X's Financial Reorganization: Insights From Musk's Recent Debt Sale

Table of Contents

Keywords: X financial reorganization, Musk debt sale, X debt financing, Twitter debt, Elon Musk finance, X restructuring, X financial strategy, high-yield debt, leveraged buyout, company debt, financial risk

Elon Musk's acquisition of X (formerly Twitter) was a high-stakes gamble, and its financial aftermath continues to unfold. A significant element of this story is Musk's recent debt sale, a bold move that has profound implications for X's financial reorganization and its long-term trajectory. This article delves into the details of this debt sale, exploring its rationale, potential risks, and the broader context of Musk's financial strategy for X.

The Details of Musk's Debt Sale

The specifics of Musk's debt sale for X are complex and still emerging, but key details are starting to surface. The sale involved a substantial amount of debt, encompassing various instruments. While precise figures remain somewhat opaque, reports suggest a significant reliance on high-yield debt, often associated with higher interest rates and greater risk for lenders.

- Total debt raised: While the exact figure remains undisclosed, reports suggest billions of dollars were raised through this debt sale. This significant amount highlights the considerable financial burden X now carries.

- Type(s) of debt instruments used: High-yield bonds were likely a primary component, along with potentially other forms of debt, such as term loans and revolving credit facilities. The mix of debt instruments reflects a strategy designed to meet X's immediate and long-term funding needs.

- Interest rates and associated costs: High-yield debt typically comes with significantly higher interest rates than more traditional financing options. These elevated interest rates increase X's debt servicing costs, placing additional pressure on profitability.

- Maturity dates and repayment schedule: The maturity dates of these debts vary, spreading repayment obligations over time. However, the timeline adds further complexity to X's financial management and puts pressure on future revenue generation.

- Lenders involved (if known): The identities of all lenders are not publicly known, but a range of financial institutions likely participated in providing the financing.

Reasons Behind the Debt Financing

Musk's decision to opt for substantial debt financing for X is multifaceted. Several factors likely influenced this strategic choice.

- Acquisition debt repayment: A substantial portion of the debt is likely earmarked for repaying existing debts incurred during the Twitter acquisition. This leveraged buyout strategy, common in large-scale acquisitions, carries substantial risk.

- Funding ongoing operations and investments in new features: X's continued operations and Musk's ambitious plans for platform development necessitate ongoing capital investment. Debt financing offers a swift, albeit risky, means of funding these endeavors.

- Reducing reliance on equity financing: Issuing more shares to raise capital could dilute existing shareholders' ownership and control. Debt provides an alternative, albeit potentially more expensive, route.

- Strategic maneuvering for future growth: The influx of capital through debt could position X for future acquisitions, partnerships, or expansion into new markets.

The advantages of debt financing include speed and potentially lower dilution for existing shareholders. However, the disadvantages are equally significant: higher interest payments, increased financial risk, and the pressure to generate sufficient revenue to service the debt.

Implications for X's Financial Reorganization

The debt sale significantly impacts X's financial health and its ongoing restructuring efforts.

- Increased debt burden and associated interest payments: This substantially increases X’s financial obligations, impacting profitability and potentially limiting investment in other areas.

- Potential impact on credit rating: The increased debt load could lead to a downgrade in X's credit rating, making future borrowing more expensive and potentially impacting its access to credit markets.

- Increased financial risk: X now faces a heightened risk of default if revenue generation fails to meet debt servicing obligations.

- Opportunities for future acquisitions or investments: The availability of capital, however risky, opens doors for strategic acquisitions or investments in other businesses or technologies.

- Potential pressure to increase revenue and profitability: To manage its substantial debt, X faces intense pressure to enhance revenue streams and achieve substantial profitability.

Risk Assessment of X's Current Financial State

X's high-debt strategy presents inherent risks that require careful consideration.

- Default risk: The risk of X failing to meet its debt obligations is a serious concern, particularly given the volatile nature of the tech industry.

- Interest rate risk: Fluctuations in interest rates could significantly increase X’s debt servicing costs, further straining its finances.

- Liquidity risk: X needs sufficient cash flow to meet its day-to-day operational expenses and debt obligations. A shortfall could trigger a liquidity crisis.

- Impact of economic downturns: In an economic downturn, revenue streams might shrink, making debt servicing even more challenging.

These risks could severely impact X’s long-term prospects, potentially leading to restructuring, asset sales, or even bankruptcy.

Musk's Overall Financial Strategy and Long-Term Vision for X

This debt sale fits into Musk's broader financial strategy for X, reflecting his ambitious vision for the platform.

- Alignment with Musk's long-term vision for the platform: The debt financing likely reflects a willingness to take on substantial risk to achieve long-term goals for X, even if it means navigating a high-debt environment.

- Potential future financing strategies: Future financing strategies might include further debt issuance, equity financing, or a combination of both, depending on X’s performance and market conditions.

- Impact on X's competitive landscape: X's financial maneuvering could influence its position in the competitive social media landscape, impacting its ability to compete with established players.

- Implications for investors and stakeholders: The debt sale carries considerable implications for investors and stakeholders, impacting shareholder value and the overall stability of the company.

Conclusion

Musk's debt sale for X is a high-stakes gamble with substantial implications for the platform's financial reorganization. While the capital infusion offers opportunities for growth and innovation, the increased debt burden introduces significant risks, including default, liquidity issues, and the potential for further financial restructuring. The long-term success of this strategy hinges on X's ability to generate sufficient revenue to service its debt and fulfill its ambitious goals.

Call to Action: Stay informed about the evolving financial landscape of X. Follow our blog for further analysis and insights into X's financial reorganization and future debt management strategies. Continue to monitor the developments related to X's financial future and its impact on the tech industry.

Featured Posts

-

Decoding Musks X Debt Sale What The New Financials Tell Us

Apr 28, 2025

Decoding Musks X Debt Sale What The New Financials Tell Us

Apr 28, 2025 -

Merd Fn Abwzby Yfth Abwabh Fy 19 Nwfmbr

Apr 28, 2025

Merd Fn Abwzby Yfth Abwabh Fy 19 Nwfmbr

Apr 28, 2025 -

Bubba Wallaces Martinsville Finish A Detailed Look At The Final Restart

Apr 28, 2025

Bubba Wallaces Martinsville Finish A Detailed Look At The Final Restart

Apr 28, 2025 -

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025 -

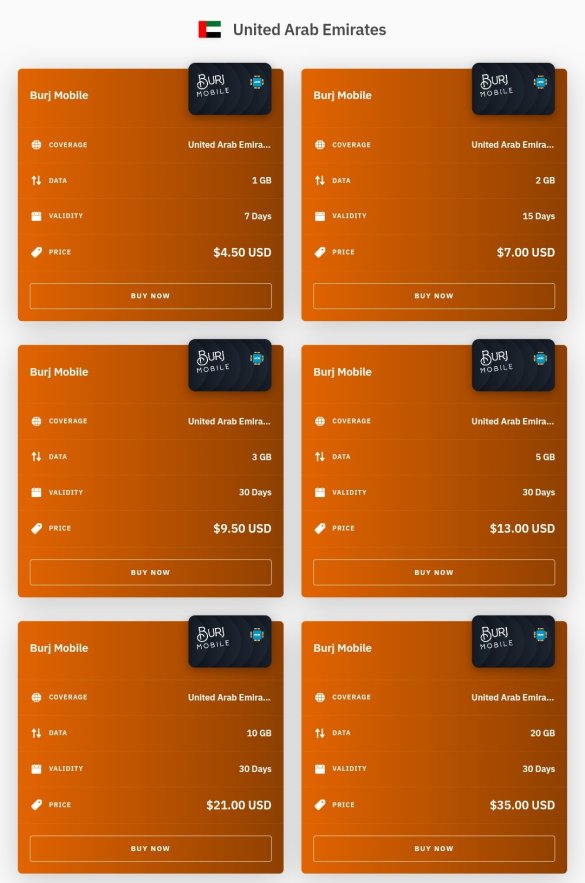

Get A 10 Gb Uae Sim Card And Save 15 With The Abu Dhabi Pass

Apr 28, 2025

Get A 10 Gb Uae Sim Card And Save 15 With The Abu Dhabi Pass

Apr 28, 2025