Why Current Stock Market Valuations Are Not A Cause For Concern: BofA

Table of Contents

BofA's Rationale: Understanding the Underlying Economic Factors

BofA's assessment of current stock market valuations hinges on a comprehensive understanding of underlying economic factors. Their analysis goes beyond simply looking at price-to-earnings ratios (P/E) and price-to-sales ratios (P/S); it incorporates a broader picture of economic growth, inflation, interest rates, and corporate performance.

-

Economic Growth Projections: BofA's economists project continued, albeit moderated, economic growth. This forecast, while acknowledging potential headwinds, suggests sufficient underlying strength to support current valuations. Specific growth figures and supporting data should be referenced here if available from BofA reports.

-

Inflation and Interest Rate Expectations: While inflation remains a concern, BofA's analysis likely incorporates projections for a gradual decline in inflation and a plateauing of interest rates. These expectations play a crucial role in determining the discount rate used in valuation models, impacting the perceived value of future earnings. Any specific BofA reports on these topics should be cited here.

-

Corporate Earnings Growth and Profit Margins: BofA's analysis likely emphasizes the importance of robust corporate earnings growth and healthy profit margins in justifying current valuations. Strong earnings demonstrate the capacity of companies to generate cash flow, supporting higher stock prices. Mention specific data points from BofA's research on this topic if possible.

-

Valuation Metrics: A Comparative Analysis: BofA likely compares current P/E and P/S ratios to historical averages, acknowledging any deviations. They would likely contextualize these deviations, explaining factors contributing to any divergence from historical norms. This analysis should incorporate data from relevant BofA research reports, such as their "Global Research" publications. For example, they may argue that higher valuations are justified by stronger earnings growth compared to previous periods.

-

Addressing Counterarguments: BofA likely addresses potential counterarguments suggesting overvaluation. They might counter these by highlighting specific factors, such as technological advancements or increased productivity, that justify premium valuations for certain sectors. Referencing any official BofA rebuttal to these concerns is vital here.

The Importance of Long-Term Perspective in Stock Market Valuations

BofA emphasizes the crucial role of a long-term perspective in evaluating stock market valuations. Short-term market fluctuations are inherent to the system, and focusing solely on short-term price movements can lead to poor investment decisions.

-

Market Cycles and Long-Term Horizon: The stock market operates in cycles, with periods of growth and decline. A long-term investment horizon allows investors to ride out market downturns and benefit from the long-term growth potential of the market. This point should be illustrated using historical data or examples.

-

Short-Term Fluctuations and Investment Decisions: BofA advises against making impulsive investment decisions based on short-term market volatility. Instead, investors should focus on their long-term financial goals and risk tolerance. Mention any BofA publications addressing this topic.

-

Diversification and Risk Mitigation: A well-diversified portfolio helps mitigate the risk associated with market volatility. By spreading investments across different asset classes and sectors, investors can reduce their exposure to any single market downturn. BofA's recommendations on portfolio diversification should be highlighted here.

-

Investment Strategy and Risk Tolerance: BofA likely advises investors to tailor their investment strategies to their individual risk tolerance and long-term financial goals. This includes considering factors like age, income, and retirement plans.

Opportunities and Potential Risks in the Current Market

While BofA's overall outlook is positive, they likely acknowledge potential risks and opportunities within the current market landscape.

-

Investment Opportunities: BofA may identify specific sectors or investment themes that they consider promising, given current stock market valuations. These might include sectors expected to benefit from long-term trends such as technological innovation or demographic shifts.

-

Market Risks and Risk Management: Potential risks, such as geopolitical uncertainty, unexpected economic downturns, or shifts in interest rate policies, should be discussed. BofA likely offers strategies for mitigating these risks, such as hedging or adjusting portfolio allocations. Examples of specific risks and BofA's recommended mitigation strategies should be provided.

-

Navigating Risks and Maximizing Returns: BofA's advice on navigating these risks and maximizing returns likely includes suggestions for adjusting asset allocation, seeking professional advice, and maintaining a disciplined investment approach.

Conclusion

BofA's analysis suggests that while careful scrutiny of current stock market valuations is warranted, they are not necessarily a cause for widespread concern. This perspective is supported by projections of continued economic growth, strong corporate earnings, and the importance of adopting a long-term investment strategy. Don't let anxieties surrounding stock market valuations dictate your investment decisions. Seek professional financial advice, conduct thorough research based on your individual circumstances, and develop a sound investment strategy to navigate the current market conditions. Learn more about BofA's market outlook and build a portfolio aligned with your long-term financial goals.

Featured Posts

-

Trumps Immigration Policies Face Significant Legal Setbacks

Apr 24, 2025

Trumps Immigration Policies Face Significant Legal Setbacks

Apr 24, 2025 -

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025 -

Market Rally Dow Jones S And P 500 And Nasdaq Post Significant Gains

Apr 24, 2025

Market Rally Dow Jones S And P 500 And Nasdaq Post Significant Gains

Apr 24, 2025 -

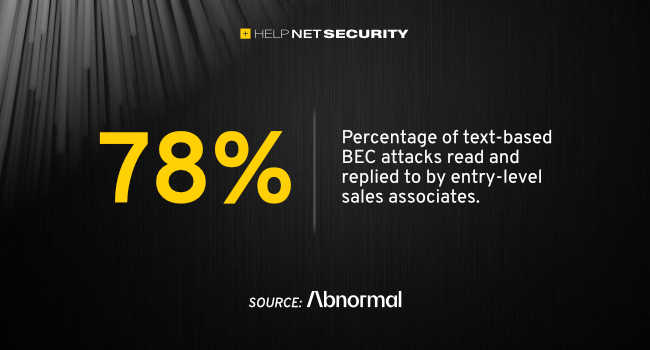

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025 -

Bold And The Beautiful Recap April 16 Hopes Worries And Bridgets Unexpected News

Apr 24, 2025

Bold And The Beautiful Recap April 16 Hopes Worries And Bridgets Unexpected News

Apr 24, 2025