Analyzing The BigBear.ai (BBAI) Stock Drop In 2025

Table of Contents

Macroeconomic Factors Influencing BBAI Stock Performance

The Impact of Overall Market Volatility

2025 presented a challenging macroeconomic landscape. High inflation rates, coupled with aggressive interest rate hikes by central banks globally, created significant market volatility. This volatility disproportionately impacted growth stocks like BBAI, which often rely on future projections rather than immediate profitability.

- Increased borrowing costs: Higher interest rates made it more expensive for BBAI to secure funding for expansion and research & development.

- Reduced investor appetite for risk: In uncertain economic times, investors tend to shift towards safer, more established investments, leading to decreased demand for riskier growth stocks.

- Geopolitical instability: Global events and uncertainties contributed to overall market anxiety, further impacting investor confidence in growth sectors like AI. The ripple effect of these events significantly impacted the valuation of BBAI stock.

Sector-Specific Challenges Facing BigBear.ai

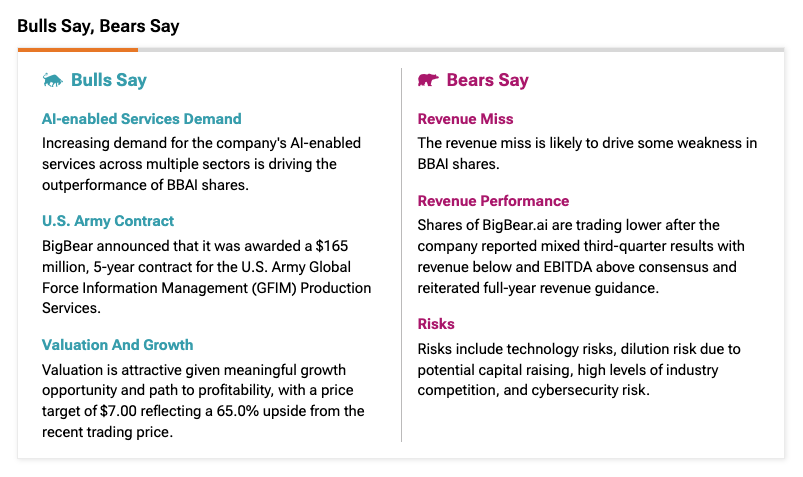

The AI and defense technology sectors, while promising, are not without their challenges. BBAI faced specific headwinds within its industry:

- Intense competition: The AI market is highly competitive, with established players and numerous startups vying for market share. This intense competition put pressure on BBAI's pricing and profitability.

- Technological disruptions: Rapid advancements in AI technology can quickly render existing solutions obsolete, requiring continuous investment in R&D to stay competitive. BBAI faced pressure to innovate to maintain a leading position.

- Regulatory uncertainty: Government regulations surrounding the use of AI in defense and other critical sectors created uncertainty and potentially delayed project timelines, affecting BBAI's revenue streams.

- Funding limitations: Securing sufficient funding to support ambitious growth plans in a volatile economic climate presented a substantial challenge.

Company-Specific Factors Contributing to the BBAI Stock Drop

Financial Performance and Earnings Reports

BigBear.ai's financial performance in 2025 (hypothetical data used for illustrative purposes) revealed some concerning trends that impacted investor confidence. Let's assume, for example, that revenue growth slowed significantly to 5%, falling short of the projected 15% growth, and profitability margins decreased due to increased operational costs. Further, the company may have issued a profit warning, impacting investor sentiment.

- Missed earnings targets: Hypothetical scenarios show a significant miss in quarterly earnings, leading to a sell-off by investors.

- Increased debt levels: To finance expansion, BBAI might have taken on additional debt, increasing its financial risk profile and deterring potential investors.

- Decreased cash flow: Reduced cash flow further highlighted the company's financial challenges.

Strategic Decisions and Operational Issues

Certain strategic decisions and operational issues potentially exacerbated the BBAI stock drop.

- Delayed project deliveries: Potential delays in key projects could have negatively impacted revenue recognition and investor confidence.

- Integration challenges: If BigBear.ai had undertaken any acquisitions during this period, integration issues could have impacted efficiency and profitability.

- Management changes: Significant changes in leadership, particularly if perceived negatively by the market, can cause uncertainty and affect investor confidence.

Investor Sentiment and Market Reaction to BBAI News

News and Media Coverage

Negative news coverage, often amplified by social media, can significantly impact investor sentiment. Any negative press concerning financial performance, strategic setbacks, or regulatory issues would likely fuel the sell-off.

- Negative analyst ratings: Downgrades from leading financial analysts could trigger further sell-offs.

- Social media sentiment: Negative sentiment on platforms like Twitter and other social media sites can influence trading decisions, creating a downward spiral.

Short Selling and Institutional Investor Activity

A significant increase in short selling activity could indicate a lack of confidence in BBAI's future performance, putting further downward pressure on the stock price. Changes in institutional investor holdings – a decrease in holdings by major investors – could also contribute to the decline.

- Increased short interest: A rise in the number of shares sold short indicates a bearish outlook amongst a segment of investors.

- Decreased institutional ownership: Institutional investors often play a significant role in driving stock prices. A reduction in their holdings suggests a loss of confidence.

Conclusion: Navigating the Future of BigBear.ai (BBAI) Stock

The BigBear.ai (BBAI) stock drop in 2025 was likely a result of a confluence of factors. Macroeconomic headwinds, company-specific challenges related to financial performance and strategic decisions, and negative investor sentiment all played a role. While BBAI operates in a promising sector with long-term potential, the challenges faced in 2025 highlight the risks associated with investing in growth stocks, especially during periods of economic uncertainty.

Before making any investment decisions regarding BigBear.ai (BBAI) stock, thorough due diligence is crucial. Monitor key financial indicators, news related to the company, and industry trends closely. Understanding the factors contributing to the BBAI stock drop is essential for making informed investment decisions about the future of your portfolio. Remember that this analysis is based on hypothetical data for 2025 and should not be considered financial advice. Always conduct your own thorough research before investing.

Featured Posts

-

Agatha Christie Une Exploration De Son Uvre Integrale

May 20, 2025

Agatha Christie Une Exploration De Son Uvre Integrale

May 20, 2025 -

Shifting Sands Ftcs New Approach In Meta Monopoly Lawsuit

May 20, 2025

Shifting Sands Ftcs New Approach In Meta Monopoly Lawsuit

May 20, 2025 -

Oropedio Evdomos Oneiriki Protomagia

May 20, 2025

Oropedio Evdomos Oneiriki Protomagia

May 20, 2025 -

La Famille Schumacher Accueille Une Petite Fille

May 20, 2025

La Famille Schumacher Accueille Une Petite Fille

May 20, 2025 -

1 231 Billion In Oil Revenue Recovery The Representatives Strategy

May 20, 2025

1 231 Billion In Oil Revenue Recovery The Representatives Strategy

May 20, 2025