US Stock Futures Jump On Trump's Reassurance Regarding Powell

Table of Contents

Trump's Reassuring Statements and Their Market Impact

President Trump's recent remarks concerning Chairman Powell sent ripples through the financial markets. His statements, while not explicitly endorsing any specific policy, conveyed a reassuring tone regarding the Fed's direction and Powell's leadership. This perceived shift in presidential attitude, after periods of public criticism, was interpreted by many investors as a positive sign for future economic stability and reduced political uncertainty. This significantly impacted investor sentiment, leading to a considerable increase in US stock futures.

- Direct quotes from Trump's statements: (Insert direct quotes here, citing the source). Analyzing the precise wording is crucial to understanding the market's response. Did the President emphasize cooperation, acknowledge the Fed's independence, or hint at future policy adjustments? These nuances are critical in deciphering investor reactions.

- Analysis of the market reaction: Immediately following the statements, US stock futures experienced a sharp increase, with major indices like the Dow Jones and S&P 500 futures showing substantial gains. The speed and magnitude of this reaction underscore the market's sensitivity to presidential pronouncements on monetary policy.

- Specific sectors/stocks: Certain sectors, particularly those sensitive to interest rate changes, likely saw disproportionately strong gains. For example, technology stocks, often vulnerable to rising interest rates, might have experienced a significant boost following Trump's comments.

The Role of Jerome Powell and the Federal Reserve

The Federal Reserve's monetary policy plays a vital role in shaping the US economy and influencing investor confidence. Chairman Powell's recent decisions on interest rates have been a subject of ongoing debate and a point of contention between the President and the central bank. Trump's comments, therefore, are interpreted within the context of the Fed's current stance and its projected path for interest rate adjustments. The Fed's independence is constitutionally protected, ensuring that monetary policy decisions are not subject to direct political influence. However, Presidential pronouncements inevitably impact market perception of the potential interplay between the executive branch and the central bank.

- Summary of the Fed's recent interest rate decisions: (Include details about recent interest rate hikes or cuts, and the Fed's stated rationale).

- Impact of different interest rate scenarios: Higher interest rates generally curb inflation but can also slow economic growth. Conversely, lower interest rates stimulate economic activity but risk increased inflation. Understanding the potential impact of various scenarios is crucial for evaluating the market's response to Trump's statements.

- Relationship between the President and the Federal Reserve: The relationship between the President and the Federal Reserve is often complex and subject to political dynamics. This relationship, and any perceived shifts in it, can significantly impact investor sentiment and market stability.

Analysis of Market Reactions and Investor Sentiment

The market's response to Trump's comments was swift and pronounced. Analyzing the details provides valuable insights into investor psychology and market dynamics. The substantial increase in US stock futures demonstrates the significant impact of presidential pronouncements on investor confidence. Examining trading volume and the VIX (Volatility Index) offers further insights into the overall market sentiment.

- Data points illustrating market gains: (Include specific percentage changes in key indices like the Dow Jones Industrial Average and S&P 500 futures).

- Trading volume as an indicator of investor activity: Increased trading volume often indicates heightened investor interest and engagement. This data point provides further context to the magnitude of the market's response.

- Discussion of the VIX and its implications: A lower VIX generally indicates reduced market volatility, suggesting increased investor confidence. The VIX's movement following Trump's comments is a key indicator of the market's perceived risk.

Long-Term Implications for the US Economy

The short-term market surge following Trump's statements raises questions about the long-term implications for the US economy. While the positive investor reaction is noteworthy, considering the potential long-term effects is essential. The interplay between political statements, monetary policy, and market behavior can significantly impact economic growth, inflation, and employment in the long run.

- Potential scenarios for future economic growth: Different interest rate policies adopted by the Fed will lead to different outcomes for economic growth. Trump's comments indirectly influence the market's anticipation of future Fed actions.

- Risks associated with increased market volatility: While the current market reaction was positive, significant volatility can pose substantial risks to long-term economic stability.

- Assessment of the potential long-term impact on investor confidence: Sustained positive investor sentiment is crucial for sustained economic growth. The long-term impact of Trump's comments on investor confidence remains to be seen.

Conclusion

President Trump's reassuring statements regarding Jerome Powell significantly impacted US stock futures, boosting investor confidence and leading to a market surge. This article analyzed the market's reaction, the role of the Federal Reserve, and potential long-term economic implications, highlighting the dynamic relationship between political pronouncements and market movements. Understanding how Trump's pronouncements influence US stock futures is crucial.

Call to Action: Stay informed about the latest developments in US stock futures and the ongoing dialogue between the President and the Federal Reserve. Follow our updates for continuous analysis of how Trump's pronouncements influence US stock futures and the broader economic landscape. Understanding the interplay between political statements and market movements is crucial for making informed investment decisions.

Featured Posts

-

The Epa Vs Elon Musk The Impact On Tesla Space X And Dogecoin

Apr 24, 2025

The Epa Vs Elon Musk The Impact On Tesla Space X And Dogecoin

Apr 24, 2025 -

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025 -

Indias Stock Market Surge A Deep Dive Into The Niftys Rally

Apr 24, 2025

Indias Stock Market Surge A Deep Dive Into The Niftys Rally

Apr 24, 2025 -

Tensions Rise South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025

Tensions Rise South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025 -

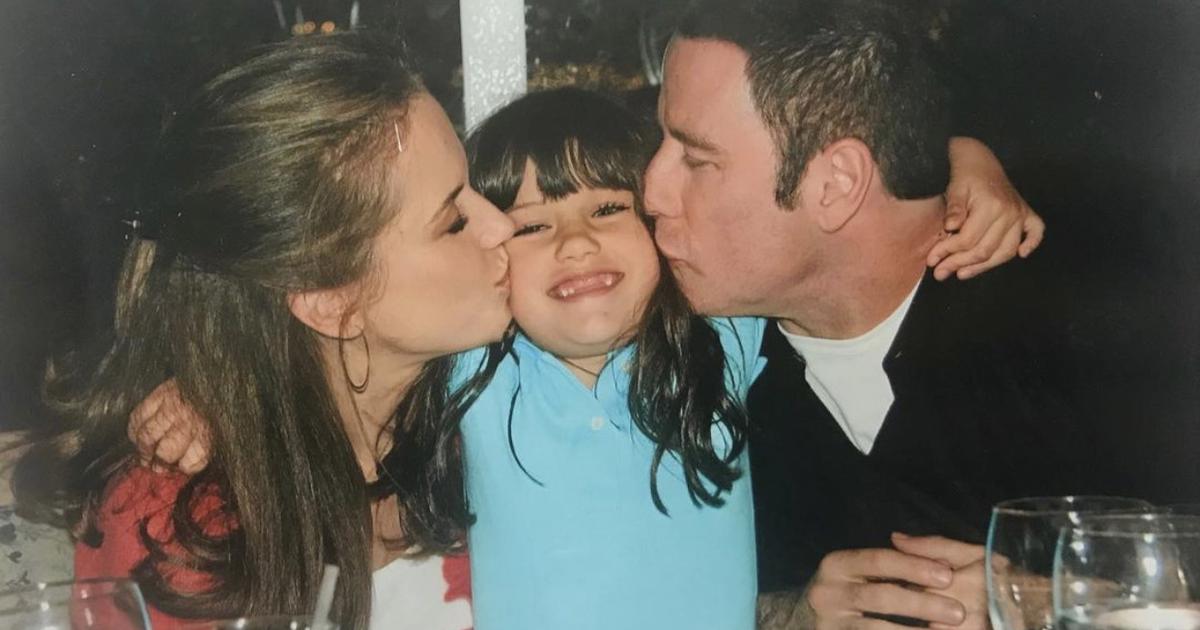

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025