XRP: ETF Hopes, SEC Shakeups, And A Ripple Of Change

Table of Contents

The Ripple-SEC Lawsuit: A Defining Factor for XRP's Future

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) is arguably the most significant factor impacting XRP's price and future. This protracted legal fight centers around the SEC's claim that XRP is an unregistered security. The outcome will have profound consequences for the cryptocurrency market as a whole.

-

Overview of the lawsuit: The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This case has been ongoing for several years, featuring numerous court filings and arguments.

-

Potential outcomes and their impact: A ruling in favor of the SEC could severely damage XRP's price and adoption, potentially leading to delisting from exchanges. A victory for Ripple, however, could significantly boost XRP's price and legitimacy, paving the way for broader institutional adoption.

-

The SEC's arguments: The SEC argues that XRP's distribution and sales were akin to an investment contract, fulfilling the Howey Test criteria for a security. They emphasize Ripple's control over XRP distribution and the expectation of profit by investors.

-

Ripple's counterarguments: Ripple maintains that XRP is a decentralized digital asset, not a security, and that its distribution was not undertaken in a manner that satisfies the Howey Test. They highlight XRP's functionality as a medium of exchange within their RippleNet payment system.

-

Impact on investor sentiment and market volatility: The uncertainty surrounding the lawsuit has created significant volatility in XRP's price. Positive developments tend to lead to price surges, while negative developments trigger sharp drops. This uncertainty greatly affects investor sentiment and confidence in the asset.

The Alluring Prospect of an XRP ETF

The possibility of an XRP ETF (Exchange Traded Fund) represents a significant potential catalyst for XRP's growth and mainstream adoption. An XRP ETF would provide institutional investors with a regulated and easily accessible way to invest in XRP.

-

Potential benefits of an XRP ETF: An ETF would greatly increase XRP's liquidity and accessibility, potentially attracting significant institutional investment. This inflow of capital could lead to substantial price appreciation.

-

Regulatory hurdles: The approval of an XRP ETF hinges on regulatory clarity regarding XRP's classification as a security. The SEC's stance on XRP will play a crucial role in determining whether an ETF application is approved.

-

Impact on XRP's price and liquidity: Approval of an XRP ETF would almost certainly lead to increased trading volume and price appreciation. The increased liquidity would make XRP more attractive to both institutional and retail investors.

-

Comparison to other successful cryptocurrency ETFs: The success of Bitcoin and Ethereum ETFs provides a model for the potential impact of an XRP ETF. However, the regulatory landscape for XRP remains unique due to the ongoing lawsuit.

-

Timing and likelihood of approval: The likelihood of XRP ETF approval is directly tied to the outcome of the Ripple-SEC lawsuit. A favorable ruling would dramatically increase the chances of approval, potentially within a relatively short timeframe.

SEC Regulatory Scrutiny: A Broader Crypto Market Concern

The SEC's actions against Ripple are not isolated incidents. The commission has increased its scrutiny of the cryptocurrency market as a whole, targeting numerous projects for alleged securities violations.

-

SEC actions against other crypto projects: The SEC's aggressive approach has affected multiple cryptocurrency projects, underscoring the need for regulatory clarity within the industry.

-

Impact of SEC regulations on the broader crypto market: The SEC's actions have created uncertainty and volatility across the entire cryptocurrency market, impacting investor confidence and hindering innovation.

-

Implications of regulatory uncertainty for XRP investors: The regulatory uncertainty surrounding XRP specifically, and the cryptocurrency market generally, presents significant risks to investors.

-

Potential future regulatory changes affecting XRP: The future regulatory landscape for cryptocurrencies remains unclear, with ongoing debates about appropriate regulations and their impact on innovation and market growth.

XRP's Technological Advantages and Use Cases Beyond the SEC Battle

Beyond the legal battles and regulatory hurdles, XRP possesses several technological advantages that support its long-term potential.

-

XRP technology and RippleNet: XRP is designed for fast, low-cost cross-border payments through RippleNet, a global payment network utilized by financial institutions.

-

Real-world applications in cross-border payments: RippleNet is already used by numerous banks and financial institutions to facilitate faster and cheaper international money transfers.

-

Efficiency and cost-effectiveness of XRP transactions: XRP transactions boast significantly faster processing times and lower fees compared to traditional banking systems.

-

Differentiation from other cryptocurrencies: XRP's focus on utility in cross-border payments differentiates it from other cryptocurrencies that primarily focus on speculation or decentralized applications.

-

Potential future use cases and technological advancements: Future advancements in XRP's technology and integration with other systems could further expand its use cases and enhance its capabilities.

Conclusion

The future of XRP remains intertwined with the outcome of the Ripple-SEC lawsuit and the possibility of an XRP ETF. While regulatory uncertainty continues to create volatility, XRP's underlying technology and potential use cases present a compelling case for its long-term prospects. The ongoing legal battles highlight the importance of clear regulations within the cryptocurrency space, impacting not just XRP, but the entire market.

Call to Action: Stay informed about the latest developments surrounding XRP, the Ripple lawsuit, and the potential for an XRP ETF. Understanding the complexities of XRP and its evolving regulatory landscape is crucial for navigating the dynamic world of cryptocurrency investment. Continue your research on XRP and make informed decisions based on the latest information.

Featured Posts

-

Bbc Faces Unprecedented Challenges After 1 Billion Income Drop

May 02, 2025

Bbc Faces Unprecedented Challenges After 1 Billion Income Drop

May 02, 2025 -

Understanding The Ripple 50 M Sec Settlement A Look Ahead For Xrp

May 02, 2025

Understanding The Ripple 50 M Sec Settlement A Look Ahead For Xrp

May 02, 2025 -

Program Tabung Baitulmal Sarawak Kembali Ke Sekolah 2025 Bantu 125 Anak Asnaf Di Sibu

May 02, 2025

Program Tabung Baitulmal Sarawak Kembali Ke Sekolah 2025 Bantu 125 Anak Asnaf Di Sibu

May 02, 2025 -

Ripple Xrp 15 000 Surge Can It Make You A Millionaire

May 02, 2025

Ripple Xrp 15 000 Surge Can It Make You A Millionaire

May 02, 2025 -

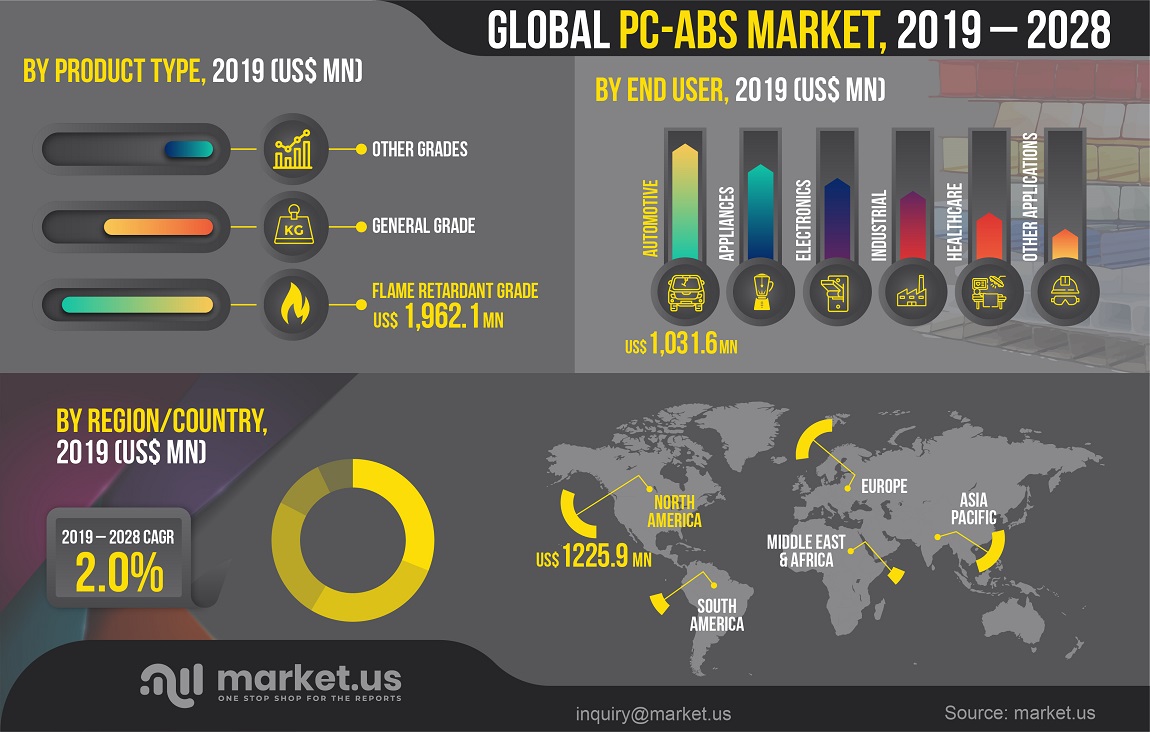

The Saudi Abs Market How A Regulatory Change Created A Major Opportunity

May 02, 2025

The Saudi Abs Market How A Regulatory Change Created A Major Opportunity

May 02, 2025