US$9 Billion Parkland Acquisition Headed For June Shareholder Vote

Table of Contents

Details of the Parkland Acquisition

The acquiring company, [Acquiring Company Name], a leading player in [Acquiring Company Industry], is seeking to bolster its market share and expand its operations through this strategic acquisition. [Acquiring Company Name]’s primary business focuses on [brief description of acquiring company's business]. Their strong financial position and established market presence make this ambitious US$9 billion deal a realistic undertaking.

Parkland, the target company, is a significant player in the [Parkland Industry] sector, known for its extensive network of [Parkland's key assets, e.g., retail locations, distribution centers, etc.]. This acquisition aims to leverage the synergies between the two companies, creating a more robust and geographically diverse entity. The rationale behind the acquisition includes:

- Market Expansion: Gaining access to Parkland's established market share in [Geographic Regions].

- Synergies: Combining operational efficiencies and streamlining processes to reduce costs and improve profitability.

- Enhanced Product Portfolio: Expanding the product offerings available to customers of both companies.

Key financial aspects of the US$9 billion Parkland acquisition include:

- Acquisition Price: US$9 billion

- Payment Method: [Specify payment method, e.g., a combination of cash and stock]

- Expected Closing Date: June [Year]

- Potential Shareholder Benefits: [Describe potential benefits, e.g., increased dividend payouts, higher share prices].

Shareholder Vote and its Implications

The June shareholder vote will determine the fate of this US$9 billion Parkland acquisition. Shareholders of both [Acquiring Company Name] and Parkland will need to approve the merger for it to proceed. The vote will follow a formal process outlined in [relevant legal documents/regulatory filings].

Potential outcomes include:

- Approval: The acquisition proceeds, creating a combined entity.

- Rejection: The acquisition is terminated, and both companies continue operating independently.

The impact of the acquisition will be far-reaching:

- Parkland's Employees: Potential job losses, relocations, or integration into the acquiring company's structure.

- Parkland's Customers: Changes in service offerings, pricing, and overall customer experience.

- Competitive Landscape: The merger could significantly alter the competitive landscape of the [Industry Name] industry, potentially leading to increased consolidation.

- Share Prices: Pre-acquisition share prices of both companies will likely fluctuate based on market sentiment. Post-acquisition, the combined entity's share price will depend on the successful integration and overall performance.

Arguments for and against the acquisition:

- For: Increased market share, enhanced profitability, diversification of operations.

- Against: Potential job losses, integration challenges, regulatory hurdles.

Market Reaction and Analyst Opinions

The announcement of the US$9 billion Parkland acquisition has been met with [describe market reaction, e.g., a mix of optimism and caution]. [Stock Ticker Symbol for Acquiring Company] and [Stock Ticker Symbol for Parkland] have seen [describe stock price fluctuations].

Financial analysts offer differing opinions:

- "[Quote from Analyst 1 regarding their prediction for the success of the acquisition]"

- "[Quote from Analyst 2 highlighting potential risks and challenges]"

Potential risks and challenges include:

- Regulatory Hurdles: Antitrust reviews and other regulatory approvals could delay or even block the acquisition.

- Integration Difficulties: Merging two distinct corporate cultures and operational structures can be complex and time-consuming.

Regulatory Scrutiny and Antitrust Concerns

The US$9 billion Parkland acquisition will likely face significant regulatory scrutiny, particularly regarding antitrust concerns. [Mention relevant regulatory bodies]. [Details on specific antitrust concerns and potential investigations]. Any delays or negative rulings from regulatory bodies could significantly impact the deal's timeline and ultimate success.

Conclusion

The US$9 billion Parkland acquisition represents a landmark deal with the potential to reshape the [Industry Name] industry. The June shareholder vote is pivotal, with significant implications for employees, customers, and the competitive landscape. Understanding the potential benefits and risks is crucial for stakeholders. The successful integration of Parkland into [Acquiring Company Name] will depend on careful planning and execution.

Stay tuned for updates on the outcome of this monumental US$9 billion Parkland acquisition and the June shareholder vote. Follow our site for continued coverage of this significant merger, including analysis of the shareholder vote results and the long-term impact of this Parkland deal. We will provide ongoing updates on the acquisition, covering all aspects of this significant merger outcome.

Featured Posts

-

The Karate Kid Part Ii Exploring The Cultural Clash And Personal Growth

May 07, 2025

The Karate Kid Part Ii Exploring The Cultural Clash And Personal Growth

May 07, 2025 -

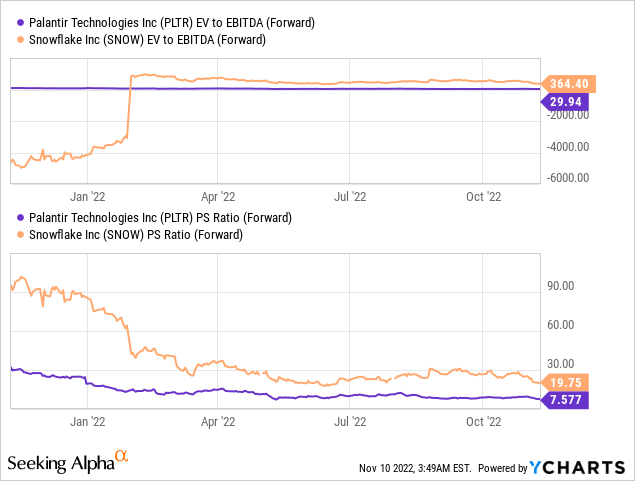

Is Palantirs High Stock Price Justified Analyzing Past Performance

May 07, 2025

Is Palantirs High Stock Price Justified Analyzing Past Performance

May 07, 2025 -

Jacek Harlukowicz I Jego Najwiekszy Sukces Wydawniczy Na Onecie W 2024

May 07, 2025

Jacek Harlukowicz I Jego Najwiekszy Sukces Wydawniczy Na Onecie W 2024

May 07, 2025 -

Draymond Green On Le Bron James Matchup With Julius Randle A Defensive Breakdown

May 07, 2025

Draymond Green On Le Bron James Matchup With Julius Randle A Defensive Breakdown

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special A Look At The Biggest Wins And Losses

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special A Look At The Biggest Wins And Losses

May 07, 2025