Understanding The HMRC's Changes To Side Hustle Tax And The New Enforcement Measures

Table of Contents

Key Changes in HMRC's Side Hustle Tax Regulations

The rules surrounding side hustle income in the UK are evolving. HMRC is clamping down on tax evasion and ensuring everyone pays their fair share. Here’s what you need to know:

Increased Reporting Requirements for Self-Employed Individuals

HMRC is demanding more detailed reporting from self-employed individuals. This means higher thresholds for reporting income and stricter adherence to reporting deadlines. Failure to comply can result in penalties, including late filing penalties and interest charges.

- New Thresholds: Be aware of the updated thresholds for reporting income; these are regularly reviewed by HMRC.

- Making Tax Digital (MTD): Many self-employed individuals are now required to use MTD-compatible software to submit their tax returns. This digitalisation streamlines the process for HMRC but requires you to adapt your record-keeping.

- Quarterly Updates: Some individuals may be required to submit quarterly updates on their income, rather than just an annual return. This provides HMRC with a more real-time view of your earnings.

Changes to Tax Deductions and Allowances for Side Hustles

The rules regarding allowable expenses for side hustles have also been clarified and, in some cases, tightened. It’s crucial to understand what expenses are deductible to accurately calculate your tax liability. Keeping accurate and detailed records is vital.

- Allowable Expenses: Examples include legitimate business costs such as office supplies, travel expenses directly related to work, and subscriptions relevant to your side hustle.

- Non-Allowable Expenses: Personal expenses, such as groceries or entertainment, are generally not deductible.

- Record Keeping: Maintain meticulous records of all income and expenses. This will be crucial if you are ever subject to an HMRC audit. Digital record-keeping is increasingly encouraged.

Clarifications on the Definition of a "Side Hustle"

HMRC has provided more detailed guidance on what constitutes a "side hustle." This helps clarify the lines between casual income, a supplementary business, and full-time employment for tax purposes.

- Supplementary Income: Side hustles are typically viewed as supplementary income streams, distinct from your primary employment.

- Different Types of Side Hustles: The rules may vary depending on the nature of your side hustle. For example, the tax implications of freelancing differ from renting out property or driving for a ride-sharing service.

- Regularity and Scale: The frequency and scale of your side hustle activity are factors HMRC considers. A casual, infrequent activity might be treated differently from a significant and regularly occurring income stream.

New HMRC Enforcement Measures for Side Hustle Tax

HMRC is actively working to improve its ability to detect unreported side hustle income, resulting in enhanced enforcement measures.

Strengthened Data Sharing and Information Gathering

HMRC is leveraging technology and data sharing agreements to improve its ability to identify unreported income. This involves collaborations with banks and online platforms.

- Bank Statement Analysis: HMRC can access and analyze bank statements to identify income discrepancies.

- Online Marketplace Data: Data from online marketplaces, such as Etsy or freelance platforms, is being used to verify income declarations.

- Third-Party Reporting: HMRC is receiving more information from third parties regarding payments made to individuals.

Increased Penalties and Investigations for Non-Compliance

The penalties for failing to accurately report side hustle income are becoming increasingly severe.

- Late Filing Penalties: Significant penalties are levied for late submission of tax returns.

- Accuracy Penalties: Penalties apply if your tax return contains inaccuracies.

- Criminal Prosecution: In cases of serious tax evasion, criminal prosecution is a possibility.

Proactive Audits and Targeted Investigations of Side Hustles

HMRC is conducting more proactive audits and targeted investigations focusing on side hustles.

- Red Flags: Factors that might trigger an HMRC investigation include large discrepancies between reported income and lifestyle, inconsistencies in financial records, and frequent payments from multiple sources.

- Audit Process: Be prepared to provide comprehensive documentation to support your income and expense claims during an audit.

Conclusion: Understanding and Complying with HMRC's Side Hustle Tax Changes

The HMRC's changes to side hustle tax are significant. Understanding and complying with these changes is crucial to avoid penalties and maintain a positive relationship with HMRC. Accurate reporting and meticulous record-keeping are paramount. If you're unsure about your obligations, seek professional tax advice. Don't risk penalties – understand your side hustle tax obligations. Ensure you are compliant with HMRC's changes to side hustle tax. Learn more about HMRC’s updated side hustle tax rules by consulting the links provided or seeking professional guidance. Staying informed and proactive is the best way to navigate the new landscape of side hustle taxation in the UK.

(Example - replace with a relevant link)

Featured Posts

-

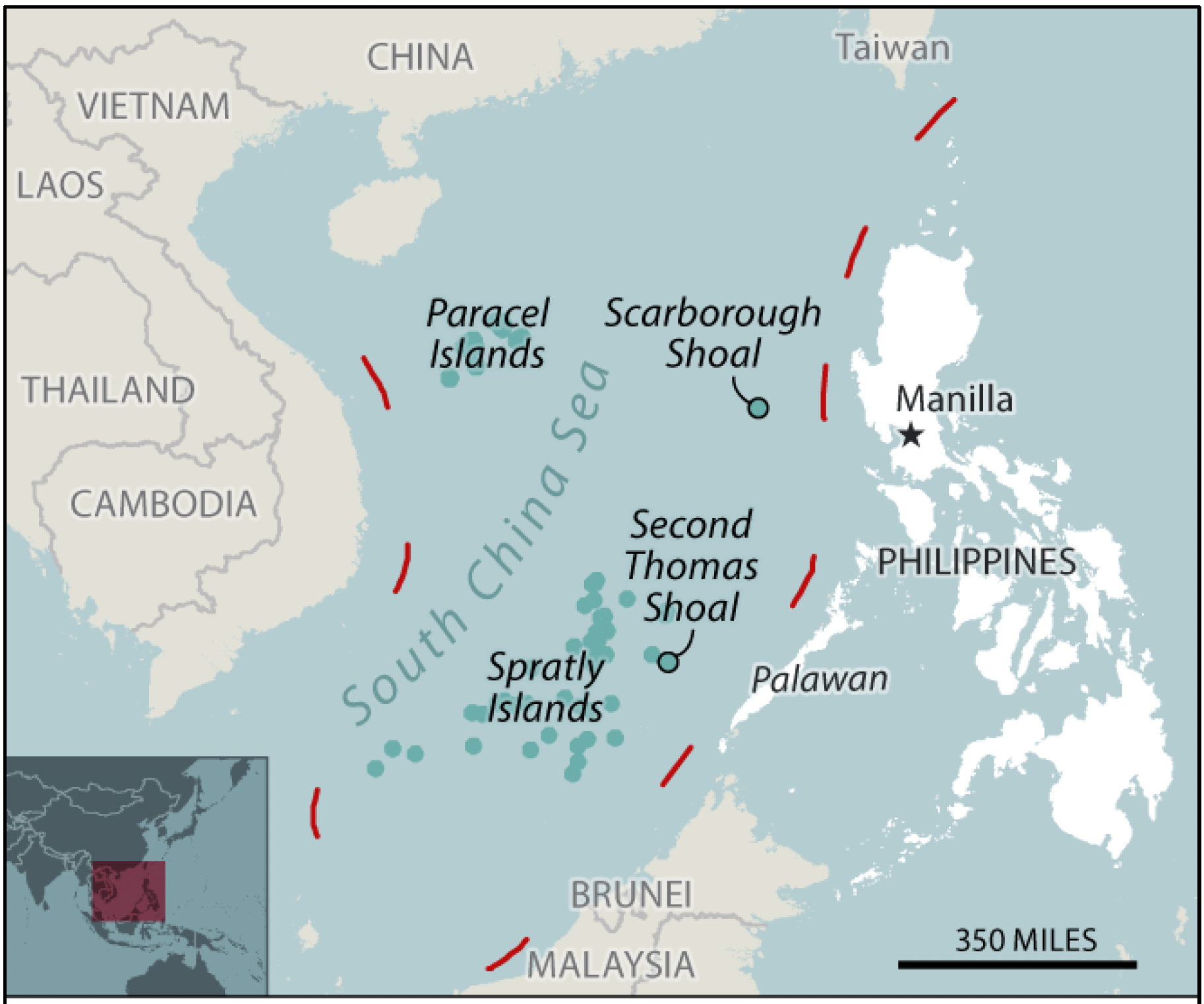

South China Sea Tensions Rise China Pressures Philippines On Missile Deployment

May 20, 2025

South China Sea Tensions Rise China Pressures Philippines On Missile Deployment

May 20, 2025 -

Hmrc Child Benefit Warning Messages You Shouldnt Ignore

May 20, 2025

Hmrc Child Benefit Warning Messages You Shouldnt Ignore

May 20, 2025 -

March 8 Nyt Mini Crossword Answers Solve The Puzzle Today

May 20, 2025

March 8 Nyt Mini Crossword Answers Solve The Puzzle Today

May 20, 2025 -

Todays Nyt Mini Crossword Answers April 25th Solutions

May 20, 2025

Todays Nyt Mini Crossword Answers April 25th Solutions

May 20, 2025 -

Conseil Municipal De Biarritz Debat Sur Les Logements Saisonniers Et Le Budget

May 20, 2025

Conseil Municipal De Biarritz Debat Sur Les Logements Saisonniers Et Le Budget

May 20, 2025

Latest Posts

-

Atkinsrealis Droit Inc Avocats Experimentes En Droit Commercial

May 20, 2025

Atkinsrealis Droit Inc Avocats Experimentes En Droit Commercial

May 20, 2025 -

Situation Critique A La Gaite Lyrique Les Employes Quittent Les Lieux Et Demandent L Intervention De La Mairie

May 20, 2025

Situation Critique A La Gaite Lyrique Les Employes Quittent Les Lieux Et Demandent L Intervention De La Mairie

May 20, 2025 -

Services Juridiques Atkinsrealis Droit Inc Droit Commercial Et Plus

May 20, 2025

Services Juridiques Atkinsrealis Droit Inc Droit Commercial Et Plus

May 20, 2025 -

Gaite Lyrique La Securite Du Site Remise En Question Apres Depart Des Employes

May 20, 2025

Gaite Lyrique La Securite Du Site Remise En Question Apres Depart Des Employes

May 20, 2025 -

Atkinsrealis Droit Inc Solutions Juridiques Efficaces Et Personnalisees

May 20, 2025

Atkinsrealis Droit Inc Solutions Juridiques Efficaces Et Personnalisees

May 20, 2025