US Dollar Rises As Trump's Criticism Of Fed Chair Powell Subsides

Table of Contents

Trump's Past Criticism and its Market Impact

President Trump's previous criticisms of Jerome Powell and the Federal Reserve's monetary policy were frequent and often highly publicized. He repeatedly voiced his disapproval of interest rate hikes, viewing them as detrimental to economic growth and his reelection chances. This consistent public pressure created significant uncertainty within the financial markets.

The consequences of this criticism were substantial:

- Increased uncertainty for investors: The unpredictable nature of the President's pronouncements made it difficult for investors to gauge the future direction of monetary policy, leading to hesitation and reduced investment.

- Decreased confidence in the US economy: Trump's attacks on the Fed undermined confidence in the institution's independence and its ability to manage the economy effectively, negatively impacting the overall perception of US economic stability.

- Potential for inflationary pressures: While not directly caused by Trump's actions, the uncertainty fueled by his criticism could have inadvertently contributed to inflationary pressures by impacting investor behavior and market confidence.

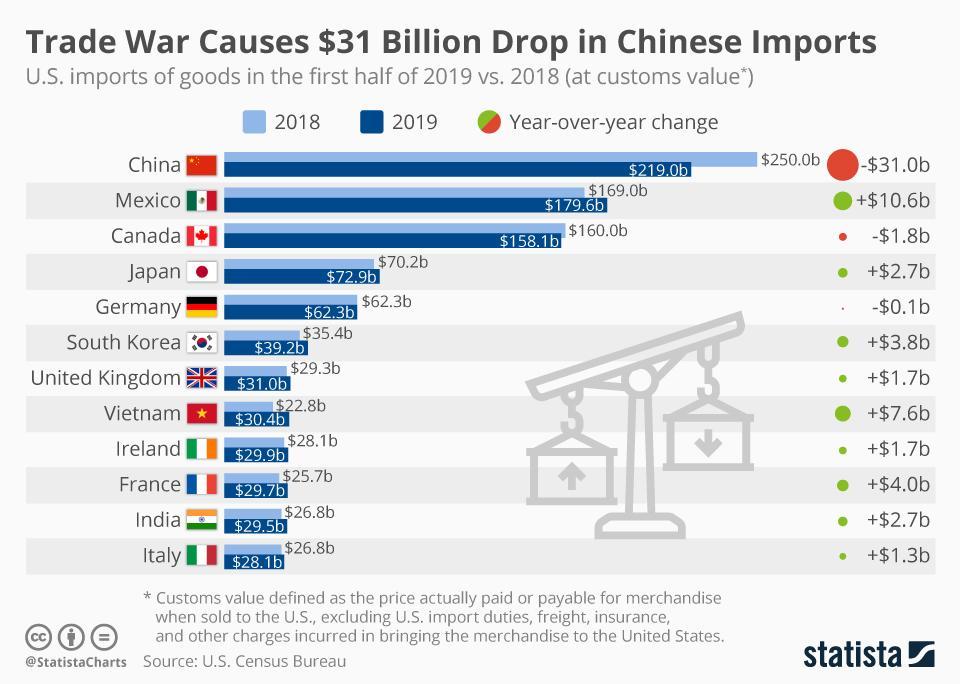

- Weakening of the US dollar against other major currencies: The uncertainty and decreased confidence directly translated into a weaker US dollar relative to other major currencies like the Euro and the Yen. This made imports more expensive and exports cheaper, impacting the US trade balance.

The Recent Shift in Tone and its Implications

In a notable shift, President Trump's public statements regarding Powell and the Fed have become noticeably less critical in recent weeks. While the exact reasons for this change are multifaceted, several factors are likely at play, including the upcoming election and positive shifts in key economic indicators.

This change in tone has had a palpable impact:

- Reduced uncertainty in the market: The absence of constant, negative pronouncements has calmed investor nerves, allowing for a more stable and predictable market environment.

- Increased investor confidence in the US economy: The perceived improvement in the relationship between the President and the Fed has boosted confidence in the overall health and stability of the US economy.

- Positive impact on US dollar exchange rates: The restored confidence has resulted in a surge in demand for the US dollar, leading to its appreciation against other major currencies.

- Potential for stable interest rates: A more cooperative relationship between the President and the Fed could contribute to greater stability in interest rate policy, fostering a more predictable environment for businesses and consumers.

Economic Factors Contributing to the US Dollar's Rise

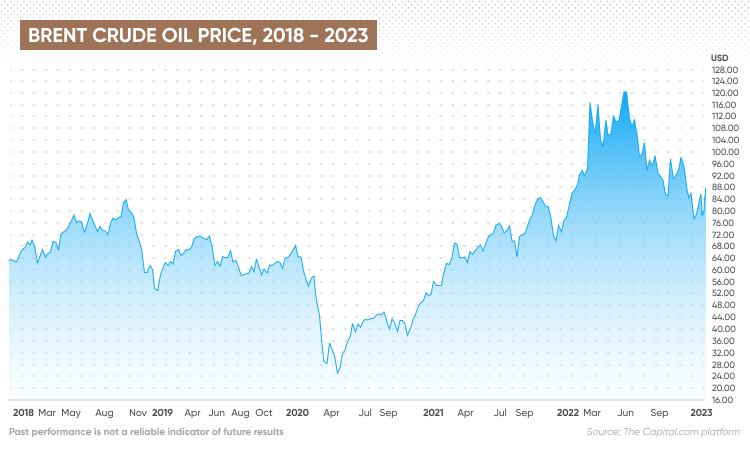

While the easing of Trump-Powell tensions is a significant factor, other economic variables have also contributed to the US dollar's recent strength. These include:

- Stronger-than-expected US economic data: Positive economic indicators such as robust job growth and rising consumer confidence have bolstered the US dollar's appeal.

- Global economic slowdown driving safe-haven flows into the dollar: Amidst global economic uncertainty, investors often flock to the US dollar as a safe-haven asset, further increasing its demand.

- Relative strength of the US economy compared to other major economies: The relatively stronger performance of the US economy compared to its counterparts in Europe and Asia has made the US dollar a more attractive investment.

Analyzing the Future Trajectory of the US Dollar

Predicting the future performance of the US dollar is always challenging, given the complex interplay of economic and political factors. However, several key developments could influence its future trajectory:

- Potential impact of upcoming elections: The outcome of the upcoming election could significantly impact investor sentiment and, consequently, the value of the US dollar.

- Influence of global trade negotiations: The ongoing trade disputes and negotiations could create further uncertainty, affecting investor confidence and the US dollar's value.

- Impact of future Fed policy decisions: The future course of the Fed's monetary policy will remain a key driver of the US dollar's performance.

- Predictions for US Dollar value against other major currencies (Euro, Yen, Pound): Experts offer varying predictions, but many suggest continued strength against certain currencies, although the level of appreciation remains uncertain.

Conclusion

The recent strengthening of the US dollar is a multifaceted event, driven largely by the easing of tensions between President Trump and Federal Reserve Chair Jerome Powell. This improved relationship has boosted investor confidence and reduced market uncertainty, contributing to the dollar's appreciation. However, other economic factors, such as robust US economic data and global uncertainty, have also played a significant role. While the future trajectory of the US dollar remains uncertain, understanding the interplay between political dynamics and economic indicators is vital for navigating the currency markets. Stay informed about the ever-changing dynamics affecting the US dollar. Follow our blog for further analysis and insights on the US dollar, Trump's influence on the Fed, and currency market trends. Understanding these relationships is crucial for making informed financial decisions in this volatile market. Keep up-to-date on US Dollar fluctuations and the impact of political developments.

Featured Posts

-

Us Tariff Impact On Chinas Lpg The Rise Of Middle Eastern Suppliers

Apr 24, 2025

Us Tariff Impact On Chinas Lpg The Rise Of Middle Eastern Suppliers

Apr 24, 2025 -

Oil Prices Today April 23rd Market Update And Analysis

Apr 24, 2025

Oil Prices Today April 23rd Market Update And Analysis

Apr 24, 2025 -

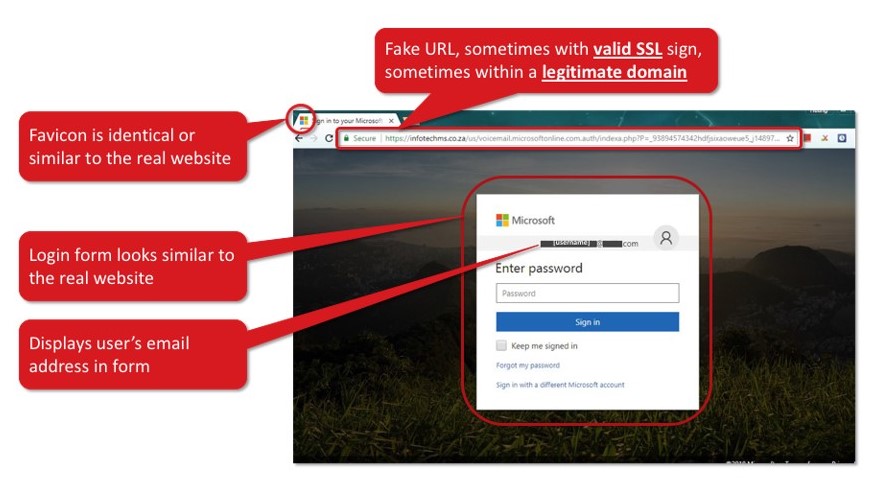

Office 365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025

Office 365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025 -

Cantor Explores 3 Billion Crypto Spac With Tether And Soft Bank A Deep Dive

Apr 24, 2025

Cantor Explores 3 Billion Crypto Spac With Tether And Soft Bank A Deep Dive

Apr 24, 2025 -

Persistent Toxic Chemicals The Ohio Train Derailments Ongoing Impact On Buildings

Apr 24, 2025

Persistent Toxic Chemicals The Ohio Train Derailments Ongoing Impact On Buildings

Apr 24, 2025