Bitcoin Investment: Is A 1,500% Increase In 5 Years Realistic?

Table of Contents

Historical Bitcoin Price Volatility and Past Performance

Bitcoin's price has demonstrated extraordinary volatility since its inception. Analyzing past performance provides valuable context, although it doesn't predict future outcomes. Charts clearly illustrate periods of dramatic price swings, both upward and downward.

- Significant Growth Periods: The period following the 2017 cryptocurrency bull run saw substantial price appreciation, driven by increased media attention, institutional adoption, and technological advancements. Similarly, the halving events, which reduce the rate of new Bitcoin creation, have historically been followed by periods of price increase.

- Significant Price Drops: Conversely, regulatory crackdowns, major market crashes (like the one in 2022), and negative news cycles have all contributed to steep price declines. The interconnectedness of Bitcoin with the broader financial markets also influences its price.

- Comparison with Other Asset Classes: Compared to traditional asset classes like stocks and bonds, Bitcoin's average annual growth rate has been significantly higher, but also far more erratic. This highlights the higher risk associated with Bitcoin investments.

(Include a relevant chart or graph illustrating Bitcoin's price history here)

Factors Influencing Bitcoin's Future Price

Predicting Bitcoin's future price is inherently challenging, but several factors play a significant role:

- Macroeconomic Factors: Global economic uncertainty, inflation rates, and interest rate policies by central banks all impact investor sentiment and the flow of capital into cryptocurrencies like Bitcoin. A period of high inflation might drive investors towards Bitcoin as a hedge against inflation.

- Technological Advancements: Upgrades like the Lightning Network and Taproot improve Bitcoin's scalability and transaction speed, potentially increasing its adoption and utility. Further development and innovation could drive price appreciation.

- Regulatory Developments: Government regulations and policies surrounding cryptocurrencies significantly influence market sentiment and adoption rates. Positive regulatory frameworks can lead to increased institutional investment and price growth, while restrictive policies can have the opposite effect.

- Institutional Adoption and Social Sentiment: Large-scale investments by institutional investors, coupled with positive social media sentiment and mainstream media coverage, can fuel price rallies. Conversely, negative news or regulatory uncertainty can trigger sell-offs.

- Scarcity and Limited Supply: Bitcoin's inherent scarcity – a fixed supply of 21 million coins – is a key factor supporting its potential long-term value. This limited supply creates a potential for price appreciation as demand increases.

Assessing the Realism of a 1,500% Increase

A 1,500% increase in Bitcoin's price over five years is a highly ambitious target. While theoretically possible given its past volatility, it's crucial to acknowledge the substantial risks involved.

- Market Corrections and Bear Markets: Cryptocurrency markets are prone to significant corrections and extended bear markets. A substantial price drop could wipe out a significant portion of an investor's capital.

- Volatility and Potential for Losses: The inherent volatility of Bitcoin means substantial price swings are common. Investors must be prepared for significant losses, even with a long-term investment horizon.

- Diversification: Diversifying one's investment portfolio across different asset classes is essential to mitigate risk and avoid over-reliance on a single, highly volatile asset like Bitcoin.

Strategies for Managing Risk in Bitcoin Investment

Managing risk is paramount when investing in Bitcoin. Several strategies can help mitigate potential losses:

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, reduces the impact of volatility.

- Diversification: Spreading investments across different asset classes reduces overall portfolio risk.

- Limit Orders and Stop-Loss Orders: Limit orders allow you to buy at a specific price, while stop-loss orders automatically sell your Bitcoin if the price falls below a predetermined level.

- Reputable Exchanges and Wallets: Choosing secure and reputable cryptocurrency exchanges and wallets is essential to protect your investments from theft or loss.

- Due Diligence: Thorough research and understanding of the risks associated with Bitcoin investment are crucial before committing any funds. Only invest what you can afford to lose.

Conclusion

While a 1,500% increase in Bitcoin investment over five years is theoretically possible, it’s crucial to approach Bitcoin investments with caution and a realistic understanding of the market. The potential for high returns exists, but so do considerable risks. Conduct thorough research, manage your risk effectively, and only invest what you can afford to lose. Learn more about responsible Bitcoin investment strategies today!

Featured Posts

-

Ubers Big Shift Cash Only Auto Service

May 08, 2025

Ubers Big Shift Cash Only Auto Service

May 08, 2025 -

Andor Season 2 A Recap Before The New Episodes Arrive

May 08, 2025

Andor Season 2 A Recap Before The New Episodes Arrive

May 08, 2025 -

Ubers Antitrust Lawsuit Against Door Dash Examining The Food Delivery Market Competition

May 08, 2025

Ubers Antitrust Lawsuit Against Door Dash Examining The Food Delivery Market Competition

May 08, 2025 -

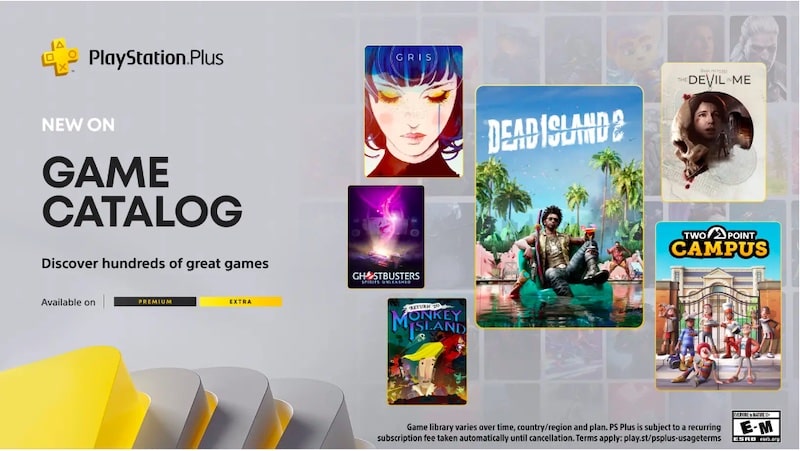

Your March 2024 Ps Plus Premium And Extra Games Await

May 08, 2025

Your March 2024 Ps Plus Premium And Extra Games Await

May 08, 2025 -

Sonos And Ikea Collaboration Officially Over Impact On Smart Home Speakers

May 08, 2025

Sonos And Ikea Collaboration Officially Over Impact On Smart Home Speakers

May 08, 2025