XRP Price Surge: Understanding The 400% Rally And Future Outlook

Table of Contents

Catalysts Behind the XRP Price Explosion

Several key factors have contributed to the explosive growth in XRP price. Let's examine the most significant ones:

The Ripple vs. SEC Lawsuit: A Turning Point?

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has been a major influence on XRP's price trajectory. Positive developments in the case, such as recent court filings and expert testimonies favoring Ripple, have significantly boosted investor sentiment. Potential outcomes, including a settlement or a favorable ruling, could dramatically impact the XRP price.

- Recent court filings: Favorable interpretations of Ripple's arguments regarding XRP's classification have fueled optimism.

- Expert opinions: Positive expert testimony has strengthened the case for Ripple, bolstering investor confidence.

- Potential settlement scenarios: Even a settlement could bring much-needed regulatory clarity, positively affecting the XRP price.

- Impact on investor confidence: Positive news has significantly reduced the uncertainty surrounding XRP, leading to increased investment.

Increased Institutional Adoption: A Sign of Growing Acceptance?

The growing interest from institutional investors is another crucial factor in the XRP price surge. Major financial institutions are increasingly exploring the potential of XRP for cross-border payments and other financial applications. This increased adoption signifies a growing level of confidence in the technology and the long-term prospects of XRP.

- Examples of institutional adoption: While specific examples might be confidential, increased trading volume on major exchanges suggests growing institutional involvement.

- Increased trading volume on major exchanges: Higher trading volumes often indicate increased institutional participation in the market.

- Impact of regulatory clarity: Any positive developments in the SEC lawsuit contribute directly to greater institutional acceptance.

Growing Utility and Ecosystem Development: Expanding the XRP Ledger

The increasing utility of XRP within its ecosystem is another key driver. XRP's use in cross-border payments, its speed, and low transaction fees are attracting users and developers. The ongoing development and expansion of the XRP Ledger (XRPL) further enhance its capabilities and appeal.

- New partnerships: Collaborations with financial institutions and businesses expand the use cases for XRP and increase its visibility.

- Improved transaction speeds: Faster and more efficient transactions attract more users and contribute to network growth.

- Expansion into new markets: Growth into new geographical markets expands the potential user base and increases demand.

- Enhanced features of the XRP Ledger: Constant improvements and upgrades to the XRPL improve its functionality and attract developers.

Market Sentiment and Speculation: FOMO and Market Trends

Market psychology and speculation play a significant role in any cryptocurrency's price fluctuations. The recent XRP rally has been fueled, in part, by Fear Of Missing Out (FOMO), as investors rush to capitalize on the price increase. The overall positive sentiment in the broader cryptocurrency market has also contributed to this surge.

- Social media sentiment analysis: Positive sentiment on social media platforms amplifies the price increase through speculation.

- Correlation with Bitcoin and other cryptocurrencies: XRP's price often correlates with the overall crypto market performance.

- Overall market conditions: A bullish crypto market generally supports upward price movements for individual cryptocurrencies like XRP.

Analyzing the Sustainability of the XRP Rally

While the recent XRP rally is impressive, its sustainability requires careful analysis. We need to consider technical and fundamental factors, as well as the regulatory landscape.

Technical Analysis: Chart Patterns and Indicators

Technical analysis of XRP's price charts reveals important insights. Studying chart patterns, support and resistance levels, trading volume, and other indicators can offer clues about potential future price movements. However, technical analysis alone is not sufficient for predicting the future with certainty.

- Key technical indicators: Monitoring indicators such as moving averages, RSI, and MACD can help assess the momentum and potential reversal points.

- Chart patterns suggesting potential future price movements: Identifying patterns like head and shoulders or triangles can provide insights into potential price directions.

- Risk assessment: Technical analysis helps identify potential risk levels and potential support and resistance areas.

Fundamental Analysis: The Ripple Foundation

A thorough fundamental analysis of Ripple and XRP is crucial. This involves examining Ripple's financial health, technological advancements, its position within the competitive landscape, and its long-term potential.

- Ripple's financial health: Analyzing Ripple's financial statements provides insights into the company's stability and future prospects.

- Technological advancements: Ongoing development and innovation within the XRPL are vital for maintaining XRP's competitiveness.

- Competitive landscape analysis: Understanding XRP's position relative to other cryptocurrencies and payment solutions is important.

- Long-term potential: Assessing the long-term potential for XRP adoption and use cases is crucial for evaluating its investment value.

Regulatory Landscape and its Influence: Navigating Uncertainty

The regulatory landscape remains a significant factor influencing XRP's price. Uncertainty surrounding future regulations in different jurisdictions could impact the price negatively. Clear regulatory guidelines could, conversely, provide a boost.

- Regulatory developments in different jurisdictions: Monitoring regulatory changes globally is critical for assessing potential risks and opportunities.

- Potential impact of future regulations: Understanding potential regulatory outcomes is essential for risk management.

- Risk factors: Regulatory uncertainty presents a significant risk factor that needs to be considered when evaluating XRP's investment potential.

Future Outlook and Price Predictions for XRP

Predicting cryptocurrency prices is inherently challenging, but based on our analysis, we can offer a cautious outlook.

Short-Term Predictions: Navigating Volatility

In the short term, XRP's price is likely to remain volatile. Continued positive developments in the Ripple vs. SEC case could lead to further price increases, but negative news or a broader market downturn could cause corrections.

Long-Term Potential: A Vision for the Future

The long-term potential for XRP hinges on several factors: increased adoption, technological advancements, expansion of use cases, and regulatory clarity. If these factors align favorably, XRP could experience significant growth.

- Potential use cases: Expansion into new sectors and applications will be crucial for long-term success.

- Technological advancements: Continued development and innovation in the XRPL will be vital for remaining competitive.

- Market adoption: Widespread adoption by financial institutions and businesses is essential for long-term growth.

- Regulatory clarity: Clear regulatory frameworks will significantly reduce uncertainty and promote investment.

Conclusion: Navigating the Future of XRP After its 400% Rally

The recent 400% XRP price surge is a result of several interacting factors: positive developments in the Ripple lawsuit, increased institutional adoption, growing utility, and market speculation. While the rally has been impressive, its sustainability depends on continued positive developments and a favorable regulatory environment. The future of XRP price remains uncertain, with both significant upside and downside potential. Therefore, conducting thorough research and staying informed about the latest developments concerning XRP price and the Ripple lawsuit are essential before making any investment decisions. Stay informed about the latest developments affecting XRP price and make informed decisions based on your own thorough research regarding XRP investment, Ripple, and the cryptocurrency market.

Featured Posts

-

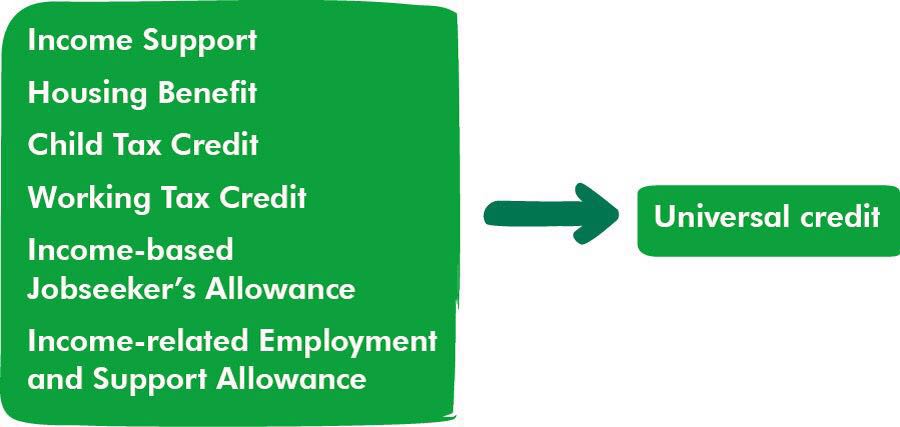

Are You Eligible For A Universal Credit Historical Payment

May 08, 2025

Are You Eligible For A Universal Credit Historical Payment

May 08, 2025 -

Star Wars Andor Showrunner Tony Gilroy Shares His Positive Experience

May 08, 2025

Star Wars Andor Showrunner Tony Gilroy Shares His Positive Experience

May 08, 2025 -

La Geometrie Chez Les Corneilles Une Intelligence Insoupconnee Qui Surpasse Les Babouins

May 08, 2025

La Geometrie Chez Les Corneilles Une Intelligence Insoupconnee Qui Surpasse Les Babouins

May 08, 2025 -

Lahore Weather Forecast Eid Ul Fitr Update Next 2 Days

May 08, 2025

Lahore Weather Forecast Eid Ul Fitr Update Next 2 Days

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025