Why Some See Uber As A Recession-Resistant Stock

Table of Contents

Uber's Diversified Revenue Streams

Uber's strength lies in its diversification. Unlike companies heavily reliant on a single product or service, Uber operates in multiple interconnected markets, mitigating the impact of economic slowdowns.

Ride-Sharing's Unexpected Resilience

Even during economic downturns, people still need transportation. While discretionary trips might decrease, essential travel remains consistent.

- Price Sensitivity and Strategic Adjustments: Uber's dynamic pricing allows it to adjust fares based on demand. During economic hardship, they can lower prices to attract price-sensitive customers, maintaining ridership.

- Essential Transportation: Commuting to work, attending medical appointments, and responding to emergencies remain crucial, regardless of the economic climate. This provides a solid base of demand for ride-sharing services.

- Public Transport Alternatives: Concerns about public transportation safety or hygiene can drive increased reliance on private ride-sharing services, even during recessions.

The Booming Delivery Services Market

Uber Eats, Uber's food delivery service, has experienced explosive growth. This segment provides a significant buffer against potential downturns in the ride-sharing sector.

- Convenience and Time Constraints: The convenience of food delivery remains attractive, even during economic hardship. People may opt for delivery to save time and effort, especially when juggling multiple responsibilities.

- Market Dominance and Competitive Advantage: Uber Eats holds a substantial market share, benefiting from strong brand recognition and extensive delivery networks. This competitive advantage helps it weather economic storms.

- Beyond Food Delivery: Uber's delivery network is versatile and can expand beyond food, delivering groceries, pharmaceuticals, and other goods, diversifying its revenue streams and adding resilience.

Uber's Cost-Cutting Capabilities & Efficiency

Uber's operational efficiency and ability to adapt to changing market conditions are key to its perceived recession resistance.

Dynamic Pricing and Demand-Based Operations

Uber's pricing algorithms adjust in real-time based on demand, maximizing profitability during peak periods and minimizing losses during slower times.

- Efficient Driver Network: The driver network scales up or down depending on demand. This flexibility reduces operational costs during periods of lower ridership.

- Cost Reduction Strategies: During economic downturns, Uber can implement cost-cutting measures, optimizing its operations without significantly impacting service quality.

Technological Advantages & Automation

Uber's significant investment in technology and automation contributes significantly to its cost efficiency.

- AI and Machine Learning: The use of AI and machine learning optimizes routes, predicts demand, and improves overall operational efficiency, lowering costs.

- Autonomous Vehicles (Long-Term Potential): The long-term potential of autonomous vehicles promises to drastically reduce operational costs, further enhancing Uber's resilience.

Addressing Counterarguments & Risks

While Uber presents a compelling case as a recession-resistant stock, it's crucial to acknowledge potential risks.

Competition and Market Saturation

The ride-sharing and food delivery markets are intensely competitive. New entrants and established players pose ongoing challenges.

- Market Share Vulnerability: Increased competition could lead to reduced market share in certain segments.

- Maintaining Competitiveness: Uber needs to continually innovate and adapt its strategies to maintain its competitive edge and defend its market position.

Regulatory Hurdles and Legal Challenges

The regulatory landscape for ride-sharing and delivery services is complex and constantly evolving.

- Legal and Regulatory Uncertainty: Ongoing legal battles and changes in regulations can impact profitability and operational efficiency.

- Navigating the Regulatory Landscape: Uber's ability to effectively navigate these complexities will be crucial for its long-term success.

Conclusion

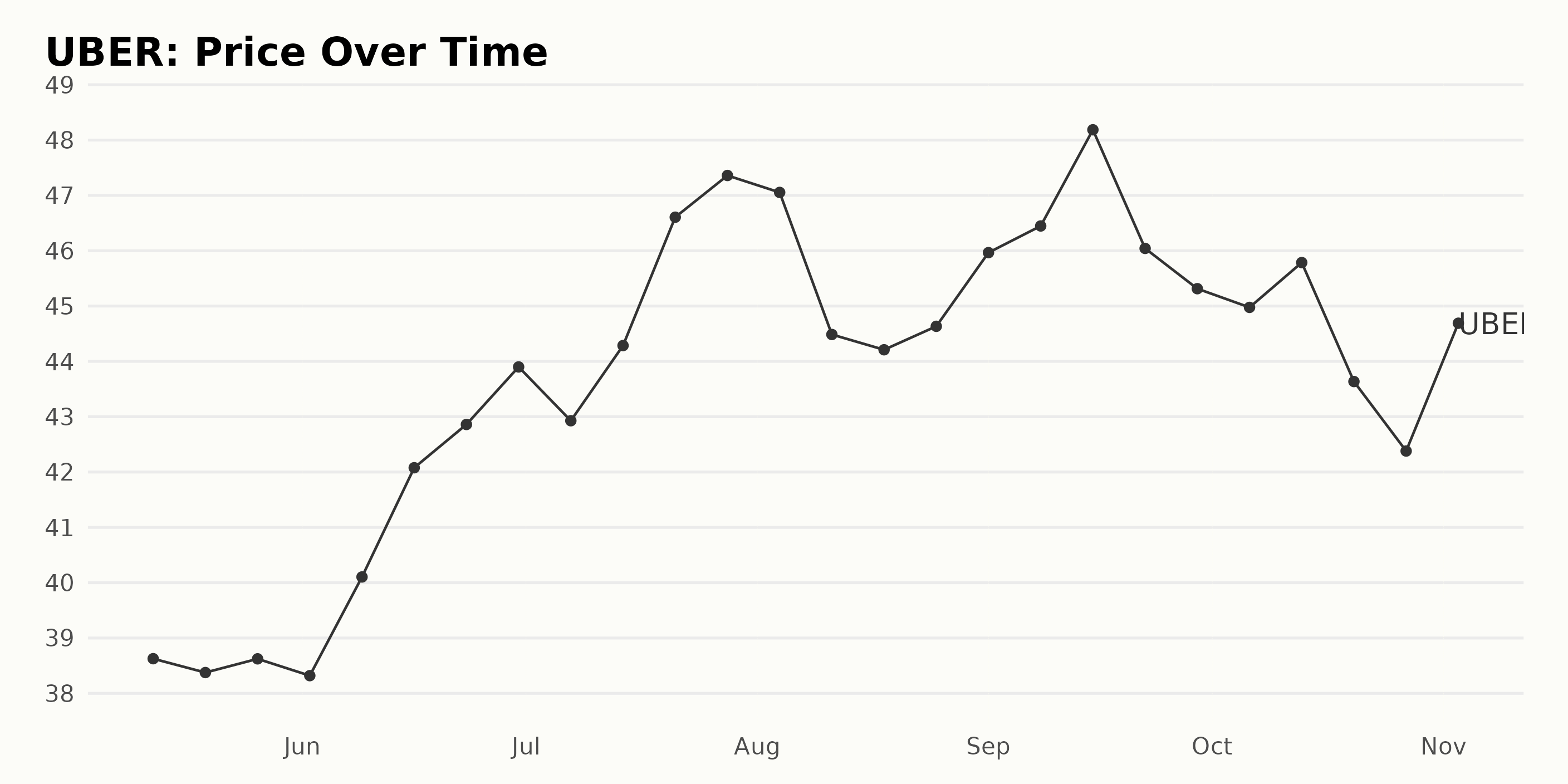

Several factors suggest why some investors view Uber as a recession-resistant stock. Its diversified revenue streams, encompassing both ride-sharing and delivery services, coupled with its dynamic pricing model and cost-cutting capabilities, contribute to its resilience in facing economic downturns. While competition and regulatory challenges pose risks, Uber's technological advantages and adaptable business model position it favorably. However, remember that no investment is entirely risk-free.

Call to Action: Investigate Uber's resilience as a recession-resistant stock today. Learn more about the potential of Uber as a recession-proof investment by exploring independent financial analysis and conducting your own thorough research. Understanding the company’s financial health and future prospects is crucial before making any investment decisions.

Featured Posts

-

Jackbit Casino Review A Leading Bitcoin Casino For 2025

May 18, 2025

Jackbit Casino Review A Leading Bitcoin Casino For 2025

May 18, 2025 -

Angels Stars Tragic Offseason Family Health Crisis Details

May 18, 2025

Angels Stars Tragic Offseason Family Health Crisis Details

May 18, 2025 -

Uber Stock Recession Proof Analyst Insights

May 18, 2025

Uber Stock Recession Proof Analyst Insights

May 18, 2025 -

Best Online Casino Bonus Usa 2025 Wild Casino Bonus Codes And Offers

May 18, 2025

Best Online Casino Bonus Usa 2025 Wild Casino Bonus Codes And Offers

May 18, 2025 -

Brooklyn Bridge Park Homicide Investigation Following Gunshot Death

May 18, 2025

Brooklyn Bridge Park Homicide Investigation Following Gunshot Death

May 18, 2025