Wall Street Comeback Threatens DAX's Recent Gains

Table of Contents

Wall Street's Resurgence: Factors Driving the Comeback

The impressive comeback of Wall Street is fueled by a confluence of factors impacting the US economy and investor sentiment. Several key elements contribute to this renewed strength, potentially overshadowing the recent positive performance of the DAX.

- Improved Corporate Earnings: Stronger-than-expected corporate earnings reports from major US companies across various sectors are boosting investor confidence and driving stock prices higher. These positive results reflect underlying economic strength and future growth potential.

- Cooling Inflation and Interest Rates: Signs of cooling inflation in the US are prompting expectations of less aggressive interest rate hikes by the Federal Reserve. This easing monetary policy reduces borrowing costs for businesses and consumers, stimulating economic activity and supporting higher valuations in the stock market.

- Positive Economic Indicators: A range of positive economic indicators, including robust job growth and consumer spending, suggest sustained economic expansion in the US. This positive outlook is attracting further investment into US markets.

- Technological Advancements: Breakthroughs in key technologies, particularly in artificial intelligence (AI), are driving significant rallies in specific sectors, further fueling the Wall Street upswing. This technological dynamism is attracting substantial capital inflows.

- Increased Investor Confidence: A general increase in investor confidence and a shift towards a higher risk appetite are also contributing to the current Wall Street rally. This renewed optimism is a critical factor in driving market performance.

The DAX's Vulnerability: Analyzing Recent Performance and Risks

While the DAX has seen recent gains, its performance is intrinsically linked to the global economic climate and particularly vulnerable to shifts in the US market. Several factors expose the DAX to potential setbacks in the face of Wall Street's resurgence.

- Global Economic Dependence: The German economy, and by extension the DAX, is heavily reliant on the global economic landscape, making it susceptible to negative shocks originating in major economies like the US. A pullback in Wall Street could easily trigger a corresponding decline in the DAX.

- Energy Crisis Impact: Europe, and particularly Germany, continues to grapple with the ongoing energy crisis, which significantly impacts industrial production and overall economic growth. This vulnerability increases the DAX's susceptibility to external economic pressures.

- High Inflation Concerns: High inflation in Europe continues to exert pressure on consumer spending and business investment, potentially dampening economic growth and impacting DAX performance. This internal pressure contrasts with the relative easing of inflation seen in the US.

- Geopolitical Risks: Geopolitical uncertainties, including the ongoing war in Ukraine, contribute to investor uncertainty and could trigger capital outflows from Europe, including Germany. This adds another layer of risk to the DAX's outlook.

- Capital Outflow Risk: The potential for capital outflow from Europe to the US in search of higher returns represents a significant threat to the DAX's recent gains. Investors may reallocate their assets to benefit from the perceived stronger performance of US markets.

Comparative Analysis: DAX vs. Wall Street Performance Metrics

A direct comparison of key performance indicators (KPIs) between the DAX index and major US indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite reveals a notable divergence. (Insert charts and graphs comparing market capitalization, trading volume, and sector-specific performance of the DAX against the Dow Jones, S&P 500, and Nasdaq. Highlight key differences and trends.) This analysis visually demonstrates the relative strength of Wall Street compared to the DAX, further emphasizing the potential threat to the DAX's recent gains.

Impact on Investors: Navigating Market Uncertainty

The current market dynamics necessitate a cautious and strategic approach for investors. Understanding the interplay between Wall Street and the DAX is crucial for managing risk and optimizing returns.

- Diversified Portfolios: Maintaining a well-diversified investment portfolio across different asset classes and geographical regions is crucial to mitigate risk and protect against market volatility. This reduces dependence on any single market's performance.

- Hedging Strategies: Employing hedging strategies, such as options trading or currency hedging, can help to protect against potential losses resulting from market fluctuations. These strategies can help limit downside risk.

- Risk Assessment: Careful risk assessment and a thorough understanding of market dynamics are essential before making any significant investment decisions. A clear understanding of the interconnectedness between Wall Street and the DAX is critical.

- Alternative Investments: Consideration of alternative investment options, such as bonds or real estate, can further reduce dependence on the stock market and help to balance the portfolio. Diversification is key.

- Professional Advice: Seeking professional financial advice from a qualified financial advisor before making substantial investment decisions is highly recommended, particularly during periods of market uncertainty.

Conclusion

The recent resurgence of Wall Street presents a significant challenge to the DAX's recent gains. Factors such as cooling inflation in the US, strong corporate earnings, and increased investor confidence are driving the US market’s performance. Simultaneously, the DAX faces headwinds from the ongoing European energy crisis, high inflation, and geopolitical uncertainties. Understanding this interplay between Wall Street and the DAX is crucial for investors navigating this period of market uncertainty. Stay informed about the latest developments affecting both markets and consider diversifying your investment portfolio to mitigate risk. Monitor the Wall Street comeback and its impact on the DAX closely to make informed investment decisions.

Featured Posts

-

Le Francais Selon Mathieu Avanzi Bien Plus Que La Langue De L Enseignement

May 24, 2025

Le Francais Selon Mathieu Avanzi Bien Plus Que La Langue De L Enseignement

May 24, 2025 -

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025 -

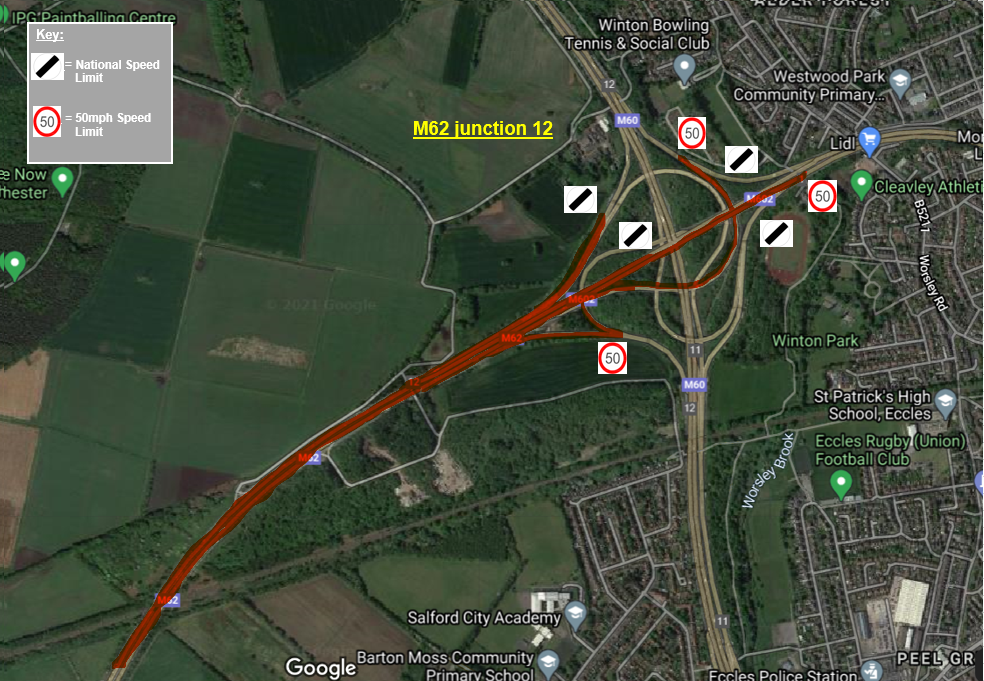

Road Closure M62 Westbound Resurfacing From Manchester To Warrington

May 24, 2025

Road Closure M62 Westbound Resurfacing From Manchester To Warrington

May 24, 2025 -

Over 100 Firearms Seized In Massachusetts Crackdown 18 Brazilian Nationals Charged

May 24, 2025

Over 100 Firearms Seized In Massachusetts Crackdown 18 Brazilian Nationals Charged

May 24, 2025 -

Amsterdam Exchange Suffers 7 Fall Trade War Intensifies Market Instability

May 24, 2025

Amsterdam Exchange Suffers 7 Fall Trade War Intensifies Market Instability

May 24, 2025