5 Factors Fueling Today's Stock Market Rally: Sensex At 1,400 Points, Nifty Above 23,800

Table of Contents

Global Economic Optimism and Foreign Institutional Investor (FII) Inflows

Positive global economic data and increased Foreign Institutional Investor (FII) inflows are major contributors to the current Indian stock market rally. This influx of international investment signifies a vote of confidence in the Indian economy.

-

Positive global economic data is boosting investor confidence. Reports indicating improved global growth and reduced recessionary fears are encouraging investors to seek higher returns in emerging markets. This positive sentiment spills over into the Indian stock market, attracting both domestic and international investment.

-

Increased FII inflows are injecting significant liquidity into the Indian stock market. FIIs are pouring billions into Indian equities, driven by attractive valuations and the expectation of continued growth. This substantial liquidity fuels the stock market rally, pushing up prices across various sectors.

-

Stronger-than-expected corporate earnings in various sectors are attracting foreign investment. Robust financial performance by Indian companies reinforces the narrative of a thriving economy, further enticing FII investment. This positive feedback loop strengthens the market rally.

-

Reduced global uncertainty is leading to a flight to safety in emerging markets like India. As global uncertainties diminish, investors are shifting their focus towards emerging economies perceived as offering high-growth potential. India's strong fundamentals and robust growth prospects are attracting significant foreign investment, contributing significantly to the current stock market surge.

Strong Corporate Earnings and Positive Business Outlook

The strength of the Indian stock market rally is intrinsically linked to robust corporate earnings and a positive business outlook. Companies across various sectors are exceeding expectations, bolstering investor confidence.

-

Many Indian companies are reporting robust quarterly earnings, exceeding market expectations. This showcases the resilience and growth potential of Indian businesses, attracting both domestic and foreign investors. Strong profit margins and revenue growth are key drivers of this positive trend.

-

Positive business sentiment indicates continued growth and expansion in various sectors. Business surveys and reports suggest a high level of optimism among Indian businesses, pointing towards sustained growth and expansion in the coming quarters. This positive sentiment is translating into higher stock valuations.

-

Improved macroeconomic indicators are bolstering investor confidence in corporate profitability. Factors like stable GDP growth, declining unemployment, and manageable inflation levels all contribute to a positive business environment, further strengthening investor confidence.

-

Strong domestic demand is supporting the growth of several key industries. Increased consumer spending power and a growing middle class are fueling demand in sectors such as FMCG (Fast-Moving Consumer Goods), retail, and automobiles, thereby boosting corporate performance and driving stock prices higher.

Government Policies and Infrastructure Development

Government initiatives and policies play a crucial role in shaping the Indian stock market's trajectory. Pro-business reforms and substantial infrastructure investments are key catalysts behind the current rally.

-

Government initiatives aimed at infrastructure development are attracting investment. Massive investments in roads, railways, ports, and other crucial infrastructure projects are creating new opportunities and attracting significant investments, both domestic and foreign.

-

Pro-business reforms are creating a favorable environment for businesses to flourish. Ease of doing business improvements and deregulation are creating a more conducive environment for businesses to operate and expand, driving economic growth and boosting investor confidence.

-

Fiscal and monetary policies are supportive of economic growth and market stability. The government's well-calibrated fiscal policies, combined with the Reserve Bank of India's (RBI) monetary policy, are contributing to a stable and growth-oriented macroeconomic environment.

-

Focus on digitalization and technology adoption is boosting investor confidence. India's ongoing digital revolution and push towards technological advancement are attracting investment in the technology sector and fostering innovation across various industries.

Reduced Inflation and Stable Interest Rates

Stable interest rates and reduced inflation are key macroeconomic factors supporting the current stock market rally. These contribute to a predictable and favorable investment environment.

-

Easing inflation pressures reduce uncertainty and boost investor sentiment. Lower inflation provides greater certainty about future earnings and reduces the risk of erosion of investment returns, thus boosting investor confidence.

-

Stable interest rates maintain a favorable borrowing environment for businesses. Predictable and relatively low interest rates make it easier for businesses to borrow money for expansion and investment, fueling economic growth and supporting stock prices.

-

The RBI's proactive monetary policy is contributing to macroeconomic stability. The RBI's careful management of interest rates and inflation expectations plays a critical role in maintaining macroeconomic stability, which is essential for a healthy stock market.

-

Predictable interest rates encourage investment and reduce market volatility. Stable and transparent interest rate policies reduce uncertainty and volatility in the market, encouraging both domestic and international investment.

Sector-Specific Growth Drivers

The current stock market rally isn't uniform across all sectors; certain sectors are outperforming others, further fueling the overall market surge.

-

Strong performance in specific sectors (e.g., technology, financials, FMCG) is driving the overall market rally. These high-growth sectors are attracting significant investment and driving up the overall market indices.

-

Innovation and technological advancements are fueling growth in certain sectors. The technology sector, in particular, is experiencing significant growth driven by innovation and technological advancements.

-

Increased consumer spending is boosting sectors like FMCG and retail. Strong domestic demand is fueling growth in consumer-facing sectors, leading to higher earnings and stock valuations.

-

Government support for specific sectors is contributing to their expansion. Government initiatives and policies targeted at specific sectors are providing additional support for their growth and expansion.

Conclusion

The recent Sensex and Nifty surge is a result of a confluence of factors, including global economic optimism, strong corporate earnings, supportive government policies, reduced inflation, and sector-specific growth drivers. Understanding these contributing elements provides valuable insights for investors navigating the current market conditions. To stay informed about the ongoing market dynamics and effectively manage your investment portfolio during this stock market rally, continue following the latest news and analysis related to the Sensex and Nifty. Keep a close eye on key economic indicators and government policies for informed decision-making in this dynamic environment.

Featured Posts

-

The Elon Musk Business Empire How He Built His Wealth

May 10, 2025

The Elon Musk Business Empire How He Built His Wealth

May 10, 2025 -

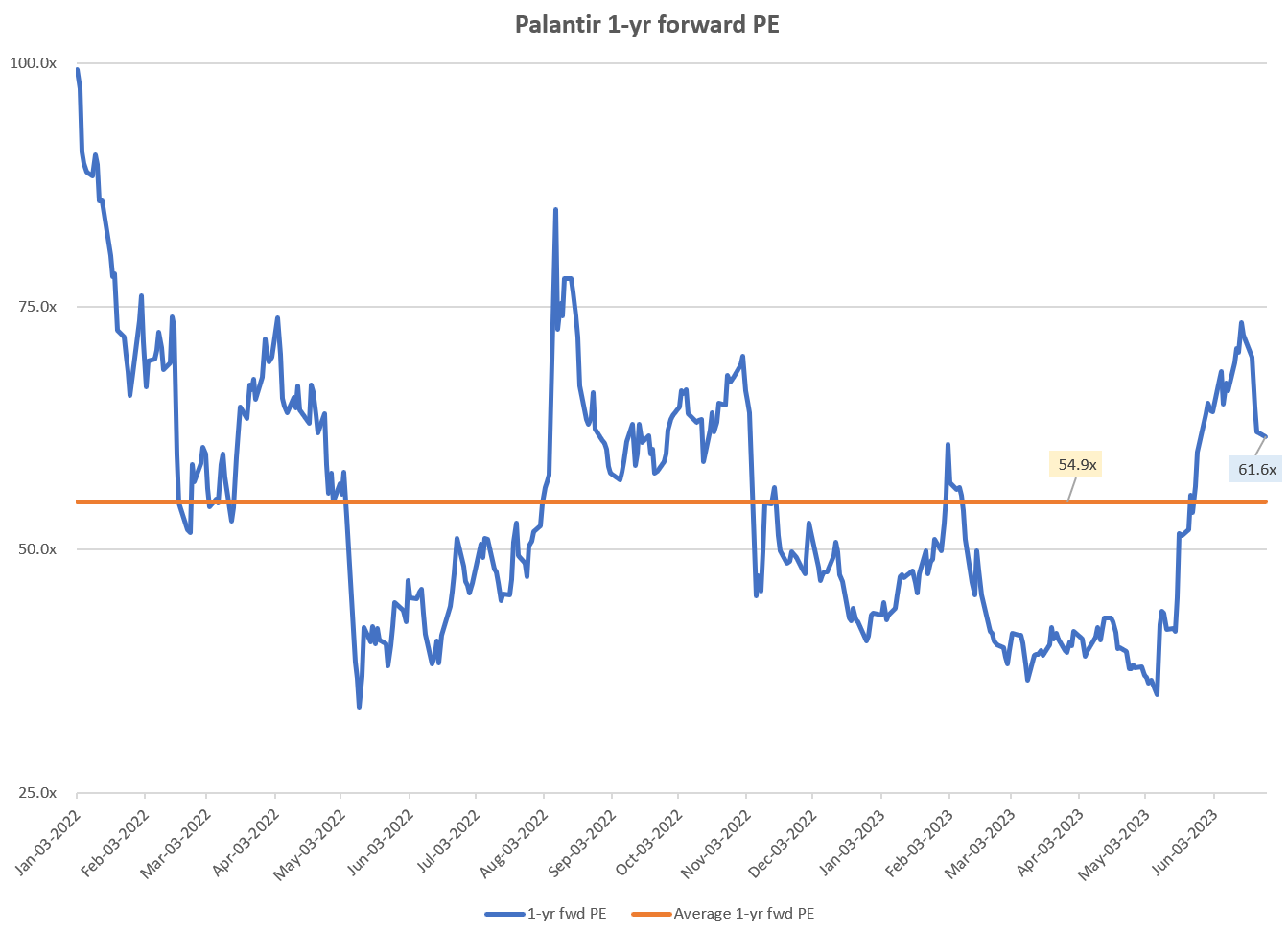

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Predictions

May 10, 2025

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Predictions

May 10, 2025 -

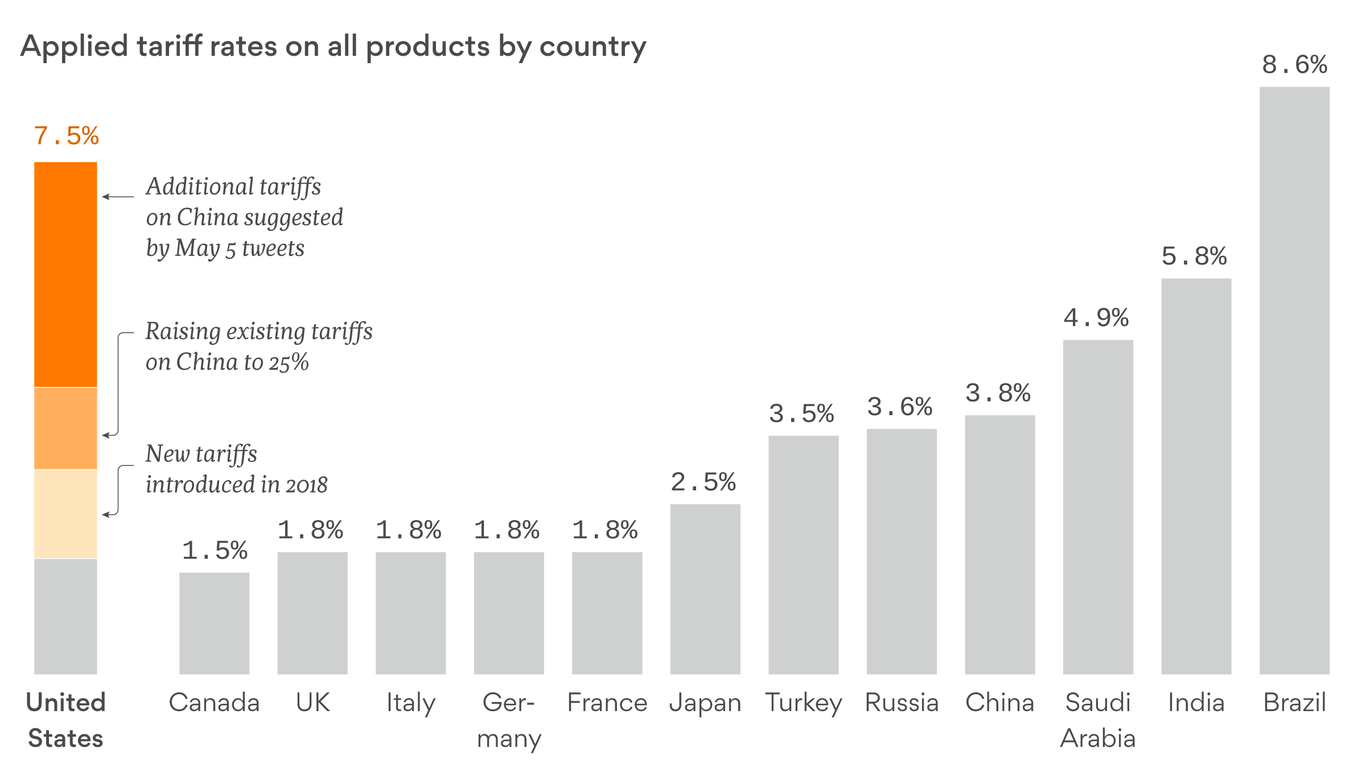

Trump Tariffs Weigh On Infineon Ifx Sales Guidance Revised Downward

May 10, 2025

Trump Tariffs Weigh On Infineon Ifx Sales Guidance Revised Downward

May 10, 2025 -

Russias Military Strength On Display At Victory Day Parade

May 10, 2025

Russias Military Strength On Display At Victory Day Parade

May 10, 2025 -

Executive Orders Under Trump How Transgender People Were Affected

May 10, 2025

Executive Orders Under Trump How Transgender People Were Affected

May 10, 2025