Understanding ING Group's 2024 Performance: A Look At The Form 20-F

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

The ING Group's 2024 Form 20-F provides a detailed picture of the bank's financial health. Analyzing this annual report is essential for understanding the performance of this major Dutch bank and its implications for investors.

Revenue and Net Income

ING's reported revenue and net income for 2024 will be crucial indicators of the bank's overall financial health. (Note: Specific data from the 2024 Form 20-F will need to be inserted here once released). We will compare these figures to previous years (2023, 2022, etc.) and industry benchmarks to assess growth or decline percentages. This analysis will include a breakdown of revenue by business segment, such as:

- Wholesale Banking: Revenue generated from services to institutional clients, including trading, investment banking, and corporate lending.

- Retail Banking: Revenue from personal banking services, including mortgages, savings accounts, and credit cards.

- Insurance: Revenue from insurance products offered to both retail and corporate clients.

Furthermore, we will assess how closely the actual results match analyst predictions and analyze the impact of interest rate changes on profitability. Rising interest rates can positively impact net interest income but may also affect loan demand and overall economic activity.

Asset Quality and Loan Performance

Analyzing ING's asset quality is critical for understanding the bank's risk profile. Key metrics to examine include:

- Non-Performing Loans (NPL) Ratio: The percentage of loans that are 90 days or more past due. A rising NPL ratio indicates increasing credit risk.

- Changes in Loan Loss Provisions: The amount of money set aside to cover potential loan losses. Increases in loan loss provisions suggest growing concerns about asset quality.

We will assess the impact of macroeconomic factors, such as economic growth, unemployment, and inflation, on ING's loan portfolio performance and analyze the geographical distribution of loan performance to understand potential regional risks.

Capital Ratios and Liquidity

ING's capital adequacy and liquidity are crucial for assessing its financial stability. We will examine:

- Common Equity Tier 1 (CET1) Ratio: This key metric measures a bank's core capital relative to its risk-weighted assets. A higher CET1 ratio indicates greater financial strength and resilience.

- Liquidity Coverage Ratio (LCR): This ratio measures a bank's ability to meet its short-term liquidity needs.

We will compare ING's capital ratios and LCR to regulatory requirements and analyze the results of any stress tests performed to evaluate the bank's ability to withstand adverse economic scenarios. The impact of any regulatory changes on ING's capital position will also be reviewed.

Operational Performance and Strategic Initiatives

ING's operational performance and strategic initiatives are equally important in assessing its overall health.

Strategic Initiatives and Growth Strategies

ING's 2024 Form 20-F will detail the bank's strategic initiatives and their impact on performance. We will examine:

- Specific strategies implemented for growth in different business segments.

- Progress made toward achieving strategic goals.

- The impact of any mergers, acquisitions, or divestitures on the bank's overall performance.

- The role of significant partnerships in driving growth and innovation.

Technological Investments and Digital Transformation

ING's investments in technology and digital transformation are critical for maintaining competitiveness. We will analyze:

- Investments in digital platforms and infrastructure.

- The impact of these investments on operational efficiency and cost reduction.

- Customer adoption rates for digital banking channels.

- The implementation of new technologies, such as artificial intelligence and machine learning.

Risk Management and Compliance

A strong risk management framework is vital for any financial institution. We'll review ING's approach, focusing on:

- The key risk factors identified by ING.

- The risk mitigation strategies employed.

- Updates on regulatory compliance.

- Any significant compliance issues.

Conclusion

This analysis of ING Group's 2024 Form 20-F provides valuable insights into the bank's financial performance, operational efficiency, and strategic direction. We highlighted key financial metrics from the ING financial report, strategic initiatives, and risk management practices. Understanding ING Group's financial performance, as detailed in their Form 20-F, is crucial for investors and stakeholders. For a comprehensive understanding, download and thoroughly review the full ING Group 2024 Form 20-F. Stay updated on ING Group's future performance by regularly consulting their financial reports and staying informed about market analysis of ING stock. Further analysis of ING Group's 20-F filings is recommended to gain a deeper perspective on their future prospects and the implications for your investment strategy.

Featured Posts

-

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025 -

Wayne Gretzkys Trump Connection Impact On His Legacy

May 21, 2025

Wayne Gretzkys Trump Connection Impact On His Legacy

May 21, 2025 -

Javier Baez Recuperacion Y Productividad En El Campo

May 21, 2025

Javier Baez Recuperacion Y Productividad En El Campo

May 21, 2025 -

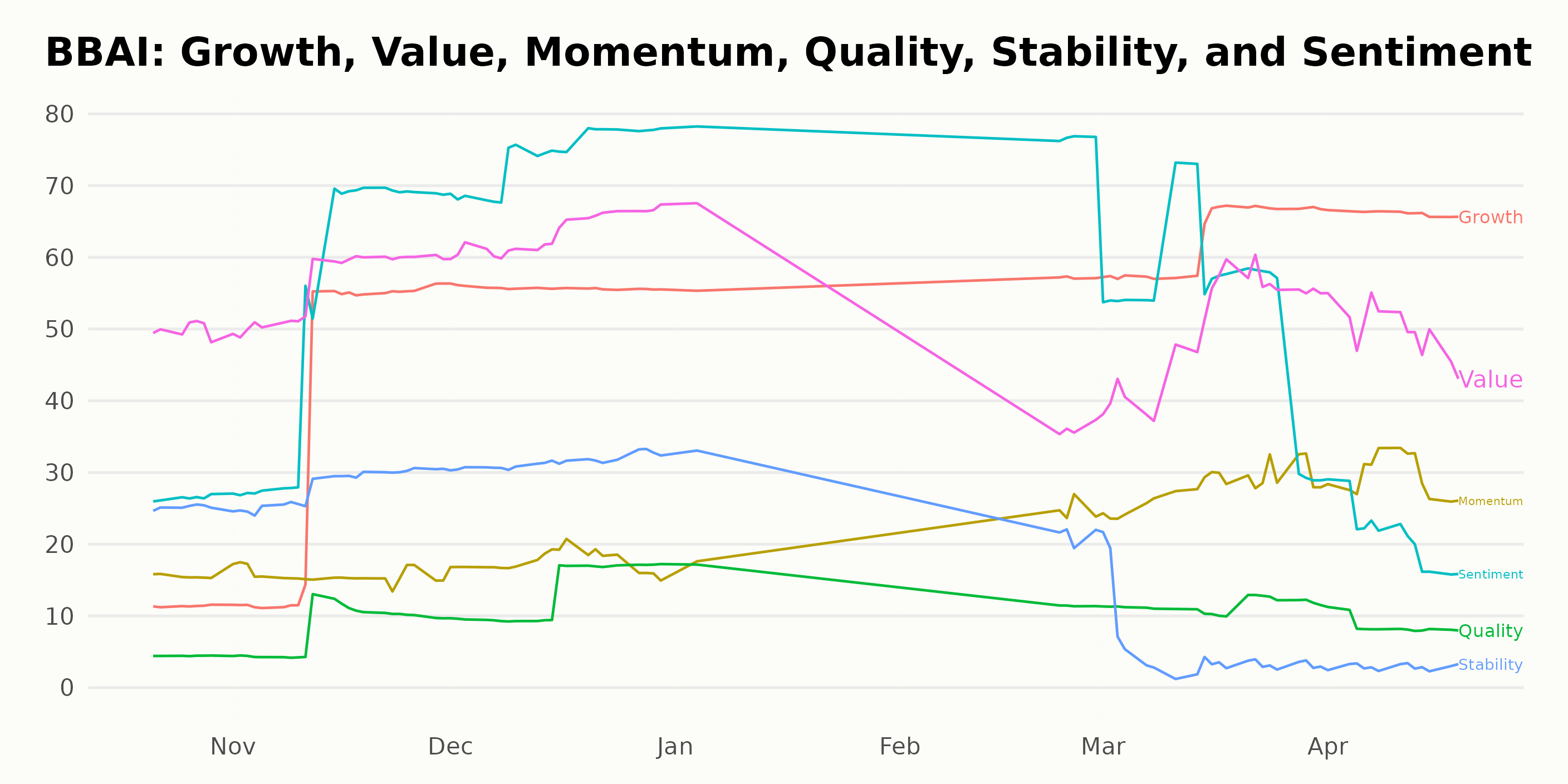

Is Big Bear Ai Bbai A Top Penny Stock To Watch

May 21, 2025

Is Big Bear Ai Bbai A Top Penny Stock To Watch

May 21, 2025 -

Peppa Pigs Baby Sisters Name The Heartwarming Meaning Revealed

May 21, 2025

Peppa Pigs Baby Sisters Name The Heartwarming Meaning Revealed

May 21, 2025