$67M Ethereum Liquidation Event: Analyzing The Market's Future

Table of Contents

A liquidation event, in simple terms, occurs when a trader's position is automatically closed by an exchange or lending platform due to insufficient collateral to cover losses. This typically happens when prices move against a leveraged position, leading to margin calls that, if unmet, result in the liquidation of assets. The sheer scale of this particular $67 million event, involving Ethereum, a leading cryptocurrency, makes it a significant case study for understanding market dynamics and risk management. This article will analyze the causes, consequences, and implications of this event, offering insights into future market behavior.

Causes of the $67M Ethereum Liquidation Event

Several interconnected factors contributed to the $67M Ethereum liquidation event.

Market Volatility and Leverage

High leverage trading, where traders borrow funds to amplify potential profits, significantly increases risk. Sudden market swings, even minor ones, can trigger margin calls, leading to liquidations.

- Regulatory news: Unexpected announcements from regulatory bodies can drastically shift market sentiment, causing price volatility.

- Macroeconomic factors: Global economic events, such as inflation or recessionary fears, influence investor behavior and cryptocurrency prices.

- Whale activity: Large-scale trades by "whales" (individuals or entities holding significant cryptocurrency) can create substantial price movements, affecting leveraged positions.

Leverage acts as a double-edged sword. While it magnifies profits during bullish trends, it exponentially increases losses during bearish periods. Even small price drops can force liquidations when high leverage is employed, as seen in this instance.

Smart Contract Exploits & Bugs

The possibility of vulnerabilities within smart contracts, the self-executing contracts that underpin many DeFi applications, cannot be ignored. Exploits or unforeseen bugs in these contracts can lead to unexpected liquidations.

- The DAO hack in 2016.

- Various exploits targeting liquidity pools and lending platforms.

Such vulnerabilities can trigger a chain reaction, causing cascading liquidations across the DeFi ecosystem. Robust auditing and security protocols are essential to mitigate these risks.

Cascading Liquidations

The initial $67M Ethereum liquidation didn't occur in isolation. It triggered a cascade of further liquidations.

- Automated liquidation systems: These systems are designed to protect lenders and platforms but can exacerbate price drops during market downturns.

- Liquidation domino effect: As one position is liquidated, it can further depress the price, triggering margin calls on other leveraged positions.

This domino effect can significantly amplify the impact of an initial event, leading to a more substantial market correction than might otherwise have been expected.

Impact and Consequences of the $67M Ethereum Liquidation

The $67M liquidation had far-reaching consequences across the cryptocurrency landscape.

Price Fluctuations and Market Sentiment

The immediate impact was a noticeable dip in Ethereum's price and a general decline in market sentiment.

- [Insert chart illustrating price movements during and after the event]

The event fueled fear and uncertainty among traders and investors, leading to sell-offs and further price instability. This highlights the psychological impact of significant liquidation events.

Impact on Decentralized Finance (DeFi)

The Ethereum DeFi ecosystem, heavily reliant on smart contracts and leveraged trading, bore the brunt of the consequences.

- Specific examples of affected DeFi protocols: [List examples if available, mentioning specific platforms impacted].

The event exposed vulnerabilities in some DeFi protocols, highlighting the need for better risk management, improved auditing, and more robust security measures within the DeFi space.

Wider Cryptocurrency Market Impact

The ripple effect extended beyond Ethereum, influencing other cryptocurrencies.

- Examples of other crypto assets affected: [List examples and percentage changes, if data is available].

This demonstrates the interconnectedness of the cryptocurrency market and the potential for contagion risk – where the problems in one area quickly spread to others. The event served as a reminder of the systemic risk within the cryptocurrency market.

Analyzing the Future of Ethereum Based on the Liquidation Event

The $67M Ethereum liquidation offers valuable lessons and informs our understanding of Ethereum's future.

Lessons Learned and Risk Mitigation Strategies

The event highlighted the critical need for robust risk management in the crypto space.

- Recommendations for traders and investors: Diversify investments, avoid excessive leverage, conduct thorough due diligence before entering trades, and understand the risks associated with different DeFi protocols.

- Improved smart contract auditing and security protocols: Greater emphasis on rigorous code audits and the development of more secure smart contracts is essential to prevent similar events.

Ethereum's Long-Term Prospects

Despite the setback, Ethereum's long-term prospects remain positive.

- Positive aspects of Ethereum: The ongoing development of Ethereum 2.0, addressing scalability issues, increased adoption by institutions, and the expanding DeFi ecosystem all contribute to its strong long-term potential.

Ethereum's ability to recover from significant events like this underscores its resilience and its position as a leading blockchain platform.

Regulatory Implications

The $67M Ethereum liquidation may spur increased regulatory scrutiny of the cryptocurrency market.

- Examples of existing or potential regulations: [Discuss specific regulations, like those concerning stablecoins or margin trading].

Increased regulation could both present challenges and opportunities for the Ethereum market. It could enhance investor protection but might also stifle innovation.

Conclusion: Learning from the $67M Ethereum Liquidation Event and Looking Ahead

The $67M Ethereum liquidation event served as a stark reminder of the inherent volatility and risks associated with leveraged trading and the cryptocurrency market. It highlighted the interconnectedness of the DeFi ecosystem and the potential for cascading liquidations. Key takeaways include the importance of rigorous risk management, enhanced smart contract security, and a greater understanding of market dynamics. To navigate the future effectively, stay informed about market developments, practice responsible risk management, and continue learning about Ethereum liquidations, Ethereum market analysis, and Ethereum price volatility. By understanding these factors, you can better position yourself within the ever-evolving cryptocurrency landscape.

Featured Posts

-

Celtics Vs Nets Jayson Tatums Availability Tonight

May 08, 2025

Celtics Vs Nets Jayson Tatums Availability Tonight

May 08, 2025 -

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025 -

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025 -

Is Ubers Auto Service Going Cash Only A Comprehensive Guide

May 08, 2025

Is Ubers Auto Service Going Cash Only A Comprehensive Guide

May 08, 2025 -

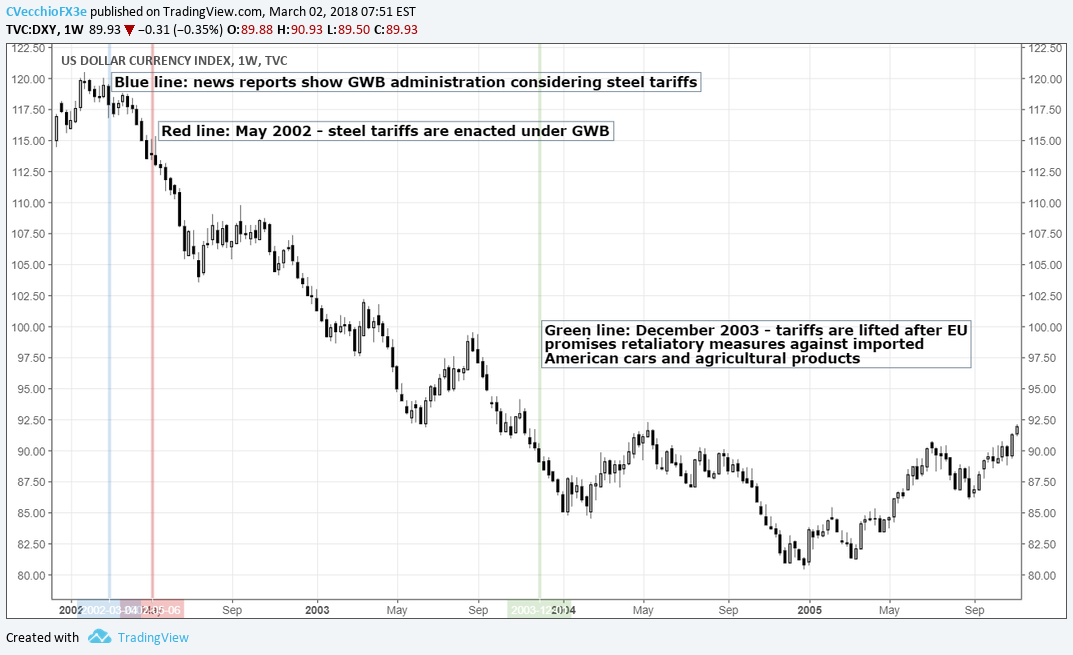

Understanding The Stock Markets Reaction To The Liberation Day Tariffs

May 08, 2025

Understanding The Stock Markets Reaction To The Liberation Day Tariffs

May 08, 2025