XRP Commodity Classification: Implications Of The Ripple-SEC Settlement

Table of Contents

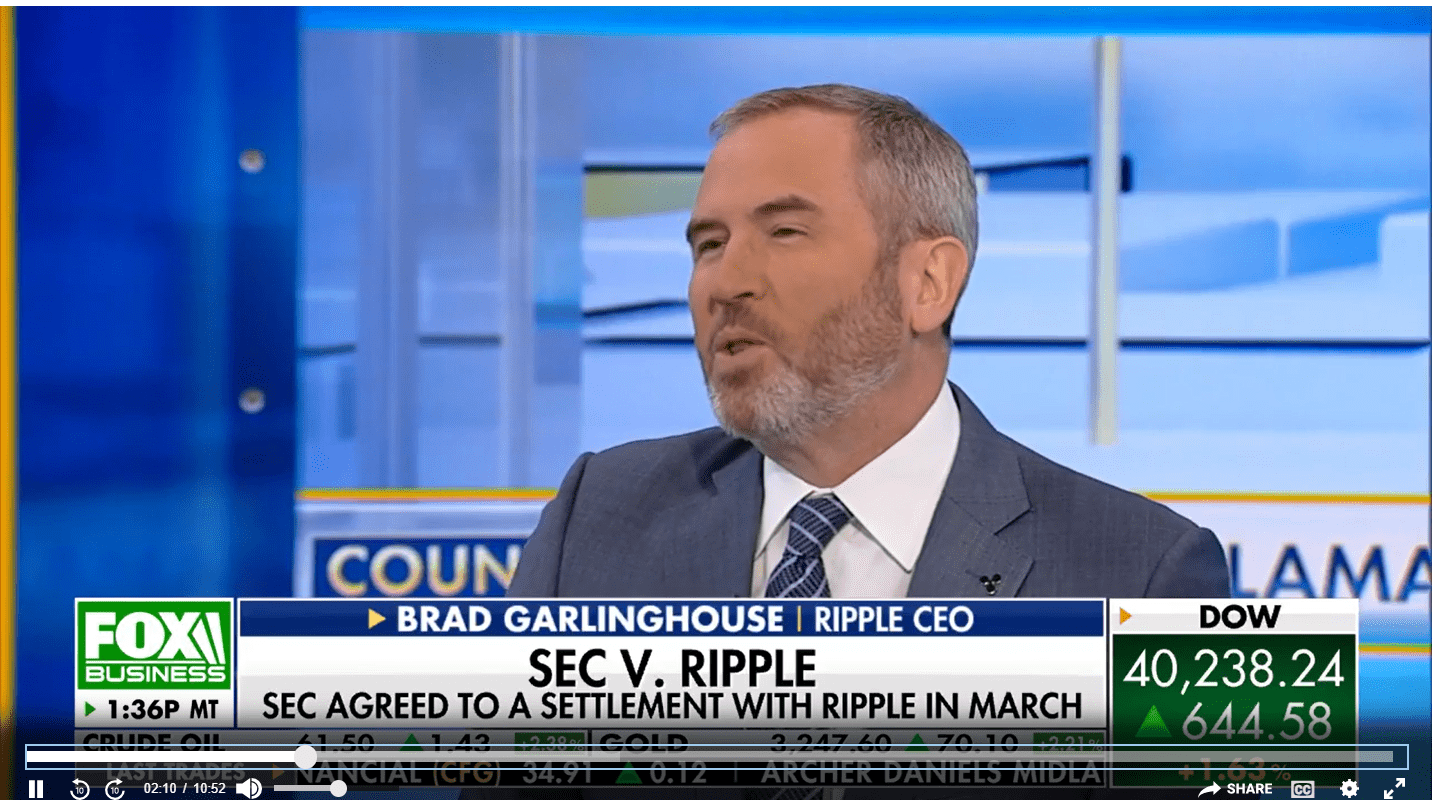

The Ripple-SEC Settlement: A Summary

The lengthy legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) centered on the SEC's claim that Ripple's sales of XRP constituted unregistered securities offerings. The SEC alleged that Ripple violated federal securities laws by selling XRP without proper registration. This classification as a security had significant consequences, impacting XRP's trading and accessibility.

- SEC's allegations against Ripple: The SEC argued that XRP sales were investment contracts, meeting the Howey Test criteria, thus qualifying as securities.

- Ripple's defense and counterarguments: Ripple countered that XRP was a currency and a utility token, not a security, and that its sales did not constitute investment contracts. They emphasized XRP's decentralized nature and its use in a functional payment system.

- Key terms of the settlement, focusing on XRP classification implications: The settlement didn't explicitly classify XRP as a commodity, but it avoided a definitive court ruling on whether XRP was a security. The settlement focused on specific aspects of Ripple's past XRP sales.

- Financial penalties imposed on Ripple: Ripple paid a substantial fine as part of the settlement, without admitting or denying wrongdoing. This aspect influenced the market perception of the outcome and the future of XRP.

XRP's Classification as a Commodity: Legal Ramifications

The Ripple-SEC settlement, while not explicitly declaring XRP a commodity, has opened the door for interpreting its status differently than a security. This commodity classification, even if implicit, carries significant legal ramifications.

- How commodity classification affects regulatory oversight: If treated as a commodity, XRP would fall under the purview of the Commodity Futures Trading Commission (CFTC), rather than the SEC. This shift in regulatory oversight could lead to different rules concerning trading, reporting, and compliance.

- Implications for exchanges listing XRP: Exchanges that delisted XRP following the SEC's initial lawsuit may reconsider their stance, now that the settlement suggests less regulatory risk concerning XRP's classification as a security.

- Impact on future fundraising and offerings involving XRP: The outcome might influence how future projects structure their token offerings to mitigate the risk of security classification. Understanding the nuances of XRP classification sets a precedent.

- Comparison to how other cryptocurrencies are classified: The Ripple-SEC case sets a precedent, potentially influencing how other cryptocurrencies are classified and regulated, adding further complexity to the ever-evolving regulatory landscape.

Impact on XRP Investors and Market Sentiment

The Ripple-SEC settlement significantly impacted XRP investors and market sentiment.

- Price volatility following the settlement announcement: The price of XRP experienced considerable volatility following the settlement announcement, reflecting the uncertainty and anticipation surrounding the implications of the ruling.

- Changes in investor confidence and trading volume: Investor confidence, along with trading volume, saw fluctuations based on interpretations of the settlement's impact on XRP's future. Many analysts are focused on the long-term implications of XRP commodity classification.

- The effect on long-term XRP holders versus short-term traders: Long-term holders may have viewed the settlement as a positive development, while short-term traders might have reacted more acutely to price swings. The effect of XRP commodity classification is still playing out.

- Potential for future price fluctuations based on the classification: Future price fluctuations will depend largely on how the market interprets the ongoing implications of the settlement and any subsequent regulatory clarifications. Continued uncertainty around XRP classification is a key factor.

The Broader Implications for the Crypto Industry

The Ripple-SEC settlement has broader implications for the crypto industry and regulatory clarity.

- Precedents set for future regulatory actions against crypto projects: The settlement establishes a precedent that could influence future regulatory actions against other cryptocurrency projects, particularly concerning token classifications and fundraising practices.

- Influence on how other projects structure their offerings to avoid security classification: Projects might now restructure their offerings to minimize the risk of security classification and the associated regulatory burdens. This is a major concern when considering XRP commodity classification.

- The ongoing debate about regulatory frameworks for cryptocurrencies: The settlement highlights the ongoing need for clear and comprehensive regulatory frameworks for cryptocurrencies, which are currently largely undefined across many jurisdictions.

- Potential for increased regulatory scrutiny across the digital asset space: The settlement may increase regulatory scrutiny across the digital asset space, leading to stricter compliance requirements and potentially hindering innovation.

The Future of XRP and Regulatory Uncertainty

Despite the settlement, considerable uncertainty remains.

- Potential for future legal challenges or interpretations of the settlement: The settlement leaves room for future legal challenges or varying interpretations, depending on how courts and regulatory bodies interpret the implications of the ruling.

- The need for clearer regulatory guidance on cryptocurrency classification: The crypto industry needs clearer regulatory guidance on how to classify different types of crypto assets, preventing future conflicts and uncertainty. The debate surrounding XRP commodity classification highlights this need.

- The role of international regulatory bodies in shaping the future of XRP: International regulatory bodies will play a key role in shaping the future regulatory landscape for XRP, influencing its global adoption and accessibility.

Conclusion

The Ripple-SEC settlement and its resulting implications for XRP's commodity classification have significant ramifications for investors, exchanges, and the cryptocurrency industry as a whole. Understanding the legal, market, and regulatory consequences of this landmark case is crucial for navigating the evolving landscape of digital assets. Staying informed about updates and future developments regarding XRP commodity classification is vital for making informed investment decisions and understanding the future of this prominent cryptocurrency. Continue researching and following the developments in XRP classification to stay ahead in this dynamic space.

Featured Posts

-

Branch Officers Resignations Rock Reform Uk Mp Treatment Under Scrutiny

May 02, 2025

Branch Officers Resignations Rock Reform Uk Mp Treatment Under Scrutiny

May 02, 2025 -

Open Ai And The Ftc Understanding The Ongoing Investigation Into Chat Gpt

May 02, 2025

Open Ai And The Ftc Understanding The Ongoing Investigation Into Chat Gpt

May 02, 2025 -

Ripple Vs Sec The 50 M Settlement And Its Implications For Xrp Investors

May 02, 2025

Ripple Vs Sec The 50 M Settlement And Its Implications For Xrp Investors

May 02, 2025 -

Vermijd Piekuren Slim Opladen Met Enexis In Noord Nederland

May 02, 2025

Vermijd Piekuren Slim Opladen Met Enexis In Noord Nederland

May 02, 2025 -

Actress Priscilla Pointer Known For Carrie Dead At 100

May 02, 2025

Actress Priscilla Pointer Known For Carrie Dead At 100

May 02, 2025