BBAI Stock: A Prudent Investor's Guide To BigBear.ai

Table of Contents

Understanding BigBear.ai's Business Model

BigBear.ai's success hinges on its innovative business model, leveraging cutting-edge AI and advanced analytics to solve complex problems for both national security and commercial clients. This dual focus offers diversification and potential for sustained growth.

AI-Powered Solutions for National Security & Commercial Markets

BigBear.ai offers a suite of AI-powered solutions designed to tackle some of today's most pressing challenges. Their core offerings include:

- Cybersecurity Solutions: Protecting critical infrastructure and sensitive data from cyber threats through predictive analytics and advanced threat detection.

- Intelligence Analysis: Providing actionable insights from vast amounts of data to support national security and law enforcement efforts.

- Data Analytics & Visualization: Turning complex data sets into clear, actionable intelligence for various sectors, including finance and healthcare.

- Geospatial Intelligence: Utilizing location-based data to enhance situational awareness and decision-making.

Their key clientele includes government agencies (like the Department of Defense) and major corporations requiring sophisticated data analysis and security solutions. BigBear.ai's competitive advantage lies in its ability to combine cutting-edge AI technologies with deep domain expertise across multiple sectors.

Revenue Streams and Growth Potential

BigBear.ai's revenue is generated primarily through:

- Government Contracts: A significant portion of their revenue comes from long-term contracts with government agencies, offering stability but also subject to the complexities of government procurement processes.

- Commercial Contracts: Increasingly, BigBear.ai is securing contracts with large commercial clients, demonstrating the versatility and applicability of their AI solutions.

- Subscription Models: BigBear.ai is implementing subscription-based services for some of their offerings, creating recurring revenue streams and improving predictability.

While past performance is not indicative of future results, analyzing BigBear.ai's financial reports reveals key trends. [Insert relevant financial data and charts here, if available, showing revenue growth, contract wins, etc.]. Strategic partnerships and acquisitions also play a role in expanding their revenue streams and market reach. Analyzing these factors is crucial for any BBAI investment decision.

Analyzing BBAI Stock Performance and Valuation

Evaluating the potential of BBAI stock requires a thorough analysis of its performance and valuation metrics. This section provides insights into its historical performance and its financial health.

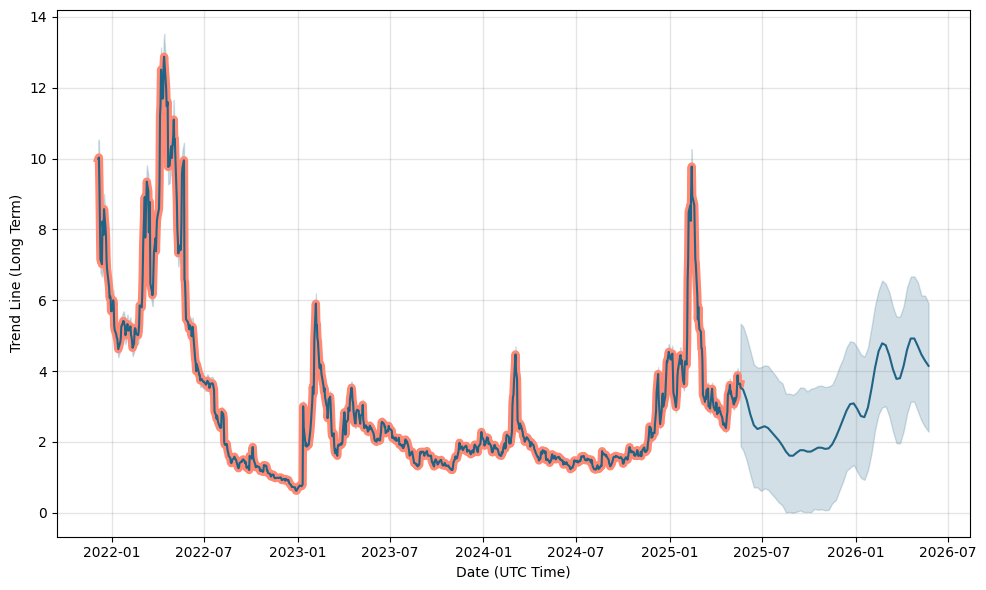

Stock Price History and Volatility

BBAI stock, like many technology stocks, has experienced significant price fluctuations. [Insert relevant chart showing stock price history]. Factors influencing BBAI stock price include:

- Market Sentiment: Overall market conditions, investor confidence, and broader technology sector trends significantly impact BBAI's valuation.

- Contract Wins: Large contract announcements often lead to positive market reaction and price increases.

- Financial Performance: Quarterly earnings reports and overall financial health influence investor confidence and subsequent stock price movements.

- News and Announcements: Significant news events (e.g., partnerships, product launches, regulatory changes) can cause substantial short-term volatility.

Understanding these influences is essential for informed BBAI investment decisions.

Key Financial Metrics and Valuation Ratios

To assess BBAI's financial health, examining key financial indicators is crucial:

- Price-to-Earnings Ratio (P/E): Comparing BBAI's P/E ratio to competitors in the AI sector helps determine its relative valuation.

- Debt-to-Equity Ratio: Assessing the company's leverage and financial stability.

- Revenue Growth: Analyzing the trend of revenue growth provides insights into the company's expansion rate.

- Profitability and Sustainability: Evaluating the company’s ability to generate consistent profits and the long-term sustainability of its business model.

A comprehensive analysis of these metrics, along with a comparison to industry benchmarks, is essential before committing to a BBAI investment.

Assessing the Risks and Rewards of BBAI Investment

Like any investment, BBAI stock presents both risks and potential rewards. A prudent investor must carefully weigh these factors.

Market Risks and Competition

Investing in BBAI stock involves several risks:

- Market Volatility: The technology sector is inherently volatile, making BBAI stock susceptible to market swings.

- Competition: The AI market is highly competitive, with established players and emerging startups vying for market share.

- Technological Disruption: Rapid technological advancements could render BigBear.ai's current technologies obsolete.

- Government Regulations: Changes in government regulations could impact their contracts and revenue streams.

Understanding the competitive landscape and BigBear.ai's ability to innovate and adapt is crucial for managing risk.

Growth Potential and Long-Term Outlook

Despite the inherent risks, the potential rewards of a BBAI investment are significant:

- AI Market Growth: The overall AI market is experiencing exponential growth, presenting significant opportunities for BigBear.ai.

- Market Share Expansion: BigBear.ai has the potential to expand its market share in both national security and commercial sectors.

- Technological Innovation: Continued innovation and development of new AI solutions could drive future growth.

Practical Guidance for BBAI Stock Investment

This section offers practical advice for those considering a BBAI investment.

Investment Strategies and Diversification

- Diversification: Investing in BBAI should be part of a well-diversified investment portfolio, not a sole focus.

- Risk Tolerance: Invest only an amount you are comfortable losing, aligning your investment with your personal risk profile.

- Time Horizon: A long-term investment horizon is generally recommended for technology stocks like BBAI, allowing time to weather market fluctuations.

- Exit Strategy: Develop a clear exit strategy with predefined thresholds for profit-taking or loss limitation.

Resources and Further Research

Before investing in BBAI stock, conduct thorough due diligence:

- SEC Filings: Review BigBear.ai's SEC filings (10-K, 10-Q) for detailed financial information. [Link to SEC EDGAR database]

- Company Website: Visit BigBear.ai's website for information about their products, services, and business strategy. [Link to BigBear.ai website]

- Financial News Sources: Stay informed about BBAI through reputable financial news outlets.

Conclusion

Investing in BBAI stock requires careful consideration of its business model, financial performance, market position, and inherent risks. This guide has provided a framework for analyzing these factors. Remember, past performance is not indicative of future results, and a thorough understanding of the company, its competitive landscape, and the overall market is crucial. Learn more about BBAI stock through diligent research and consider it within the context of your overall investment strategy. Make an informed BBAI investment decision today, but always remember to diversify your portfolio to mitigate risk. Invest wisely in BigBear.ai, but only after conducting your own comprehensive due diligence.

Featured Posts

-

Biarritz Le Guide Complet Des Nouveaux Restaurants Et Chefs

May 20, 2025

Biarritz Le Guide Complet Des Nouveaux Restaurants Et Chefs

May 20, 2025 -

Sueper Lig Dusan Tadic 100 Maca Ulasti

May 20, 2025

Sueper Lig Dusan Tadic 100 Maca Ulasti

May 20, 2025 -

1 231 Billion In Oil Revenue Recovery The Representatives Strategy

May 20, 2025

1 231 Billion In Oil Revenue Recovery The Representatives Strategy

May 20, 2025 -

Zivot Gina Marie Schumacher Kceri Michaela Schumachera

May 20, 2025

Zivot Gina Marie Schumacher Kceri Michaela Schumachera

May 20, 2025 -

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 20, 2025

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 20, 2025