Ultra-Low Growth: David Dodge's Forecast For The Canadian Economy Next Year

Table of Contents

Key Factors Contributing to Ultra-Low Growth According to Dodge

David Dodge's ultra-low growth prediction isn't based on isolated concerns; rather, it stems from a confluence of global and domestic challenges impacting the Canadian economy.

Global Economic Headwinds

The global economic landscape is fraught with instability. Several factors contribute to the anticipated slowdown in Canadian growth.

- The War in Ukraine: The ongoing conflict has significantly disrupted global supply chains, driving up energy prices and exacerbating inflationary pressures worldwide.

- Rising Energy Prices: Increased energy costs impact businesses and consumers, reducing disposable income and dampening economic activity. This is especially pertinent to Canada, a significant energy producer and consumer.

- Persistent Inflation: High inflation erodes purchasing power, leading to decreased consumer spending and investment, hindering economic growth. Central banks globally are battling to curb inflation, often leading to higher interest rates.

- Supply Chain Issues: Lingering supply chain disruptions continue to constrain production and increase costs for businesses. This global issue significantly impacts Canada's manufacturing and export sectors. Keywords: Global inflation, supply chain issues, geopolitical risks, energy prices.

Domestic Challenges Facing the Canadian Economy

Beyond global headwinds, Canada faces internal economic pressures that further contribute to the ultra-low growth forecast.

- Interest Rate Hikes: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are impacting borrowing costs for businesses and consumers, potentially leading to reduced investment and spending.

- Housing Market Correction: The Canadian housing market is undergoing a correction, with prices falling in some areas. This decline impacts consumer wealth and confidence, potentially slowing down economic activity.

- High Consumer Debt: Canadians carry a significant level of household debt, making them vulnerable to rising interest rates. Increased debt servicing costs reduce disposable income, further impacting consumer spending. Keywords: Interest rate hikes, housing market, consumer debt, Canadian GDP.

Dodge's Specific Concerns and Predictions

Dodge's concerns extend beyond general economic anxieties. His forecast likely includes specific predictions regarding key economic indicators. While precise figures may vary depending on the source, we can expect his analysis to highlight:

- Lower GDP Growth: A significant slowdown in GDP growth, potentially dipping into ultra-low territory (e.g., below 1%).

- Increased Unemployment: A rise in the unemployment rate, as businesses respond to slowing demand by cutting back on hiring or even laying off employees.

- Persistent Inflation: While interest rate hikes aim to curb inflation, the impact may be delayed, leading to persistent inflationary pressures for some time. Keywords: GDP forecast, unemployment rate, inflation prediction, economic slowdown.

Potential Mitigation Strategies and Policy Responses

Addressing the ultra-low growth forecast requires a multi-pronged approach involving government intervention and proactive business strategies.

Government Policy Options

The Canadian government has several policy tools at its disposal to stimulate economic growth.

- Fiscal Policy: The government could implement fiscal stimulus measures, such as increased government spending on infrastructure projects or targeted tax cuts, to boost aggregate demand. However, this approach must be carefully calibrated to avoid exacerbating inflation and increasing the national debt.

- Monetary Policy: The Bank of Canada's monetary policy plays a crucial role. While interest rate hikes aim to curb inflation, the Bank must carefully assess the impact on economic growth and potentially adjust its approach if the economy weakens significantly. Keywords: Fiscal policy, monetary policy, Bank of Canada, government spending, stimulus package.

Business Strategies for Navigating Ultra-Low Growth

Businesses need to adapt to thrive in an environment of ultra-low growth.

- Cost Cutting: Implementing efficient cost-reduction measures is crucial for maintaining profitability during a slowdown. This could involve streamlining operations, negotiating better terms with suppliers, and optimizing resource allocation.

- Diversification: Reducing reliance on a single market or product line can mitigate the risks associated with economic uncertainty. Diversification can help businesses to maintain revenue streams even if one segment of their business is affected.

- Investment in Innovation: Investing in research and development and adopting innovative technologies can help businesses enhance their competitiveness and find new growth opportunities. Keywords: Business strategies, economic resilience, cost reduction, innovation.

Comparing Dodge's Forecast with Other Economic Experts

While Dodge's prediction is significant, it’s crucial to consider other perspectives.

Alternative Perspectives

Various economic analysts and financial institutions offer their own forecasts, which may differ from Dodge's predictions in terms of severity and timing. Comparing these forecasts provides a more comprehensive understanding of the range of possible outcomes. Keywords: Economic analysts, financial institutions, consensus forecast.

Range of Possible Outcomes

Economic forecasting inherently involves uncertainty. While ultra-low growth seems likely, the actual outcome could range from a mild recession to a prolonged period of slow growth. Considering this range of possibilities is crucial for effective planning and risk management. Keywords: Economic uncertainty, recession risk, economic outlook.

Conclusion: Understanding and Preparing for Ultra-Low Growth in the Canadian Economy

David Dodge's prediction of ultra-low growth for the Canadian economy highlights the significant challenges ahead. A combination of global headwinds and domestic vulnerabilities contribute to this forecast. While the government can employ fiscal and monetary policies to mitigate the impact, businesses must also adopt proactive strategies to enhance their resilience. Understanding the potential range of outcomes – from a mild slowdown to a more significant recession – is crucial. Staying informed about economic developments and developing robust plans to navigate this challenging period is essential for both individuals and businesses. Continue to monitor the latest economic news and consult with financial professionals to prepare for ultra-low growth and its potential consequences.

Featured Posts

-

Manchester United Community Grieves With Poppys Family

May 03, 2025

Manchester United Community Grieves With Poppys Family

May 03, 2025 -

The Exclusive Beach House Melissa Gorgas New Jersey Getaway

May 03, 2025

The Exclusive Beach House Melissa Gorgas New Jersey Getaway

May 03, 2025 -

Infuriating Glastonbury Schedule Fans React To Impossible Choices

May 03, 2025

Infuriating Glastonbury Schedule Fans React To Impossible Choices

May 03, 2025 -

Japans Central Bank Lowers Growth Forecast Trade War Weighs Heavily

May 03, 2025

Japans Central Bank Lowers Growth Forecast Trade War Weighs Heavily

May 03, 2025 -

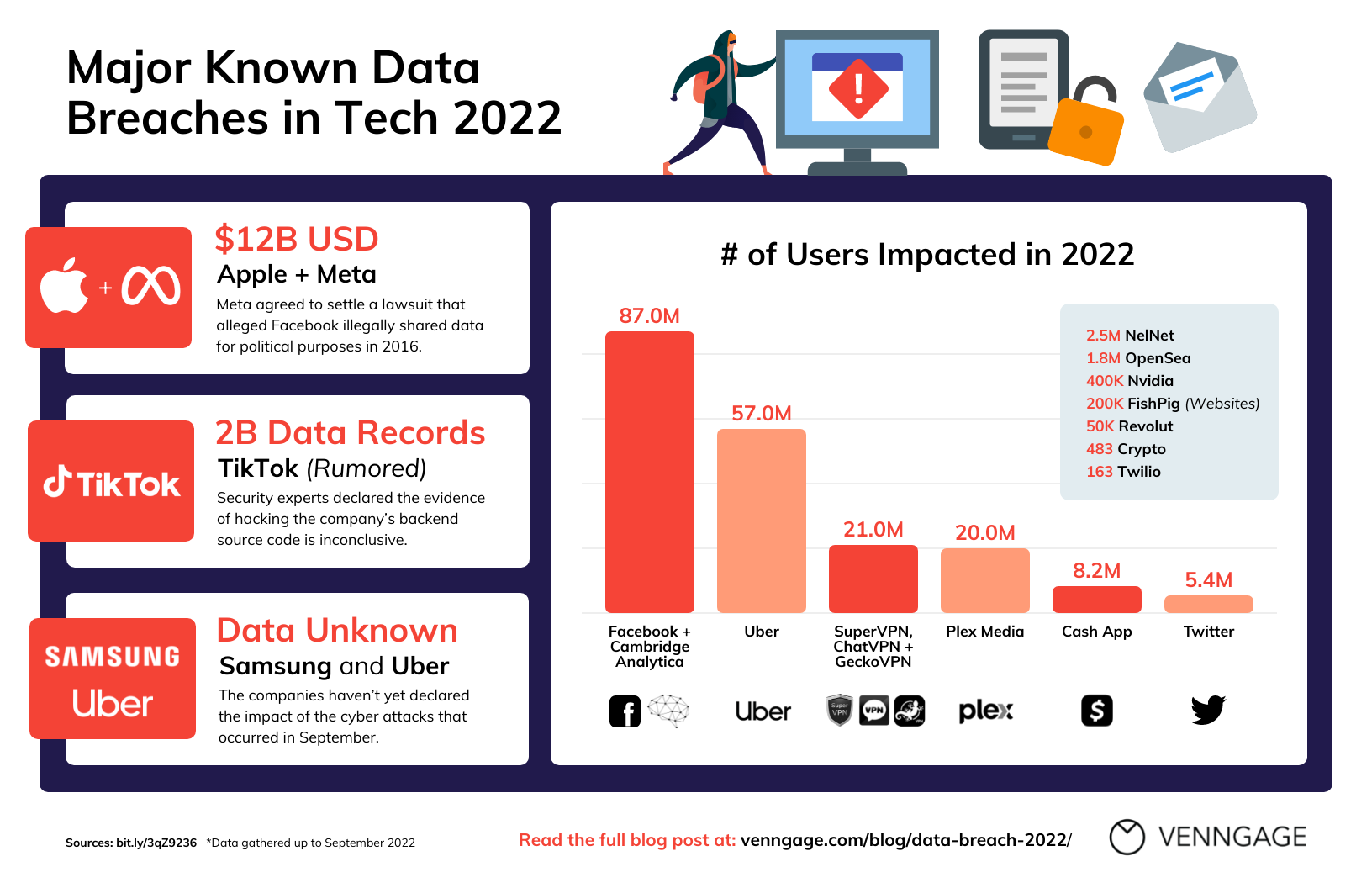

Data Breaches Cost T Mobile 16 Million A Three Year Security Lapse

May 03, 2025

Data Breaches Cost T Mobile 16 Million A Three Year Security Lapse

May 03, 2025