$440 Million Deal: CMA CGM Acquires Major Stake In Turkish Logistics

Table of Contents

CMA CGM's Strategic Expansion into Turkey

Turkey's Geopolitical Importance

Turkey's strategic location at the crossroads of Europe and Asia makes it a highly attractive market for logistics companies. Its geographical position offers unparalleled access to key trade routes and burgeoning markets across the continent. This pivotal location makes Turkey a crucial transit hub for goods flowing between East and West.

- Key Trade Routes: Turkey sits at the nexus of critical trade routes, including the historic Silk Road, connecting it to Central Asia and the Far East, and maritime routes through the Mediterranean, linking it to Europe and Africa. These established networks offer significant logistical advantages.

- Access to Burgeoning Markets: The rapidly growing economies of Central Asia and the Middle East offer immense potential for companies operating within Turkey's logistics sector. CMA CGM's investment taps into this potential for significant returns.

- Robust Port Infrastructure: Turkey has made significant investments in modernizing its port infrastructure, creating state-of-the-art facilities capable of handling the increasing volume of goods passing through the country. This upgraded infrastructure is a key draw for global logistics players.

CMA CGM's Global Ambitions

This acquisition is a testament to CMA CGM's ambitious global expansion strategy. The company consistently seeks opportunities to diversify its portfolio and solidify its presence in key markets worldwide. This Turkish investment aligns perfectly with their ongoing commitment to creating a robust, globally integrated supply chain.

- Previous Acquisitions: CMA CGM's history is marked by strategic acquisitions that have significantly expanded their operational capacity and market reach. This latest move reflects a continued pattern of calculated growth and expansion.

- Market Share: CMA CGM holds a substantial market share in the global shipping industry. This Turkish acquisition further solidifies their dominant position and provides them access to new sectors.

- Global Supply Chain Focus: The company's focus extends beyond simple shipping; they aim to provide end-to-end supply chain solutions, and this acquisition allows for a more integrated approach to logistics within a strategically important region.

The Target Turkish Logistics Company (Name and Details)

[Insert the name of the acquired Turkish company here]. This company specializes in [insert company specialization, e.g., intermodal transportation, warehousing, and last-mile delivery]. They hold a significant market share in Turkey's logistics sector, boasting [insert key figures, e.g., annual revenue, employee count, and market share percentage]. Their expertise and established network make them a valuable asset for CMA CGM's expansion plans.

- Specialization: [e.g., Port operations, freight forwarding, contract logistics]

- Market Share: [e.g., Holding a leading 25% share in the Turkish intermodal transport sector]

- Key Financial Indicators: [Include relevant financial data, such as revenue, profitability, and growth trajectory.]

Financial Implications of the $440 Million Deal

Deal Structure and Valuation

The $440 million investment represents a significant commitment from CMA CGM, reflecting the considerable potential they see in the Turkish logistics market and the acquired company's capabilities. [Specify whether the deal involved a majority stake or a full acquisition]. The valuation reflects the target company's strong growth potential and its strategic position within Turkey's expanding logistics sector.

- Deal Breakdown: [If available, detail the allocation of the $440 million investment across different aspects of the acquisition.]

- Funding Sources: [Mention the sources of funding used for the acquisition, such as internal resources or external financing.]

- Projected ROI: [Discuss analyst projections regarding the return on investment (ROI) expected from this acquisition.]

Market Reactions and Analyst Opinions

The announcement of the CMA CGM acquisition has been broadly well-received by market analysts, who view it as a strategic move that will strengthen CMA CGM's presence in a rapidly developing region. The deal is expected to boost the Turkish logistics sector as a whole.

- Stock Price Movements: [Describe any significant changes in CMA CGM's stock price following the acquisition announcement.]

- Analyst Comments: [Include quotes from analysts and their perspectives on the deal's potential impact.]

- Future Growth Forecasts: [Summarize the projected growth prospects for both CMA CGM and the Turkish logistics sector as a result of the acquisition.]

Impact on the Turkish Logistics Industry and Global Trade

Increased Efficiency and Capacity

The acquisition is expected to significantly boost efficiency and capacity within Turkey's logistics sector. This will benefit both domestic and international businesses by streamlining operations and improving delivery times.

- Infrastructure Improvements: The deal could lead to upgrades in infrastructure, particularly in port operations and transportation networks.

- Technology Adoption: CMA CGM's expertise in technology and digital logistics could be leveraged to modernize operations and improve efficiency within the Turkish market.

- Supply Chain Optimization: The integration of the acquired company's operations into CMA CGM's global network could lead to significant improvements in supply chain management and reduce bottlenecks.

Competition and Market Dynamics

This acquisition will undoubtedly shift the competitive landscape within the Turkish logistics industry. It could lead to further consolidation or strategic partnerships as other players seek to maintain their market share. The changes will ripple across global trade networks, creating improved efficiency across key trade routes.

- Potential Mergers and Acquisitions: The deal may encourage further consolidation within the Turkish logistics sector as competitors react to CMA CGM's increased market dominance.

- Strategic Partnerships: We may see increased strategic partnerships and collaborations as companies seek to compete with the enhanced capabilities of CMA CGM in the region.

- Global Trade Impact: The acquisition has the potential to influence global trade flows by enhancing efficiency and reliability along vital shipping routes passing through Turkey.

Conclusion

The $440 million CMA CGM acquisition marks a significant step forward for both CMA CGM and the Turkish logistics industry. The strategic investment highlights Turkey's growing prominence as a global trade hub and underscores CMA CGM's commitment to global expansion. The deal's effects will be far-reaching, increasing efficiency, attracting investment, and transforming the competitive landscape. Stay tuned to witness how this pivotal CMA CGM acquisition impacts the future of Turkish logistics and global supply chains. Follow future developments in the Turkish logistics industry to see the full impact of this strategic investment by CMA CGM.

Featured Posts

-

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025 -

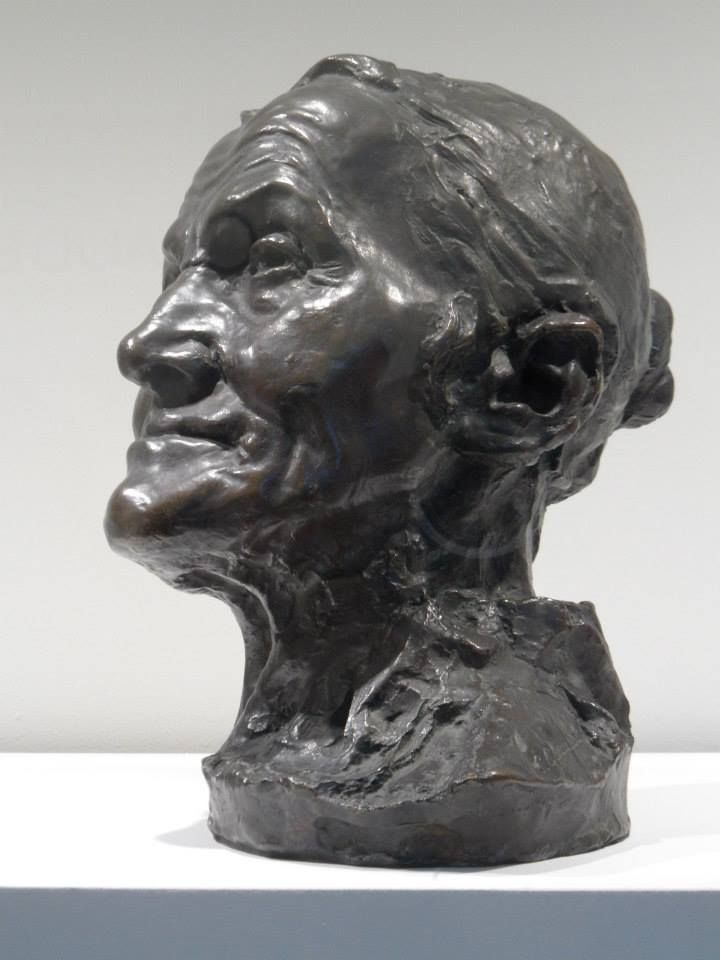

Camille Claudel Bronze Sculpture A 3 Million Auction Result

Apr 27, 2025

Camille Claudel Bronze Sculpture A 3 Million Auction Result

Apr 27, 2025 -

High Stock Market Valuations Bof As Case For Why Investors Shouldnt Panic

Apr 27, 2025

High Stock Market Valuations Bof As Case For Why Investors Shouldnt Panic

Apr 27, 2025 -

Green Bay Packers Eyeing Two International Games In 2025 Season

Apr 27, 2025

Green Bay Packers Eyeing Two International Games In 2025 Season

Apr 27, 2025 -

Bencic Through To Abu Dhabi Open Final

Apr 27, 2025

Bencic Through To Abu Dhabi Open Final

Apr 27, 2025

Latest Posts

-

U S Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025

U S Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Tesla And Tech Stocks Drive U S Market Surge

Apr 28, 2025

Tesla And Tech Stocks Drive U S Market Surge

Apr 28, 2025 -

Tech Giants Boost U S Stocks Tesla Leads The Charge

Apr 28, 2025

Tech Giants Boost U S Stocks Tesla Leads The Charge

Apr 28, 2025 -

Proposed Starbucks Raise Rejected By Union

Apr 28, 2025

Proposed Starbucks Raise Rejected By Union

Apr 28, 2025 -

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 28, 2025

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 28, 2025