XRP Regulatory Uncertainty: Latest News And Analysis

Table of Contents

The SEC Lawsuit and its Implications

Background of the SEC vs. Ripple Lawsuit

The core of the XRP regulatory uncertainty lies in the ongoing lawsuit between the Securities and Exchange Commission (SEC) and Ripple Labs. The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. Ripple counters that XRP is a cryptocurrency, not a security, and therefore not subject to the same regulations. This fundamental disagreement forms the basis of the lengthy legal battle.

Recent Developments in the Lawsuit

The SEC vs. Ripple lawsuit has seen numerous twists and turns. Recent key developments include [Insert specific recent court rulings, dates, and brief descriptions. For example: "the Judge's ruling on [Date] regarding the Hinman documents," or "expert testimony from [Expert Name] on [Date] focusing on [Specific topic]"]. These developments significantly impact the potential outcomes and the overall XRP regulatory uncertainty.

- Key Legal Arguments: The SEC argues that XRP's sale and distribution involved an expectation of profit based on Ripple's efforts, thus classifying it as a security. Ripple contends that XRP functions as a decentralized currency, akin to Bitcoin or Ethereum, and was not sold with the expectation of profit driven by Ripple's actions.

- Significant Wins/Setbacks: [Insert specific examples of legal wins or setbacks for each side. e.g., "Ripple's success in [Specific legal motion]" or "the SEC's challenge to [Specific aspect of Ripple's argument]"].

- Potential Outcomes: The lawsuit's outcome could significantly affect the cryptocurrency market, potentially setting a precedent for how other cryptocurrencies are regulated. A ruling in favor of the SEC could severely impact XRP's price and future; a ruling in Ripple's favor could foster greater regulatory clarity and potentially boost XRP's adoption.

- Expert Opinions: Legal experts have offered diverse opinions, with some suggesting [summarize expert opinions supporting the SEC] and others arguing [summarize expert opinions supporting Ripple]. This divergence highlights the complexities of the case and the prevailing XRP regulatory uncertainty.

Impact of Regulatory Uncertainty on XRP Price and Market Sentiment

Price Volatility and Market Reactions

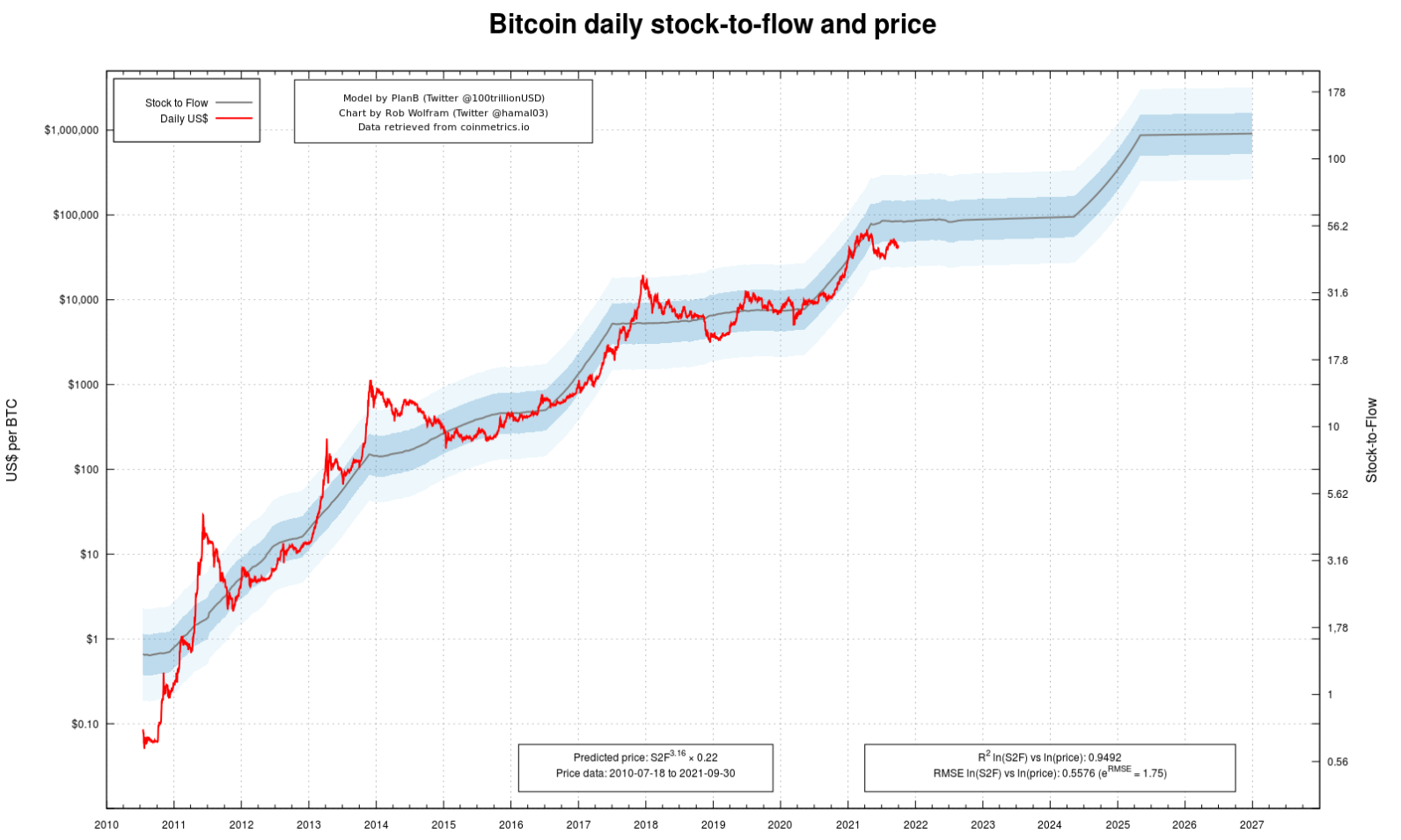

The ongoing legal battle has significantly impacted XRP's price, creating considerable volatility. [Include a chart or graph illustrating XRP's price fluctuations correlated with significant events in the lawsuit]. Price drops often coincide with negative news or perceived setbacks for Ripple, while positive developments tend to lead to price increases. This price volatility reflects the high level of XRP regulatory uncertainty in the market.

Investor Confidence and Market Sentiment

Investor confidence in XRP has fluctuated dramatically depending on the legal developments. Positive rulings tend to boost confidence and increase trading volume, while negative developments often lead to sell-offs and decreased market participation.

- Price Charts and Volatility: [Include specific examples of price movements tied to specific court rulings or news events. e.g., "Following the [Date] ruling, XRP's price experienced a [Percentage]% drop."]

- Market Analyst Sentiment: Many analysts remain cautious, highlighting the significant XRP regulatory uncertainty and recommending a wait-and-see approach. However, some bullish analysts point to [mention any positive indicators for XRP's future despite the ongoing legal battle].

- Institutional vs. Retail Investors: Institutional investors have generally shown more caution, while retail investors have demonstrated varying levels of risk tolerance, contributing to the overall volatility in the XRP market.

Global Regulatory Landscape and its Impact on XRP

Varying Regulatory Approaches Worldwide

Regulatory approaches to cryptocurrencies differ significantly across jurisdictions. While the US SEC focuses on the securities aspect, other countries like Japan and Singapore have adopted more flexible regulatory frameworks. This disparity in approach creates a complex global regulatory landscape impacting XRP's usage and adoption.

Potential for Future Regulations

The SEC vs. Ripple lawsuit's outcome could significantly influence future cryptocurrency regulations globally. A ruling in favor of the SEC might lead to stricter regulations across the board, potentially impacting other cryptocurrencies. Conversely, a ruling in Ripple's favor could encourage a more lenient approach.

- Regulatory Comparisons: [Provide brief comparisons of regulatory approaches in key jurisdictions. e.g., "The EU's MiCA framework offers a more comprehensive regulatory approach than the fragmented US regulations."]

- Impact on Global Adoption: Regulatory clarity is crucial for mainstream adoption. The current XRP regulatory uncertainty hinders wider institutional and retail adoption.

- Future Regulatory Frameworks: Future regulatory frameworks could impact XRP's functionality, potentially influencing its use cases and overall utility.

Navigating XRP Regulatory Uncertainty: Strategies for Investors

Risk Assessment and Due Diligence

Investing in XRP under the current XRP regulatory uncertainty requires a thorough risk assessment. Investors should carefully weigh the potential rewards against the substantial risks associated with the ongoing legal battle.

Diversification and Portfolio Management

Diversification is crucial for mitigating risk. Investors should not over-allocate their portfolio to XRP, given the significant uncertainty. A diversified portfolio across different asset classes can help cushion potential losses.

- Risk Management Steps: Investors should thoroughly research the lawsuit, understand the potential outcomes, and monitor news and analysis closely.

- Risk/Reward Balance: Investors should carefully consider their risk tolerance before investing in XRP.

- Adjusting Investment Strategies: Investors should be prepared to adjust their investment strategies based on significant developments in the lawsuit. Staying informed is paramount.

Conclusion

The XRP regulatory uncertainty remains a significant factor affecting the cryptocurrency market. The SEC vs. Ripple lawsuit has created considerable price volatility and impacted investor sentiment. Understanding the legal complexities, the varying global regulatory approaches, and the potential future implications is crucial for navigating this uncertain environment. Staying informed about developments in the lawsuit and the broader regulatory landscape is paramount. Monitor the SEC lawsuit for updates and learn more about managing risk in the volatile XRP market. The future of XRP hinges significantly on the resolution of this legal battle and the evolving regulatory framework for cryptocurrencies.

Featured Posts

-

Uber Kenya Announces Cashback Rewards For Customers And Increased Orders For Drivers And Couriers

May 08, 2025

Uber Kenya Announces Cashback Rewards For Customers And Increased Orders For Drivers And Couriers

May 08, 2025 -

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025 -

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025 -

Dwp Doubles Home Visits Thousands Affected By Benefit Changes

May 08, 2025

Dwp Doubles Home Visits Thousands Affected By Benefit Changes

May 08, 2025 -

Futbolista Argentino Sancionado Un Mes Fuera Del Brasileirao

May 08, 2025

Futbolista Argentino Sancionado Un Mes Fuera Del Brasileirao

May 08, 2025