XRP Price: Awaiting Recovery Despite Derivatives Market Stagnation

Table of Contents

Ripple Lawsuit's Impact on XRP Price

The ongoing Ripple lawsuit against the SEC significantly impacts XRP's price and overall market sentiment. Understanding the nuances of this legal battle is crucial for assessing XRP's future.

Positive Developments and Uncertainty

While the lawsuit continues, there have been positive developments for Ripple.

- Recent court rulings favoring Ripple: Judge Analisa Torres' partial summary judgment ruling in July 2023 declared that XRP sales on public exchanges were not securities offerings. This was a major victory for Ripple and boosted XRP price temporarily.

- Ongoing legal battles: Appeals from the SEC are still pending, creating lingering uncertainty. The final outcome remains unclear, adding volatility to the XRP price.

- Potential impact on future price movements: The final ruling will profoundly affect XRP's regulatory status in the US and globally, potentially unlocking significant price appreciation if the ruling is fully favorable to Ripple.

The legal battles surrounding XRP continue to create uncertainty. A definitive victory for Ripple could result in a surge in investor confidence and trading volume, leading to a substantial increase in XRP's price. Conversely, a negative ruling could trigger further price drops. The situation demands close monitoring of legal proceedings and their implications for XRP's regulatory landscape.

Regulatory Uncertainty and Market Sentiment

Regulatory uncertainty surrounding XRP remains a major factor influencing investor confidence and market sentiment.

- SEC's stance on XRP: The SEC's classification of XRP as an unregistered security casts a long shadow over the cryptocurrency. This stance impacts institutional investment and general market acceptance.

- Impact of regulatory clarity (or lack thereof) on trading volume and price: Clearer regulatory guidelines could significantly increase trading volume and investor confidence, potentially leading to a substantial price increase.

- Sentiment analysis from social media and news sources: Monitoring social media and news sentiment reveals considerable volatility in investor opinion. Positive news tends to boost prices, while negative news has the opposite effect.

Regulatory uncertainty contributes to market volatility and discourages large institutional investments. Clarity from regulatory bodies is paramount for XRP's future price stability and growth. The absence of clear guidelines keeps institutional investors on the sidelines, limiting liquidity and price discovery.

Stagnation in the XRP Derivatives Market

The XRP derivatives market, encompassing futures and options contracts, is currently experiencing significant stagnation.

Low Trading Volume and Open Interest

The XRP derivatives market exhibits considerably low trading volumes and open interest compared to other major cryptocurrencies.

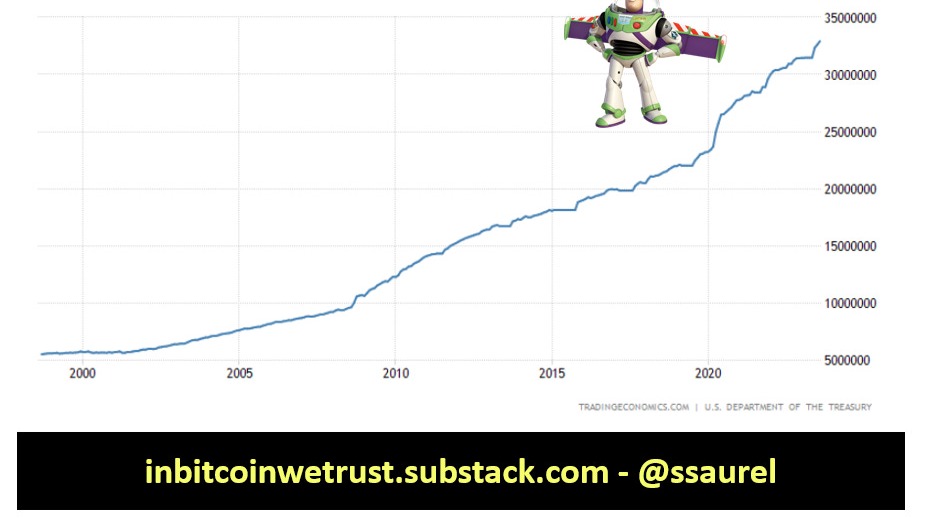

- Data on trading volumes in futures and options contracts: Data from major exchanges shows substantially lower trading volumes in XRP derivatives compared to Bitcoin or Ethereum derivatives.

- Comparison with other cryptocurrencies: This lack of activity highlights a significant gap in institutional participation and overall market confidence.

- Potential reasons for low activity: Regulatory concerns and the lack of a robust institutional infrastructure likely contribute to this low activity.

The low liquidity in the XRP derivatives market hampers price discovery and increases price volatility. This makes it harder for investors to accurately gauge the true value of XRP and can lead to exaggerated price swings based on limited trading activity. Visualizing this with charts and graphs would underscore the severity of the situation.

Lack of Institutional Participation

Institutional investors' limited involvement in the XRP derivatives market is a key factor contributing to its stagnation.

- Comparison with other cryptocurrencies with higher institutional participation: Bitcoin and Ethereum boast significantly higher institutional participation in their derivatives markets, indicating a notable difference in market maturity and investor confidence.

- Reasons for institutional reluctance: The regulatory risks surrounding XRP and the lack of established infrastructure for institutional-grade trading are primary deterrents.

Institutional investors play a crucial role in stabilizing prices and increasing market liquidity. Their absence in the XRP derivatives market exacerbates volatility and limits price discovery, contributing to the current stagnation.

Potential Catalysts for XRP Price Recovery

Despite the current stagnation, several factors could catalyze XRP price recovery.

Positive Ripple Lawsuit Outcome

A favorable outcome in the Ripple lawsuit could be a significant catalyst for XRP's price recovery.

- Price predictions based on various scenarios: Various analysts have offered price predictions ranging from modest gains to substantial increases, depending on the outcome of the lawsuit and market sentiment.

- Potential increase in trading volume and institutional investment: A positive ruling could unlock substantial institutional investment, leading to increased trading volume and price appreciation.

- Positive media coverage and its effects: Favorable news coverage would undoubtedly contribute to positive market sentiment and attract more investors.

A positive resolution would likely lead to a significant surge in XRP's price, potentially reaching levels unseen since its peak. This positive sentiment would attract new investors and fuel further price increases.

Increased Institutional Adoption

Increased institutional adoption is crucial for driving long-term XRP price growth.

- Potential partnerships and integrations with financial institutions: Partnerships with established financial institutions could significantly increase XRP's credibility and adoption.

- The impact of technological advancements (e.g., improved scalability): Continued improvements in XRP's technology, such as enhanced scalability, would make it more attractive to institutional investors.

- Increased utility of XRP in cross-border payments: The increasing use of XRP in cross-border payments demonstrates its real-world utility and attracts further institutional interest.

Broader institutional adoption would lead to increased liquidity, price stability, and ultimately, a sustained rise in XRP's price. This would solidify XRP's position in the cryptocurrency market.

Growing Adoption in the Real World

The expanding use of XRP in real-world applications can significantly impact its price.

- Examples of XRP's use cases (e.g., cross-border payments): XRP's speed and low transaction costs make it suitable for cross-border payments, attracting businesses and individuals.

- Increasing adoption by businesses and individuals: Growing adoption demonstrates XRP's practical value and strengthens its market position.

- The overall impact on market demand: Increased demand due to real-world utility is a critical factor in driving price appreciation.

Real-world applications demonstrate XRP's value beyond speculation, attracting a wider range of users and businesses. This increased demand will eventually translate to higher prices.

Conclusion

The XRP price currently awaits a recovery, hampered by stagnation in the derivatives market and lingering regulatory uncertainty. However, potential catalysts such as a positive Ripple lawsuit outcome, increased institutional adoption, and growing real-world applications could significantly boost the XRP price. The current low liquidity and lack of institutional participation in the XRP derivatives market highlight a crucial area for improvement. While uncertainty remains, understanding these factors is crucial for navigating the XRP market effectively.

While the XRP price awaits recovery, stay informed about the ongoing developments in the Ripple lawsuit and the broader cryptocurrency market. Continue researching the XRP price and its potential for future growth. Thorough due diligence is essential before making any investment decisions regarding XRP.

Featured Posts

-

Xrp Price Awaiting Recovery Despite Derivatives Market Stagnation

May 08, 2025

Xrp Price Awaiting Recovery Despite Derivatives Market Stagnation

May 08, 2025 -

The Long Walk Trailer Simplicity Breeds Fear

May 08, 2025

The Long Walk Trailer Simplicity Breeds Fear

May 08, 2025 -

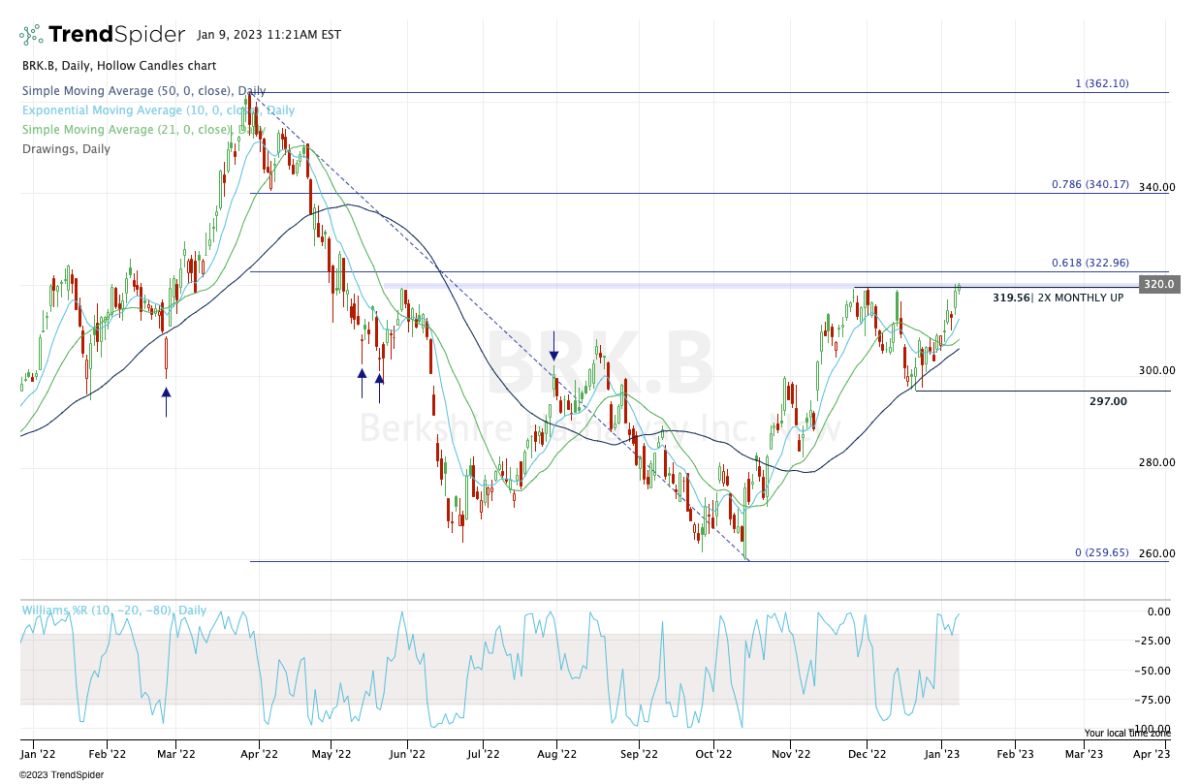

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025 -

Is The Recent Bitcoin Rebound Sustainable Experts Weigh In

May 08, 2025

Is The Recent Bitcoin Rebound Sustainable Experts Weigh In

May 08, 2025 -

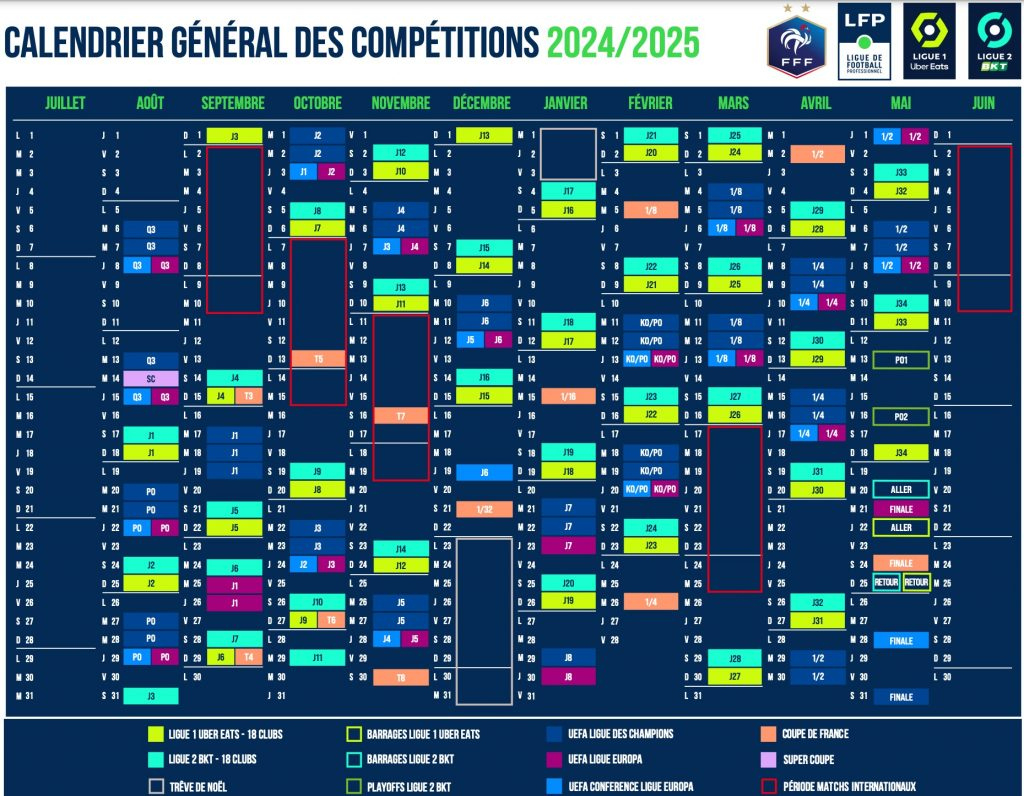

Resultados De La Ligue 1 Psg Gana A Lyon

May 08, 2025

Resultados De La Ligue 1 Psg Gana A Lyon

May 08, 2025