Will Republican Divisions Sink Trump's Tax Bill?

Table of Contents

Keywords: Trump tax bill, Republican divisions, tax reform, GOP infighting, House Republicans, Senate Republicans, tax cuts, legislative gridlock, political analysis

President Trump's ambitious tax reform plan faces a significant hurdle: deep divisions within his own Republican party. The proposed tax cuts, intended to stimulate the economy, are caught in a crossfire of conflicting ideologies and political maneuvering, raising serious questions about whether the bill will ever become law. This analysis explores the key fault lines within the GOP and assesses the potential for Republican divisions to sink the Trump tax bill.

The Fractured Republican Party: A House Divided?

The Republican party, far from being a unified bloc, is comprised of several distinct factions, each with its own priorities and reservations regarding the proposed tax reform. These divisions are creating significant obstacles to the bill's passage.

-

Policy Disagreements: The Trump tax bill has sparked intense debate over key provisions. Conservative Republicans push for deep cuts across the board, including significant reductions in corporate tax rates. Moderate Republicans, however, express concerns about the potential impact on the national debt and the distribution of tax benefits. Libertarian Republicans might favor a broader tax simplification, even if it means fewer specific cuts. The differing views on issues like the estate tax, individual income tax brackets, and deductions for state and local taxes are creating significant friction.

-

Key Republican Figures and Their Stances: While President Trump actively champions the bill, key figures like Senate Majority Leader Mitch McConnell and House Speaker Paul Ryan face the challenge of navigating these internal conflicts. Their strategies, whether through compromise or strong-arm tactics, will greatly influence the bill’s fate. Individual senators, particularly those representing swing states, hold significant power to alter or even block the legislation.

-

Lobbying Influence: Powerful lobbyist groups representing various sectors of the economy are actively involved, further complicating the legislative process. Their influence on individual lawmakers adds another layer of complexity to the already fraught political landscape. The battle over deductions and tax loopholes highlights the power of these special interest groups in shaping the final version of the bill, if it passes at all.

Senate Challenges: A Path to Failure?

The Senate poses a particularly formidable challenge to the Trump tax bill. The potential for a filibuster—a tactic used by the minority party to block legislation—significantly increases the difficulty of securing the necessary 60 votes for passage.

-

Amendments and Their Impact: Even if the bill manages to overcome a filibuster, the Senate amendment process could significantly alter its original form. Amendments proposed by individual senators could add or remove provisions, potentially upsetting the delicate balance of compromises already made within the Republican party.

-

Swing Votes and Political Influence: The influence of moderate Republicans, and even a few Democratic senators, is paramount. These swing votes hold the power to shape the final legislation, potentially leading to watered-down tax cuts or even the complete defeat of the bill. Public pressure and media scrutiny on these senators will also play a significant role.

-

Public Opinion and Media Scrutiny: Negative public reaction to certain aspects of the bill, fueled by media coverage, could sway undecided senators and influence the political calculations surrounding the legislation. Negative media portrayal of particular provisions, such as those benefiting wealthy individuals or corporations, can significantly impact public perception and sway the debate.

Economic Consequences of Failure: What Happens Next?

The failure of the Trump tax bill would carry significant economic ramifications. The uncertainty surrounding the bill's fate already affects investor confidence, creating a climate of uncertainty that discourages investment and economic expansion.

-

Impact on the Stock Market and Investor Confidence: The lack of clarity regarding tax policy negatively impacts the stock market, as investors react to uncertainty by potentially pulling their investments or delaying investment decisions. This can create a negative feedback loop, further depressing economic activity.

-

Effects on Economic Growth and Job Creation: A failure to pass the bill could stifle economic growth by removing the anticipated stimulus of tax cuts. This could negatively impact job creation as businesses postpone expansion plans or even implement layoffs due to a lack of confidence in future tax policy.

-

Consequences for the National Debt: While the bill aims for tax cuts, the long-term impact on the national debt remains a point of contention. Failure to pass a bill may lead to continued budget deficits or even necessitate further spending cuts, potentially triggering further negative consequences.

The Role of the Trump Administration in Navigating Divisions

The Trump administration faces a formidable task in uniting its party and pushing the tax bill through Congress.

-

Executive Power and Influence: The President can use his influence to lobby individual lawmakers, highlighting the benefits of the bill and attempting to address concerns. He can also leverage executive power to implement certain aspects of the plan through executive orders, though this approach has its own limitations and potential legal challenges.

-

Compromises and Appeasement: The administration might be forced to make compromises to appease different factions within the Republican party, potentially watering down some of the original tax cuts to gain necessary support. This process of compromise could lead to a final bill that differs greatly from the initial proposal.

-

Effectiveness of Trump's Negotiating Tactics: President Trump’s negotiating style, characterized by a combination of pressure and persuasion, will play a crucial role in determining the bill’s success. His effectiveness in navigating the complex political landscape and securing the necessary votes will be a key factor in the bill's fate.

Conclusion

The Trump tax bill faces an uphill battle, largely due to the significant divisions within the Republican party. The differing priorities of conservative, moderate, and libertarian Republicans, combined with the challenges posed by the Senate and the potential for filibusters, create a highly uncertain outlook for the bill's passage. Failure to pass the legislation carries significant economic risks, including negative impacts on investor confidence, economic growth, and the national debt. The Trump administration's ability to navigate these internal conflicts and effectively utilize its political capital will ultimately determine the fate of this ambitious piece of legislation. Stay informed about the evolving situation regarding the Trump tax bill and the potential for Republican divisions to shape its fate. Follow our updates for the latest political analysis on this critical piece of legislation. Learn more about the potential impact of the Trump tax bill and the ongoing Republican divisions.

Featured Posts

-

Dari Zuffenhausen Ke Dunia Menelusuri Sejarah Porsche 356

Apr 29, 2025

Dari Zuffenhausen Ke Dunia Menelusuri Sejarah Porsche 356

Apr 29, 2025 -

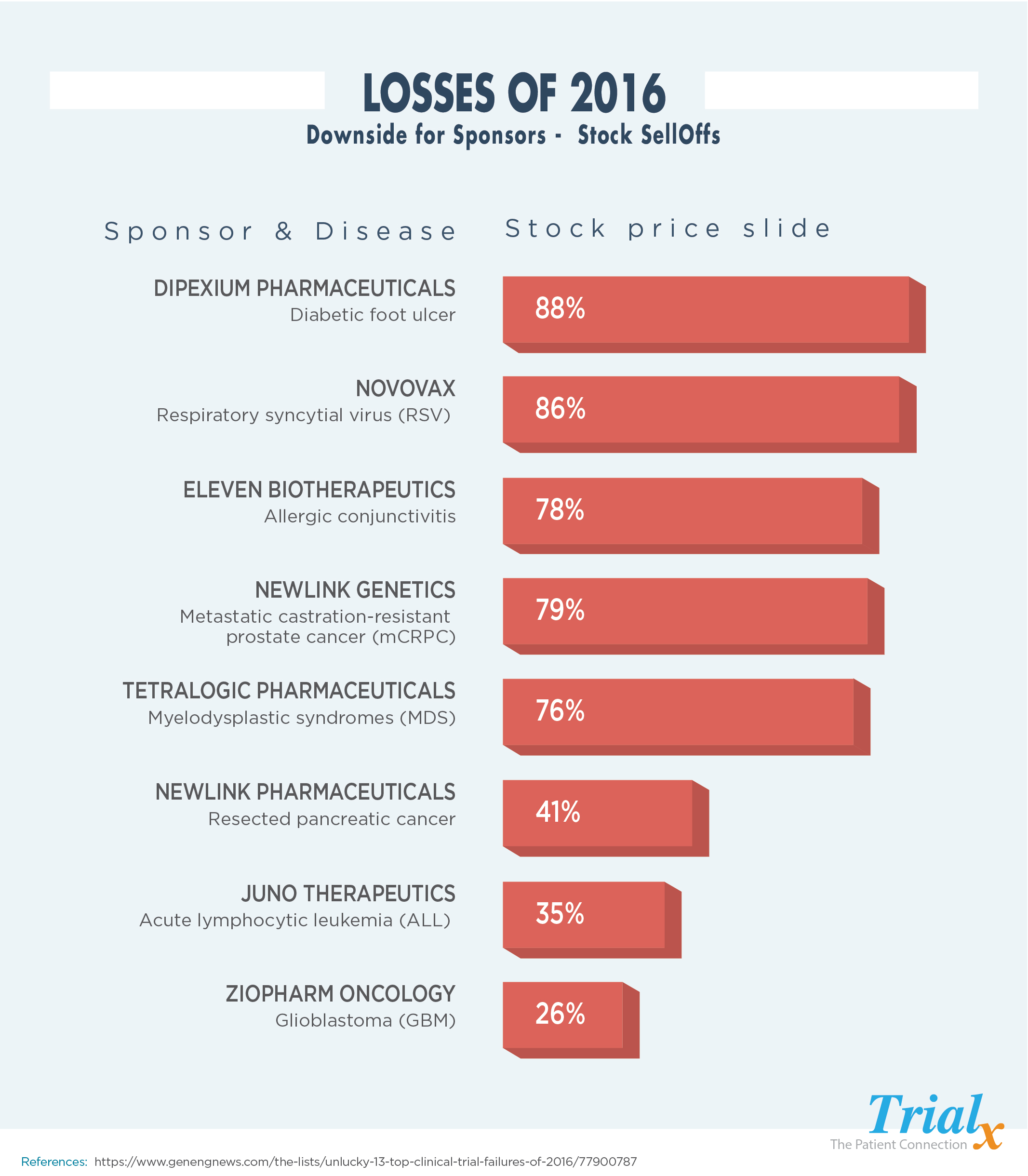

Akesos Clinical Trial Failure Sends Stock Prices Tumbling

Apr 29, 2025

Akesos Clinical Trial Failure Sends Stock Prices Tumbling

Apr 29, 2025 -

Convicted Cardinals Demand To Participate In Papal Conclave

Apr 29, 2025

Convicted Cardinals Demand To Participate In Papal Conclave

Apr 29, 2025 -

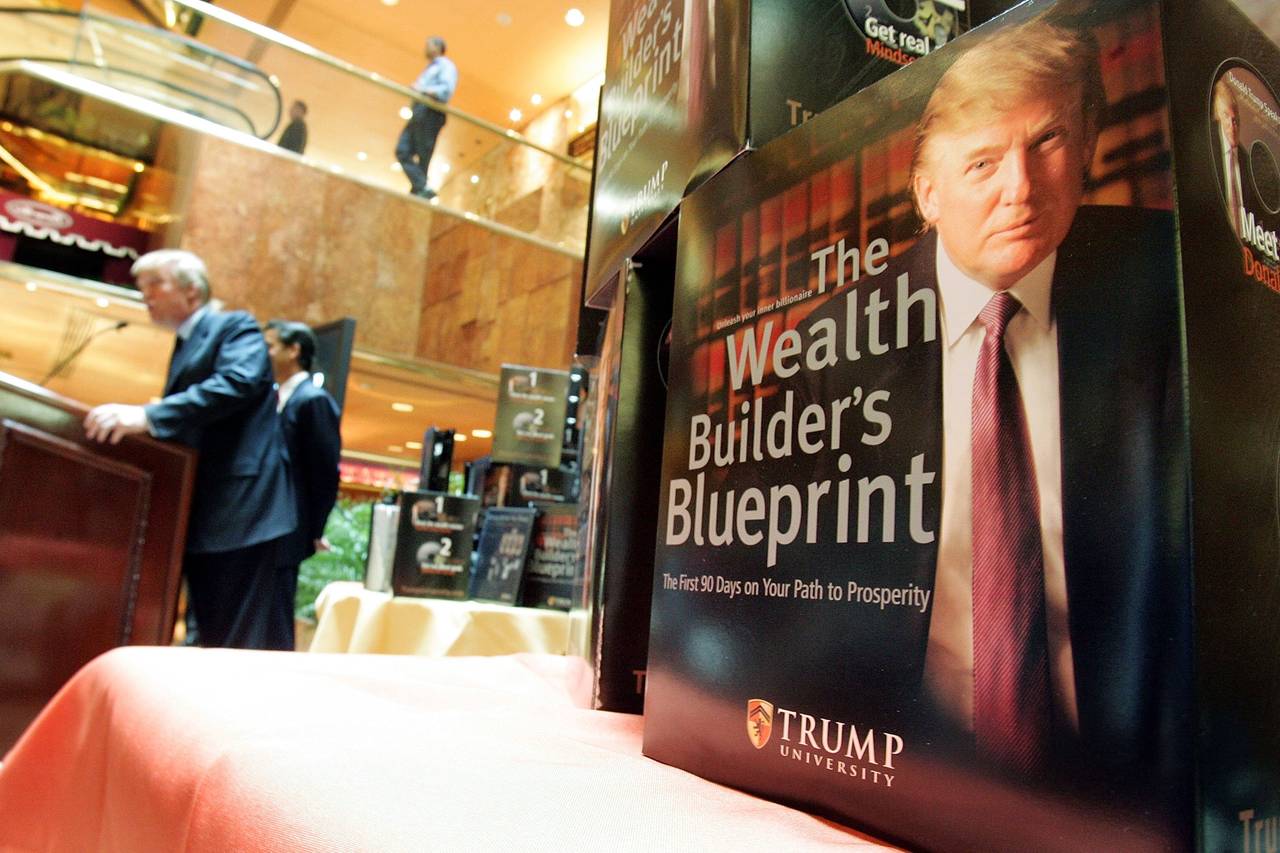

Private University Alliance Challenges Trump Administration

Apr 29, 2025

Private University Alliance Challenges Trump Administration

Apr 29, 2025 -

Klauss Entlassen Pacult Als Rapid Trainer Gefordert

Apr 29, 2025

Klauss Entlassen Pacult Als Rapid Trainer Gefordert

Apr 29, 2025