When Professionals Sold, Individuals Bought: Understanding Market Swings

Table of Contents

The recent market downturn witnessed a fascinating phenomenon: as professional investors significantly reduced their holdings, individual investors stepped in, increasing their market activity dramatically. This surge in retail participation, occurring simultaneously with a pullback from institutional players, highlights a crucial aspect of market dynamics – the interplay between professional and individual investor behavior. The phrase "When Professionals Sold, Individuals Bought" encapsulates this intriguing shift, prompting us to analyze its causes and potential implications for future market trends. This article will delve into the reasons behind this divergence, exploring the motivations and strategies employed by both groups and ultimately assessing the consequences of this significant shift in market participation.

H2: Professional Investor Behavior During Market Swings

H3: Identifying Professional Selling Signals:

Professional investors, unlike individual investors often driven by emotion, rely on a sophisticated arsenal of tools and strategies to navigate market swings. Identifying when they are selling requires understanding their approach.

- Technical Indicators: Professionals frequently monitor technical indicators like declining trading volume, suggesting waning interest, and bearish chart patterns, such as head and shoulders formations, signaling potential price reversals.

- Fund Manager Outflows: A decrease in institutional ownership, evident through reduced fund manager holdings reported in regulatory filings, can be a strong signal of professional selling. Significant outflows from specific sectors or asset classes suggest a loss of confidence.

- Macroeconomic Factors: External forces significantly influence professional investment decisions. Rising interest rates, increased inflation, or geopolitical uncertainty can prompt professionals to reduce risk exposure, triggering widespread selling.

H3: Reasons Behind Professional Selling:

Professional selling is rarely driven by panic; it's typically a calculated response to various factors:

- Risk Aversion & Portfolio Rebalancing: As market uncertainty increases, professionals often adopt a more risk-averse approach, rebalancing their portfolios to reduce exposure to volatile assets.

- Example: Shifting from equities to bonds during periods of high inflation.

- Profit-Taking: After periods of sustained market growth, professionals might take profits to secure gains and reduce their risk.

- Example: Selling off high-performing tech stocks after a significant rally.

- Regulatory Changes & Internal Mandates: New regulations or internal fund mandates can necessitate selling to meet compliance requirements or maintain specific investment strategies.

- Example: Selling assets to comply with stricter capital requirements.

H2: Individual Investor Behavior During Market Swings

H3: The Rise of Retail Investing:

The accessibility of online brokerage accounts and user-friendly trading apps has democratized investing, leading to a surge in retail participation.

- Accessibility of Online Brokerage: Platforms like Robinhood and Fidelity have made investing significantly easier for individuals, lowering barriers to entry.

- Social Media Influence: Social media platforms and online forums can amplify market trends, influencing individual decisions, sometimes leading to herd behavior and potentially exacerbating market swings.

- Fear of Missing Out (FOMO): The fear of missing out on potential gains can drive individuals to invest impulsively, especially during periods of rapid market growth.

H3: Motivations for Individual Buying:

While professional selling often signifies caution, individual buying during market downturns can stem from various motivations:

- Value Investing: Individuals may view market dips as opportunities to buy undervalued assets, hoping to capitalize on potential future price appreciation.

- Example: Buying stocks at a discounted price during a market correction.

- Low Interest Rates: Low interest rates can make investment in higher-yielding assets (like stocks) more attractive.

- Dollar-Cost Averaging & Long-Term Strategies: Some individuals utilize dollar-cost averaging, investing a fixed amount regularly, regardless of market fluctuations, as part of a long-term strategy.

H2: Analyzing the Impact of This Shift

H3: Short-Term Market Volatility: The influx of individual investors, often less experienced in navigating market volatility, can increase short-term price swings and exacerbate market fluctuations.

H3: Long-Term Market Trends: The long-term consequences of this shift are complex and depend on several factors, including the sustainability of individual investor participation and the overall macroeconomic environment. It could lead to increased market efficiency or potentially create bubbles in specific sectors.

H3: Risk Management Strategies: Both individual and professional investors need to adapt their risk management strategies in this dynamic environment. Individuals should focus on education and diversification, while professionals might need to factor in the increased market volatility driven by retail participation.

Conclusion:

In summary, "When Professionals Sold, Individuals Bought" describes a significant shift in market dynamics. Professionals' selling often reflects risk aversion and strategic portfolio adjustments, while individual buying is influenced by factors ranging from FOMO to long-term value investing opportunities. Understanding these opposing forces is crucial for informed investment decision-making. The increased market volatility caused by this shift necessitates a careful approach to risk management for all investors. To better navigate future market swings, and understand the implications of "When Professionals Sell," we encourage you to subscribe to our newsletter for in-depth market analysis and insights. Mastering market swings requires a nuanced understanding of the interplay between professional and individual investor behavior, so continue to learn and adapt your strategies accordingly. Leave a comment below and share your thoughts on this significant market trend.

Featured Posts

-

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025 -

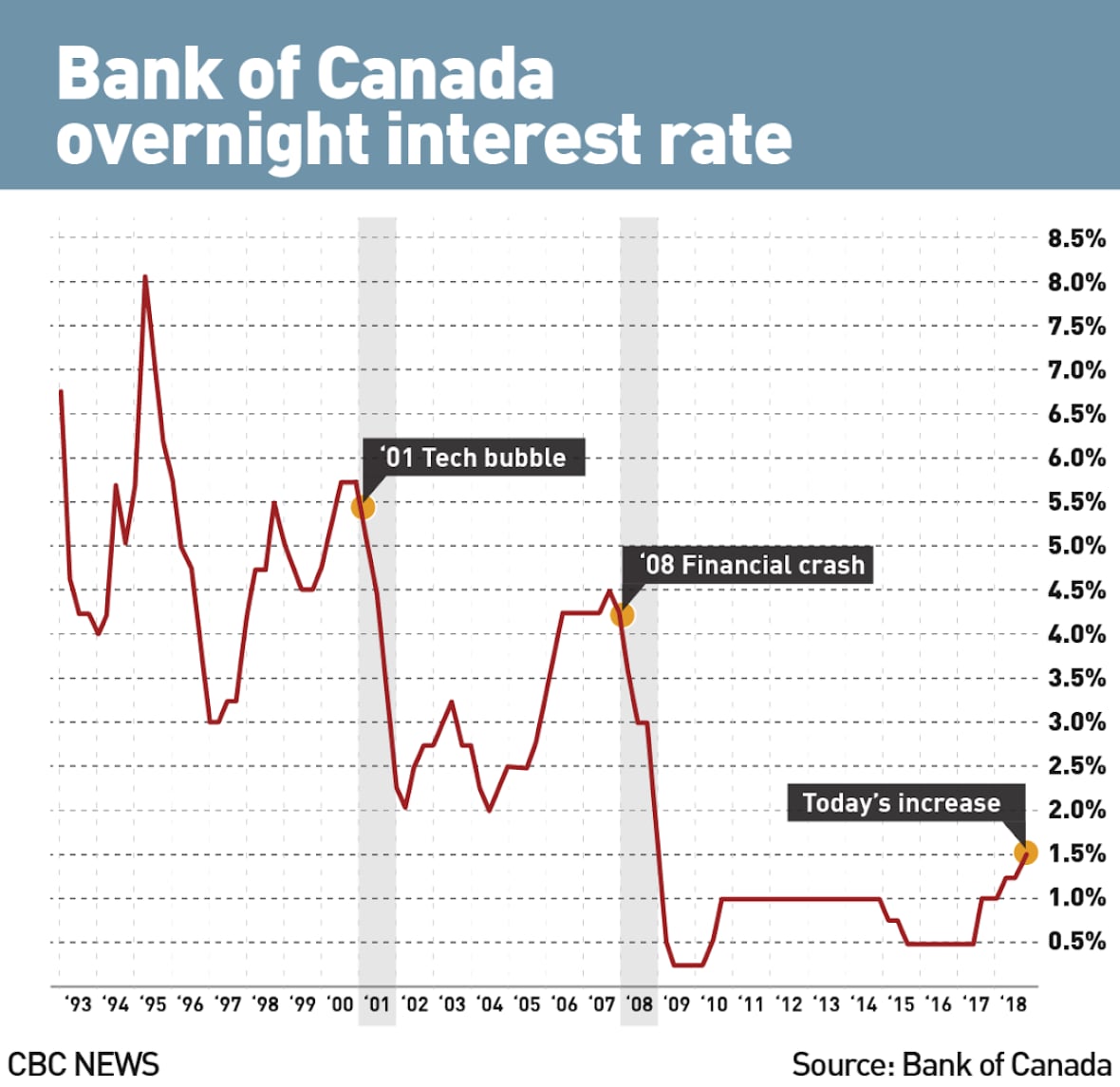

Weak Retail Sales Precursor To Bank Of Canada Interest Rate Cuts

Apr 28, 2025

Weak Retail Sales Precursor To Bank Of Canada Interest Rate Cuts

Apr 28, 2025 -

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

Lapd Releases Videos Showing Chaos Before Shooting Of Weezer Bassists Wife

Apr 28, 2025

Lapd Releases Videos Showing Chaos Before Shooting Of Weezer Bassists Wife

Apr 28, 2025 -

Richard Jeffersons Latest Dig At Shaquille O Neal What Happened

Apr 28, 2025

Richard Jeffersons Latest Dig At Shaquille O Neal What Happened

Apr 28, 2025