Analyzing Uber's Stock Performance During Economic Uncertainty

Table of Contents

Uber's Business Model and its Vulnerability to Economic Downturns

Uber's business model, heavily reliant on consumer discretionary spending, makes it inherently vulnerable to economic downturns. Analyzing Uber's stock performance requires a deep understanding of these vulnerabilities.

Impact of Reduced Consumer Spending

Reduced consumer spending directly impacts Uber's core businesses. As disposable income decreases, people are less likely to utilize ride-sharing services for non-essential travel.

- Decreased ride-sharing demand: Economic downturns typically see a reduction in leisure travel, impacting Uber's ride-hailing segment.

- Potential impact on Uber Eats orders: While Uber Eats might see some resilience due to its food delivery service being a necessity, consumers may reduce spending on restaurant meals and opt for cheaper alternatives.

- Price sensitivity of consumers: During economic uncertainty, consumers become more price-sensitive, potentially leading to a decrease in Uber's premium service usage.

This decreased demand translates to lower revenue and potentially impacts driver earnings, potentially leading to fewer drivers on the platform. Historical data from previous recessions shows a clear correlation between economic contraction and reduced ridership for ride-sharing platforms.

Fuel Prices and Inflationary Pressures

Rising fuel prices and inflationary pressures significantly impact Uber's operational expenses and profitability.

- Increased operating costs for drivers: Higher fuel costs directly impact drivers' profitability, potentially leading to reduced supply or increased fares.

- Impact on profitability: Increased operating costs, without a corresponding increase in fares, can squeeze Uber's profit margins.

- Potential fare adjustments and customer reactions: While Uber may adjust fares to offset increased costs, this could lead to reduced demand as consumers become more price-sensitive.

The interplay between fuel prices, inflation, and consumer behavior is a key factor affecting Uber's financial performance and subsequent stock price fluctuations during periods of economic uncertainty.

Competition and Market Share

Economic uncertainty intensifies competition within the ride-sharing industry and affects Uber's ability to maintain market share.

- Competition from other ride-sharing services: Existing competitors like Lyft, and potential new entrants, will actively compete for the reduced market demand.

- Impact of alternative transportation options: Economic hardship may drive consumers to utilize cheaper alternatives like public transportation or carpooling.

- Market share fluctuations during economic stress: Companies with more robust financial positions may be better equipped to weather the storm, potentially gaining market share at the expense of weaker competitors.

Understanding the competitive landscape is crucial for assessing Uber's resilience during economic instability.

Analyzing Uber's Stock Performance Data

Analyzing historical data provides valuable insights into how Uber's stock has reacted to past economic downturns.

Stock Price Fluctuations

A clear correlation exists between Uber's stock price and key economic indicators.

- Chart illustrating stock price movement correlated with economic indicators (e.g., CPI, GDP): (Insert chart here showing correlation between Uber stock price and relevant economic indicators like CPI and GDP).

- Key dates of significant price changes: (Highlight specific dates where significant price changes coincided with major economic events).

By visualizing this data, we can identify periods of significant volatility and understand the market's reaction to specific economic events.

Investor Sentiment and Market Reaction

Investor sentiment plays a critical role in shaping Uber's stock performance.

- Analysis of news articles and analyst reports: (Summarize prevailing sentiment towards Uber from news and analyst reports during periods of economic uncertainty).

- Identification of key factors influencing investor confidence: (Identify news or events that significantly impacted investor confidence in Uber).

Negative news, coupled with broader market uncertainty, can lead to sell-offs and depressed stock prices.

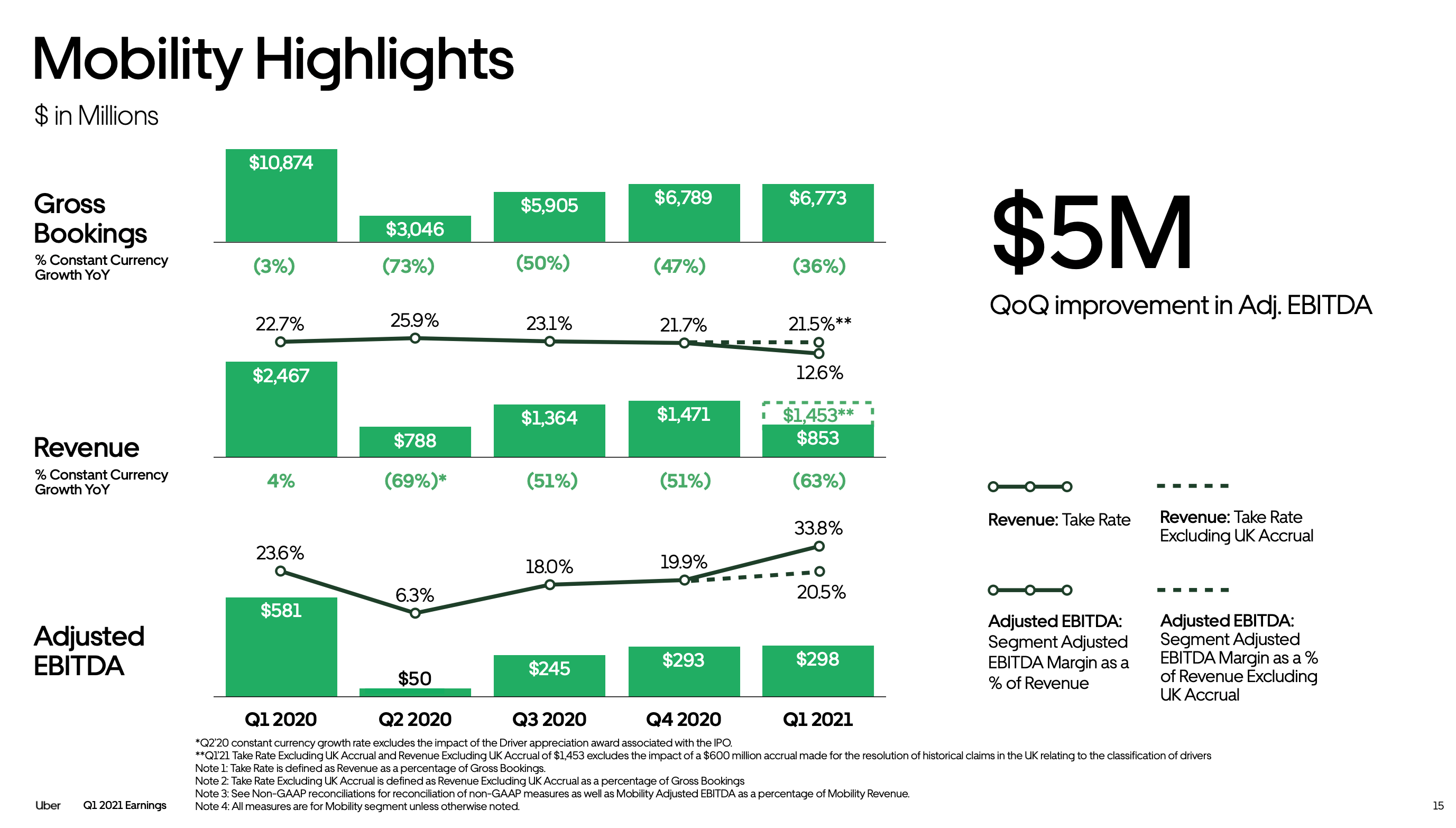

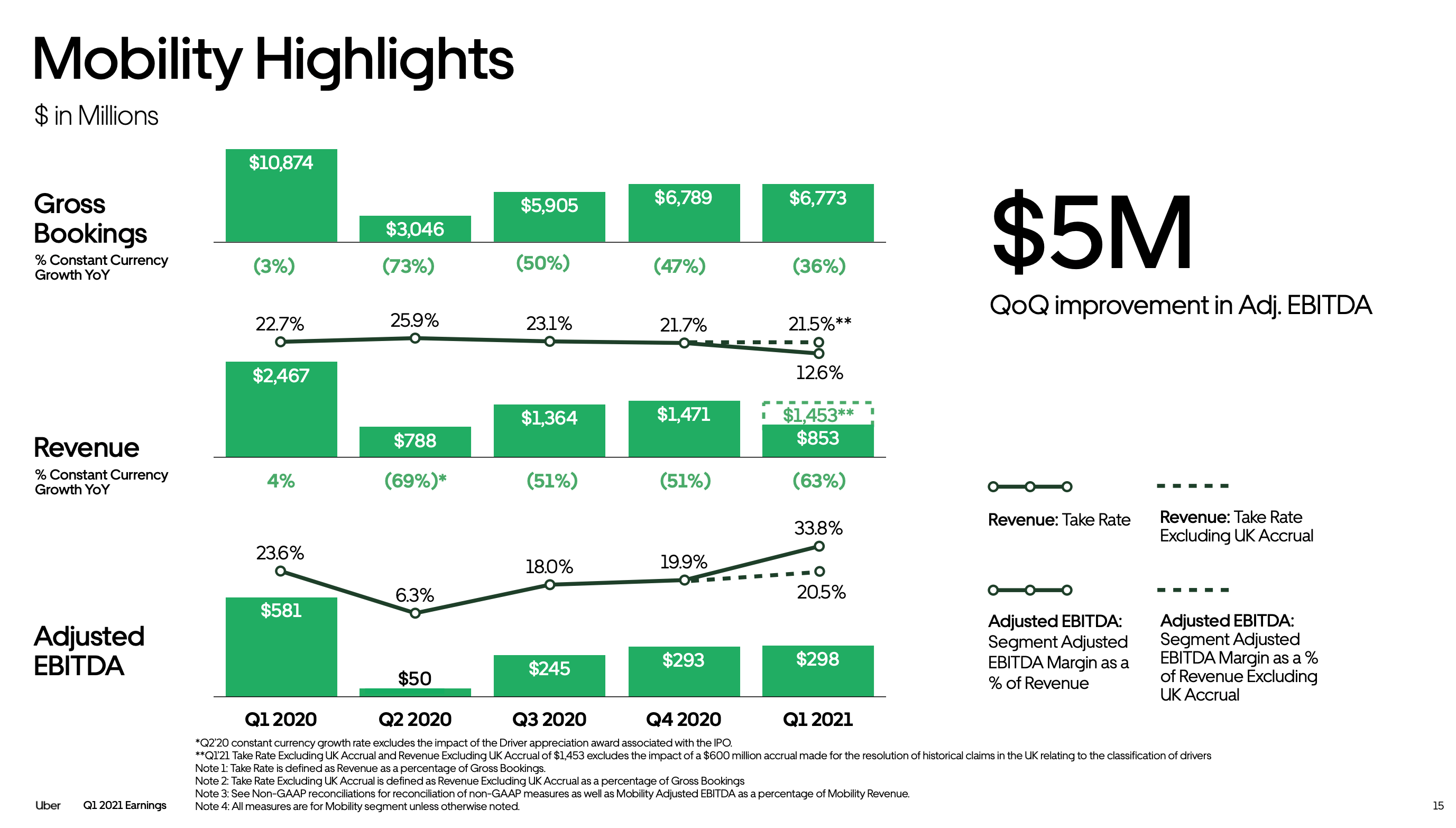

Financial Performance Indicators

Examining Uber's financial statements reveals its financial health and resilience.

- Review of quarterly/annual earnings reports: (Summarize key financial data from Uber's earnings reports, highlighting revenue, profit margins, and debt levels).

- Revenue growth or decline: (Analyze revenue trends during periods of economic uncertainty to determine the impact on the business).

- Profitability margins: (Assess the impact of economic downturns on Uber's profitability margins).

- Debt levels: (Examine Uber's debt burden and its capacity to service debt during challenging economic conditions).

This analysis provides a clearer picture of the company's financial strength and its ability to withstand economic headwinds.

Strategies for Navigating Economic Uncertainty (From an Investor's Perspective)

Successfully navigating the uncertainties of the market requires a well-defined investment strategy.

Diversification and Risk Management

Diversification is key to mitigating risk.

- The importance of diversification within investment portfolios: Don't put all your eggs in one basket. Spreading investments across various asset classes reduces the impact of any single investment's downturn.

- Hedging strategies to mitigate risk: Employing hedging strategies can help protect against potential losses in Uber stock during periods of economic uncertainty.

Long-Term vs. Short-Term Investment Strategies

The choice between long-term and short-term strategies depends on individual risk tolerance and investment goals.

- Advantages and disadvantages of each approach for Uber stock: Long-term investors might benefit from potential growth after an economic recovery, while short-term investors might need to react more quickly to market fluctuations.

- Considering potential for growth and recovery: Uber's long-term prospects should be considered alongside short-term risks.

Fundamental Analysis vs. Technical Analysis

Both fundamental and technical analyses provide valuable insights.

- How each approach can help investors make informed decisions about Uber stock, considering economic factors: Fundamental analysis focuses on the company's intrinsic value, while technical analysis examines price charts and trends to predict future movements.

- Considering economic factors: Both approaches should incorporate macroeconomic factors like inflation, interest rates, and consumer confidence.

Conclusion

Analyzing Uber stock performance during economic uncertainty reveals its vulnerability to reduced consumer spending, rising fuel costs, and intensified competition. Understanding these factors is crucial for investors. While Uber's long-term growth potential remains significant, its susceptibility to economic downturns necessitates careful consideration of both long-term and short-term investment strategies. Diversification and a robust risk management plan are essential for navigating market volatility. Continue researching and analyzing Uber stock performance during economic uncertainty to make informed investment decisions. Stay updated on market trends and company performance for a comprehensive understanding before investing.

Featured Posts

-

Us Credit Rating Downgraded By Moody S White House Responds

May 18, 2025

Us Credit Rating Downgraded By Moody S White House Responds

May 18, 2025 -

Resorts World Casino Fined 10 5 Million Money Laundering Case Details

May 18, 2025

Resorts World Casino Fined 10 5 Million Money Laundering Case Details

May 18, 2025 -

Six Years Of The Division 2 A Celebration Of Community And Gameplay

May 18, 2025

Six Years Of The Division 2 A Celebration Of Community And Gameplay

May 18, 2025 -

Solve The Nyt Mini Crossword March 5 2025 Hints And Solutions

May 18, 2025

Solve The Nyt Mini Crossword March 5 2025 Hints And Solutions

May 18, 2025 -

Inmate Escape Caught On Camera New Orleans Jail Video Released

May 18, 2025

Inmate Escape Caught On Camera New Orleans Jail Video Released

May 18, 2025