, investors must remain cautious. Economic downturns, geopolitical instability, and sector-specific risks could impact the market's performance. Keywords: risk mitigation, portfolio diversification, investment risk.

Sector-Specific Analysis

Analyzing individual sectors within the TSX is essential for making informed investment decisions. High-growth sectors present attractive opportunities, but understanding sector-specific risks is crucial.

- Energy Stock Outlook: The energy sector remains attractive, but volatility due to global events warrants careful consideration. Keywords: energy stock investment, oil and gas stocks, renewable energy.

- Technology Stock Potential: The technology sector offers high growth potential, but it can be susceptible to market corrections. Keywords: tech stock investing, artificial intelligence, software companies.

- Financial Sector Stability: The financial sector generally demonstrates stability, but interest rate changes can influence profitability. Keywords: bank stocks, financial services investing, insurance sector.

Long-Term Outlook

While the current trend is positive, investors need a long-term perspective when considering the TSX Composite Index's future performance.

- Market Forecast: Expert predictions vary, but many analysts see sustained growth, although at a potentially slower pace than currently experienced. Keywords: long-term investment, market forecast, future growth prospects.

- Potential Challenges: Geopolitical risks, inflation, and potential economic slowdowns are potential challenges that could impact the TSX's performance. Keywords: market volatility, economic uncertainty, geopolitical risk.

Conclusion

The TSX Composite Index reaching a new intraday record high signifies a positive trend in the Canadian stock market, driven by strong corporate earnings, favorable global economic conditions, and supportive government policies. While opportunities abound, investors should remain mindful of potential risks and employ sound investment strategies. Diversification, risk management, and thorough due diligence are crucial for navigating this dynamic market.

Call to Action: Stay informed about the evolving landscape of the TSX Composite Index and seize the opportunities presented by this exciting new milestone. Learn more about investing in the TSX and building a robust investment portfolio tailored to your needs. Monitor the TSX record highs and actively manage your investment strategy to capitalize on the potential of the Canadian stock market.

Featured Posts

-

Kupovina Stanova U Inostranstvu Srbi Prednjace U Odredenim Regionima

May 17, 2025

Kupovina Stanova U Inostranstvu Srbi Prednjace U Odredenim Regionima

May 17, 2025 -

Angel Reeses Key Tip For Hailey Van Liths Rookie Year

May 17, 2025

Angel Reeses Key Tip For Hailey Van Liths Rookie Year

May 17, 2025 -

Japans Economic Slowdown A Q1 Review Before Trumps Tariffs

May 17, 2025

Japans Economic Slowdown A Q1 Review Before Trumps Tariffs

May 17, 2025 -

How Effective Middle Management Fuels Company Success And Employee Well Being

May 17, 2025

How Effective Middle Management Fuels Company Success And Employee Well Being

May 17, 2025 -

Arsenal Leading The Chase For Stuttgarts Midfielder

May 17, 2025

Arsenal Leading The Chase For Stuttgarts Midfielder

May 17, 2025