XRP News: SEC Commodity Classification And Regulatory Uncertainty

Table of Contents

The SEC's Case Against Ripple and its Impact on XRP

The SEC's lawsuit against Ripple Labs, filed in December 2020, is at the heart of the current uncertainty surrounding XRP. The outcome of this case will significantly shape the future of XRP and could set a precedent for the regulation of other cryptocurrencies.

Key Allegations of the SEC Lawsuit:

- Unregistered Securities Offering: The SEC alleges that Ripple conducted an unregistered securities offering by selling XRP to the public.

- Investment Contract Argument: The SEC argues that XRP sales constituted an "investment contract," meeting the Howey Test criteria, meaning investors purchased XRP with the expectation of profit based on Ripple's efforts.

- Market Impact: The lawsuit significantly impacted XRP's price and trading volume. Many exchanges delisted XRP following the SEC's filing, limiting accessibility and creating volatility.

Ripple's Defense and Arguments:

- Utility Token Argument: Ripple maintains that XRP is a utility token used within its payment network, not a security. They argue it facilitates transactions and isn't offered as an investment.

- Programmatic Sales: Ripple emphasizes that XRP sales were largely programmatic and not directed at specific investors seeking profit from Ripple's efforts.

- Legal Strategies: Ripple's defense strategy involves presenting expert testimony, legal precedent, and arguments focused on distinguishing XRP from securities.

The Ongoing Legal Battle and its Uncertain Outcomes:

The legal battle has been protracted, involving numerous court filings, motions, and expert testimonies. Key developments include:

- Partial Summary Judgement: The court ruled on aspects of the case, offering some clarity but leaving much still unresolved.

- Expert Witness Testimony: Both sides presented expert witnesses to support their arguments, leading to detailed analyses of market behavior and XRP's functionality.

- Potential Outcomes: The potential outcomes range from a complete victory for the SEC, declaring XRP a security, to a complete dismissal of the case, or a more nuanced ruling defining certain XRP sales as securities and others as not.

The Broader Implications of the XRP Commodity Classification Debate

The XRP case extends beyond Ripple's immediate future, impacting investors, the crypto market, and the broader regulatory landscape.

Impact on Investors:

- Risk and Uncertainty: XRP investors face significant risk and uncertainty due to the ongoing legal battle. The value of their holdings is directly tied to the outcome of the case.

- Due Diligence: Investors should exercise extreme due diligence before investing in XRP, fully understanding the potential for significant losses.

- Potential Financial Consequences: Depending on the outcome, XRP holders could see significant gains or substantial losses.

Impact on the Crypto Market:

- Regulatory Precedent: The SEC's actions against Ripple have sent shockwaves through the crypto market, creating uncertainty about the regulatory status of other cryptocurrencies.

- US and Global Regulations: The case highlights the evolving regulatory landscape for cryptocurrencies in the US and globally, emphasizing the need for clear and consistent rules.

- Influence on Future Decisions: The outcome will undoubtedly influence future regulatory decisions concerning other crypto assets and platforms.

The Future of XRP and Regulatory Clarity:

Several scenarios are possible after the SEC lawsuit concludes:

- XRP Classified as a Security: This would severely restrict XRP's trading and usage in the US.

- XRP Classified as a Commodity or Utility Token: This would allow for greater freedom in trading and usage, but regulatory clarity might still be lacking.

- Negotiated Settlement: A settlement between Ripple and the SEC could result in a compromise that shapes future regulatory approaches.

Staying Informed about XRP News and Regulatory Developments

Staying up-to-date on the latest developments is crucial for anyone interested in XRP.

Reliable Sources of Information:

- Reputable News Outlets: Follow established financial news sources that provide balanced coverage of the legal proceedings.

- Legal Filings: Access court documents directly through PACER or official court websites for accurate information.

- Regulatory Announcements: Monitor official announcements from the SEC and other relevant regulatory bodies.

Strategies for Managing Risk in the XRP Market:

- Diversification: Diversify your investment portfolio to mitigate the risk associated with XRP's uncertain future.

- Risk Tolerance: Only invest in XRP if you have a high risk tolerance and fully understand the potential for significant losses.

- Position Sizing: Don't invest more than you can afford to lose.

Conclusion: Understanding the Future of XRP Amidst Regulatory Uncertainty

The SEC's classification of XRP remains a pivotal point of contention, creating significant uncertainty for investors. Staying informed about XRP News: SEC Commodity Classification and Regulatory Uncertainty through reputable sources and employing sound risk management strategies is paramount. The outcome of the Ripple case will have far-reaching consequences, not only for XRP but for the entire crypto market. Continue researching the latest developments and make informed decisions based on your own risk tolerance and investment goals. For further reading, explore resources from the SEC, reputable financial news outlets, and legal analysis websites covering the Ripple case.

Featured Posts

-

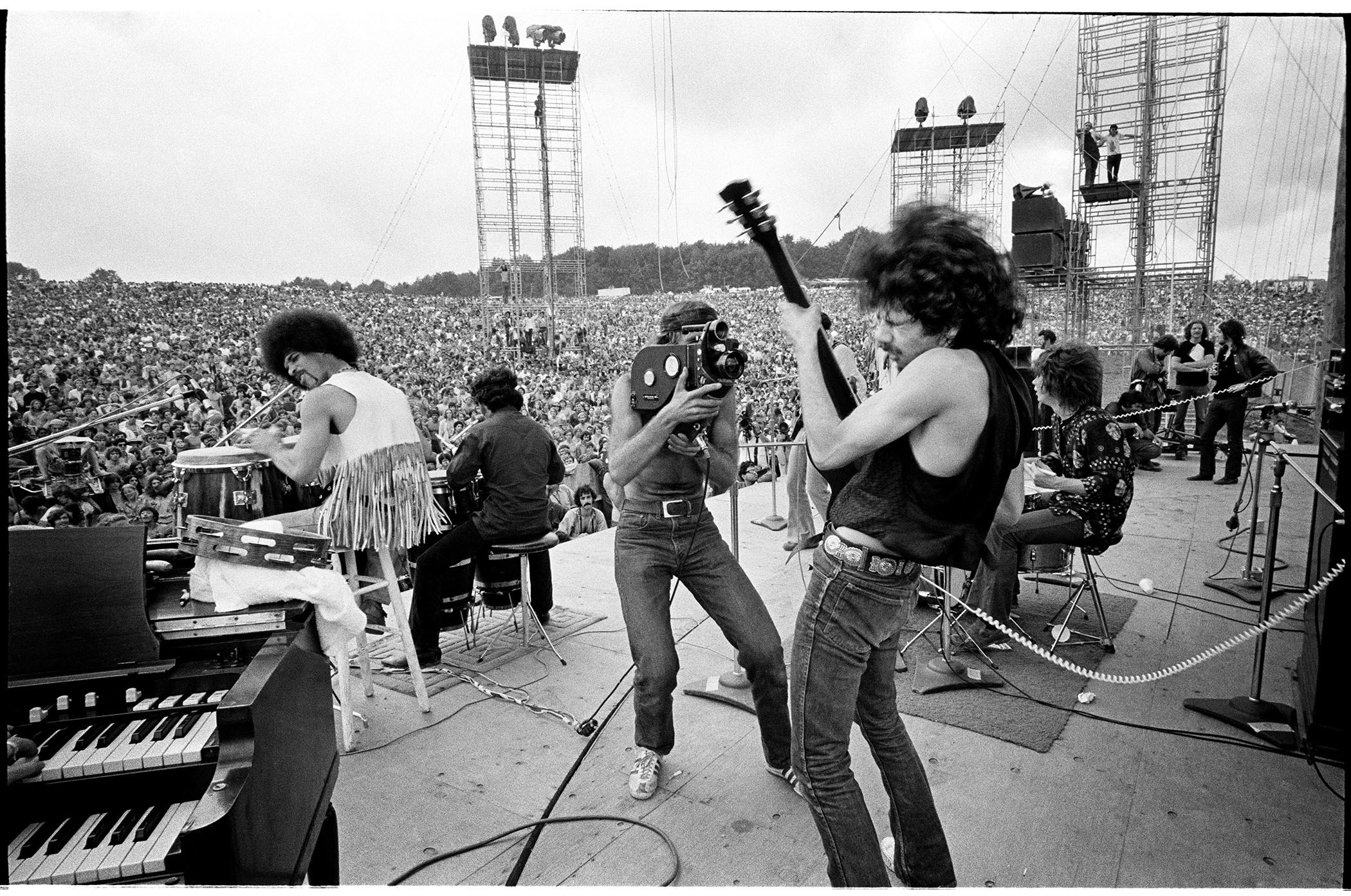

Iconic Bands Strict Festival Rule Life Or Death Situation Only

May 02, 2025

Iconic Bands Strict Festival Rule Life Or Death Situation Only

May 02, 2025 -

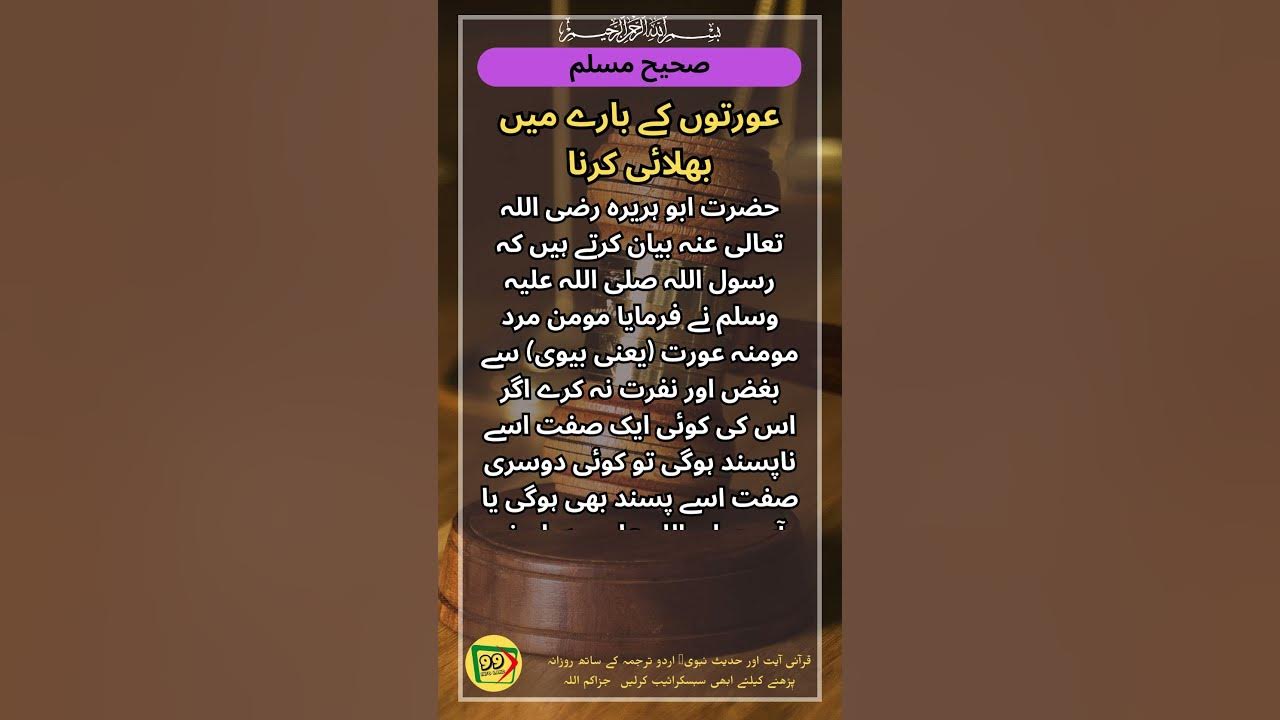

Kya Shhr Ewrt Hmyshh Ke Lye Khnjr Ke Saye Tle Rhe Ga Ayksprys Ardw Ky Rwshny Myn

May 02, 2025

Kya Shhr Ewrt Hmyshh Ke Lye Khnjr Ke Saye Tle Rhe Ga Ayksprys Ardw Ky Rwshny Myn

May 02, 2025 -

Ripple Xrp Settlement Latest News On Sec Commodity Classification

May 02, 2025

Ripple Xrp Settlement Latest News On Sec Commodity Classification

May 02, 2025 -

Is This Really Christina Aguilera Fans React To Heavily Edited Photos

May 02, 2025

Is This Really Christina Aguilera Fans React To Heavily Edited Photos

May 02, 2025 -

The Walking Deads Negan In Fortnite Jeffrey Dean Morgans Interview

May 02, 2025

The Walking Deads Negan In Fortnite Jeffrey Dean Morgans Interview

May 02, 2025