Universal Credit Changes: What Claimants Need To Know

Table of Contents

Navigating the complexities of Universal Credit can be challenging, especially with ongoing changes. This comprehensive guide outlines the latest Universal Credit changes claimants need to know to ensure they receive the correct benefits and avoid potential issues. We'll break down key updates affecting eligibility, payment amounts, and the application process itself.

Key Changes to Universal Credit Payment Amounts and Eligibility

Increased Work Allowances

Recent increases in Universal Credit work allowances significantly affect claimants' take-home pay. These changes aim to incentivize work and reduce in-work poverty. The increased allowance means claimants can earn more before their benefits are reduced.

- Examples: A single adult claimant might see their work allowance increase by £100 per month, allowing them to keep more of their earnings. A couple with children may see an even larger increase, depending on their circumstances. These Universal Credit work allowance increases vary depending on household composition.

- Impact: This Universal Credit increase directly impacts in-work poverty, helping families keep more of their income when working. Increased in-work benefits can make a considerable difference to household budgets.

Changes to the Taper Rate

Adjustments to the Universal Credit taper rate influence how much benefit claimants retain when working. The taper rate determines the amount of benefits reduced for each pound earned. A lower taper rate means claimants keep a larger portion of their earnings.

- Explanation: The taper rate is the percentage of your earnings deducted from your Universal Credit payment. For example, a taper rate of 55% means for every £1 earned, 55p is deducted from your benefit.

- Impact on Income: Changes to the taper rate directly influence a claimant's disposable income. A lower taper rate provides a stronger incentive to work, as claimants retain a larger share of their earnings. Understanding the Universal Credit taper rate is key to budgeting effectively. This is closely linked to the Universal Credit income threshold.

- Benefit Cap: It's important to remember the benefit cap still applies, limiting the total amount of benefits a household can receive.

Updated Eligibility Criteria

Alterations in the qualifying criteria for Universal Credit eligibility impact who can claim. These changes may involve adjustments to age limits, residency requirements, or specific circumstances affecting eligibility.

- Changes: Recent updates might involve stricter residency requirements or changes to the assessment of disability and health conditions. Always check the latest government guidelines for detailed information on Universal Credit eligibility.

- Impact on Application: Understanding these updated Universal Credit eligibility criteria is essential before applying for Universal Credit. Carefully review the requirements to ensure you meet the necessary conditions to claim Universal Credit.

Impact of Universal Credit Changes on Different Claimant Groups

Single Parents

Universal Credit changes significantly impact single parents. The increase in work allowances and adjustments to the taper rate can provide substantial support. However, childcare costs remain a significant barrier for many.

- Childcare Costs: Support with childcare costs is crucial for single parents. Understanding the available help is vital for managing finances.

- Challenges: Balancing work and childcare responsibilities, while navigating the complexities of Universal Credit, poses unique challenges for single parents. Universal Credit single parents often require additional assistance.

- Support: The government provides various forms of Universal Credit families support, and understanding which applies to you is key.

Disabled Claimants

Universal Credit changes have specific implications for claimants with disabilities. Accessing additional benefits and navigating the work capability assessment requires careful planning.

- Support: Disabled claimants may be eligible for additional support under the Universal Credit disability system, alongside their standard payment. It is essential to seek professional advice.

- Work Capability Assessment: The work capability assessment (WCA) process may influence eligibility for certain benefits linked to Universal Credit health conditions.

- Accessing Benefits: Claimants should ensure they're accessing all available disability benefits and understand how these interact with their Universal Credit payment.

Older Claimants

Approaching retirement age adds another layer of complexity for claimants. Understanding the interaction between Universal Credit and the state pension is essential.

- Pension Implications: The transition from Universal Credit to the state pension requires careful planning, understanding the timing of payments and potential overlaps.

- Accessing Benefits: Older claimants should ensure they are aware of all available benefits to assist them during this transition period. Universal Credit pensioners may also be eligible for other government assistance.

- Retirement Planning: Effective financial planning is critical for Universal Credit retirement to ensure a comfortable transition.

Navigating the Universal Credit Application and Management Process

Online Application Process

The online application for Universal Credit is generally straightforward. However, understanding the process and required documents is vital.

- Step-by-Step: The Universal Credit online application process is accessible through the government website, with clear step-by-step instructions.

- Required Documents: Gather all necessary documentation (proof of ID, income, and housing) before starting the application.

- Common Errors: Avoid common mistakes by carefully reviewing your application before submission. This reduces delays in receiving your payment.

Reporting Changes in Circumstances

Promptly reporting any changes in circumstances is crucial to maintain accurate benefit entitlement.

- Changes to Report: Any changes (address, employment status, income, household composition) must be reported immediately using the Universal Credit portal. Failing to report a change can lead to sanctions.

- Methods of Reporting: Several options exist for Universal Credit reporting, including online updates via the portal and contacting your work coach.

- Penalties: Delays or failure to report changes accurately can result in Universal Credit sanctions, impacting your payments.

Accessing Support and Assistance

Various resources provide support and guidance to claimants.

- Jobcentres: Jobcentres offer valuable assistance with navigating the application and managing your claim.

- Citizens Advice: Citizens Advice Bureaux provide free and impartial advice on benefits and other related matters.

- Online Help: Numerous online resources offer guidance and support for understanding your Universal Credit entitlements. These are invaluable sources of Universal Credit help and Universal Credit advice.

Conclusion

This guide has outlined key changes to Universal Credit, covering updated payment amounts, eligibility criteria, and the application process. Understanding these changes is crucial for claimants to maximize their benefits and avoid potential complications. Staying informed about Universal Credit is essential for navigating the system effectively.

Call to Action: Stay informed about future Universal Credit changes by regularly checking official government websites and seeking advice from relevant support organizations. Don't hesitate to contact a benefits advisor if you have specific questions about your Universal Credit claim. Understanding your Universal Credit entitlements is vital.

Featured Posts

-

Stream Andor Season 1 Episodes Before Season 2

May 08, 2025

Stream Andor Season 1 Episodes Before Season 2

May 08, 2025 -

Stephen Kings The Long Walk First Look At The Movie Trailer

May 08, 2025

Stephen Kings The Long Walk First Look At The Movie Trailer

May 08, 2025 -

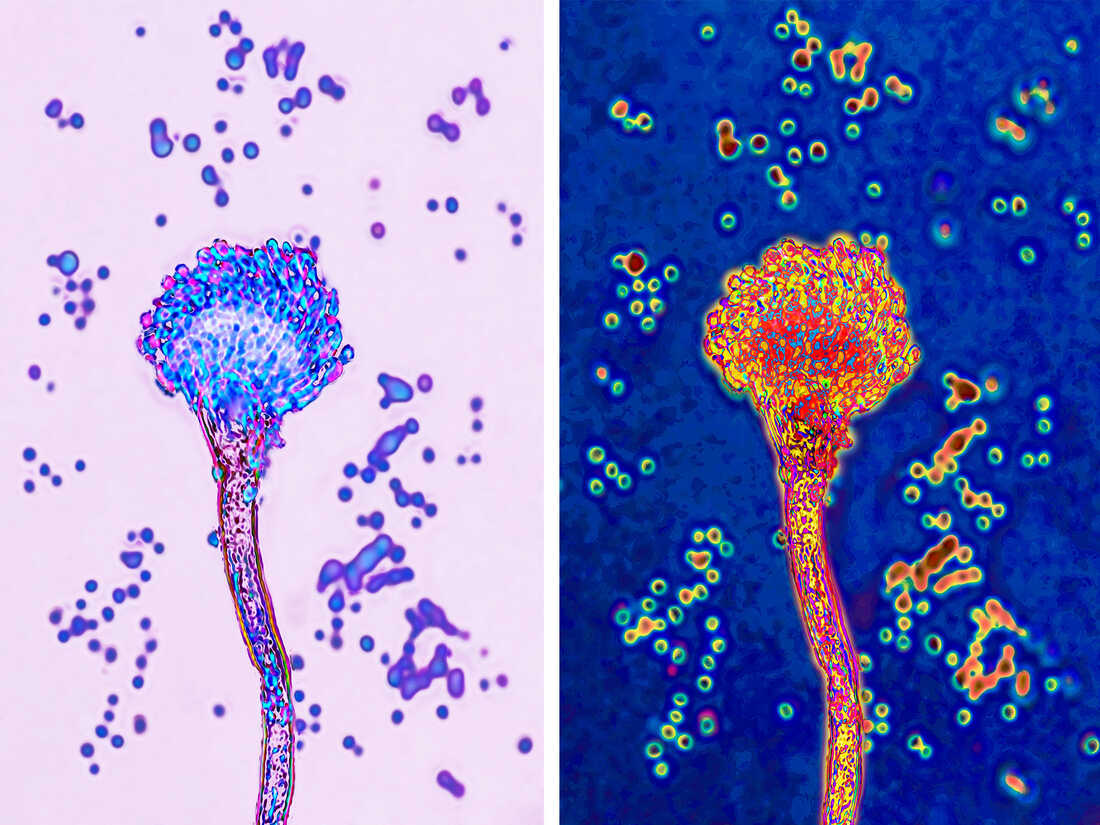

Are Deadly Fungi Fueling The Next Public Health Emergency

May 08, 2025

Are Deadly Fungi Fueling The Next Public Health Emergency

May 08, 2025 -

Repetitive Scatological Documents Ais Role In Creating A Poop Podcast

May 08, 2025

Repetitive Scatological Documents Ais Role In Creating A Poop Podcast

May 08, 2025 -

Etf

May 08, 2025

Etf

May 08, 2025