Understanding High Stock Market Valuations: A BofA-Informed Perspective

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these factors is key to making informed investment decisions.

Low Interest Rates and Monetary Policy

Low interest rates significantly influence investor behavior and drive up asset prices, including stocks. Historically low interest rates, often a result of central bank monetary policy like quantitative easing, reduce the cost of borrowing for corporations and increase investor appetite for riskier assets.

- Impact on corporate borrowing costs: Lower borrowing costs allow companies to invest more, potentially boosting earnings and fueling further stock price increases.

- Increased investor appetite for riskier assets: With lower returns on safer investments like bonds, investors often seek higher returns in the stock market, even if it means accepting higher risk.

- Potential for inflation: Sustained low interest rates can lead to inflation, which erodes the purchasing power of money and can push investors towards assets like stocks as a hedge against inflation. This interaction between low interest rates, inflation, and high stock market valuations is a complex one requiring careful consideration.

Strong Corporate Earnings and Profitability

Robust corporate earnings and profitability play a crucial role in supporting high stock valuations. Many sectors have shown impressive growth, leading to increased investor confidence.

- Examples of strong-performing sectors: Technology, healthcare, and consumer staples often exhibit strong earnings, driving up their stock prices and contributing to overall market valuations. (Note: Specific examples and data would be included here with a real BofA analysis.)

- Factors driving profitability: Increased efficiency, cost-cutting measures, and strong consumer demand can all contribute to higher corporate profits.

- Potential for future growth: Strong current earnings often signal optimism about future growth, further fueling investor demand and high stock market valuations.

Technological Innovation and Growth

Technological advancements, particularly in specific sectors, are a significant driver of stock valuations. The rapid pace of innovation creates new opportunities and fuels investor enthusiasm for growth stocks.

- Examples of leading tech companies: Companies at the forefront of technological innovation often command high valuations due to their perceived growth potential. (Note: Specific examples would be included with a real BofA analysis.)

- Disruptive technologies: The emergence of disruptive technologies can reshape entire industries, leading to significant stock price appreciation for companies effectively leveraging these advancements.

- Long-term growth potential: Investors often place a premium on companies with strong long-term growth potential, particularly in technology-driven sectors. This leads to a higher market valuation for growth stocks compared to value stocks.

Investor Sentiment and Market Psychology

Investor optimism and speculation significantly influence stock prices. Positive market sentiment can create a self-fulfilling prophecy, pushing prices even higher.

- FOMO (fear of missing out): The fear of missing out on potential gains can drive investors to buy stocks even at high valuations, further increasing prices.

- Herd behavior: Investors often follow the crowd, leading to amplified market movements and potentially unsustainable price increases.

- Impact of media and news sentiment: Positive news coverage and optimistic market commentary can boost investor confidence and contribute to higher stock valuations. Conversely, negative news can trigger sell-offs. Understanding market psychology and its influence on stock prices is crucial for effective investment management.

Assessing the Risks Associated with High Valuations

While high stock market valuations can signal strong economic fundamentals, they also present significant risks. It's essential to carefully assess these risks before making investment decisions.

Valuation Metrics and Indicators

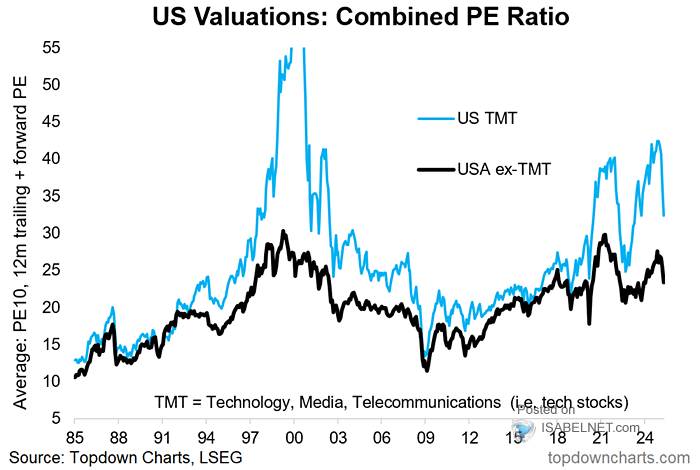

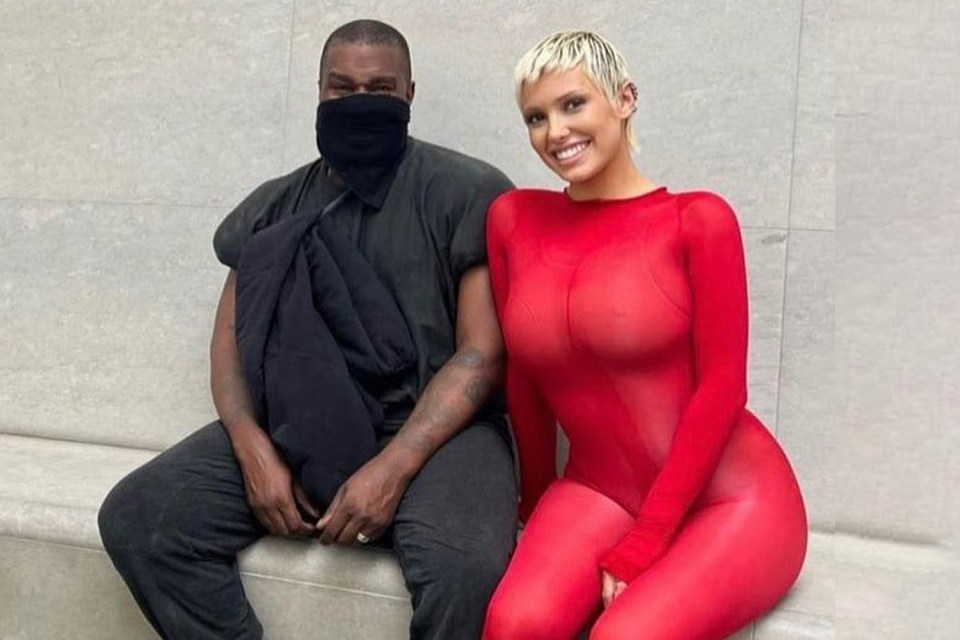

Key valuation metrics, such as P/E ratios and price-to-sales ratios, provide insights into whether current valuations are justified. Comparing current ratios to historical averages and industry benchmarks is crucial for evaluating potential overvaluation.

- Interpretation of different metrics: Various metrics offer different perspectives on valuation. A high P/E ratio might signal high growth expectations but also increased risk. (Note: Specific examples and data would be included with a real BofA analysis.)

- Comparisons to historical averages: Comparing current valuations to historical averages helps determine whether current prices are significantly above or below their long-term trend.

- Potential risks of overvaluation: Overvalued stocks are more susceptible to price corrections, meaning significant drops in value can occur if market sentiment shifts.

Potential Market Corrections and Volatility

Given the current high valuations, the potential for a market correction or increased volatility is a significant risk. Market corrections are a normal part of the market cycle, but their timing and severity are difficult to predict.

- Historical examples of market corrections: Studying past market corrections can provide insights into potential triggers and the magnitude of price declines. (Note: Specific examples and data would be included with a real BofA analysis.)

- Potential triggers for a downturn: Changes in interest rates, economic slowdown, geopolitical events, or a shift in investor sentiment can trigger a market downturn.

- Strategies for mitigating risk: Diversification, hedging, and having a well-defined investment strategy are crucial for mitigating risk during periods of market volatility. Risk management is paramount during periods of high stock market valuations.

Geopolitical and Macroeconomic Factors

Global events and economic conditions significantly influence stock market valuations. Geopolitical risks and macroeconomic uncertainties can create volatility and impact investor confidence.

- Examples of geopolitical risks: International conflicts, trade wars, and political instability can all impact market sentiment and stock prices. (Note: Specific examples and data would be included with a real BofA analysis.)

- Economic uncertainties (inflation, recession): Concerns about inflation or a potential recession can lead to decreased investor confidence and trigger sell-offs.

- Impact on investor confidence: Uncertainty surrounding geopolitical and macroeconomic factors can significantly impact investor confidence, leading to increased volatility and potential market corrections.

Understanding High Stock Market Valuations - A Call to Action

This analysis highlights the complex interplay of factors contributing to current high stock market valuations. While strong corporate earnings and technological innovation support high prices, risks associated with overvaluation, potential market corrections, and macroeconomic uncertainty remain significant.

Key Takeaways: Current high stock market valuations are driven by a combination of low interest rates, strong corporate earnings, technological innovation, and positive investor sentiment. However, this presents significant risks, including potential market corrections and volatility influenced by geopolitical and macroeconomic factors. A careful assessment of valuation metrics and a well-defined risk management strategy are crucial.

Understanding high stock market valuations is crucial for navigating today's complex investment landscape. Continue your research and consult with a financial advisor to make informed decisions about your portfolio. Stay informed about market trends and continue to understand high stock market valuations, adapting your investment strategy accordingly.

Featured Posts

-

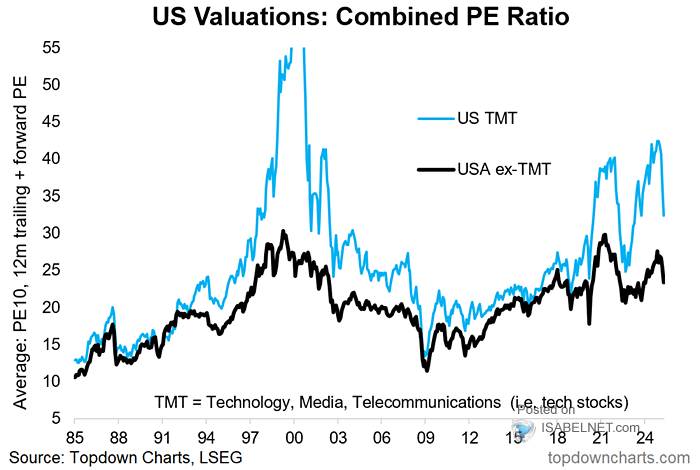

Boosting Chinas Economy The Challenges Of Increasing Household Consumption

May 28, 2025

Boosting Chinas Economy The Challenges Of Increasing Household Consumption

May 28, 2025 -

Bennedict Mathurins Overtime Heroics Lead Pacers Past Nets

May 28, 2025

Bennedict Mathurins Overtime Heroics Lead Pacers Past Nets

May 28, 2025 -

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025 -

Pittsburgh Pirates Skenes Gets Opening Day Nod

May 28, 2025

Pittsburgh Pirates Skenes Gets Opening Day Nod

May 28, 2025 -

A Hideg Es A Szarazsag Kihivasai Alfoeldi Noevenykulturak Vedelme

May 28, 2025

A Hideg Es A Szarazsag Kihivasai Alfoeldi Noevenykulturak Vedelme

May 28, 2025