Uber Stock's Resilience: Analyzing Its Position During Economic Downturns

Table of Contents

Uber's Business Model and its Recession-Proofing Aspects

Uber's success isn't solely reliant on its ride-sharing services. A key factor contributing to Uber stock's resilience is its diversified business model.

Diversification Across Services

Uber's expansion beyond its core ride-hailing service has significantly enhanced its resilience. This diversification includes:

- Uber Eats: The food delivery service provides a significant revenue stream, particularly robust during economic downturns when people may opt for more affordable home-cooked meals or takeout. Data shows that food delivery services often see increased demand during recessions.

- Uber Freight: This segment caters to businesses needing transportation services, offering relative stability compared to the fluctuating demand of consumer ride-sharing. This provides a buffer against downturns in consumer spending.

- Other Services: Uber continues to expand into new areas like micromobility (scooters and bikes) and autonomous vehicles, adding further layers to its diversified portfolio.

These diverse offerings help mitigate the impact of economic fluctuations. While ride-sharing demand might soften during a recession, the demand for food delivery or freight services can remain relatively stable, thus bolstering overall revenue.

Network Effects and the "Winner-Takes-All" Dynamic

Uber benefits significantly from network effects. The more drivers and riders on the platform, the more valuable the service becomes for both sides. This creates a significant barrier to entry for competitors.

- Increased User Base: A larger user base attracts more drivers, leading to shorter wait times and improved service.

- Improved Driver Earnings: More riders translate into higher earnings for drivers, incentivizing them to stay on the platform.

- Competitive Advantage: This positive feedback loop creates a "winner-takes-all" dynamic, making it difficult for competitors to gain substantial market share.

This network effect is a crucial aspect of Uber stock's resilience, making it less susceptible to disruptions from new entrants during periods of economic stress.

Pricing Strategies and Demand Elasticity

Uber employs dynamic pricing models to adapt to fluctuating demand and maintain profitability.

- Surge Pricing: During peak demand (e.g., rush hour or inclement weather), prices increase to incentivize more drivers to work and meet the heightened demand.

- Promotional Offers: During economic downturns, Uber can implement promotional offers to attract price-sensitive customers, stimulating demand.

- Demand Forecasting: Sophisticated algorithms help Uber predict demand fluctuations, allowing for proactive adjustments to pricing and driver allocation.

While demand may be elastic (sensitive to price changes) during recessions, Uber's dynamic pricing models allow it to navigate these fluctuations while maintaining a level of profitability.

Historical Performance of Uber Stock During Economic Slowdowns

While Uber is relatively young, analyzing its performance during past economic slowdowns (and comparing it to similar companies) offers insights into its resilience.

Analyzing Past Recessions

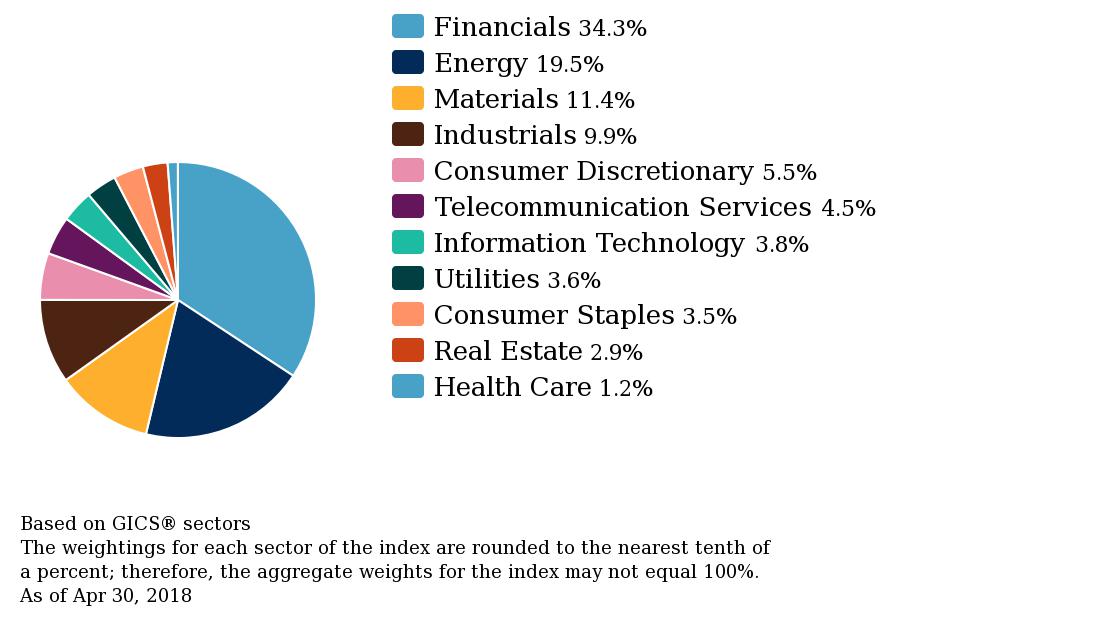

(Insert a chart here showing Uber's stock performance during previous economic downturns, if applicable. Compare it to the performance of competitors like Lyft or other transportation companies. Analyze the data to explain any resilience shown.)

For example, [Insert specific data point or analysis if available]. This demonstrates [explain what the data point shows about resilience or vulnerability].

Identifying Key Indicators of Resilience

Several key financial metrics demonstrate Uber's resilience:

- Revenue Growth: Sustained revenue growth despite economic headwinds shows a strong underlying demand for its services.

- User Retention: High user retention rates indicate strong customer loyalty, mitigating the impact of reduced spending during recessions.

- Profitability (or path to profitability): Moving toward profitability shows the business model's ability to generate profit even during periods of economic uncertainty.

(Include data points supporting these indicators from previous downturns)

Future Outlook and Potential Vulnerabilities

Despite Uber's strengths, it's crucial to acknowledge potential challenges.

Assessing Future Economic Uncertainty

Several factors could impact Uber's future performance:

- Inflation: Increased inflation could reduce consumer spending on discretionary services like ride-sharing.

- Interest Rate Hikes: Higher interest rates could increase borrowing costs, affecting Uber's expansion plans and potentially slowing growth.

- Geopolitical Instability: Global events can significantly impact economic conditions and consumer behavior.

These economic headwinds present challenges but also opportunities for Uber to adapt and innovate.

Identifying Potential Risks and Mitigation Strategies

Uber faces several potential risks:

- Increased Competition: The rise of new competitors could erode market share.

- Regulatory Changes: New regulations could impact pricing, driver classifications, and operational costs.

- Driver Shortages: A shortage of drivers could hinder service availability and negatively impact customer satisfaction.

To mitigate these risks, Uber can invest in:

- Technological Innovation: Developing autonomous vehicle technology and improving its platform's efficiency.

- Strategic Partnerships: Collaborating with other companies to expand reach and access new markets.

- Strong Public Relations: Building positive relationships with regulators and the public.

Long-Term Growth Prospects

Despite economic uncertainties, Uber's long-term growth prospects remain positive.

- Expanding into New Markets: Further expansion into underserved markets presents significant growth potential.

- Developing New Services: Innovation and development of new services can create new revenue streams and enhance its market position.

- Technological Advancements: Embracing technological innovation in areas like autonomous driving can dramatically reduce costs and improve efficiency.

Investing in Uber Stock's Resilience - A Long-Term Perspective

Understanding Uber stock's resilience requires a comprehensive analysis of its diversified business model, historical performance, and future outlook. While economic downturns present challenges, Uber's adaptive business model, dynamic pricing strategies, and potential for long-term growth suggest a degree of resilience that makes it an interesting investment prospect for long-term investors. Remember to carefully consider all factors before making any investment decisions. Further research into Uber stock's resilience and consultation with a qualified financial advisor are strongly recommended.

Featured Posts

-

Seaweed Breakthrough Condo Instability And Corporate Crisis Your Daily News Update

May 17, 2025

Seaweed Breakthrough Condo Instability And Corporate Crisis Your Daily News Update

May 17, 2025 -

Searching For Stake Alternatives Top Replacement Casinos For 2025

May 17, 2025

Searching For Stake Alternatives Top Replacement Casinos For 2025

May 17, 2025 -

Tom Thibodeau How Fixing A Flaw Saved The Knicks From Disaster

May 17, 2025

Tom Thibodeau How Fixing A Flaw Saved The Knicks From Disaster

May 17, 2025 -

Record High For Canadas S And P Tsx Composite Index Intraday Update

May 17, 2025

Record High For Canadas S And P Tsx Composite Index Intraday Update

May 17, 2025 -

The Warner Bros Pictures 2025 Cinema Con Presentation A Detailed Look

May 17, 2025

The Warner Bros Pictures 2025 Cinema Con Presentation A Detailed Look

May 17, 2025