Warren Buffett's Lessons: Humility And Avoiding Mistakes For Effective Leadership

Table of Contents

The Power of Humility in Warren Buffett's Leadership Style

Buffett's humility isn't mere modesty; it's a cornerstone of his leadership, fostering an environment of trust and collaboration both within his team at Berkshire Hathaway and with external stakeholders. This approach transcends mere personality and directly impacts the effectiveness of his leadership and the overall success of the organization.

Building Trust Through Humility

Buffett’s actions consistently demonstrate his commitment to building trust:

- Acknowledging limitations: He readily admits when he doesn't know something, fostering an environment where others feel comfortable sharing their expertise. This prevents the perception of infallibility, allowing for open dialogue and learning.

- Actively listening to others' opinions: Buffett is known for his ability to listen intently to diverse perspectives, valuing the input of his team members, even when it challenges his own initial thinking. This shows respect and creates a safe space for constructive criticism.

- Giving credit where it's due: Rather than taking all the credit for Berkshire Hathaway's success, Buffett consistently highlights the contributions of his team and the underlying strength of the businesses they invest in. This builds morale and fosters a sense of shared accomplishment.

- Admitting mistakes openly and promptly: Buffett doesn't shy away from acknowledging past errors. This transparency builds trust and demonstrates a commitment to continuous improvement, making mistakes opportunities for growth. His candidness regarding investment setbacks underscores this.

These actions create a strong foundation of trust, crucial for effective leadership and team cohesion.

Fostering Collaboration Through Humility

Buffett's humble leadership style naturally cultivates collaboration:

- Creating a culture of open communication: At Berkshire Hathaway, open communication is encouraged at all levels. This free flow of information facilitates informed decision-making and prevents misunderstandings.

- Encouraging diverse perspectives: Buffett actively seeks out and values diverse viewpoints, recognizing that a variety of perspectives leads to more robust and insightful analysis.

- Valuing dissenting opinions: He doesn’t suppress conflicting opinions; instead, he encourages debate and constructive criticism, fostering innovation and preventing groupthink.

- Empowering employees to take ownership and make decisions: Buffett delegates authority, empowering his team members to take ownership of their work and make decisions within their areas of expertise. This fosters a sense of responsibility and commitment.

Berkshire Hathaway's success is a direct reflection of this collaborative environment; its decentralized structure allows managers considerable autonomy, a testament to Buffett's trust and confidence in his team.

Warren Buffett's Approach to Avoiding Costly Mistakes

Warren Buffett's remarkable success is equally defined by his meticulous approach to avoiding costly mistakes. This involves a rigorous, patient approach and a deep understanding of risk.

The Importance of Thorough Due Diligence

Buffett’s investment decisions are not impulsive; they are preceded by exhaustive research:

- Extensive research: His team undertakes extensive research before making any investment decision, poring over financial statements and industry reports.

- Detailed analysis of financial statements: They meticulously analyze financial statements, assessing the health and profitability of potential investments.

- Understanding underlying business models: They delve deep into understanding the underlying business models of companies, evaluating their competitive advantages and long-term prospects.

- Seeking diverse opinions: The team actively seeks diverse opinions, challenging assumptions and ensuring a comprehensive understanding of potential risks and opportunities. This ensures that all aspects are considered before any investment is made.

This rigorous due diligence significantly mitigates the risk of making costly investment errors.

The Power of Patience and Long-Term Vision

Buffett's investment strategy prioritizes long-term value over short-term gains:

- Avoiding impulsive decisions: He avoids impulsive decisions driven by market sentiment or short-term trends.

- Focusing on intrinsic value rather than short-term market fluctuations: He focuses on the intrinsic value of businesses, considering their long-term growth potential rather than short-term market fluctuations.

- Resisting the urge to chase trends: He consistently resists the urge to chase hot trends, preferring to invest in fundamentally strong businesses with a proven track record.

This patient approach allows him to weather market downturns and capitalize on long-term growth opportunities.

Effective Risk Management Strategies

Risk management is an integral part of Buffett's investment philosophy:

- Diversification of investments: Berkshire Hathaway's portfolio is remarkably diversified, mitigating the risk associated with individual investments.

- Understanding and mitigating potential risks: They carefully assess and mitigate potential risks associated with each investment, developing contingency plans to address unforeseen circumstances.

- Setting clear risk tolerance limits: They define clear risk tolerance limits, ensuring that investments align with the company's overall risk profile.

This multi-faceted risk management approach minimizes exposure to significant losses.

Applying Warren Buffett's Lessons to Your Leadership

Integrating Buffett's principles into your leadership style requires a conscious and ongoing effort.

Cultivating Humility in Your Leadership Style

- Practice active listening, truly seeking to understand others' perspectives.

- Acknowledge your limitations and seek input from others.

- Give credit where it’s due.

- Embrace feedback, viewing criticism as an opportunity for growth.

Implementing Rigorous Due Diligence Processes

- Establish a systematic process for gathering and analyzing information.

- Develop clear decision-making criteria.

- Seek diverse perspectives before making critical decisions.

- Document your decision-making process.

Fostering a Culture of Continuous Learning

- Encourage open communication and feedback.

- Provide opportunities for professional development.

- Embrace mistakes as learning opportunities.

- Foster a culture of experimentation and innovation.

Conclusion

Warren Buffett’s leadership exemplifies the power of humility and meticulous planning in achieving long-term success. His approach, characterized by a deep respect for others, a commitment to thorough due diligence, and a patient long-term vision, provides a blueprint for effective leadership across all fields. By embracing these principles of Warren Buffett leadership—cultivating humility, implementing rigorous processes, and fostering continuous learning—you can significantly improve team performance, reduce errors, and achieve greater success. To delve deeper into Buffett's investing philosophy and leadership approach, consider exploring his letters to Berkshire Hathaway shareholders and biographies exploring his life and career. Embrace the power of Warren Buffett leadership and transform your own leadership journey.

Featured Posts

-

Cavaliers Mitchell And Mobley Power Blowout Win Against Knicks

May 07, 2025

Cavaliers Mitchell And Mobley Power Blowout Win Against Knicks

May 07, 2025 -

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025 -

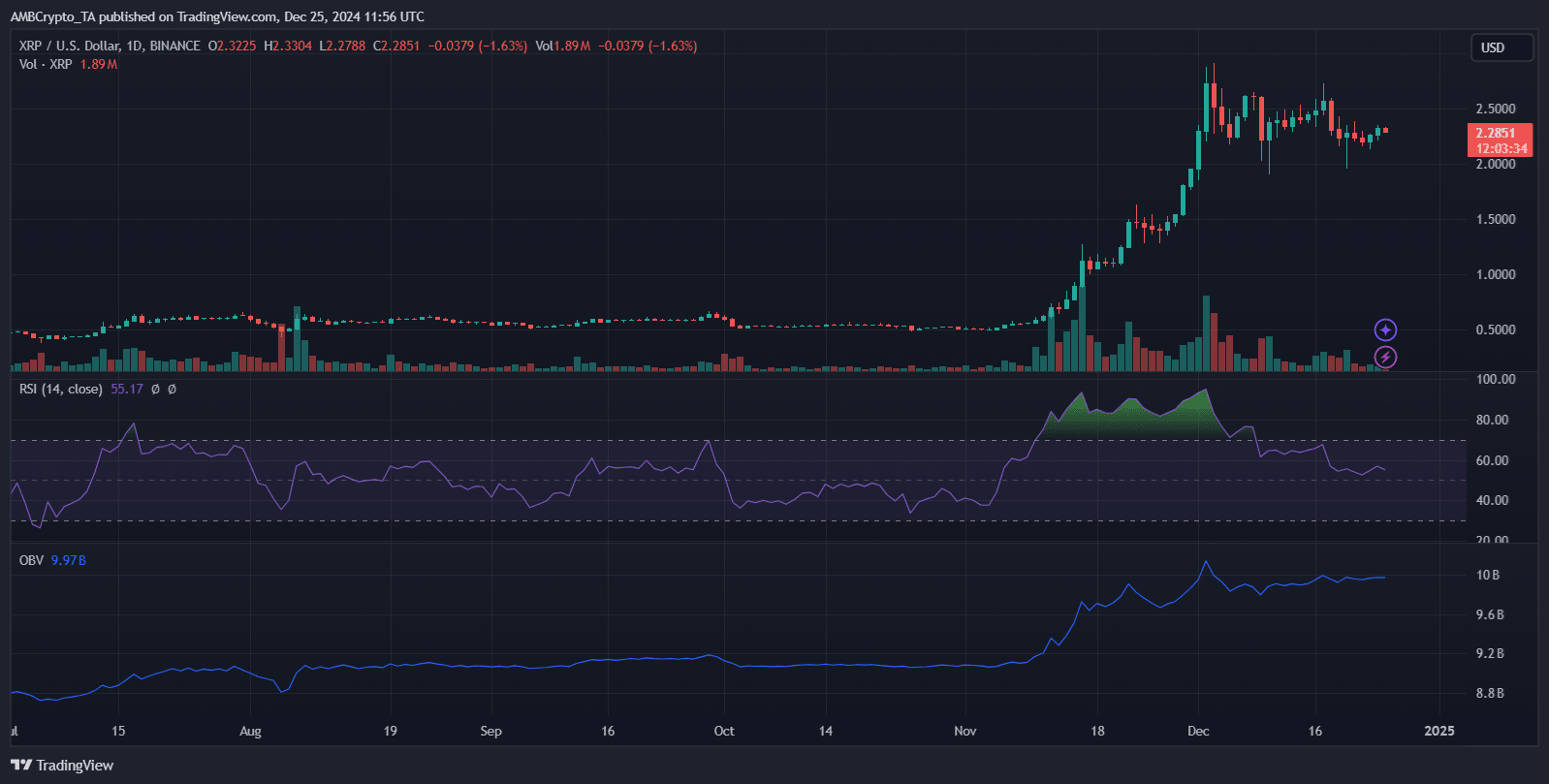

20 Million Xrp Purchased Whale Activity Sparks Market Speculation

May 07, 2025

20 Million Xrp Purchased Whale Activity Sparks Market Speculation

May 07, 2025 -

Cavaliers Victory Over Bulls Propels Them To First Place In The East

May 07, 2025

Cavaliers Victory Over Bulls Propels Them To First Place In The East

May 07, 2025 -

Will Pedro Pascals Star Power Outshine Supermans Legacy At The Box Office The Fantastic Fours Challenge

May 07, 2025

Will Pedro Pascals Star Power Outshine Supermans Legacy At The Box Office The Fantastic Fours Challenge

May 07, 2025