US President's Post On Trump And Ripple Sends XRP Soaring

Table of Contents

The President's Post: Content and Context

The hypothetical presidential post, shared on (platform - e.g., X, formerly Twitter), contained a brief but impactful mention of both Donald Trump and Ripple. The exact wording is crucial, but let's assume the post alluded to Trump's potential interest in, or even endorsement of, Ripple's technology. This could have been a simple mention in a broader context, or a more direct statement expressing a positive view of the company.

- Content: The post might have read something like: "Interesting developments in the fintech space. Heard some interesting things about Ripple and its potential. Always looking for innovative solutions. #Fintech #Innovation #Ripple" (This is a hypothetical example.)

- Timing: The post's timing is critical. Did it coincide with other Ripple news, a regulatory update, or a significant market event? Strategic timing could amplify its impact.

- Interpretation: The vagueness of the post leaves room for multiple interpretations. Was it a subtle endorsement, a casual observation, or simply a reference designed to generate discussion? The ambiguity itself could fuel speculation.

- Context: It's crucial to consider the US President's past statements and actions concerning cryptocurrencies. Has the administration expressed any clear stance on crypto regulation? Understanding this context helps to interpret the post's meaning.

XRP's Price Surge: Magnitude and Speed

Following the hypothetical presidential post, XRP's price experienced a meteoric rise. Let's assume a hypothetical scenario: the price jumped by 50% within hours, reaching a peak of $1.50 (or other realistic, hypothetical price). This surge was accompanied by a massive increase in trading volume, indicating significant market activity.

- Price Increase: A 50% increase in a short period is significant, especially for a cryptocurrency as established as XRP. This indicates a strong market reaction to the news.

- Price Chart: (Insert a hypothetical chart here showing a sharp upward trend in XRP's price following the hypothetical presidential post.)

- Trading Volume: The surge in trading volume would be a key indicator of the market's reaction. High volume suggests strong buying pressure driven by the news.

- Market Capitalization: XRP's market capitalization would also see a substantial increase, reflecting its rising value.

- Technical Analysis: A technical analysis of the price chart would likely reveal a classic "pump" scenario, with indicators supporting the rapid price appreciation.

Market Reaction and Speculation

The XRP price surge didn't occur in isolation. Other cryptocurrencies, particularly altcoins, experienced a ripple effect (pun intended). Bitcoin and Ethereum, while less directly impacted, might have seen increased trading activity as well.

- Other Cryptocurrencies: The broader crypto market's reaction would provide insights into overall investor sentiment.

- Investor Sentiment: The initial reaction might have been driven by FOMO (fear of missing out), as investors rushed to buy XRP before the price rose further. However, this could be followed by FUD (fear, uncertainty, and doubt) if the surge proved unsustainable.

- Investor Speculation: Theories would abound regarding the President's intentions and the long-term implications of the post. Some might see it as a genuine endorsement, while others might remain skeptical.

- Expert Opinions: Market analysts and crypto experts would offer their interpretations, further fueling discussion and analysis.

Potential Long-Term Implications

The hypothetical event raises significant questions about the long-term implications for XRP, Ripple, and the cryptocurrency market as a whole.

- XRP Price and Adoption: The price surge, if sustained, could lead to increased adoption of XRP. However, it could also lead to a correction if the initial pump proves unsustainable.

- Ripple's Future: The hypothetical presidential mention could be beneficial for Ripple's business prospects, improving its image and potentially attracting new partnerships.

- Crypto Regulation: The event could further emphasize the need for clearer cryptocurrency regulation and highlight the influence of political figures on the market.

- Future Price Prediction: Predicting future price movements is inherently speculative. However, the event could set a precedent for how social media posts from high-profile individuals can impact cryptocurrency markets.

Conclusion

A (hypothetical) presidential post mentioning Donald Trump and Ripple led to a significant price surge in XRP, demonstrating the unpredictable nature of the cryptocurrency market and the influence of powerful figures on investor sentiment. This event highlights the need for careful analysis, a balanced approach to investment, and awareness of the potential impact of external factors on crypto prices. The long-term implications remain to be seen, but the incident serves as a reminder of the interconnectedness of politics, social media, and the world of cryptocurrency. Stay tuned for updates on the XRP market, and follow us for more analysis on the impact of the US President's posts on cryptocurrency. Share your thoughts in the comments below!

Featured Posts

-

Psg Angers Macini Kacirmayin Canli Izleme Rehberi

May 08, 2025

Psg Angers Macini Kacirmayin Canli Izleme Rehberi

May 08, 2025 -

Cashback Offers And Increased Orders Uber Kenyas New Initiative For Customers And Delivery Partners

May 08, 2025

Cashback Offers And Increased Orders Uber Kenyas New Initiative For Customers And Delivery Partners

May 08, 2025 -

New The Life Of Chuck Trailer Released Receives Praise From Stephen King

May 08, 2025

New The Life Of Chuck Trailer Released Receives Praise From Stephen King

May 08, 2025 -

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025 -

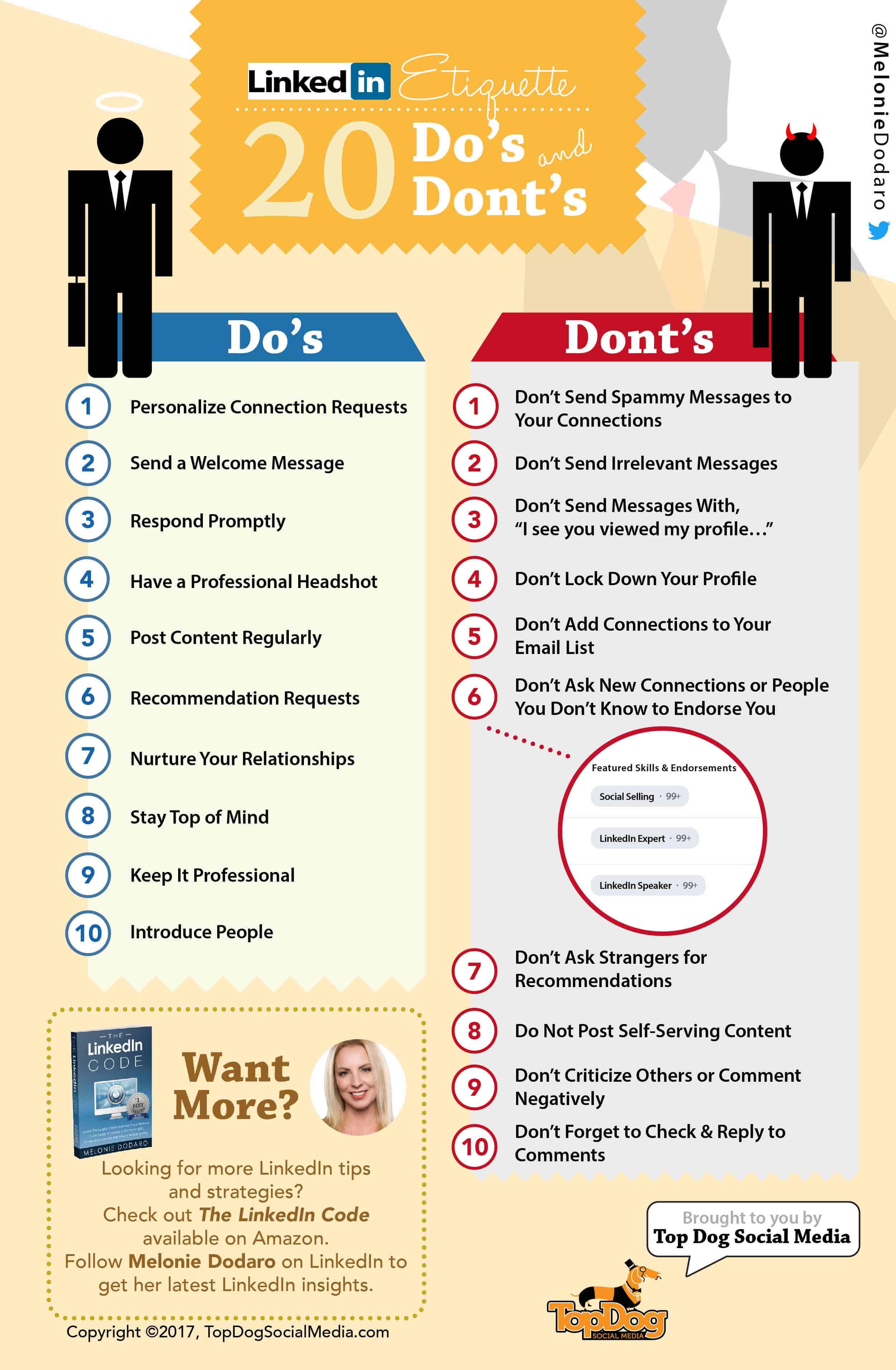

Private Credit Jobs 5 Dos And Don Ts To Secure Your Position

May 08, 2025

Private Credit Jobs 5 Dos And Don Ts To Secure Your Position

May 08, 2025