Understanding The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the price per share if the ETF were to be liquidated. For the Amundi MSCI All Country World UCITS ETF USD Acc, which tracks the MSCI All Country World Index, this means the NAV reflects the collective value of its underlying global holdings.

NAV Calculation Process: A Step-by-Step Guide

Calculating the NAV involves several key steps:

- Market Value of Holdings: The ETF's holdings (stocks, bonds, etc.) are valued at their current market prices. This is a critical step, as market fluctuations directly impact the NAV.

- Accrued Income: Any dividends received from underlying holdings or interest earned on bonds are added to the total asset value.

- Expenses Deduction: Management fees, operational expenses, and other costs are subtracted from the total asset value.

- Division by Outstanding Shares: The resulting net asset value is divided by the total number of outstanding ETF shares to arrive at the NAV per share.

Factors Affecting NAV Fluctuations

Several factors contribute to the daily fluctuations in the Amundi MSCI All Country World UCITS ETF USD Acc's NAV:

- Market Movements: Changes in the prices of the underlying assets (stocks, bonds) directly impact the NAV. A rising market generally leads to a higher NAV, and vice versa.

- Currency Exchange Rates: As the ETF invests globally, fluctuations in exchange rates between currencies (e.g., USD, EUR, JPY) affect the value of the holdings and consequently the NAV.

- Dividend Distributions: When underlying holdings pay dividends, the NAV will adjust accordingly, initially increasing before the dividend is distributed.

NAV vs. Market Price: Understanding the Difference

While closely related, the NAV and the market price of an ETF can differ slightly. The market price reflects the price at which the ETF is currently trading on the exchange, influenced by supply and demand. Slight discrepancies can arise due to trading volume, market sentiment, and timing differences in price updates.

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV

The Amundi MSCI All Country World UCITS ETF USD Acc aims to track the MSCI All Country World Index, providing investors with broad global market exposure. This means its NAV reflects the performance of a diversified portfolio of companies across developed and emerging markets.

Locating the Daily NAV

You can find the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc on several platforms:

- Amundi Website: Check the official Amundi website for the latest NAV data.

- Financial News Sources: Reputable financial news websites and portals usually provide ETF NAV information.

- Brokerage Platforms: Your brokerage account will display the current NAV alongside other relevant information.

Interpreting the NAV and Investment Decisions

The NAV allows you to track your investment's performance. For example, a rising NAV suggests positive performance, while a falling NAV indicates a decline. However, remember that short-term fluctuations are normal. It's crucial to consider the long-term investment horizon and avoid making hasty decisions based solely on short-term NAV changes.

Impact of Currency Fluctuations on NAV

For investors holding the Amundi MSCI All Country World UCITS ETF USD Acc in a currency other than USD, fluctuations in exchange rates will directly impact the NAV in their local currency. A strengthening USD against their local currency will result in a lower NAV in local currency terms, and vice versa.

NAV and Investment Strategies

Understanding the NAV is critical for developing sound investment strategies.

Using NAV for Buy/Sell Decisions

While the NAV shouldn't be the sole factor dictating buy/sell decisions, it provides valuable context. Consider the long-term investment goals and avoid trying to "time the market" based on short-term NAV movements. A disciplined investment strategy that aligns with your risk tolerance and financial objectives is crucial.

NAV and Performance Evaluation

The NAV is the primary metric to track the ETF's performance over time. By comparing the NAV at different points, you can assess the growth or decline of your investment.

Comparing NAV to Other ETFs

Comparing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc to similar ETFs (e.g., other global market ETFs) helps assess relative performance. However, it's important to consider the expense ratios and other factors beyond just the NAV.

Conclusion: Mastering the Net Asset Value of Your Amundi MSCI All Country World UCITS ETF USD Acc Investment

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for effective investment management. This article has explained the meaning of NAV, its calculation, the factors influencing it, and how it can be used to monitor performance and inform investment decisions. Regularly monitoring your Amundi MSCI All Country World UCITS ETF USD Acc's NAV, coupled with a long-term perspective, will help you make informed decisions about your investment. Remember that consulting with a financial advisor can provide personalized guidance for your investment strategy. For more information on the Amundi MSCI All Country World UCITS ETF USD Acc and its performance, visit the [Amundi Website Link] and your brokerage platform.

Featured Posts

-

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 24, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 24, 2025 -

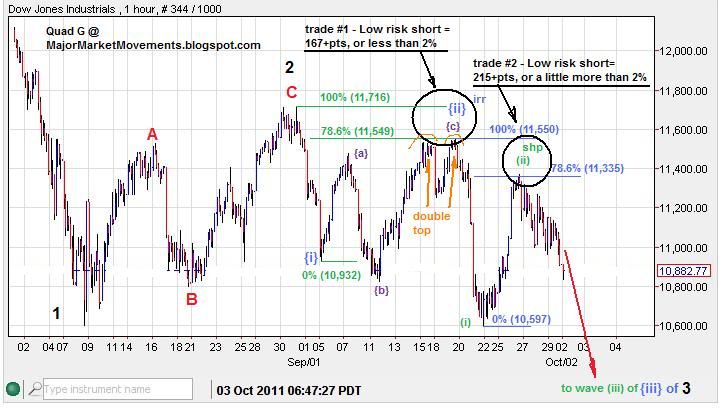

Stock Market Analysis Bonds Dow Bitcoin Latest Market Movements

May 24, 2025

Stock Market Analysis Bonds Dow Bitcoin Latest Market Movements

May 24, 2025 -

Global Healthcare Transformation The Philips Future Health Index 2025 Report On Ai

May 24, 2025

Global Healthcare Transformation The Philips Future Health Index 2025 Report On Ai

May 24, 2025 -

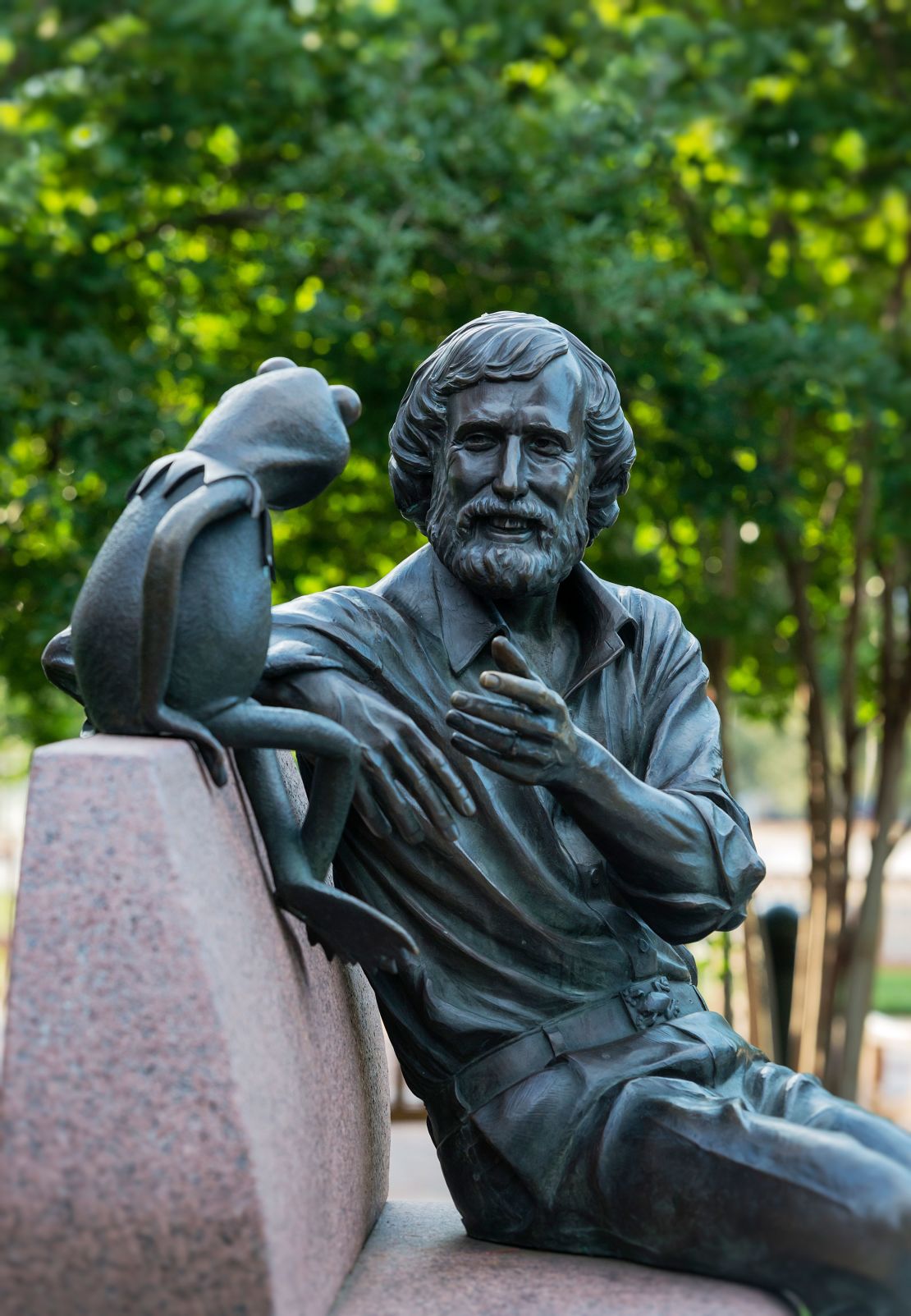

2025 Commencement Kermit The Frog Addresses University Of Maryland Graduates

May 24, 2025

2025 Commencement Kermit The Frog Addresses University Of Maryland Graduates

May 24, 2025 -

Tik Tok Sensation Childhood Memories Of Pope Leo Resurface

May 24, 2025

Tik Tok Sensation Childhood Memories Of Pope Leo Resurface

May 24, 2025