US-China Trade War: 80% Tariff Proposal Shakes Stock Market

Table of Contents

The proposed 80% tariff increase on Chinese goods sent shockwaves through the global financial markets, triggering a period of intense uncertainty and volatility. This dramatic escalation in the US-China trade war has profound implications for investors and the global economy. This article examines the impact of this proposed tariff increase on the US-China trade war, focusing on its immediate and long-term consequences for the stock market, encompassing market reactions, industry-specific impacts, and potential economic repercussions. We'll explore how this development affects everything from stock market volatility to international trade and investment strategies.

2. Main Points:

H2: Immediate Market Reactions to the 80% Tariff Proposal

The announcement of the potential 80% tariff hike was met with immediate and significant market reactions.

H3: Stock Market Plunge: Major indices experienced sharp declines. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all saw percentage drops (specific figures would be inserted here based on real-time data if this were a live article). This downturn reflected widespread investor concern about the potential negative impact on corporate earnings and economic growth.

- Technology stocks, heavily reliant on Chinese supply chains, suffered disproportionately large losses. Examples include (insert examples of affected tech companies here).

- Retail stocks also took a hit as the tariffs threatened to increase prices for consumer goods imported from China.

- Increased market volatility and investor uncertainty were evident in the increased trading volume and wider price swings.

H3: Safe-Haven Assets Surge: As investors sought to protect their portfolios from the market turmoil, there was a significant flight to safety.

- Gold prices surged as investors viewed the precious metal as a hedge against economic uncertainty. (Insert data on gold price increases here).

- Demand for US Treasury bonds also increased, reflecting a preference for low-risk, government-backed securities. (Insert data on bond yield changes here).

- These safe-haven assets generally appreciate during times of economic uncertainty and geopolitical risk.

H3: Currency Fluctuations: The proposed tariffs also impacted currency markets.

- The US dollar initially strengthened against the Chinese yuan, reflecting investor confidence in the US economy despite the trade tensions. (Insert data on USD/CNY exchange rate changes here).

- However, prolonged uncertainty could lead to currency instability, impacting international trade flows and competitiveness.

- Fluctuations in exchange rates add another layer of complexity to the already challenging investment landscape.

H2: Sector-Specific Impacts of the Proposed Tariffs

The proposed 80% tariffs would have significantly varied impacts across different economic sectors.

H3: Technology Sector Vulnerability: The technology sector would likely experience the most substantial impact.

- Many tech companies rely on Chinese manufacturing for components and finished goods. The tariffs would increase their production costs, squeezing profit margins. (Insert examples of affected tech companies here).

- Supply chain disruptions are highly probable, leading to potential delays in product launches and decreased production.

- This could further exacerbate the already challenging global chip shortage.

H3: Retail and Consumer Goods: Consumers would face higher prices for imported goods.

- Increased costs due to tariffs would likely lead to inflation, potentially dampening consumer spending.

- Retailers would struggle to maintain profit margins, potentially resulting in reduced sales and layoffs.

- This could lead to a decrease in overall consumer confidence and economic activity.

H3: Agricultural Sector Concerns: The agricultural sector could also face significant challenges.

- China is a major importer of US agricultural products like soybeans and corn. Retaliatory tariffs from China could significantly harm US agricultural exports.

- Farmers might experience reduced income and increased financial stress.

- This could have ripple effects throughout the US agricultural economy.

H2: Long-Term Economic Implications of the US-China Trade War

The protracted US-China trade war, exacerbated by the proposed 80% tariffs, poses severe long-term risks.

H3: Global Economic Slowdown: The trade conflict has the potential to trigger a global economic slowdown.

- Reduced trade between the two largest economies in the world will undoubtedly disrupt global supply chains and reduce overall economic activity.

- This would negatively impact global growth, particularly in countries heavily reliant on trade with either the US or China.

- The uncertainty surrounding the trade war also inhibits investment and economic planning, exacerbating the negative impact.

H3: Geopolitical Tensions: The trade war has significantly intensified geopolitical tensions between the US and China.

- This heightened rivalry extends beyond economics, potentially impacting international relations and global cooperation on other crucial issues.

- The risk of further escalation, including potential conflicts in other areas, adds to global uncertainty.

- This political instability adds another layer of risk to global markets and investment decisions.

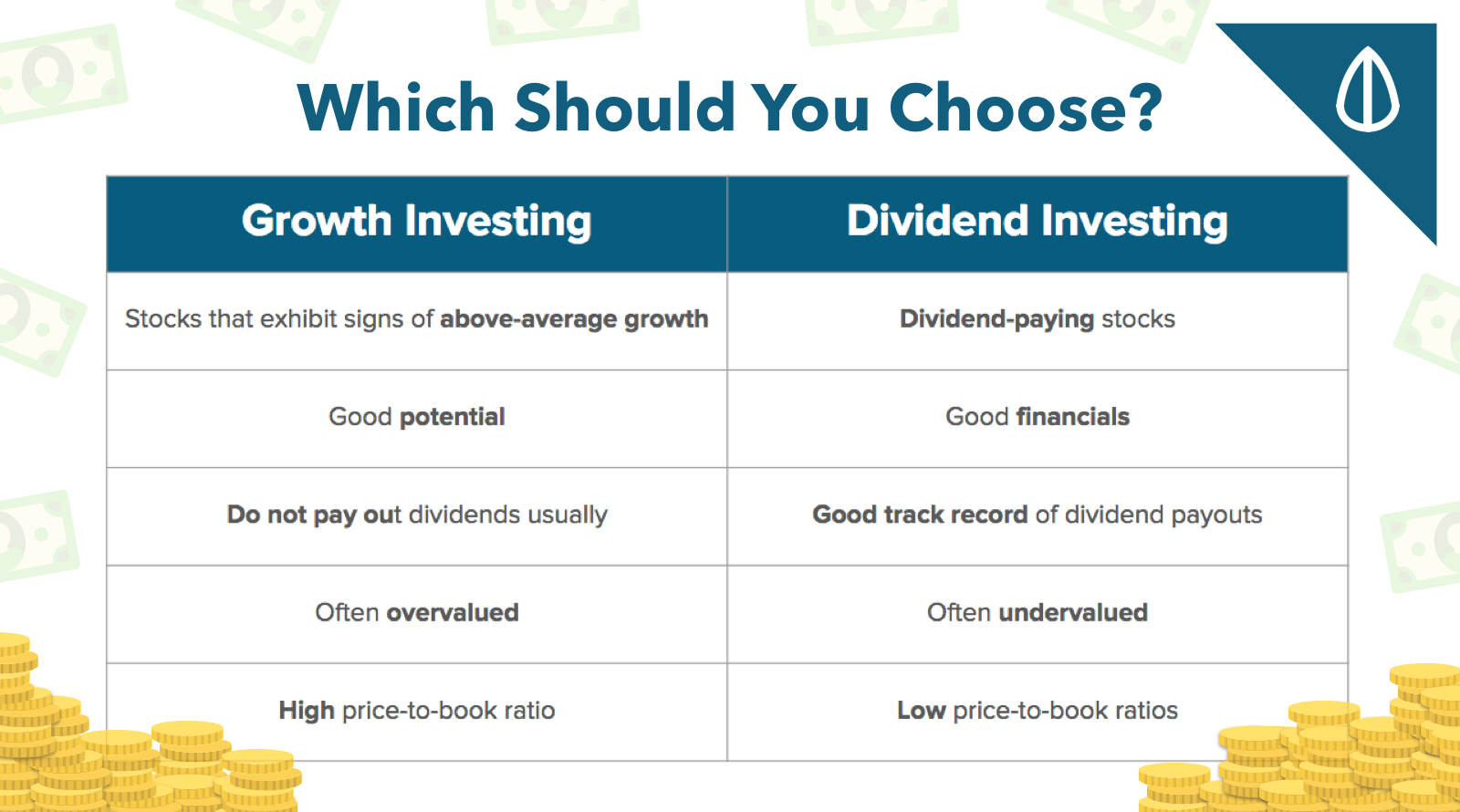

H3: Investment Strategies in a Volatile Market: The current environment demands a cautious and adaptive approach to investment.

- Diversification of investment portfolios is crucial to mitigate risk in this volatile market.

- Careful risk management strategies are essential to protect against potential market downturns.

- Seeking professional financial advice is strongly recommended to navigate the complexities of the US-China trade war and its impact on investments.

3. Conclusion: Navigating the Uncertainties of the US-China Trade War

The proposed 80% tariffs highlight the significant and far-reaching consequences of the ongoing US-China trade war. The resulting stock market volatility, sector-specific impacts, and potential for a global economic slowdown underscore the need for careful monitoring and proactive risk management. Understanding the impact of tariffs on various industries and the broader economy is critical. To effectively manage your investments during the US-China trade war, stay informed about the latest developments and seek professional financial advice. Monitor the US-China trade war closely and make informed decisions to protect your financial future.

Featured Posts

-

Thomas Mueller 25 Ans Au Bayern Puis Le Depart

May 11, 2025

Thomas Mueller 25 Ans Au Bayern Puis Le Depart

May 11, 2025 -

Nba Playoffs 2024 Pinakas Agonon And Imerominies

May 11, 2025

Nba Playoffs 2024 Pinakas Agonon And Imerominies

May 11, 2025 -

Ftc Appeals Activision Blizzard Deal Ruling Microsoft Merger Uncertain

May 11, 2025

Ftc Appeals Activision Blizzard Deal Ruling Microsoft Merger Uncertain

May 11, 2025 -

Lily Collins In Calvin Klein New Campaign Photos

May 11, 2025

Lily Collins In Calvin Klein New Campaign Photos

May 11, 2025 -

A Simple Highly Profitable Dividend Investing Strategy

May 11, 2025

A Simple Highly Profitable Dividend Investing Strategy

May 11, 2025